Budget Reconciliation: Tracking the 2025 Trump Tax Cuts

Our experts are providing the latest details and analysis of proposed federal tax policy changes.

14 min read

Our experts are providing the latest details and analysis of proposed federal tax policy changes.

14 min read

Our preliminary analysis of the Senate Finance tax plan finds the major tax provisions would increase long-run GDP by 1.1 percent and reduce federal tax revenue by $4.7 trillion over the next decade.

11 min read

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems (ETSs), and carbon taxes.

4 min read

The increased senior deduction with the phaseout would deliver a larger tax cut to lower-middle- and middle-income taxpayers compared to exempting all Social Security benefits from income taxation and would not weaken the trust funds as much. But given the temporary nature of the policy, it would increase the deficit-impact of the reconciliation bills without boosting long-run economic growth.

3 min read

Lawmakers are right to be concerned about deficits and economic growth. The best path to address those concerns is to ensure OBBB provides permanent full expensing of capital investment, avoids inefficient tax cuts, and offsets remaining revenue losses by closing tax loopholes and reducing spending.

8 min read

Expanding and updating the US tax treaty network—both by forging new agreements and modernizing existing ones—is vital to maintaining the country’s competitiveness in a rapidly evolving global tax landscape.

4 min read

Summer has arrived, and states are beginning to implement policy changes that were enacted during this year’s legislative session (or that have delayed effective dates or are being phased in over time).

28 min read

If Michiganders are interested in increasing the state’s spending on education or other priorities—and believe that current revenues are insufficient to support such an increase—there are several ways to do so without significantly affecting residents’ incentives to live and work in Michigan.

4 min read

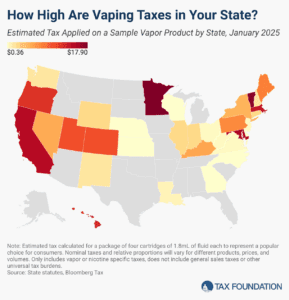

The vaping industry has grown rapidly in recent decades, becoming a well-established product category and a viable alternative to cigarettes for those trying to quit smoking. US states levy a variety of tax structures on vaping products.

7 min read

The Senate draft overall makes more changes to international tax policy than the House draft. On net the changes are positive.

8 min read

New Jersey’s residents deserve tax relief, and the state must stem the tide of out-migration. Affordable reforms in the near term could pave the way for more sweeping, and competitive, reforms to take root in the future.

Senate Republicans have advanced legislation to extend many provisions of the 2017 Tax Cuts and Jobs Act (TCJA) alongside dozens of new provisions, following broadly similar legislation put forward by House Republicans.

7 min read

The Senate’s version of the OBBB restores the benefit of avoiding the SALT deduction cap with PTETs for all pass-through businesses, while placing new limits on the extent of the workarounds.

6 min read

Tax Foundation Europe’s Sean Bray had the opportunity to interview Dr. Stefanie Geringer, a postdoctoral researcher at the Faculty of Law at the University of Vienna and Masaryk University Brno, a certified tax advisor and manager of tax at BDO Austria, about the future of the EU tax mix.

14 min read

Many countries incentivize business investment in research and development (R&D), intending to foster innovation. A common approach is to provide direct government funding for R&D activity. However, a significant number of jurisdictions also offer R&D tax incentives.

4 min read

If Illinois’ budget is enacted as-is, Illinois will newly tax 50 percent of Global Intangible Low-Taxed Income (GILTI) as of tax year 2025, retroactively increasing tax burdens for US businesses and further hindering Illinois’ business tax competitiveness.

7 min read

Senator Ted Cruz’s (R-TX) CREATE JOBS Act prioritizes permanence for the most cost-effective tax reforms—expensing and Neutral Cost Recovery (NCRS)—to boost growth in a relatively fiscally responsible way.

4 min read

If the federal government really wanted to make saving more accessible for taxpayers, it would swap the proposal for Trump Accounts to replace the complicated mess of savings accounts currently available with universal savings accounts.

4 min read

The final House bill makes impressive cuts to the IRA green energy tax credits, but it does so in part by introducing more complexity.

5 min read

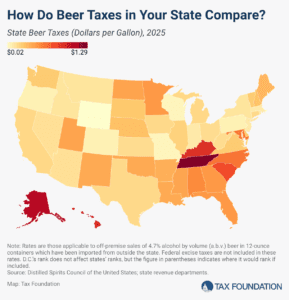

In the United States, taxes are the single most expensive ingredient in beer. The tax burden accounts for more of the final price of beer than labor and materials combined—the many different layers of applicable taxes combining to total as much as 40.8 percent of the retail price.

6 min read