Taxes and Interstate Migration: 2024 Update

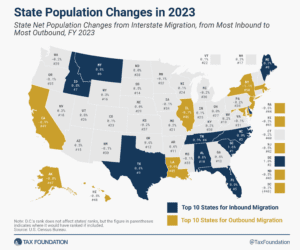

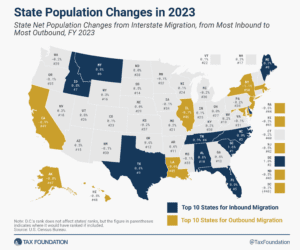

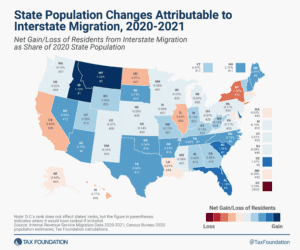

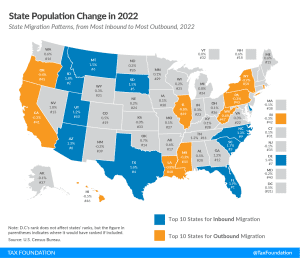

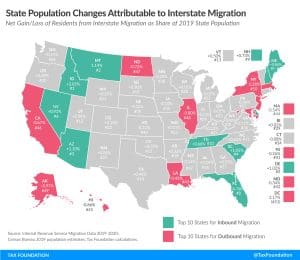

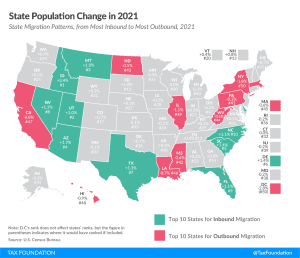

The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

8 min read

The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

8 min read

Do taxes affect individuals’ decisions regarding where to live and work? Can high taxes cause the outmigration of wealthy individuals?

5 min read

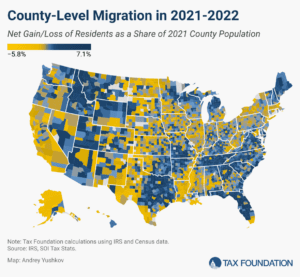

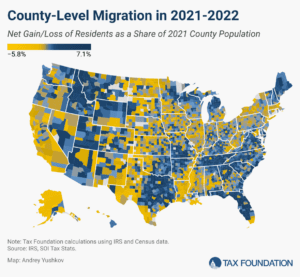

The pandemic has accelerated changes to the way we live and work, making it far easier for people to move—and they have. As states work to maintain their competitive advantage, they should pay attention to where people are moving, and try to understand why.

5 min read

Recent data suggest that tax competitiveness plays a significant role in residents’ relocation decisions.

3 min read

The State Tax Competitiveness Index enables policymakers, taxpayers, and business leaders to gauge how their states’ tax systems compare. While there are many ways to show how much state governments collect in taxes, the Index evaluates how well states structure their tax systems and provides a road map for improvement.

115 min read

The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

8 min read

Do taxes affect individuals’ decisions regarding where to live and work? Can high taxes cause the outmigration of wealthy individuals?

5 min read

Vermont lawmakers are considering the adoption of two new taxes on high earners, which proponents have branded “wealth taxes.”

4 min read

After years of strong revenue growth, Kansas has substantial cash reserves on hand, and policymakers on both sides of the aisle have expressed a desire to return some of the extra revenue to taxpayers.

5 min read

The pandemic has accelerated changes to the way we live and work, making it far easier for people to move—and they have. As states work to maintain their competitive advantage, they should pay attention to where people are moving, and try to understand why.

5 min read

The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

8 min read

Whether tax savings motivated his move or not, the implications for Washington are very real, and serve to illustrate just how dangerous it can be to design tax systems that rely so overwhelmingly on a very small number of taxpayers choosing to stay put.

3 min read

What do The Rolling Stones, NFL star Tyreek Hill, and Maryland millionaires have in common? They all moved because of taxes.

4 min read

In recognition of the fact that there are better and worse ways to raise revenue, our Index focuses on how state tax revenue is raised, not how much. The rankings, therefore, reflect how well states structure their tax systems.

111 min read

The pandemic has accelerated changes to the way we live and work, making it far easier for people to move—and they have. As states work to maintain their competitive advantage, they should pay attention to where people are moving, and try to understand why.

5 min read

On Election Day, a narrow majority of Massachusetts voters approved Question 1, also known as the Fair Share Amendment, which will transition the Commonwealth from a flat rate individual income tax to a graduated rate system.

7 min read

IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

12 min read

When NFL star wide receiver Tyreek Hill weighed offers from the New York Jets and the Miami Dolphins, no doubt there was a lot on his mind. But one consideration towered over the rest, at least according to Hill himself: signing with the Jets “was very close to happening,” but “those state taxes man. I had to make a grown-up decision.”

7 min read

Massachusetts’ competitive tax advantage in New England is driven primarily by its competitive individual income tax rate and its sales and use tax structure. If the Commonwealth changes its tax code in ways that narrow the base or increase the rate, it cedes greater tax competitiveness to other states, regionally and nationally.

34 min read

Every change to a state’s tax system makes its business tax climate more or less competitive compared to other states and makes the state more or less attractive to business.

7 min read

Research almost invariably shows a negative relationship between income tax rates and gross domestic product (GDP). Cuts to marginal tax rates are highly correlated with decreases in the unemployment rate.

26 min read

Before competing in the UEFA Champions League, football clubs in Europe also compete to lure the best players.

4 min read

The pandemic has accelerated changes in the way we live and work, making it far easier for people to move—and they have. As states work to maintain their competitive advantage, they should pay attention to where people are moving, and try to understand why.

6 min read