Taxes and the American Revolution

The American Revolution was a tax revolt over the power to tax, not over tax burdens. It serves as a reminder that tax policy can have impacts (big and small) that last for centuries.

The American Revolution was a tax revolt over the power to tax, not over tax burdens. It serves as a reminder that tax policy can have impacts (big and small) that last for centuries.

The increased senior deduction with the phaseout would deliver a larger tax cut to lower-middle- and middle-income taxpayers compared to exempting all Social Security benefits from income taxation and would not weaken the trust funds as much. But given the temporary nature of the policy, it would increase the deficit-impact of the reconciliation bills without boosting long-run economic growth.

3 min read

Summer has arrived, and states are beginning to implement policy changes that were enacted during this year’s legislative session (or that have delayed effective dates or are being phased in over time).

28 min read

Our experts are providing the latest details and analysis of proposed federal tax policy changes.

14 min read

Our preliminary analysis of the Senate Finance tax plan finds the major tax provisions would increase long-run GDP by 1.1 percent and reduce federal tax revenue by $4.7 trillion over the next decade.

9 min read

If Michiganders are interested in increasing the state’s spending on education or other priorities—and believe that current revenues are insufficient to support such an increase—there are several ways to do so without significantly affecting residents’ incentives to live and work in Michigan.

4 min read

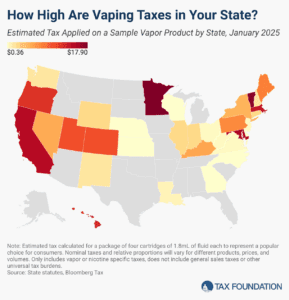

The vaping industry has grown rapidly in recent decades, becoming a well-established product category and a viable alternative to cigarettes for those trying to quit smoking. US states levy a variety of tax structures on vaping products.

7 min read

New Jersey’s residents deserve tax relief, and the state must stem the tide of out-migration. Affordable reforms in the near term could pave the way for more sweeping, and competitive, reforms to take root in the future.

Senate Republicans have advanced legislation to extend many provisions of the 2017 Tax Cuts and Jobs Act (TCJA) alongside dozens of new provisions, following broadly similar legislation put forward by House Republicans.

7 min read

The House-passed reconciliation bill leaves out Trump’s promise to eliminate taxes on Social Security benefits, opting instead to expand the standard deduction for seniors.

If the federal government really wanted to make saving more accessible for taxpayers, it would swap the proposal for Trump Accounts to replace the complicated mess of savings accounts currently available with universal savings accounts.

4 min read

The final House bill makes impressive cuts to the IRA green energy tax credits, but it does so in part by introducing more complexity.

5 min read

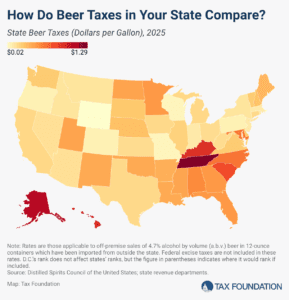

In the United States, taxes are the single most expensive ingredient in beer. The tax burden accounts for more of the final price of beer than labor and materials combined—the many different layers of applicable taxes combining to total as much as 40.8 percent of the retail price.

6 min read

The ongoing economic uncertainty from Russia’s war in Ukraine, economic recovery, supply chain disruptions, and rising interest rates have highlighted the importance of business investment.

30 min read

President’s Trump’s policies would throw high-tax states a life raft as they swim against the tide—before potentially hitting all states with a tariff-induced economic tsunami that could force lawmakers’ hands and reverse recent tax relief.

Rhode Island lawmakers are debating raising the state’s top income tax rate. Though billed as a tax hike on high earners, the consequences would manifest across the state’s entire economy—creating a risk that Rhode Island will tax its way into uncompetitiveness.

Rather than permanently expanding a complicated, nonneutral tax break, Congress should prioritize permanence for the most neutral and pro-growth policies like bonus depreciation and R&D expensing.

6 min read

Our preliminary analysis finds the tax provisions increase long-run GDP by 0.8 percent and reduce federal tax revenue by $4.0 trillion from 2025 through 2034 on a conventional basis before added interest costs.

9 min read

The House-passed “One Big Beautiful Bill” includes a new 3.5 percent tax on remittances, or non-commercial transfers of money that people in the US send to people abroad.

7 min read

As the Senate considers next steps for the House-passed “big, beautiful” tax bill, the battle lines have been drawn for a showdown over the state and local tax (SALT) deduction.