Do Consumption Taxes Do a Better Job of Taxing Criminals?

One of the arguments in favor of the FairTax is that it would do a better job of taxing the underground economy than the income tax it is intended to replace.

6 min read

One of the arguments in favor of the FairTax is that it would do a better job of taxing the underground economy than the income tax it is intended to replace.

6 min read

The overall U.S. tax and transfer system is overwhelmingly progressive, and understanding the extent—and source—of that progressivity is essential for lawmakers considering the trade-offs associated with each tax policy decision.

23 min read

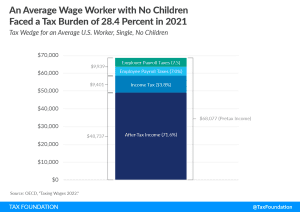

Tax burdens rose across the country as pandemic-era economic changes caused taxable income, activities, and property values to rise faster than net national product. Tax burdens in 2020, 2021, and 2022 are all higher than in any other year since 1978.

24 min read

The Biden administration has targeted U.S. businesses, including corporations and passthrough entities, to raise revenue to fund new spending. However, individual taxpayers across America will end up footing the bill.

4 min read

The Biden administration has pledged to not raise taxes on anyone earning less than $400,000 a year. However, the administration’s corporate tax proposals would likely violate that pledge, given that corporations are comprised of people who also might earn less than $400,000.

3 min read

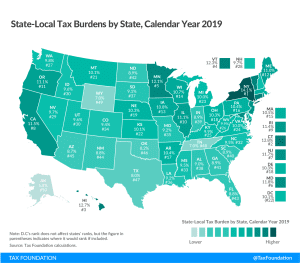

New Yorkers faced the highest burden, with 14.1 percent of income in the state going to state and local taxes. Connecticut (12.8 percent) and Hawaii (12.7 percent) followed.

19 min read

Increasing the corporate tax rate is often offered as a solution to income inequality because higher-income individuals tend to own more corporate shares than others and may bear the burden of a tax increase on corporate income.

4 min read

Recent empirical evidence shows that workers bear upwards of 70 percent of the corporate income tax burden, much more than popular tax models claim, which make errors in how they account for super-normal returns and the openness of our economy.

50 min read