The Biden administration has proposed several taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. increases on businesses, whether structured as C corporations subject to the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. or passthrough entities such as S corporations, partnerships, or sole proprietorships that are subject to the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. . It is important to remember that those business taxes ultimately fall on people, including business owners and employees all across America.

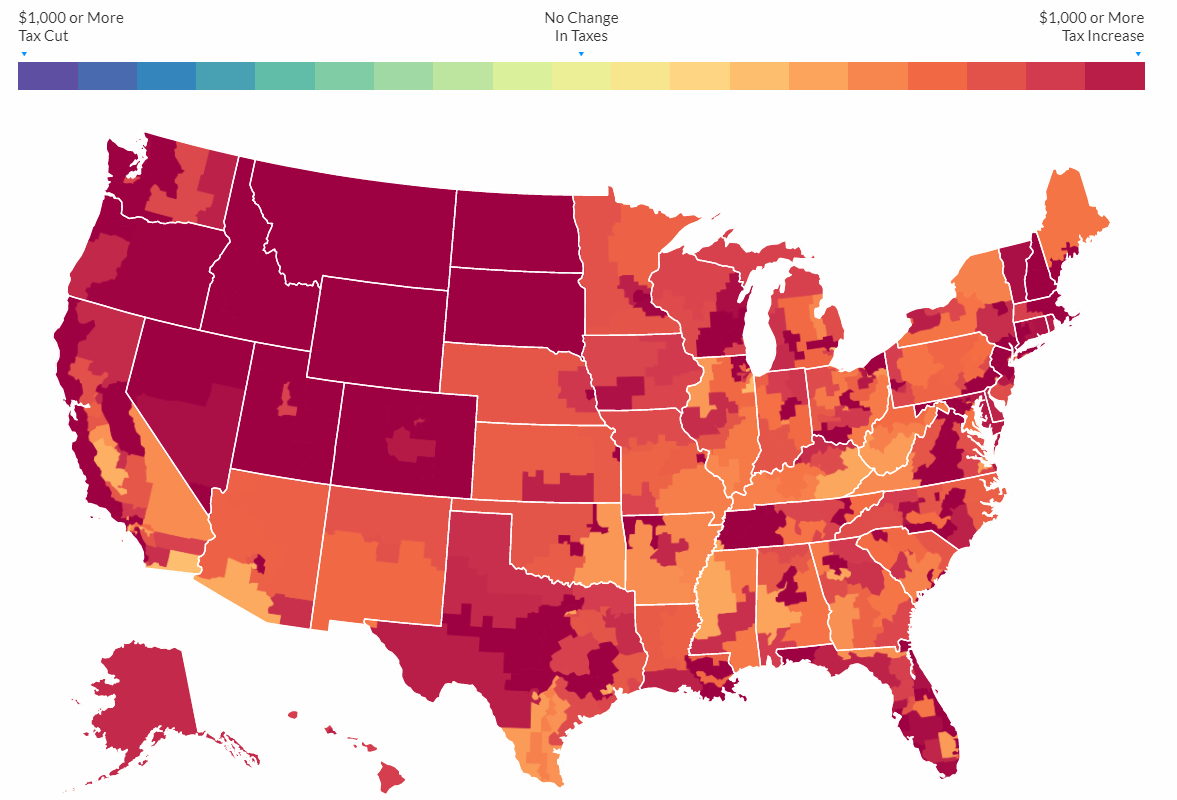

Based on individual tax return data from the IRS at the congressional district level, the Tax Foundation’s new Interactive Tax Map shows how individuals across the country would be impacted by the tax increases.

Biden’s plans contain several tax proposals that in total would increase business income taxes by more than $2 trillion over 10 years, including:

- Corporate tax increases

- Raise the corporate tax rate to 28 percent

- Raise taxes on the foreign earnings of U.S. corporations

- Passthrough business increases

- Impose Net Investment Income Tax (NIIT) on active pass-through income above $400,000

- Make the active passthrough loss limitation permanent

- Individual income tax increase

- Raise top individual income tax bracketA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. to 39.6 percent

- Capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment.

increase

- Tax unrealized capital gains at death over $1 million and impose a 39.6 percent tax rate on capital gains over $1 million

The proposed corporate tax increases are large, amounting to about $1.7 trillion over 10 years. Economists generally find that the burden of corporate taxes falls on some combination of capital and labor income, and we assume the burden initially falls largely on capital income and in the long run falls evenly on capital and labor income. As such, after distributing the proposed corporate tax increases to capital and labor income reported on individual tax returns, we find it would increase the average tax burden per filer in every state, with tax increases in 2022 ranging from $416 per filer in West Virginia to $1,490 per filer in Massachusetts. In 2031, average tax increases per filer would range from $706 in West Virginia to $1,729 in Massachusetts.

Besides Massachusetts, 10 other states would see average tax increases in excess of $1,000 per filer in 2022: Connecticut, New York, New Jersey, Wyoming, California, Florida, Washington, Colorado, Illinois, and Nevada. By 2031, most states (34) would see average tax increases of $1,000 or more.

Every state has a substantial passthrough business sector, and the two proposals clearly aimed at passthrough business income, amounting to about $220 billion in new taxes over 10 years, would raise tax burdens in every state depending on the amount of passthrough business income reported in each state. Average tax increases in 2022 would range from $32 per filer in West Virginia to $154 per filer in New York, growing to $104 in West Virginia and $503 in New York in 2031.

Raising the top individual income tax rate to 39.6 percent would raise $116 billion over 10 years, affecting a large share of passthrough business income as well as other sources of investment income and wages. This provision would raise tax burdens in every state over the next three years, with average tax increases in 2022 ranging from $45 per filer in West Virginia to $360 per filer in Connecticut.

Lastly, taxing unrealized capital gains at death and raising the capital gains tax rate would raise $213 billion over 10 years, impacting investors and business owners in every state and limiting the ability of many types of businesses to get funding and to remain viable from one generation to the next. The proposal would cause tax burdens to grow over time in every state, resulting in average tax increases ranging from $42 per filer in West Virginia to $503 per filer in Connecticut in 2031.

The Biden administration has targeted U.S. businesses, including corporations and passthrough entities, to raise revenue to fund new spending. However, businesses are comprised of people, which means individual taxpayers across America will end up footing the bill.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe