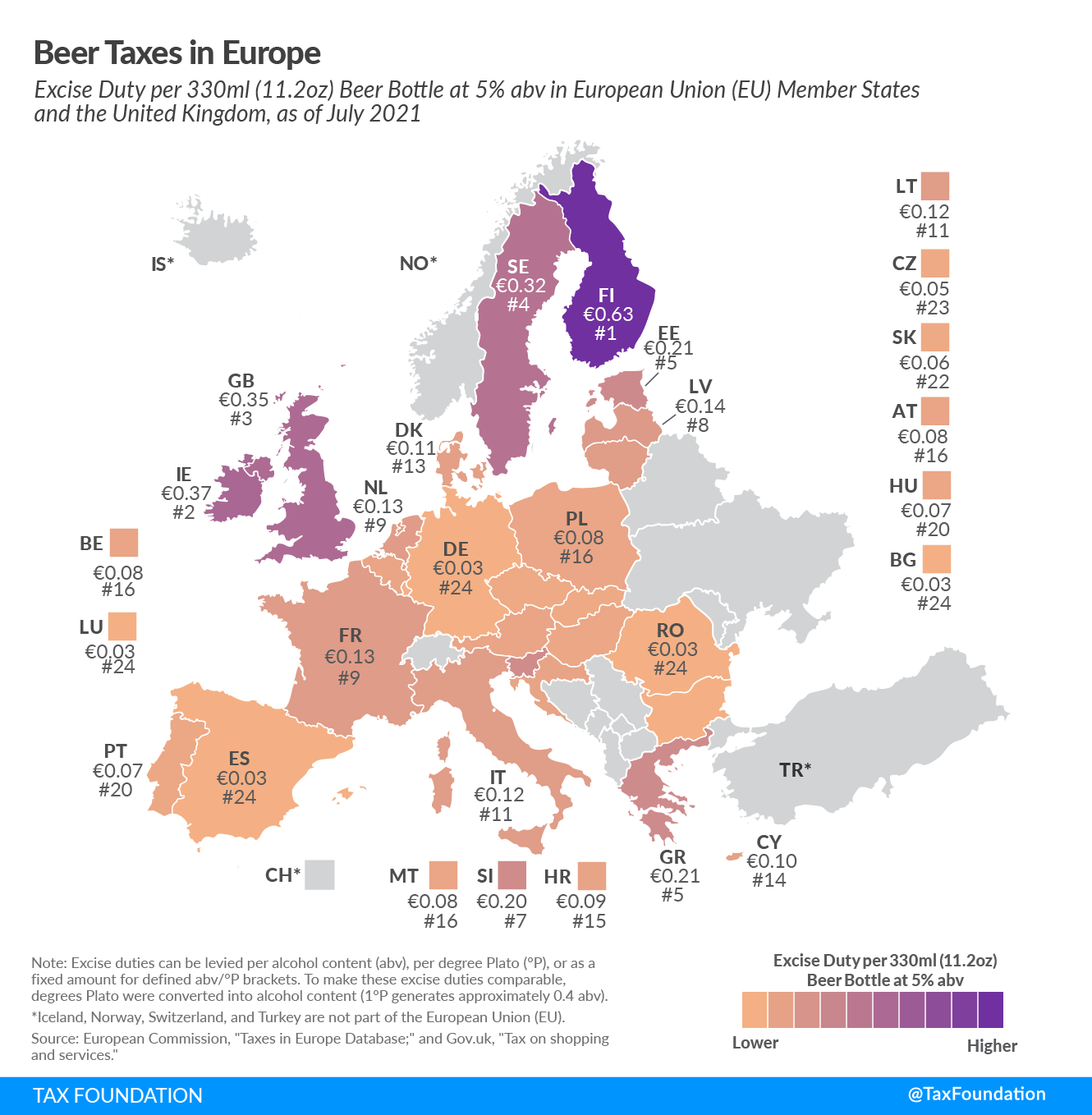

Beer Taxes in Europe

2 min readBy:This is the beginning of a map series in which we’ll explore different types of excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. es throughout Europe, starting with excise duties on beer.

According to EU law, every EU country is required to levy an excise duty on beer of at least €1.87 per 100 liters (26.4 gal) and degree of alcohol content, translating to approximately €0.03 per 330ml (11.2 oz) beer bottle at 5% abv. As this map illustrates, only a few EU countries stick close to the minimum rate; most levy on much higher excise duties.

Finland, Ireland, and the United Kingdom are the three countries covered that levy the highest excise duties on beer. Finland has the highest excise taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. on beer in Europe at €0.63 per 330ml beer bottle. Ireland and the United Kingdom are second and third, at €0.37 and €0.35, respectively.

Bulgaria, Germany, Luxembourg, Romania, and Spain are the countries levying approximately the EU’s minimum rate of €0.03 per beer bottle.

All European countries covered also levy a value-added tax (VAT) on beer, which is charged on the sales value of a beer bottle. The excise amounts shown in the map above relate only to excise taxes and do not include the VAT.

| Country | Excise Duty per 330ml (11.2oz) Beer Bottle at 5% abv | |

|---|---|---|

| Euros | US-Dollars | |

| Austria (AT) | €0.08 | $0.09 |

| Belgium (BE) | €0.08 | $0.09 |

| Bulgaria (BG) | €0.03 | $0.04 |

| Croatia (HR) | €0.09 | $0.10 |

| Cyprus (CY) | €0.10 | $0.11 |

| Czech Republic (CZ) | €0.05 | $0.06 |

| Denmark (DK) | €0.11 | $0.12 |

| Estonia (EE) | €0.21 | $0.24 |

| Finland (FI) | €0.63 | $0.72 |

| France (FR) | €0.13 | $0.14 |

| Germany (DE) | €0.03 | $0.04 |

| Greece (GR) | €0.21 | $0.24 |

| Hungary (HU) | €0.07 | $0.08 |

| Ireland (IE) | €0.37 | $0.42 |

| Italy (IT) | €0.12 | $0.14 |

| Latvia (LV) | €0.14 | $0.15 |

| Lithuania (LT) | €0.12 | $0.13 |

| Luxembourg (LU) | €0.03 | $0.04 |

| Malta (MT) | €0.08 | $0.09 |

| Netherlands (NL) | €0.13 | $0.14 |

| Poland (PL) | €0.08 | $0.09 |

| Portugal (PT) | €0.07 | $0.08 |

| Romania (RO) | €0.03 | $0.04 |

| Slovakia (SK) | €0.06 | $0.07 |

| Slovenia (SI) | €0.20 | $0.23 |

| Spain (ES) | €0.03 | $0.04 |

| Sweden (SE) | €0.32 | $0.36 |

| United Kingdom (GB) | €0.35 | $0.40 |

|

Source: European Commission, “Taxes in Europe Database,” accessed July 23, 2021, https://ec.europa.eu/taxation_customs/tedb/splSearchForm.html; and Gov.uk, “Tax on shopping and services: Alcohol and tobacco duties,” https://www.gov.uk/tax-on-shopping/alcohol-tobacco. Notes: Some countries levy reduced excise duties for independent small breweries. The average 2020 exchange rate provided by the U.S. Internal Revenue Service (IRS) was used for the conversion from euros to dollars (USD 1 = EUR 0.877). |

||

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe