Trump Tariffs: Tracking the Economic Impact of the Trump Trade War

The Trump tariffs amount to an average tax increase of nearly $1,300 per US household in 2025 and over $1,600 per US household in 2026.

39 min read

The Trump tariffs amount to an average tax increase of nearly $1,300 per US household in 2025 and over $1,600 per US household in 2026.

39 min read

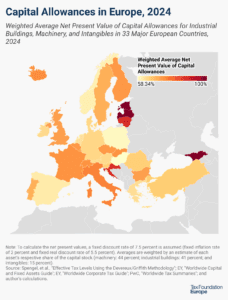

Although sometimes overlooked in discussions about corporate taxation, capital allowances play an important role in a country’s corporate tax base and can impact investment decisions—with far-reaching economic consequences.

6 min read

The Trump tariffs will likely raise the cost of food for Americans, particularly for liqueurs and spirits, baked goods, coffee, fish, and beer.

4 min read

Even when international relations are frayed, there is value in finding ways to combat corporate profit shifting while also fostering a healthy commercial atmosphere and positive trade relations.

7 min read

Rather than adopt temporary policies that phase out and expire, policymakers should focus their efforts on long-term reforms to support investment.

7 min read

Our experts explain how this major tax legislation may affect you and how policymakers can better improve the tax code.

24 min read 2025 Tax Brackets

2025 Tax Brackets Facts & Figures 2025: How Does Your State Compare?

Facts & Figures 2025: How Does Your State Compare? Summary of the Latest Federal Income Tax Data, 2025 Update

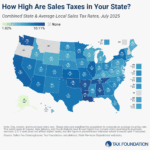

Summary of the Latest Federal Income Tax Data, 2025 Update State and Local Sales Tax Rates, Midyear 2025

State and Local Sales Tax Rates, Midyear 2025 State Individual Income Tax Rates and Brackets, 2025

State Individual Income Tax Rates and Brackets, 2025 Corporate Tax Rates Around the World, 2024

Corporate Tax Rates Around the World, 2024 Top Personal Income Tax Rates in Europe, 2025

Top Personal Income Tax Rates in Europe, 2025

The Tax Foundation is the world’s leading nonpartisan tax policy 501(c)(3) nonprofit. For over 80 years, our mission has remained the same: to improve lives through tax policies that lead to greater economic growth and opportunity.

Our vision is a world where the tax code doesn’t stand in the way of success. Every day, our team of trusted experts strives towards that vision by remaining principled, insightful, and engaged and by advancing the principles of sound tax policy: simplicity, neutrality, transparency, and stability.

TaxEDU is designed to advance tax policy education, discussion, and understanding in classrooms, living rooms, and government chambers. It combines the best aspects of cutting-edge and traditional education to elevate the debate, enable deeper understanding, and achieve principled policy.

TaxEDU gives teachers the tools to make students better citizens, taxpayers a vocabulary to see through the rhetoric, lawmakers crash courses to write smarter laws, and videos and podcasts for anyone who wants to boost their tax knowledge on the go.

Understand the terms of the debate with our comprehensive glossary, including over 100 tax terms and concepts.

Our animated explainer videos are designed for the classroom, social media, and anyone looking to boost their tax knowledge on the go.

Our primers are classroom-ready resources for understanding key concepts in tax policy.

Learn about the principles of sound tax policy—simplicity, transparency, neutrality, and stability—which should serve as touchstones for policymakers and taxpayers everywhere.

Our Tax Foundation University and State Tax Policy Boot Camp lecture series are designed to educate tomorrow's leaders on the principles of sound tax policy.

Commentary

See All CommentaryWill Trump Accounts Actually Help Families Save?

Who are Trump Accounts really for, and will they actually help families save? With yet another savings vehicle added to an already confusing system, do these accounts solve a real problem—or just add more complexity?

Washington Commanders Stadium Subsidy Is a Billion-Dollar Fumble

This past spring, DC taxpayers were sidelined when the Washington Commanders announced that city aid would help fund a new stadium on the site of the vacant RFK Stadium. The $4 billion deal will be offset by a staggering $1.15 billion in public revenue.

Trump’s Next Task Is Turning ‘Beautiful Bill’ Into Economic Boon

The administration has a strong desire to boost manufacturing investment and there are many provisions in the new tax bill that support this aim. But the administration’s erratic trade policy is driving up the costs of key inputs that manufacturers rely on to build things in the US.

The One Big Beautiful Bill Is Law—Now What?

The One Big Beautiful Bill is now law—but what does it actually do? In this episode, we break down the new tax law’s key provisions, including who benefits, who doesn’t, and what it means for the economy, tax certainty, and the federal deficit.

Global Minimum Tax Battles Put Emerging Economies in Crossfire

President Trump made clear that the US wouldn’t accept the global minimum tax (known as Pillar Two) from the OECD in its current form.

Response to OECD Consultation on BEPS 1.0

The BEPS project’s 15 actions were decisive responses to real problems in cross-border taxation, offering real benefits but also real costs. A decade of implementation experience has revealed a critical side effect: sharply higher compliance costs for both tax administrations and the business community.

Big, Beautiful Bill Will Raise Both Growth and Deficits

The One Big Beautiful Tax Bill: What’s In It, What’s Out

New Jersey Taxpayers Deserve Tax Relief

Breaking Down the Senior Deduction in the One, Big, Beautiful Bill

Trump’s Policies Deal a Double Blow to Tax-Cutting States

Rhode Island Should Not Imitate Massachusetts’ Tax Mistakes