Key Findings

- Republican presidential candidate Donald Trump’s taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. plan would significantly reduce income taxes and corporate taxes, and eliminate the estate taxAn estate tax is imposed on the net value of an individual’s taxable estate, after any exclusions or credits, at the time of death. The tax is paid by the estate itself before assets are distributed to heirs. .

- According to the Tax Foundation’s Taxes and Growth Model, the plan would reduce federal revenue by between $4.4 trillion and $5.9 trillion on a static basis. The amount depends on the nature of a key business policy provision.

- The plan would also significantly reduce marginal rates and the cost of capital, which would lead to higher long-run levels of GDP, wages, and full-time equivalent jobs.

- After accounting for the larger economy and the broader tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. , the plan would reduce revenues by between $2.6 trillion and $3.9 trillion after accounting for the larger economy, depending on the nature of a key policy provision.

- The plan reduces revenue by substantially less than the plan proposed by Trump last year, on both a static and dynamic basis.

- On a static basis, the plan would lead to at least 0.8 percent higher after-tax incomeAfter-tax income is the net amount of income available to invest, save, or consume after federal, state, and withholding taxes have been applied—your disposable income. Companies and, to a lesser extent, individuals, make economic decisions in light of how they can best maximize their earnings. for all taxpayer quintiles. The plan would lead to at least 10.2 percent higher incomes for the top 1 percent of taxpayers or as much as 16.0 percent higher, depending on the nature of a key business policy provision.

Introduction

Last Thursday in New York, Republican presidential candidate Donald J. Trump released a tax reform plan.[1] The plan would reform the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. code by lowering marginal tax rates on wages, investment, and business income. Furthermore, it would broaden the individual income tax base. The plan would also lower the corporate income tax rate to 15 percent and modify the corporate income tax base. Finally, the plan would eliminate federal estate and gift taxes while eliminating step-up basis.

Our analysis finds that the Trump tax plan would substantially reduce federal revenues from both individual income taxes and corporate income taxes. These reductions in revenue come primarily from lower rates on individuals and businesses.

One particular tax rate, the individual income tax rate on pass-through businessA pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax; instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates. income, is not clearly specified in current plan documentation. Assuming that the individual income tax rate on pass-through business income is the same as the rates on other individual income, the Trump tax plan would reduce federal tax revenue by $4.4 trillion over the next decade. But if the tax rate on this income is instead intended to be the same as the tax rate on corporate business income, the plan would then reduce federal revenue by $5.9 trillion. In addition to these possibilities, which we see as upper and lower bounds for total revenue generation, the policy may reduce federal revenue somewhere in between.[2]

The plan would also reduce marginal tax rates on labor and substantially reduce marginal tax rates on investment. As a result, we estimate that the plan would boost long-run GDP, raise wages, and increase the equilibrium level of full-time equivalent jobs. Due to the larger economy and the broader tax base, the plan would reduce revenue by less on a dynamic basis: by $2.6 trillion over the next decade, if pass-through income is taxed as ordinary individual income, or by $3.9 trillion under the alternate assumption, where pass-through income is taxed purely at business rates.

Our analysis does not consider how or if this revenue loss would be financed, or the macroeconomic effects of such financing. Nor does it consider any policy proposals from Trump on subjects other than taxes, even though these are likely to have substantial effects on the economy as well.

Changes to the Individual Income Tax

- Consolidates the current seven tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. into three, with rates on ordinary income of 12 percent, 25 percent, and 33 percent (Table 1).

- Adapts the current rates for qualified capital gains and dividends to the new brackets.

- Eliminates the head of household filing status.

| Ordinary Income Rate | Capital Gains Rate | Single Filers | Married Joint Filers |

|---|---|---|---|

| 12% | 0% | $0 to $37,500 | $0 to $75,000 |

| 25% | 15% | $37,500 to $112,500 | $75,000 to $225,000 |

| 33% | 20% | $112,500+ | $225,000+ |

- Eliminates the Net Investment Income Tax.

- Increases the standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. Taxpayers who take the standard deduction cannot also itemize their deductions; it serves as an alternative. from $6,300 to $15,000 for singles and from $12,600 to $30,000 for married couples filing jointly.

- Eliminates the personal exemption and introduces other childcare-related tax provisions.

- Makes childcare costs deductible from adjusted gross incomeFor individuals, gross income is the total of all income received from any source before taxes or deductions. It includes wages, salaries, tips, interest, dividends, capital gains, rental income, alimony, pensions, and other forms of income. For businesses, gross income (or gross profit) is the sum of total receipts or sales minus the cost of goods sold (COGS)—the direct costs of producing goods, including inventory and certain labor costs. for most Americans (above-the-line), up to the average cost of care in their state. The deduction would be phased out for individuals earning more than $250,000 or couples earning more than $500,000.

- Offers credits (“spending rebates”) of up to $1,200 a year for childcare expenses to lower-income families, through the earned income tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. .

- Creates new saving accounts for care for children or elderly parents, or school tuitions, and offers a 50 percent match of contributions (not modeled).

- Caps itemized deductions at $100,000 for single filers and $200,000 for married couples filing jointly.[3]

- Taxes carried interest as ordinary income.

- Eliminates the individual alternative minimum tax.

Changes to Business Income Taxes

- Reduces the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate from 35 percent to 15 percent.

- Eliminates the corporate alternative minimum tax.

- Allows firms engaged in manufacturing in the U.S. to choose between the full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. of capital investment and the deductibility of interest paid.

- Eliminates the domestic production activities deduction (section 199) and all other business credits, except for the research and development credit.

- Enacts a deemed repatriationRepatriation is the process by which multinational companies bring overseas earnings back to the home country. Prior to the 2017 Tax Cuts and Jobs Act (TCJA), the US tax code created major disincentives for US companies to repatriate their earnings. Changes from the TCJA eliminate these disincentives. of currently deferred foreign profits, at a tax rate of 10 percent.

- Increases the cap for the tax credit for employer-provided day care under Sec. 205 of the Economic Growth and Tax Relief Reconciliation Act of 2001 from $150,000 to $500,000 and reduces its recapture period from 10 years to 5.

Other Changes

- Eliminates federal estate and gift taxes but disallows step-up in basisThe step-up in basis provision adjusts the value, or “cost basis,” of an inherited asset (stocks, bonds, real estate, etc.) when it is passed on, after death. This eliminates the capital gains tax owed by the recipient, reducing the heir’s tax liability. The cost basis receives a “step-up” to its fair market value, or the price at which the good would be sold or purchased in a fair market. for estates over $10 million.[4]

Pass-Through Taxation in Donald Trump’s Tax Plan

One policy question that has received some attention since the release of the speech is the tax rate on individual income derived from pass-through businesses.

Before explaining why this policy question is important, it may be worthwhile to summarize what pass-through businesses are. Pass-throughs are businesses that pay their taxes through the individual income tax code rather than through the corporate code. Under current law, such businesses distribute all of their earnings to their owners every year, and such earnings immediately appear only on the owners’ tax returns. They are taxed at ordinary individual income tax rates.

In contrast, traditional C corporations can retain earnings without distributing them immediately to any particular shareholder. This allows shareholders to defer, but not permanently avoid, personal income tax liability on the gain in wealth that is tied up in the corporation. A substantial tax drawback to C corporations, though, is that they have to pay two layers of tax: an entity level tax on retained profits, and the personal income taxes for the shareholders who receive the profits when they are disbursed.

Donald Trump’s tax plan, as described on the website as of today, “will lower the business tax rate from 35 percent to 15 percent, and eliminate the corporate alternative minimum tax. This rate is available to all businesses, both big and small, that want to retain the profits within the business.” [5]

The current state of the plan has led to multiple interpretations of the way that pass-through businesses would be taxed under Donald Trump’s tax plan. For example, two different facts were reported Friday by The Wall Street Journal alone, on the same information. An editorial piece states: “Mr. Trump is more consistent on the corporate side, recommending a more globally competitive income-tax rate of 15% for all businesses including pass-throughs.”[6] This editorial likely based its interpretation on the language of “all businesses, both big and small.”

In contrast, a news article in The Journal reported it very differently:[7]

Mr. Trump would lower the corporate tax rate from 35% to 15%. He also appeared to abandon a core plank of his earlier tax plans, which called for a 15% top tax rate on business income reported on individual tax returns, instead of taxing such income at the same rates as ordinary income.

Small-business groups had praised the single business tax rate but the Clinton campaign criticized what it called the “Trump loophole,” because much of Mr. Trump’s business income is taxed on his own return and could have gotten the lower rate.

The Trump campaign revised its website on this throughout Thursday. A late-day version suggested but didn’t say clearly that the lower rate is only available for corporations.

Under this interpretation, the phrasing indicates that the 15 percent rate is only applicable to businesses that choose to become C corporations. One indicator is that the sentence describes lowering the rate from 35 percent, which is the current rate for C corporations. A second indicator is that it is available to businesses that want to retain the profits within the business, which is a property of C corporations. Under Donald Trump’s tax plan, as in current law, after paying the 15 percent rate on retained earnings, such a business would then presumably be subject to an additional layer of tax on individual income.

One middle ground between the two interpretations may be the idea that the Donald Trump’s tax plan would allow more businesses to file their taxes in the way that C corporations do, even if their legal structure today would have them pay taxes as a pass-through. These businesses could instead adopt paying an entity-level tax and then reduced shareholder taxes.

However, a simple calculation of rate parity would suggest that the total tax burden on C corporations in the Donald Trump’s tax plan is in fact not substantially different than the top individual rate. A 15 percent entity-level tax with a 20 percent tax on dividends comes out to a similar overall level of taxation as a 33 percent top individual rate. It is not immediately clear that pass-throughs would benefit from adding a second layer of taxation by opting for the 15 percent tax on their retained earnings.

One potential reason a pass-through could opt to become a C corporation would be as a kind of savings vehicle for an individual taxpayer, where retained earnings were then invested into financial assets to delay individual taxes. While this would not be nearly as effective a savings vehicle as, for example, a 401(k), it could be an effective strategy for some individuals. This is probably not an intended side effect of the Trump proposal, which would prefer that the 15 percent rate apply to businesses, not glorified saving accounts. Presumably, regulations would be put in place to resolve this issue and disallow small corporations from investing in financial instruments that are not relevant to their line of business.

Tax Foundation’s best understanding of the Trump proposal, after examining the totality of all statements made by the campaign, is that pass-throughs are not eligible for a single 15 percent tax rate on the individual income that their owners report; at best, they may be allowed to adopt some kind of tax status similar to that of C-corporations, either on a temporary or permanent basis.[8] In other words, our guess is that there is no means by which a business could get a single layer of taxation at a rate of 15 percent. However, we also acknowledge the arguments of those who perceive things differently.

Therefore, we will report an upper bound and a lower bound on the tax reform, based on the two most extreme possible assumptions regarding current pass-through businesses. At the high end, we will analyze the plan assuming that such businesses pay individual rates of up to 33 percent on their income. At the low end, we will estimate the plan assuming that these businesses pay a 15 percent rate on pass-through income on the individual Form 1040. The former will be referred to as the higher-rate assumption, and the latter will be referred to as the lower-rate assumption.

While these two assumptions may not be the only possible ways to understand the plan, they provide the best upper and lower bounds on most of the numbers contained in our analysis.

Impact on the Economy

According to the Tax Foundation’s Taxes and Growth Model, the Trump tax plan would increase the long-run size of the economy by 6.9 percent under the higher-rate assumption, or 8.2 percent under the lower-rate assumption (Table 2). The larger economy would result in 5.4 percent higher wages and a 20.1 percent larger capital stock under the higher-rate assumption, or 6.3 percent higher wages and a 23.9 percent larger capital stock under the lower-rate assumption. The plan would also result in 1.8 million more full-time equivalent jobs under the higher-rate assumption, or 2.2 million more under the lower-rate assumption.

These projections are measured as of the end of a ten-year period (that is, 2016-2025) and they are compared to the underlying baseline of what would occur under current policy. For example, the U.S. real GDP will grow by 19.2% from 2016-2025, according to the Congressional Budget Office (CBO), even if policy remains unchanged.[9] This paper predicts that the greater incentives for labor and investment provided by this tax reform plan would increase the end-of-period GDP by an additional 6.9% under the higher-rate assumption, or 8.2 percent under the lower-rate assumption, over and beyond the baseline growth already predicted.

The larger economy and higher wages are due chiefly to the significantly lower cost of capital under the proposal, which is due to the lower corporate income tax rate and expensing for those firms that choose to adopt it instead of deducting interest.

These projections do not include the economic effects of proposals by Trump that are not specifically tax-related. For example, spending, trade, and immigration proposals are not part of this analysis, even though they are likely to affect the economy substantially and they are therefore worthy of consideration.

Trade policy may intersect with tax policy in the specific case of tariffs. While no specific tariffs have been enumerated as part of the plan analyzed here, they have been discussed by Trump in the past. A tariffTariffs are taxes imposed by one country on goods imported from another country. Tariffs are trade barriers that raise prices, reduce available quantities of goods and services for US businesses and consumers, and create an economic burden on foreign exporters. is a differentiated tax on consumption, which would reduce growth predicted by the Taxes and Growth model and raise revenue inefficiently.

| Source: Tax Foundation Taxes and Growth Model, March 2016 Note: Numbers are listed with the higher-rate assumption first and the lower-rate assumption second. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Capital Investment | 20.1% / 23.9% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wage Rate | 5.4% / 6.3% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Full-time Equivalent Jobs (in thousands) | 1,807 / 2,155 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Impact on Revenue

If fully enacted, the proposal would reduce federal revenue by $4.4 trillion over the next decade on a static basis under the higher-rate assumption, or $5.9 trillion under the lower-rate assumption (Table 4). The plan would reduce individual income tax revenue by $2.2 trillion over the next decade under the higher-rate assumption, or $3.7 trillion under the lower-rate assumption. Corporate tax revenue would fall by $1.9 trillion in both cases, and the remainder of the revenue loss would be due to the repeal of estate and gift taxes.

On a dynamic basis, the plan would reduce federal revenue by $2.6 trillion over the next decade under the higher-rate assumption, or $3.9 trillion under the lower-rate assumption. The larger economy would boost wages and thus broaden both the income and payroll tax bases. As a result, on a dynamic basis, payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. revenues would increase substantially, and income tax revenues would decrease by less than they do under the static analysis. On the other hand, corporate income tax revenue would actually decline even more on a dynamic basis. This is because the plan will encourage more investment and result in businesses deducting more capital investments, which would reduce corporate taxable income.

| Tax | Static Revenue Impact (2016-2025) | Dynamic Revenue Impact (2016-2025) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Source: Tax Foundation Taxes and Growth Model, March 2016. Note: Individual items may not sum to total due to rounding. Numbers are listed with the higher-rate assumption first and the lower-rate assumption second, where applicable. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Individual Income Taxes | -$2,192 / -$3,730 | -$1,058 / -$2,458 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Payroll Taxes | $0 | $520 / 612 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Income Taxes | -$1,936 | -$1,958 / -$1,959 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Excise Taxes | $0 | $44 / $52 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Estate and Gift Taxes | -$240 | -$240 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Revenue | $0 | $52 / $62 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL | -$4,368 / -$5,906 | -$2,640 / -$3,932 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Revenue and Economic Impacts of Specific Provisions

Donald Trump’s tax plan contains some noteworthy base broadeners. For example, its limitation on itemized deductions raises $397 billion in individual income tax revenue over ten years relative to current law. On the business side, its repeal of Section 199 and several other corporate tax expenditures raises $213 billion.[10]

The largest sources of revenue loss in the plan come from the corporate rate reduction ($2.1 trillion), the individual income tax reduction ($1.4 trillion), the repeal of the Net Investment Income Tax ($628 billion), and the reforms for childcare-related expenses ($500 billion.)

The lower-rate assumption, if applicable, would be the second largest source of static revenue loss in the plan, at $1.5 trillion.

| Provision | Billions of Dollars, 2016-2025 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Static | GDP | Dynamic | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Source: Tax Foundation Taxes and Growth Model, March 2016 Note: Individual items may not sum to total due to rounding. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Eliminate the alternative minimum tax | -$354 | -0.3% | -$428 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cap itemized deductions | $397 | 0.2% | $451 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Repeal the Net Investment Income Tax | -$628 | 0.7% | $-447 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Eliminate Head of Household status | $116 | -0.1% | $90 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Replace the personal exemption with a larger standard deduction | $227 | 0.0% | $232 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tax carried interest as ordinary income | $14 | 0.0% | $10 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reforms for childcare-related expenses | -$500 | 0.1% | -$461 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Allow businesses to choose between interest deductibility and expensing | -$322 | 0.6% | -$192 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Eliminate Section 199 and other business expenditures | $213 | -0.2% | $152 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Reforms to capital gains basis | $48 | -0.1% | $27 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Eliminate the estate tax | -$240 | 0.9% | -$24 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consolidate individual income tax to three brackets at 12%, 25%, and 33% | -$1,418 | 0.9% | -$1,205 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lower the corporate income tax rate to 15% | -$2,122 | 4.1% | -$1,044 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Enact a deemed repatriation of deferred foreign-source income | $200 | 0.0% | $200 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total under the higher-rate assumption | -$4,368 | 6.9% | -$2,639 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Lower the individual rate on pass-through income to 15 percent) | -$1,538 | 1.3% | -$1,291 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total under the lower-rate assumption | -$5,906 | 8.2% | -$3,932 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

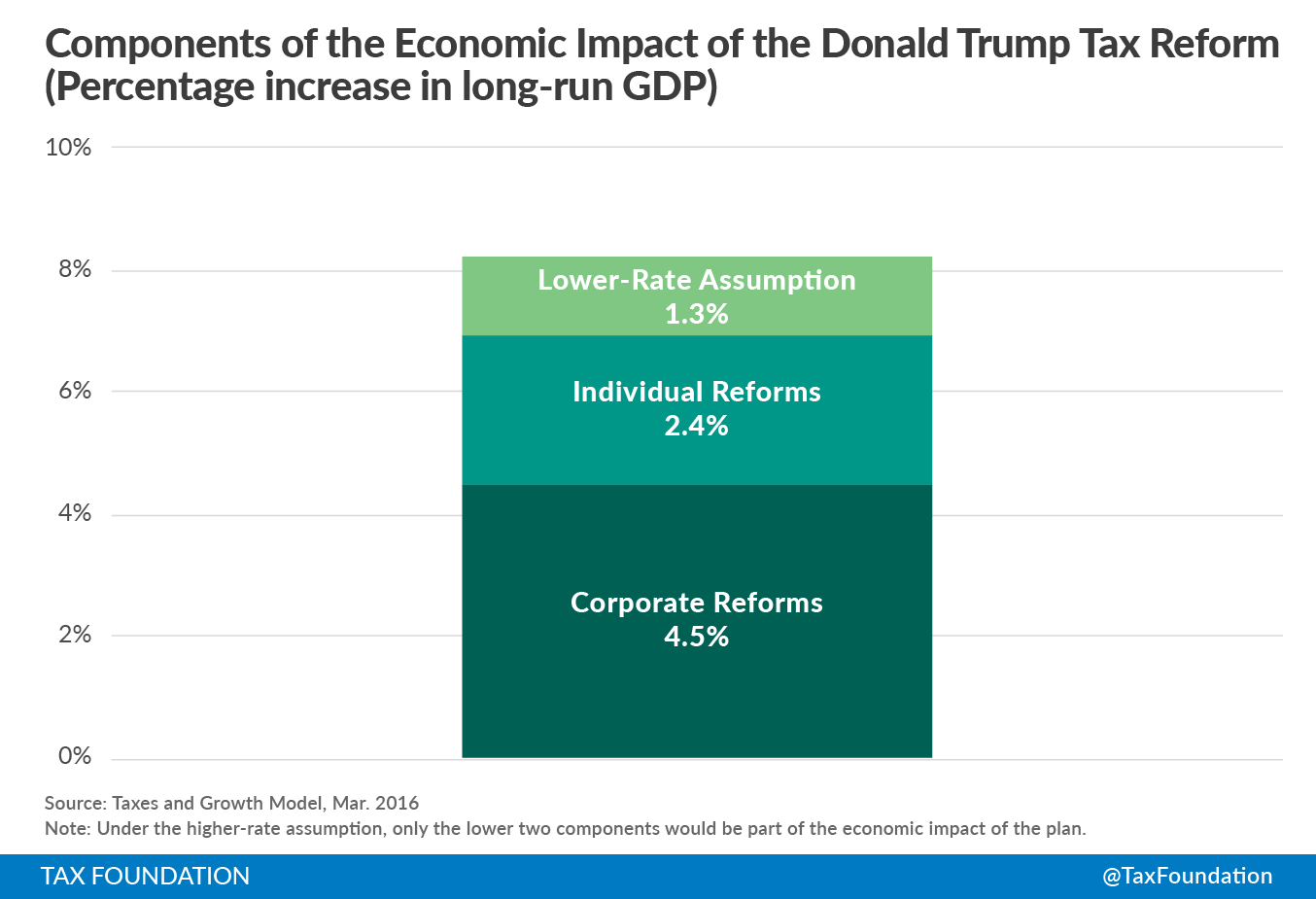

The majority of the plan’s economic impact comes from its corporate income tax reductions and reforms. These provide 4.5 percentage points of GDP growth out of the 6.9 percent total predicted by the Taxes and Growth Model under the higher-rate assumption. Under the lower-rate assumption, an additional 1.3 percent is added to long-run GDP. (Figure 5)

The corporate income tax is a substantial burden on investment in the U. S. The United States has the developed world’s highest corporate income tax rate at 35 percent. The 15 percent rate proposed here would be among the lowest in the developed world.

The Taxes and Growth model finds that the rate reduction alone would lead to a 4.1 percent increase in the long-run level of GDP. The Taxes and Growth model finds the U.S. corporate income tax reduces economic output more than other taxes do, which explains why the corporate tax cut produces the majority of the economic impact of this plan.[11]

Distributional Impact of the Plan

On a static basis, the Trump tax plan would increase the after-tax incomes of taxpayers in every income group. The bottom 80 percent of taxpayers (those in the bottom four quintiles) would see an increase in after-tax income between 0.8 percent and 1.9 percent, under both policy assumptions. Taxpayers in the top quintile would see a 4.4 percent increase in after-tax income under the higher-rate assumption, or 8.7 percent under the lower-rate assumption. Those in the top decile would see a 5.4 percent increase in after-tax income under the higher-rate assumption, or 9.3 percent under the lower-rate assumption. Finally, taxpayers in the top 1 percent would see the largest increase in after-tax income on a static basis, driven by both the lower top marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. and the lower corporate income tax. Under the higher-rate assumption this increase would be 10.2 percent, and under the lower-rate assumption this increase would be 16.0 percent.

On a dynamic basis, all taxpayers would see an increase in after-tax income of at least 6.7 percent under the higher-rate assumption, or 7.9 percent under the lower-rate assumption. The top 1 percent of taxpayers would see an increase in after-tax income of 12.2 percent on a dynamic basis under the higher-rate assumption, or 19.9 percent under the lower-rate assumption.

| Changes in After-Tax Incomes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Income Group | Static | Dynamic | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Source: Tax Foundation, Taxes and Growth Model (March 2016 version) Note: Returns with Positive Income. When two numbers are listed in a column, the number on the left reflects the higher-rate assumption and the number on the right reflects the lower-rate assumption. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0% to 20% | 1.2% | 6.9% / 8.1% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 20% to 40% | 0.8% | 6.7% / 7.9% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 40% to 60% | 1.3% | 7.7% / 9.0% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 60% to 80% | 1.9% | 7.9% / 9.0% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 80% to 100% | 4.4% / 6.5% | 8.7% / 12.3% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 90% to 100% | 5.4% / 8.3% | 9.3% / 13.7% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 99% to 100% | 10.2% / 16.0% | 12.2% / 19.9% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL | 3.1% / 4.3% | 8.2% / 10.7% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Comparison to Previous Versions of Donald Trump’s tax plan

This plan differs in a number of respects from the last complete Trump tax reform plan, released in September of 2015.[12] It has generally higher rates and a significantly broader individual income tax base. However, it preserves the lower corporate income tax rate of the original plan.

In total, the new 2016 Trump plan is a substantially smaller tax cut than the 2015 Trump plan, on a static basis (Table 7).

| Tax | Revenue Impact of Trump Plan Proposed in 2015 | Revenue Impact of Trump Plan Proposed in 2016 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Source: Tax Foundation Taxes and Growth Model, March 2016. Note: Individual items may not sum to total due to rounding. Display reflects a new analysis of the 2015 plan based on new economic data, not the analysis of the plan that was conducted at the time it was proposed. For the 2016 plan, when two numbers are listed, the number on the left reflects the higher-rate assumption and the number on the right reflects the lower-rate assumption. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Individual Income Taxes | -$10,214 | -$2,192 / -$3,730 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Payroll Taxes | $0 | $0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Income Taxes | -$1,862 | -$1,936 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Excise taxes | $0 | $0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Estate and gift taxes | -$240 | -$240 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Revenue | $0 | $0 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL | -$12,316 | -$4,368 / -$5,906 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Because the 2016 plan is a smaller static tax cut overall than the 2015 plan, the changes in after-tax income for many taxpayers have become relatively smaller. The 2015 plan would have increased mean after-tax personal incomes by 9.2 percent, while the 2016 plan would increase them by only 3.1 percent under the higher-rate assumption, or 4.3 percent under the lower-rate assumption (Table 9). This large change is mostly attributable to the fact that more income is taxable under the 2016 plan, and secondarily attributable to the fact that the rates on taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. Taxable income differs from—and is less than—gross income. are higher.

| Changes in After-Tax Incomes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Income Group | 2015 Plan | 2016 Plan | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Source: Tax Foundation, Taxes and Growth Model (March 2016 version) Note: Returns with Positive Income. Display reflects a new analysis of the 2015 plan based on new economic data, not the analysis of the plan that was conducted at the time it was proposed. For the 2016 plan, when two numbers are listed, the number on the left reflects the higher-rate assumption and the number on the right reflects the lower-rate assumption. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0% to 20% | 0.7% | 1.2% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 20% to 40% | 2.2% | 0.8% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 40% to 60% | 6.0% | 1.3% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 60% to 80% | 7.3% | 1.9% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 80% to 100% | 12.0% | 4.4% / 6.5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 90% to 100% | 13.6% | 5.4% / 8.3% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 99% to 100% | 20.7% | 10.2% / 16.0% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL | 9.2% | 3.1% / 4.3% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

While the 2016 plan is a larger tax cut than the 2015 plan in most respects, it has more in the way of benefits to the lowest quintile. The 2015 plan would have increased after-tax incomes for that quintile by only 0.7 percent, while the 2016 plan would increase the after-tax incomes for that quintile by 1.2 percent. This difference is almost entirely attributable to the refundable credit for childcare implemented as part of the 2016 plan, which was not present in the 2015 plan.

Conclusion

Donald Trump’s tax plan as outlined in September 2016 is a large tax cut, mostly on individual and corporate income. This plan would significantly reduce the cost of capital and reduce the marginal tax rate on labor. These changes in the incentives to work and invest would increase the U.S. economy’s size in the long run, boost wages, and result in more full-time equivalent jobs. On a static basis, the plan would reduce federal revenue by between $4.4 trillion and $5.9 trillion, depending on policy assumptions about business tax rates. However, due to the larger economy and the significantly broader tax base, the plan would reduce revenue by between $2.6 trillion and $3.9 trillion over the next decade, depending on those same policy assumptions. In all cases, it would increase after-tax incomes for all income groups, but reduce revenue to the Treasury.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeModeling Notes

The Taxes and Growth Model does not take into account the fiscal or economic effects of interest on debt. It also does not require budgets to balance over the long term, nor does it account for the potential macroeconomic or distributional effects of any changes to government spending that may accompany Donald Trump’s tax plan. This plan is a large net tax cut, and therefore, the need to finance it is likely to have macroeconomic impacts of its own. These macroeconomic impacts could vary depending on how and if the tax cut is financed.

We modeled all provisions outlined above, with the exception of the new dependent care saving accounts, and assumed that all provisions were enacted in the beginning of 2016. We accounted for potential transitional costs for provisions such as expensing. Both the static and dynamic revenue impacts of the plan are relative to the CBO’s current law baseline.

In modeling the distributional impact of the plan we follow the convention that changes to the corporate income tax are passed to capital and labor. We assume on a static basis that 25 percent of the corporate tax change is passed to labor and 75 percent is passed to capital. On a dynamic basis, changes to the corporate income tax fall on capital and labor in proportion to their share of factor income: roughly 70 percent labor and 30 percent capital.

[1] “Tax Reform That Will Make America Great Again,” September 14, 2016, https://www.donaldjtrump.com/positions/tax-reform.

[2] Tax Foundation is not an authoritative source on which policy will actually be adopted. However, our thoughts on what policy might be intended will be reflected in a section below.

[3] In modeling this provision, we assumed that the Pease limitation on itemized deductions was concurrently repealed.

[4] Our reading of the intent of the plan is that step-up basis would be disallowed and that the gain would be subject to tax when the inheritor sells the asset, not upon the death of the decedent. This is the understanding most consistent with the idea that the plan “will repeal the death tax.”

[5] “Tax Reform That Will Make America Great Again,” September 14, 2016, https://www.donaldjtrump.com/positions/tax-reform.

[6] The Wall Street Journal, “Trump and the Art of Growth”, September 15, 2016, http://www.wsj.com/articles/trump-and-the-art-of-growth-1473982247.

[7] Nick Timaraos and Richard Rubin, “Donald Trump Promises Tax Cuts, Offset by Robust Growth”, September 15, 2016, http://www.wsj.com/articles/donald-trump-lays-out-more-details-of-economic-plans-1473955537.

[8] This is already an existing ability for many businesses under current law, through a process called entity classification election.

[9] Congressional Budget Office, “An Update to the Budget and Economic Outlook: 2016 to 2026”, August 23, 2016, https://www.cbo.gov/publication/51908.

[10] While base broadeners raise tax revenue, they also make ensuing rate cuts, such as the ones in this plan, more costly to the Treasury because the rate reduction counts against a larger tax base.

[11] For a similar but more robust finding on the corporate income tax see: Hans Fehr, Sabine Jokisch, Ashwin Kambhampati, and Laurence J. Kotlikoff, “Simulating the Elimination of the U.S. Corporate Income Tax”, NBER Working Paper No. 19757, December 2013, http://www.nber.org/papers/w19757. In this simulation, economists found that eliminating the corporate income tax and replacing it with a consumption tax would raise GDP by 8 percent.

[12] While the previous plan was removed from the Trump campaign website, the Tax Foundation analysis from September 2015 can be found here: https://taxfoundation.org/research/all/federal/details-and-analysis-donald-trump-s-tax-plan/