Developed countries raise tax revenue through individual income taxes, corporate income taxes, social insurance taxes, taxes on goods and services, and property taxes—the combination of which determines how distortionary or neutral a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. system is. For example, taxes on income can do more economic harm than taxes on consumption and property. Countries across the Organisation for Economic Co-operation and Development (OECD) differ substantially in how they raise revenue.

While tax revenue took a hit due to the pandemic, many OECD countries are beginning to bounce back. But as the recovery continues, governments should pay close attention to how they raise revenue and avoid policy changes that could stifle an economic recovery or impose a complex burden on individuals and companies.

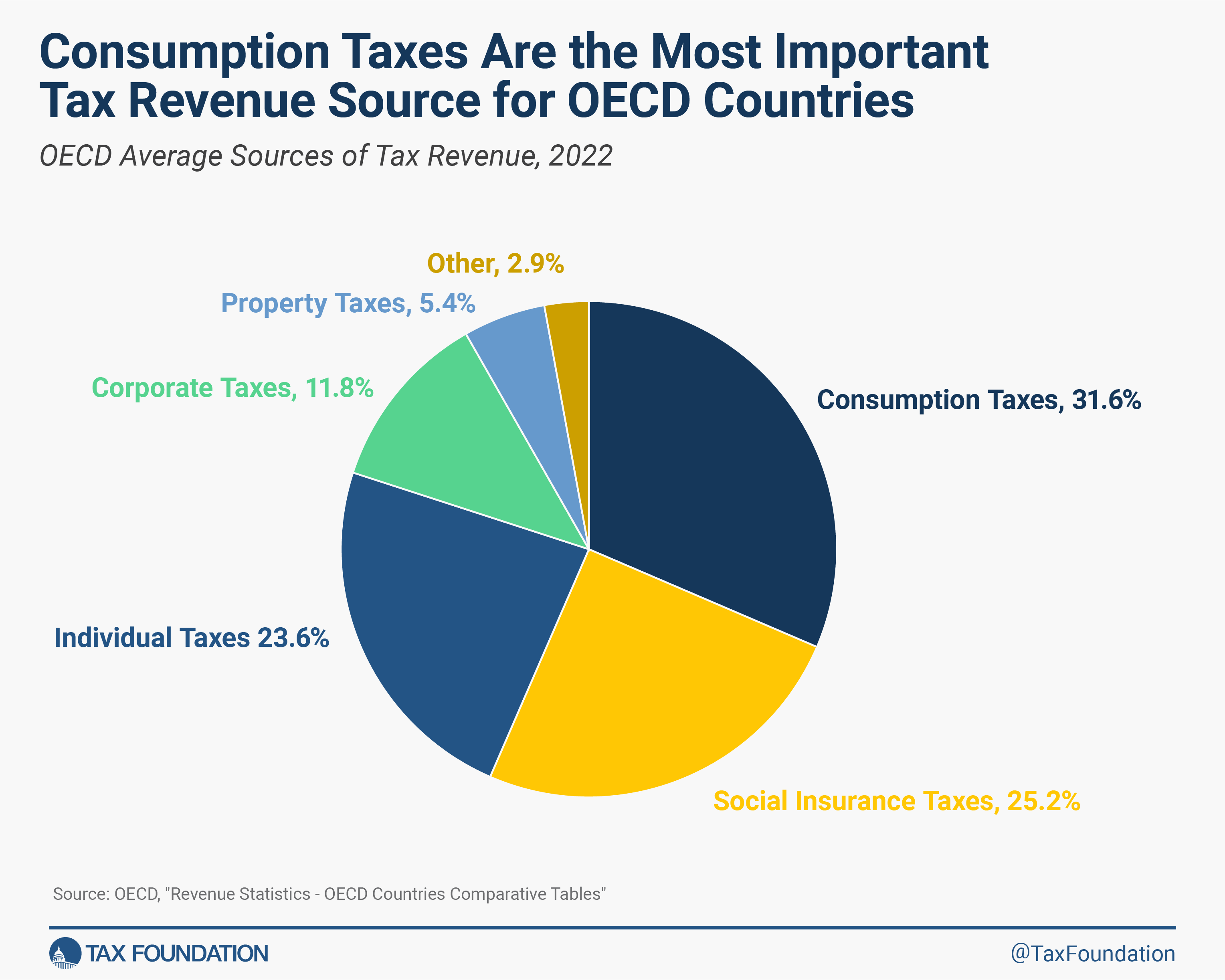

In general, OECD countries lean more on consumption taxes (31.6 percent), social insurance taxes (25.2 percent), and individual income taxes (23.6 percent) than on corporate income taxes (11.8 percent) and property taxes (5.4 percent).

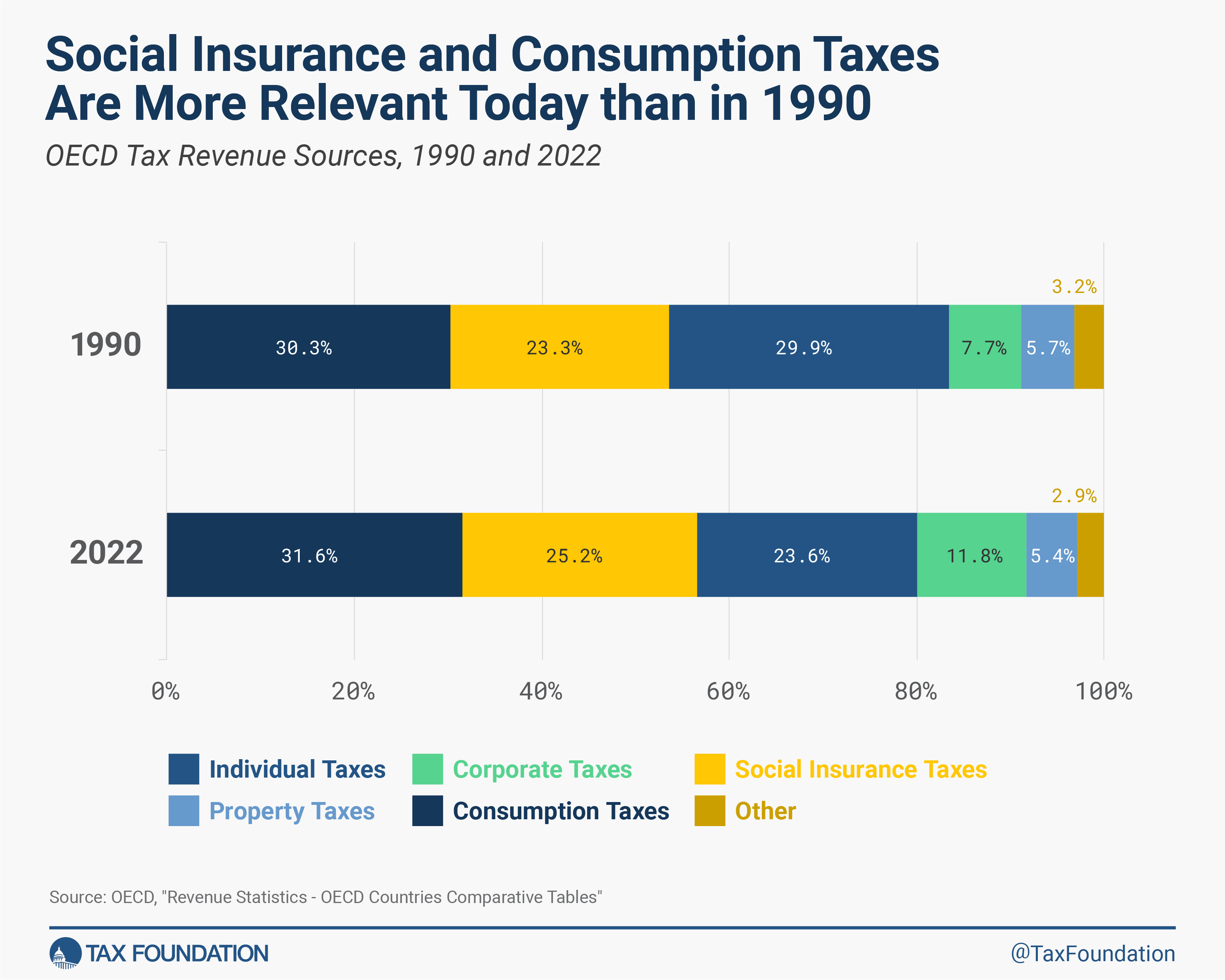

The reliance on different types of taxes has shifted over time. Compared to 1990, OECD countries have on average become more reliant on social insurance taxes (an increase of 1.9 percentage points) and less reliant on individual income taxes (a decrease of 6.3 percentage points). These policy changes matter. Social insurance taxes generally have broader bases and lower rates while taxes on personal income often have higher rates and can be more distortive to worker decisions.

OECD countries have also become more reliant on revenue from corporate income taxes. This has occurred despite a general decline in corporate tax rates around the world. One cause for this change has been a shift in the mix of OECD member countries. Since 1994, 14 countries have joined the OECD. Of this group, Colombia and Mexico raise more than 20 percent of their revenue from corporate income taxes. The average share of corporate tax revenue among the 38 OECD countries is 11.8 percent.

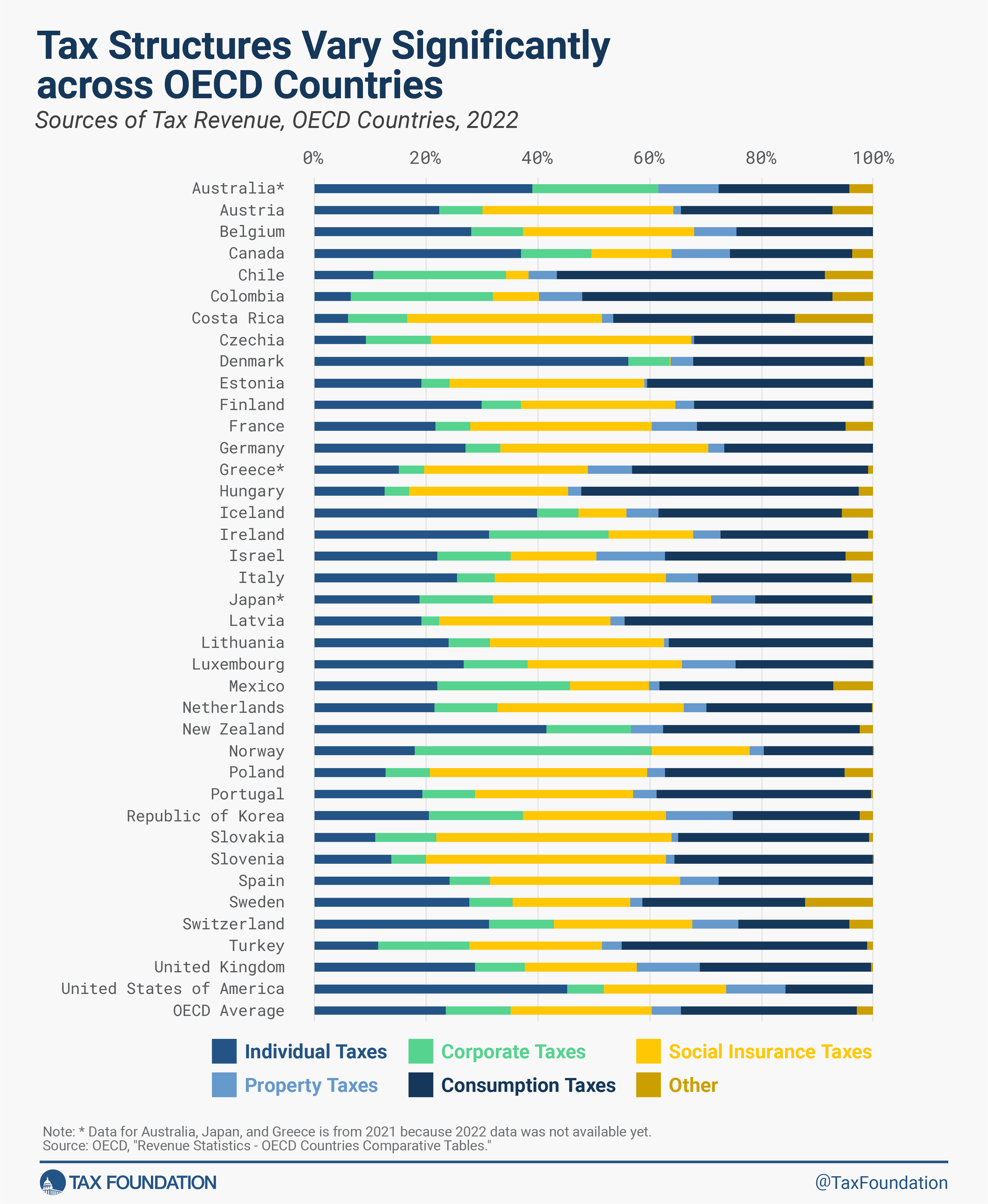

The United States is the only country in the OECD with no value-added tax (VAT). Instead, most U.S. state governments and many local governments apply a retail sales tax on the final sale of products and excise taxes on the production of goods such as cigarettes and alcohol. The lack of a VAT makes the U.S. a bit of an outlier as it raises just 15.7 percent of total government revenue from consumption taxes while the OECD average is nearly twice that amount at 31.6 percent.

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy. Policymakers should continue to explore ways to shift away from more distortive taxes like those on income toward taxes that are less likely to cause economic disruptions like consumption or property taxes.

Government Tax Revenue by Country in the OECD, 2022

| Country | Individual Taxes | Corporate Taxes | Social Insurance Taxes | Property Taxes | Consumption Taxes | Other |

|---|---|---|---|---|---|---|

| Australia* | 39% | 22.5% | 0% | 10.9% | 23.3% | 4.3% |

| Austria | 22.3% | 7.9% | 34.10% | 1.4% | 27% | 7.4% |

| Belgium | 28% | 9.30% | 30.50% | 7.70% | 24.40% | 0% |

| Canada | 36.90% | 12.60% | 14.30% | 10.50% | 21.90% | 3.70% |

| Chile | 10.50% | 23.70% | 4.10% | 5.10% | 47.80% | 8.70% |

| Colombia | 6.60% | 25.30% | 8.30% | 7.80% | 44.80% | 7.30% |

| Costa Rica | 6.10% | 10.50% | 34.80% | 2% | 32.60% | 14% |

| Czechia | 9.20% | 11.70% | 46.60% | 0.50% | 32% | 0% |

| Denmark | 56.10% | 7.50% | 0.10% | 4.10% | 30.60% | 1.60% |

| Estonia | 19.20% | 5% | 34.80% | 0.50% | 40.50% | 0% |

| Finland | 29.90% | 7% | 27.60% | 3.30% | 32% | 0.10% |

| France | 21.60% | 6.30% | 32.50% | 8% | 26.50% | 5% |

| Germany | 27.10% | 6.20% | 37.20% | 2.80% | 26.70% | 0% |

| Greece* | 15.20% | 4.50% | 29.50% | 7.90% | 42.30% | 1% |

| Hungary | 12.60% | 4.30% | 28.4 | 2.40% | 49.60% | 2.60% |

| Iceland | 39.80% | 7.50% | 8.60% | 5.70% | 32.80% | 5.60% |

| Ireland | 31.30% | 21.40% | 15.10% | 4.90% | 26.40% | 0.90% |

| Israel | 22% | 13.10% | 15.30% | 12.30% | 32.40% | 4.90% |

| Italy | 25.50% | 6.70% | 30.60% | 5.70% | 27.50% | 3.90% |

| Japan* | 18.90% | 13.10% | 39.20% | 7.90% | 20.80% | 0.30% |

| Latvia | 19.20% | 3.20% | 30.60% | 2.50% | 44.50% | 0% |

| Lithuania | 24% | 7.40% | 31.10% | 0.90% | 36.60% | 0% |

| Luxembourg | 26.80% | 11.40% | 27.60% | 9.60% | 24.50% | 0.10% |

| Mexico | 22.10% | 23.60% | 14.10% | 1.90% | 31.10% | 7.20% |

| Netherlands | 21.60% | 11.30% | 33.20% | 4.10% | 29.60% | 0.30% |

| New Zealand | 41.50% | 15.20% | 0% | 5.60% | 35.10% | 2.50% |

| Norway | 18% | 42.40% | 17.40% | 2.50% | 19.50% | 0.10% |

| Poland | 12.80% | 7.90% | 38.80% | 3.30% | 32% | 5.20% |

| Portugal | 19.40% | 9.30% | 28.40% | 4.20% | 38.20% | 0.50% |

| Republic of Korea | 20.50% | 16.80% | 25.60% | 11.90% | 22.70% | 2.50% |

| Slovakia | 10.90% | 11% | 41.90% | 1.20% | 34.10% | 0.80% |

| Slovenia | 13.70% | 6.20% | 42.90% | 1.60% | 35.40% | 0.10% |

| Spain | 24.20% | 7.20% | 34.10% | 6.80% | 27.70% | 0% |

| Sweden | 27.80% | 7.80% | 21% | 2.20% | 29.10% | 12.20% |

| Switzerland | 31.20% | 11.60% | 24.80% | 8.20% | 19.90% | 4.30% |

| Turkey | 11.40% | 16.30% | 23.80% | 3.50% | 43.90% | 1.10% |

| United Kingdom | 28.80% | 8.80% | 20.10% | 11.30% | 30.60% | 0.40% |

| United States of America | 45.30% | 6.50% | 21.90% | 10.60% | 15.70% | 0% |

| OECD Average | 23.60% | 11.80% | 25.20% | 5.40% | 31.60% | 2.90% |

Source: OECD, "Revenue Statistics - OECD Countries Comparative Tables."

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe