All Related Articles

Trade-offs of Delaying Tax Filing and Instituting a Payroll Tax Holiday on Businesses and Individuals

Some policymakers are proposing a payroll tax holiday for businesses and individuals for 2020 and a complete delay in filing deadlines for tax year 2019 and 2020 to April 2021. What are the pros and cons of doing so?

4 min read

States’ Unemployment Compensation Trust Funds Could Run Out in Mere Weeks

Six states, which collectively account for over one-third of the U.S. population, are currently in a position to pay out fewer than 10 weeks of the unemployment compensation claims that have already come in since the start of the COVID-19 pandemic.

3 min read

These States Could Tax Your Recovery Rebates

Due to a quirk of some state tax codes, the recovery rebates in the CARES Act could increase your income tax liability in six states: Alabama, Iowa, Louisiana, Missouri, Montana, and Oregon.

4 min read

Watch: Tax Foundation Experts Discuss Short-term Coronavirus Relief Packages

What could the next phase of relief look like and what role does tax policy play in ensuring the U.S. and countries around the world make a strong economic recovery?

1 min readState Rainy Day Funds and the COVID-19 Crisis

State revenue stabilization funds, often called rainy day funds, are better funded now than they were at the start of the Great Recession and can be a valuable tool as states face a sharp pandemic-linked economic contraction.

18 min read

A Good Excise Tax

4 min read

April 2nd Evening State Tax Update

California extends tax filing and payment deadline to July 31 for a broad spectrum of business taxes as Virginia keeps May 1st tax filing deadline.

4 min read

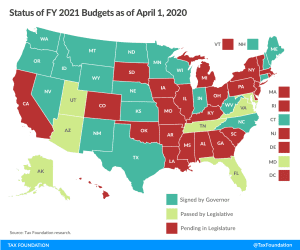

Tracking State Legislative Responses to COVID-19

Many states are racing to pass budgets, emergency COVID-19 supplemental appropriations, and other must-pass legislation as quickly as possible. We’re tracking the latest state legislative responses to the coronavirus crisis.

66 min read

Federal Coronavirus Relief: CARES Act FAQ

Congress recently passed the largest economic relief bill in American history (CARES Act). We’ve created a FAQ portal to better inform policymakers, journalists, and taxpayers across the country on the new law.

13 min read

State Strategies for Closing FY 2020 with a Balanced Budget

State options for closing FY 2020 shortfalls are limited and may ultimately include drawing on reserve funds and even accounting tricks

16 min read

A Visual Guide to Unemployment Benefit Claims

Another 1.4 million Americans filed initial regular unemployment benefit claims, the eleventh week of a decline in the rate of new claims, but still among the highest levels in U.S. history. The total number of new and continued claims now stands at 19.3 million, a marked decline from the peak of 24.9 million a month ago.

7 min read

Idaho, Mississippi, and Virginia are the Holdouts on July 15th Tax Deadlines

Every state with an individual income tax has made some adjustment to its filing or payment deadlines, but three—Idaho, Mississippi, and Virginia—have not followed the federal government’s date of July 15th or later.

3 min read

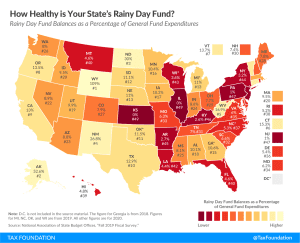

How Healthy is Your State’s Rainy Day Fund?

Rainy day funds have increasingly emerged as a standard component of states’ budgeting toolkits. Economic cycles can have significant impacts on state revenue, but states can prepare for the inevitable downturns during good times by putting away money in a revenue stabilization fund.

2 min read

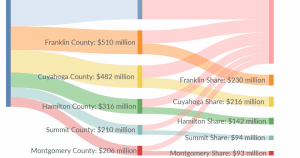

State and Local Funding Totals Under the CARES Act

State and local governments across the country split $150 billion in federal aid under a provision of the Coronavirus Aid, Relief and Economic Security (CARES) Act, passed on March 30th.

7 min read

A History and Analysis of Payroll Tax Holidays

As Congress and the White House consider ways to shore up the economy in the face of a public health crisis, President Trump has suggested suspending the entire payroll tax for the duration of the year. That would cost about $950 billion, according to our analysis.

6 min read

Retroactive SALT Repeal Combines Weak Stimulus with Bad Tax Policy

House Speaker Nancy Pelosi (D-CA) has suggested that a retroactive repeal of the cap on State and Local Tax (SALT) deductions should be included in any future stimulus plans.

3 min read

Gas Tax Revenue to Decline as Traffic Drops 38 Percent

Fewer people driving means fewer people buying gasoline, which may have positive effects on air pollution but could be detrimental to motor fuel excise tax revenue for federal and state governments.

4 min read

New Jersey Waives Telework Nexus During COVID-19 Crisis

New Jersey is temporarily waiving corporate nexus arising from employees teleworking due to the COVID-19 pandemic—a response to the crisis that other states should follow.

3 min read

Congress Approves Economic Relief Plan for Individuals and Businesses

The CARES Act, now signed into law, is intended to be a third round of federal government support in the wake of the coronavirus public health crisis and associated economic fallout, following the $8.3 billion in public health support passed two weeks ago and the Families First Coronavirus Response Act.

10 min read