The vaping industry has grown rapidly in recent decades, becoming a well-established product industry that provides a less harmful alternative to cigarettes for those wishing to consume nicotine or to quit smoking.

A wide variety of vapor products and electronic nicotine delivery systems (ENDS) are available. Open system devices allow users to refill them with vaping liquids, giving users more customization options and control over flavor. Closed system products use pre-filled disposable cartridges or pods of vaping liquid which are not refillable. Closed system products are simpler to use and have become more popular among consumers, but many of these products sold in the US have not been authorized for sale by the Food and Drug Administration (FDA).

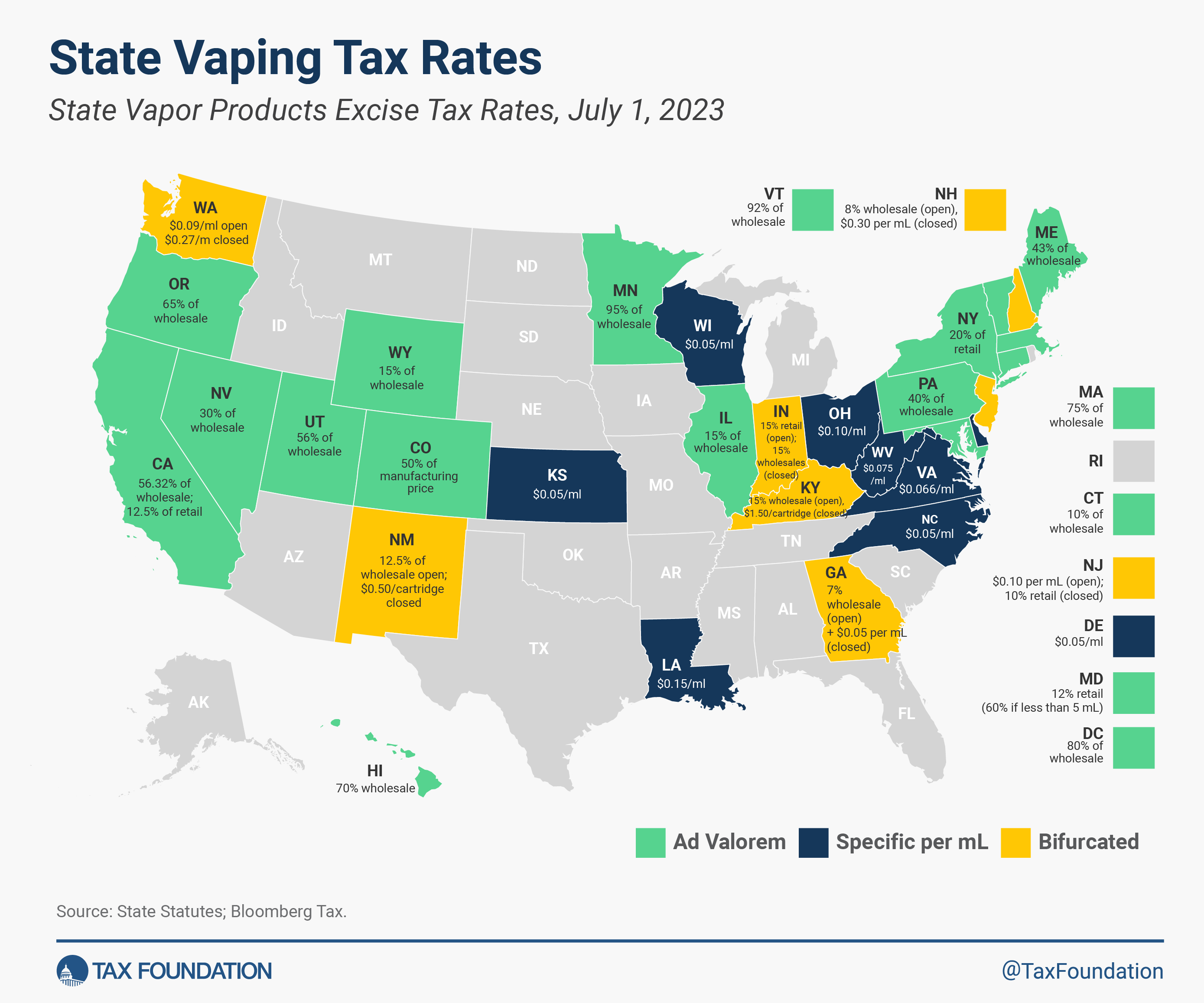

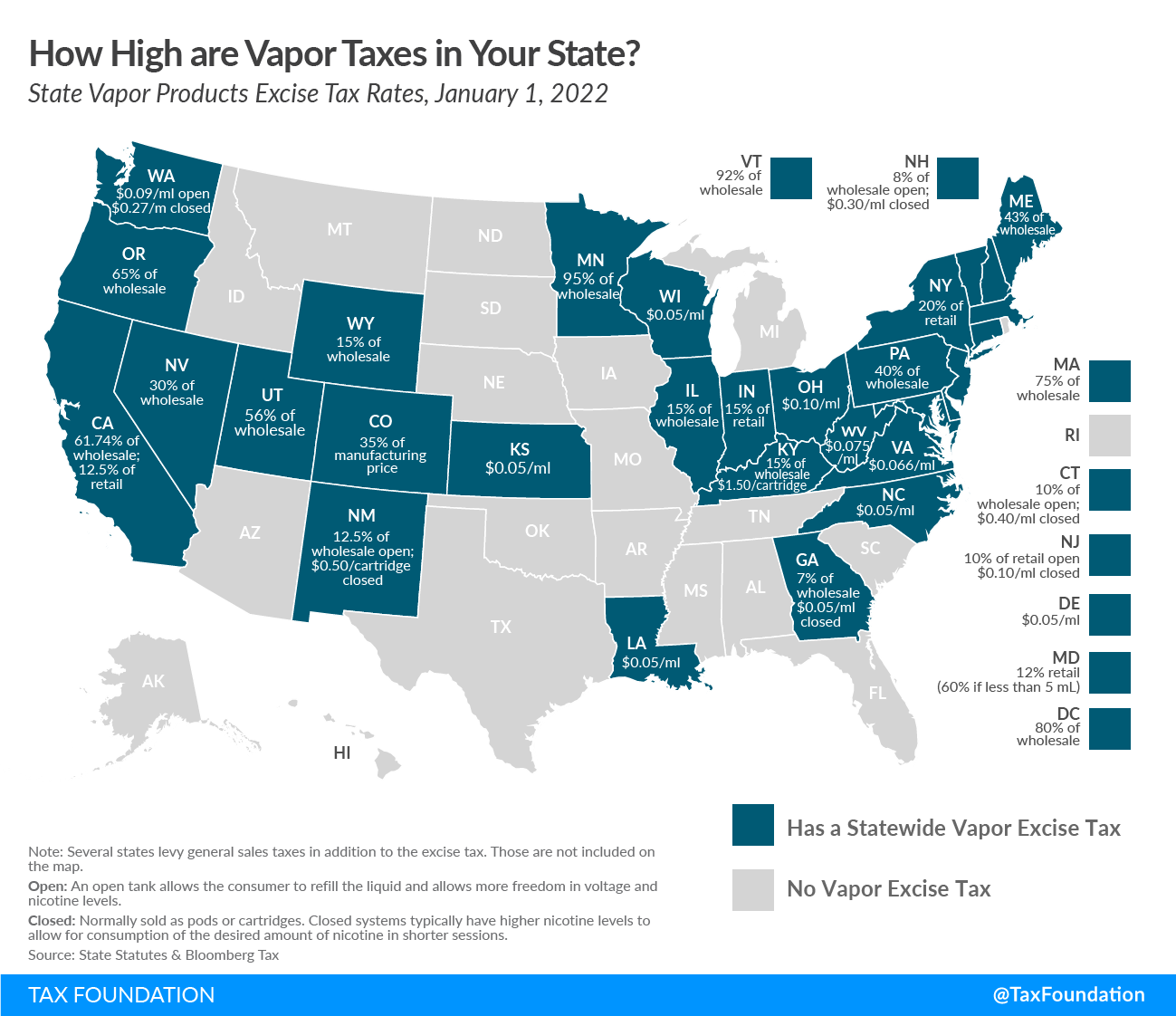

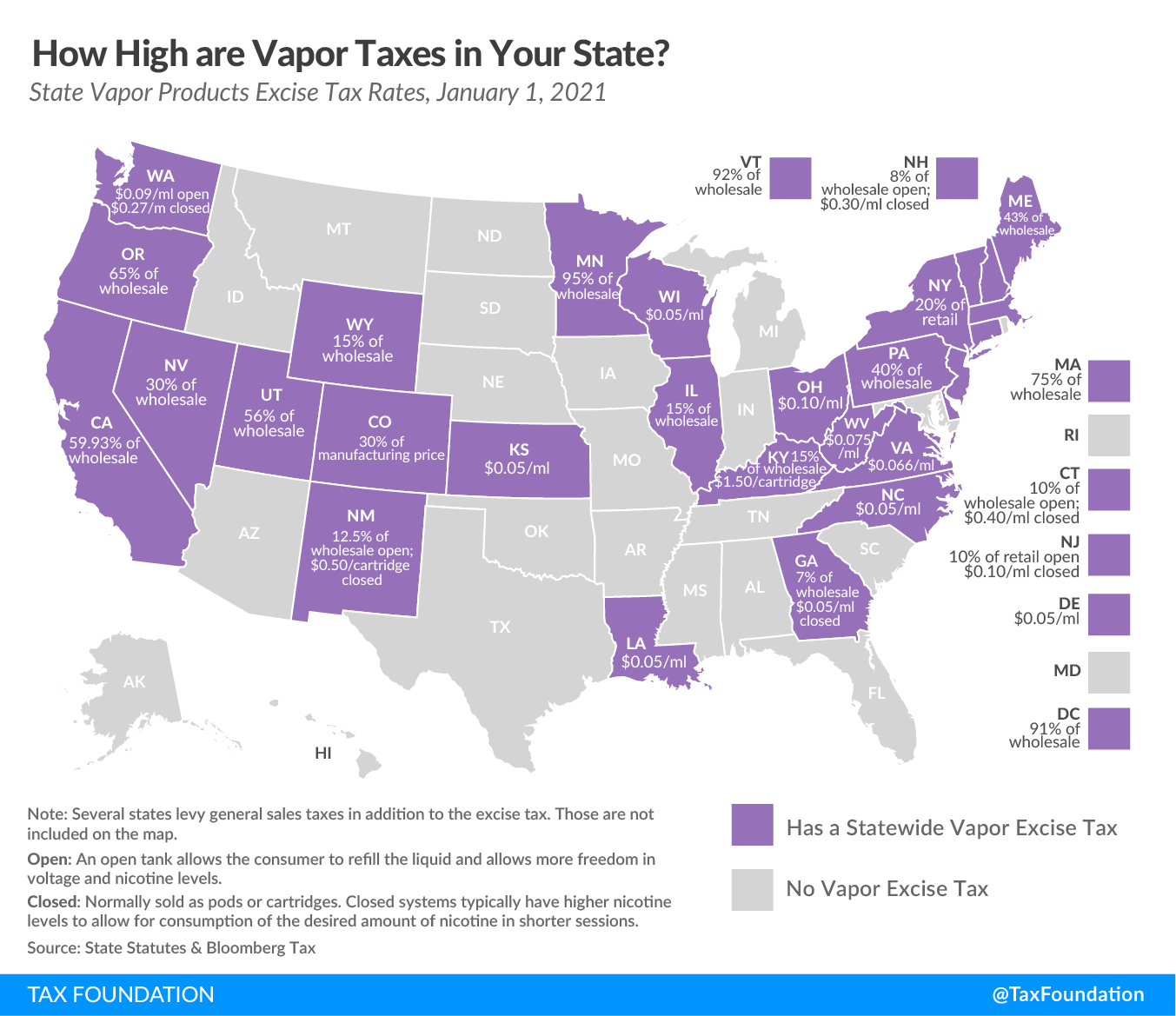

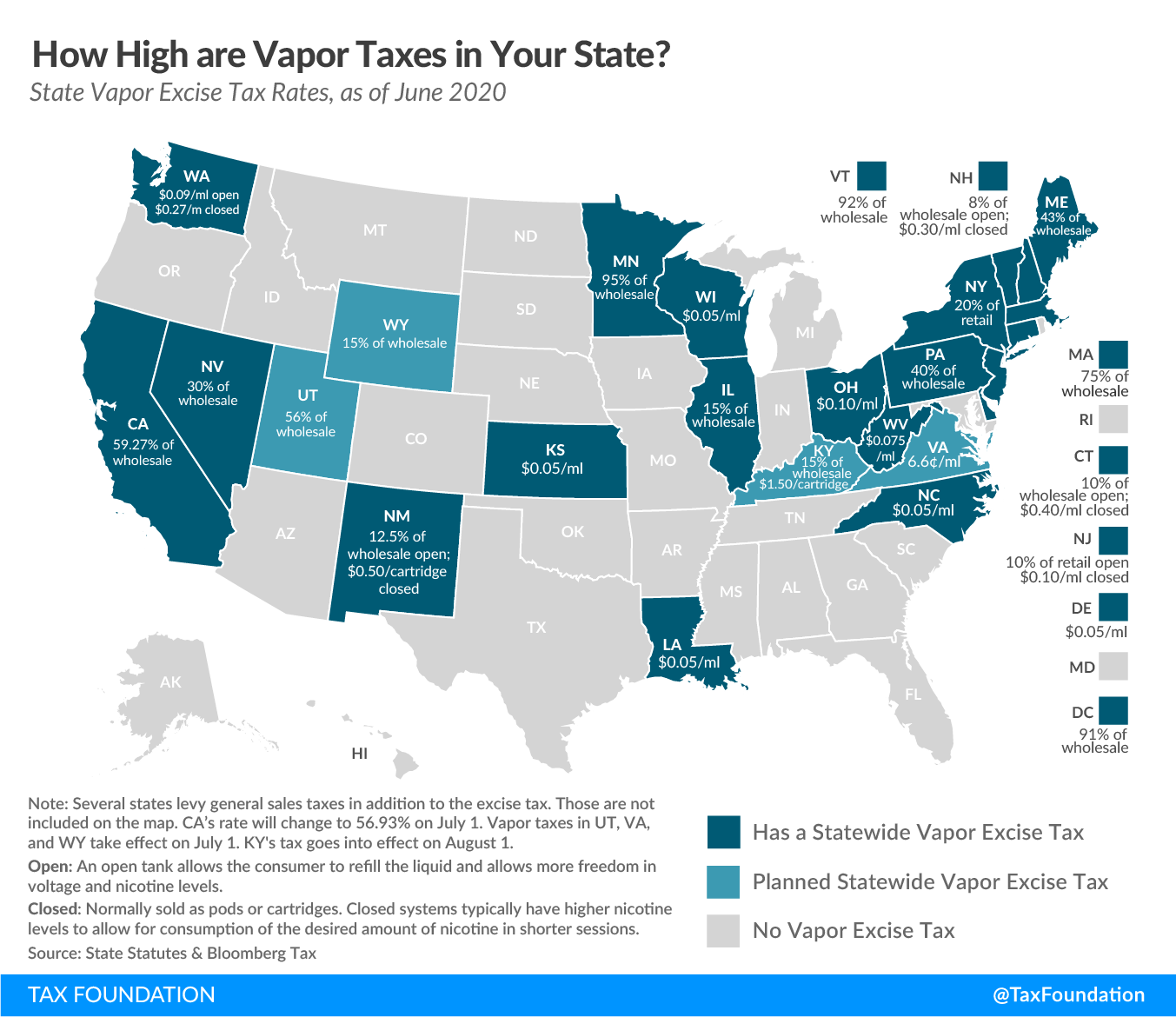

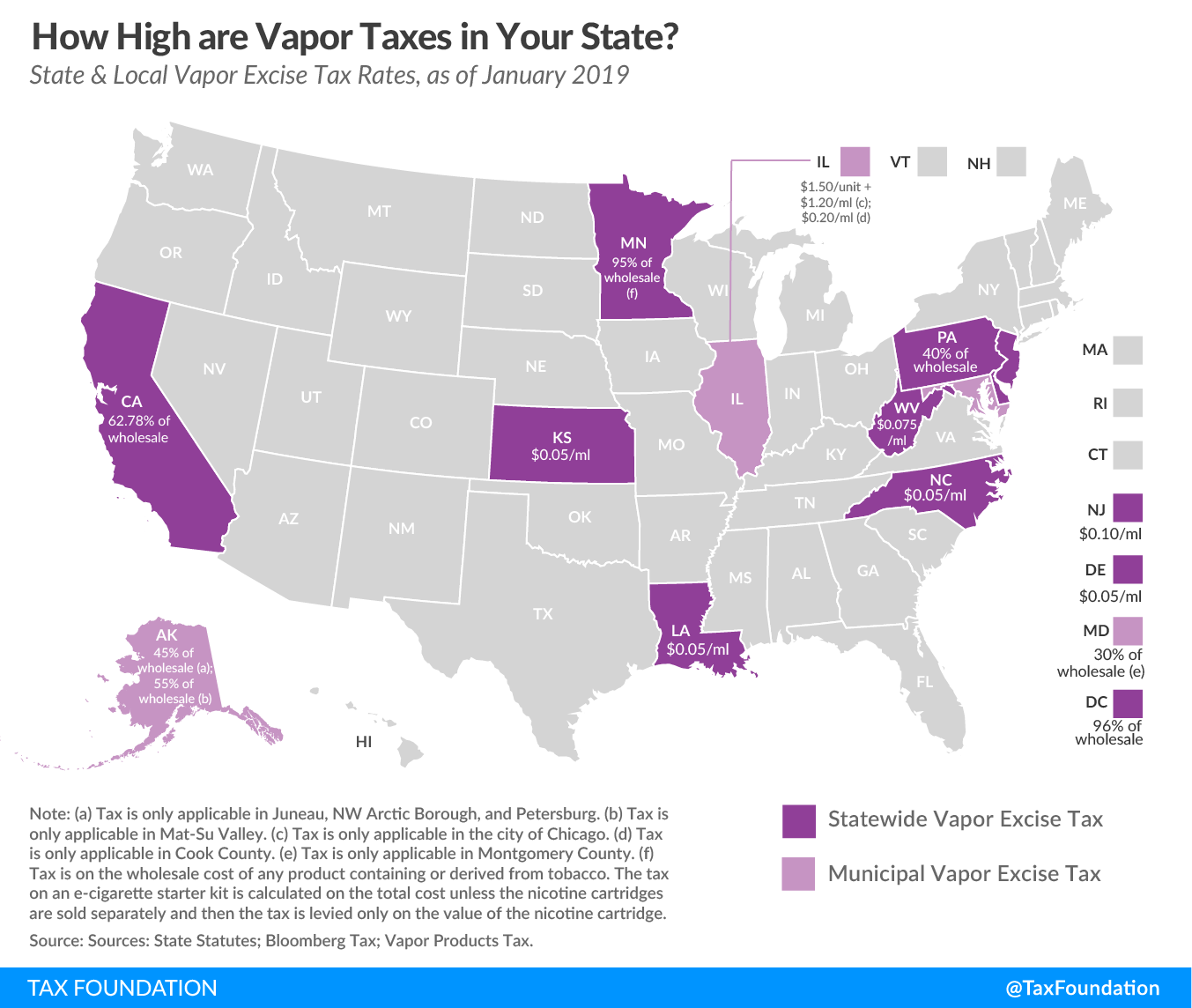

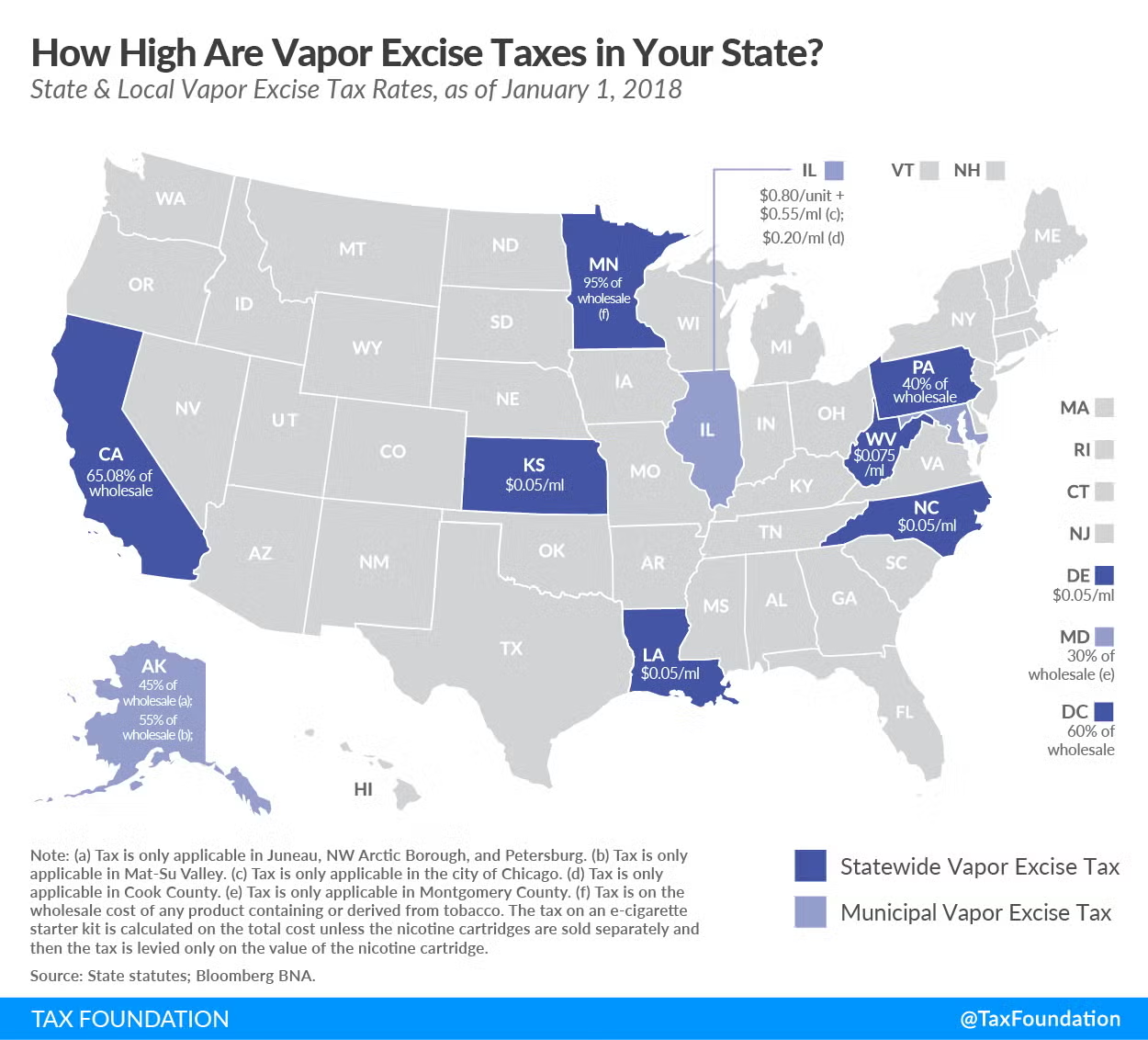

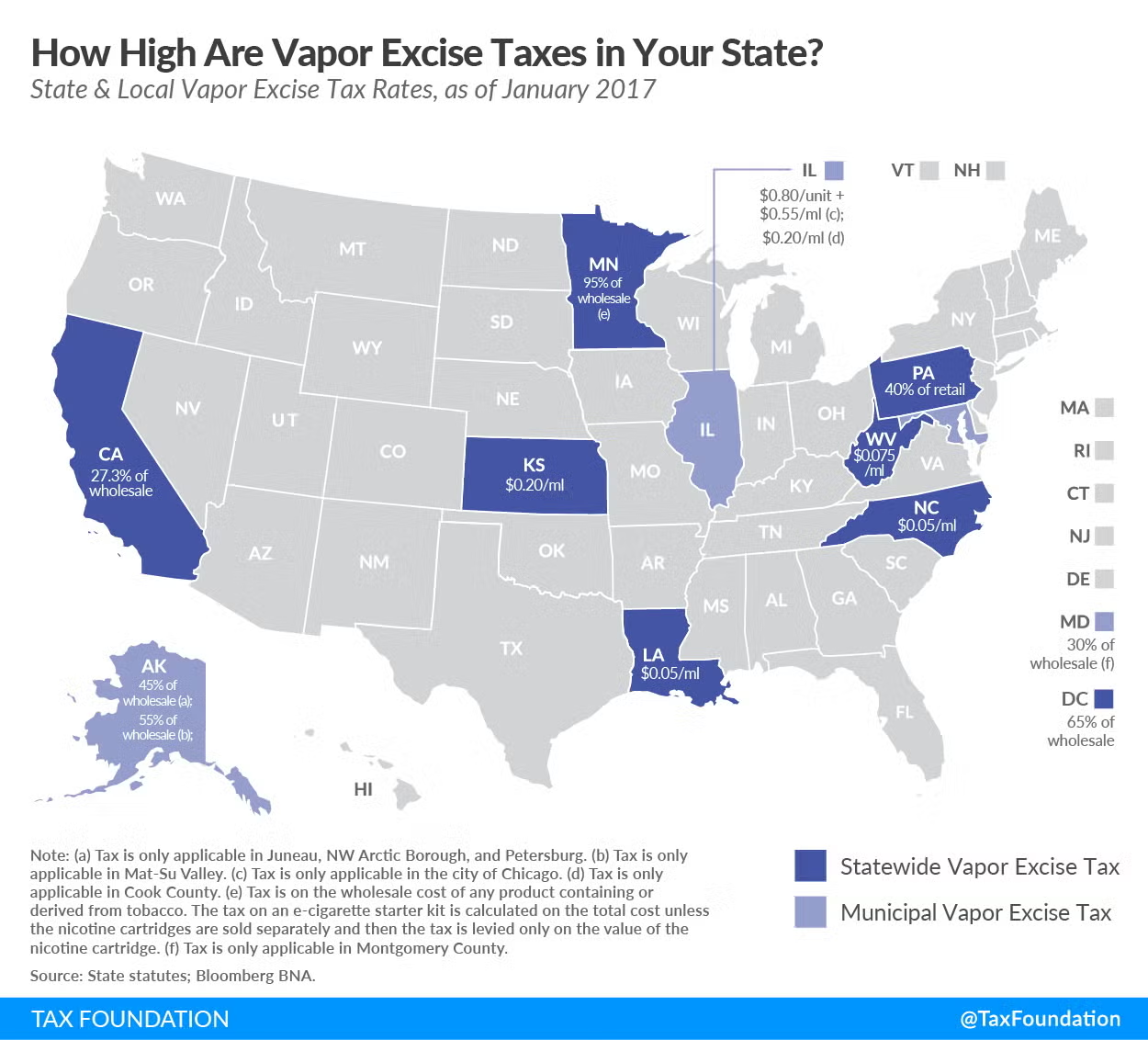

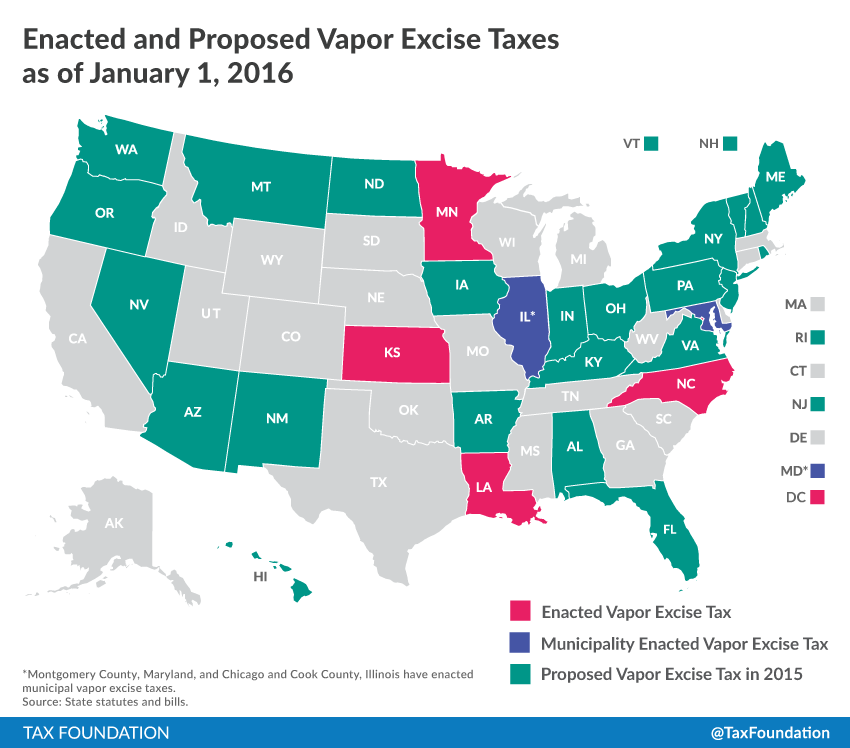

State taxes on vaping products vary significantly in both rate and structure. Higher taxes on vaping or ENDS products discourage smokers from switching to the less harmful vapor alternatives.

As of January 2025, 33 states and the District of Columbia levy an excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. on vaping products. Some states levy a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. on the manufacturer, wholesale, or retail price. Other states tax based on the product volume or number of cartridges; and some states apply a bifurcated system that has a different structure and rate for open and closed systems.

The vastly different tax structures across states makes comparing the overall tax burden between states difficult. To make the taxes comparable, we calculated the tax each state would charge on a popular vaping product, a package of four 1.8mL vaping cartridges with a wholesale price of $18.84. We assume a 5 percent wholesale price markup and a 30 percent retail price markup for determining taxes charged at different points in the production and distribution process.

State Vaping Tax and Estimates Taxes Charged

4-Pack of 1.8 mL Cartridges, 2025

| State | Tax Charged | Total Tax | Total Tax per mL | Rank (if useful) |

|---|---|---|---|---|

| Alabama | $- | $- | ||

| Alaska | $- | $- | ||

| Arizona | $- | $- | ||

| Arkansas | $- | $- | ||

| California | 52.92% of wholesale; 12.5% of retail | $16.29 | $2.26 | 3 |

| Colorado | 56% of manufacturing price | $10.55 | $1.47 | 8 |

| Connecticut | Closed: $0.40/mL; 10% of wholesale for other vapor products | $2.88 | $0.40 | 16 |

| Delaware | $0.05/mL | $0.36 | $0.05 | 28 |

| Florida | $- | $- | ||

| Georgia | Open: 7% of wholesale; Closed system: $0.05/mL | $0.36 | $0.05 | 28 |

| Hawaii | 70% of wholesale | $13.19 | $1.83 | 6 |

| Idaho | $- | $- | ||

| Illinois | 15% of wholesale | $2.83 | $0.39 | 17 |

| Indiana | Open: 15% of retail; Closed: 15% of wholesale | $2.83 | $0.39 | 17 |

| Iowa | $- | $- | ||

| Kansas | $0.05/mL | $0.36 | $0.05 | 28 |

| Kentucky | Open: 15% of wholesale; Closed: $1.50/cartridge | $6.00 | $0.83 | 12 |

| Louisiana | $0.15/mL | $1.08 | $0.15 | 23 |

| Maine | 43% of wholesale | $8.10 | $1.13 | 10 |

| Maryland | Open: 12% of retail; Closed: 60% of retail | $15.43 | $2.14 | 4 |

| Massachusetts | 75% of wholesale | $14.13 | $1.96 | 5 |

| Michigan | $- | $- | ||

| Minnesota | 95% of wholesale | $17.90 | $2.49 | 1 |

| Mississippi | $- | $- | ||

| Missouri | $- | $- | ||

| Montana | $- | $- | ||

| Nebraska | 10% retail if >3 mL; $0.05/mL if ≤3 mL | $0.36 | $0.05 | 28 |

| Nevada | 30% of wholesale | $5.65 | $0.79 | 13 |

| New Hampshire | Open: 8% of wholesale; Closed: $0.30/mL | $2.16 | $0.30 | 20 |

| New Jersey | Open: 10% of retail; Closed: $0.10/mL | $0.72 | $0.10 | 25 |

| New Mexico | Open: 12.5% of wholesale; Closed: $0.50/cartridge | $2.00 | $0.28 | 21 |

| New York | 20% of retail | $5.14 | $0.71 | 14 |

| North Carolina | $0.05/mL | $0.36 | $0.05 | 28 |

| North Dakota | $- | $- | ||

| Ohio | $0.10/mL | $0.72 | $0.10 | 25 |

| Oklahoma | $- | $- | ||

| Oregon | 65% of wholesale | $12.25 | $1.70 | 7 |

| Pennsylvania | 40% of wholesale | $7.54 | $1.05 | 11 |

| Rhode Island | Open: 10% of wholesale; Closed: $0.50/mL | $3.60 | $0.50 | 15 |

| South Carolina | $- | $- | ||

| South Dakota | $- | $- | ||

| Tennessee | $- | $- | ||

| Texas | $- | $- | ||

| Utah | 56% of manufacturing price | $10.55 | $1.47 | 8 |

| Vermont | 92% of wholesale | $17.33 | $2.41 | 2 |

| Virginia | $0.11/mL | $0.79 | $0.11 | 24 |

| Washington | Open: $0.09/mL; Closed: $0.27/mL | $1.94 | $0.27 | 22 |

| West Virginia | $0.075/mL | $0.54 | $0.08 | 27 |

| Wisconsin | $0.05/mL | $0.36 | $0.05 | 28 |

| Wyoming | 15% of wholesale | $2.83 | $0.39 | 17 |

| District of Columbia | 71% of wholesale | $13.38 | $1.86 | 6 |

Data compiled by Adam Hoffer, Jacob Macumber-Rosin

Changes from 2024

- California reduced the wholesale tax levied on vapor products from 56.32 percent to 52.92 percent.

- Colorado increased the tax on the manufacturing price of vapor products from 50 percent to 56 percent.

- The District of Columbia reduced the wholesale tax levied on vapor products from 79 percent to 71 percent.

- Rhode Island enacted an excise tax on vapor products at a rate of 10 percent of the wholesale price for open systems and $0.50 per mL for closed systems.

- Virginia increased the tax on vapor products from $0.066 to $0.11 per mL.

Minnesota imposes the heaviest wholesale tax of 95 percent, followed closely by Vermont at 92 percent, while the least burdensome wholesale taxes are levied on open systems by Georgia at 7 percent and New Hampshire at 8 percent. Retail taxes can be as high as 60 percent in Maryland or as low as 10 percent on small containers in Nebraska and open systems in New Jersey.

Volume-based taxes are highest in Rhode Island at $0.50 per mL, followed by Connecticut at $0.40 per mL and New Hampshire at $0.30 per mL on closed systems. Rather than taxing by the volume of fluid, Kentucky and New Mexico tax by the cartridge at $1.50 and $0.50 per cartridge respectively.

Minnesota levies the greatest overall tax burden at $17.90 (a $2.486 per mL equivalent), with its wholesale tax of 95 percent. Of states that tax vaping products, Delaware, Georgia, Kansas, Nebraska, North Carolina, and Wisconsin tie for the lowest overall tax levied at $0.36 (corresponding to their $0.05 per mL tax). Relative burdens would change with different products, as ad valorem taxes react to different prices, and industry markups may vary between states.

State taxes on vaping and ENDS products are important to consider because these products facilitate the delivery of nicotine, the addictive component of cigarettes and tobacco products, without the combustion and inhalation of tar inherent to traditional cigarettes. While more research into the harm reduction potential of vapor products is needed, especially for the long-term effects of vaping, the present consensus is that vapor products are significantly less harmful than traditional combustible cigarettes.

The English Ministry for Health, through Public Health England, has concluded that vaping is 95 percent less harmful than cigarettes. King’s College London later confirmed the substantial reduction in exposure to toxicants from vaping rather than smoking.

The disparity in health effects emphasizes the importance of understanding and embracing harm reduction in the design of excise taxes on vapor products. Vaping, while not completely harmless, is a much less harmful alternative to smoking. One of the primary obstacles to those trying to quit smoking is the addictive properties of nicotine. Harm reduction refers to the concept that it is more practical to reduce the harm associated with using certain products rather than attempting to eliminate that harm completely through counterproductive policies like ineffective bans or punitive levels of taxation.

Protecting access to harm-reducing vapor products is crucial for excise tax policy because nicotine-containing products are economic substitutes. Lower tax rates on vaping encourage consumers to switch from more harmful combustibles. High excise taxes on less harmful alternatives risk harming public health by pressuring vapers back to smoking. The implementation of a 95 percent tax on vapor products in Minnesota was found to have deterred 32,400 smokers in the state from quitting cigarettes.

The current regulatory regime administered by the FDA and some individual states that ban the sale of almost all vapor devices, those that have not received approval by the FDA, or flavored products precludes a great deal of harm reduction across the US. The illicit market these policies help create have also seemed to preclude a great deal of revenue collection as well, as consumers are pushed toward more dangerous, unregulated, and untaxed illicit vapes. Policy reform in this area represents a prime opportunity to bolster public health by reducing lives lost to smoking, generating more tax revenue for health programs, and enabling growth in a market that consumers clearly support.

If the goal of taxing cigarettes is to encourage cessation, vapor taxation must be considered as part of that policy design. Ideal tax design for vapor products and other alternative nicotine products should account for the relative harms of each alternative.