All Related Articles

Revenue Gains in Asian and Pacific Countries Likely Offset by COVID-19

Because of the COVID-19 pandemic and the associated economic crisis, countries in the Asia-Pacific region will see a differentiated impact on their capacity of mobilizing domestic revenue depending on the structure of their economy. According to the OECD report, those economies that rely mostly on natural resources, tourism, and trade taxes are especially vulnerable.

5 min read

New York and New Jersey Consider Financial Transaction Taxes

Seeking new sources of funding, New York and New Jersey—two states at the heart of global financial markets—are considering financial transaction taxes.

5 min read

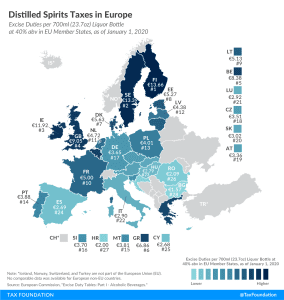

Distilled Spirits Taxes in Europe

2 min read

Sales Tax Holidays by State, 2020

In the midst of the coronavirus crisis, some states are hoping that a sales tax holiday might help restart struggling industries by stimulating the economy. However, sales tax holidays can mislead consumers about savings and distract from genuine, permanent tax relief.

41 min read

Tax Options to Promote Short-Term Recovery and Long-Term Economic Growth in Wisconsin

From a revenue standpoint, Wisconsin was better off than many states going into this crisis, but the policy decisions—including tax policy decisions—state policymakers make in the months ahead will have far-reaching implications for how quickly jobs and wages are restored in Wisconsin.

7 min read

Financial Transaction Tax Could Hit Average Spanish

Spain is planning to implement two major taxes during the next few months, a digital services tax and a financial transaction tax, which have the potential to negatively impact capital formation, growth, and economic recovery and start a harmful trade war.

5 min read

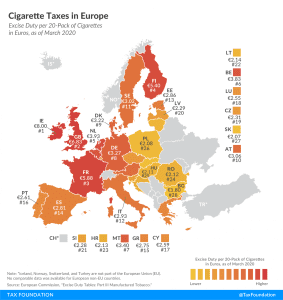

Cigarette Taxes in Europe, 2020

Ireland and the United Kingdom levy the highest excise duties on cigarettes in the European Union (EU), at €8.00 ($8.95) and €6.83 ($7.64) per 20-cigarette pack, respectively. This compares to an EU average of €3.22 ($3.61). Bulgaria (€1.80 or $2.01) and Slovakia (€2.07 or $2.32) levy the lowest excise duties.

3 min read

Sources of Personal Income, Tax Year 2017

Reviewing the sources of personal income shows that the personal income tax is largely a tax on labor, primarily because our personal income is mostly derived from labor. However, varied sources of capital income also play a role in American incomes.

9 min read

Hungarian COVID-19 Response: Surtax for Banks and Retail

Hungary is the only EU state to have actually implemented COVID-19 tax hikes.

3 min read

State Forecasts Indicate $121 Billion 2-Year Tax Revenue Losses Compared to FY 2019

Revised state revenue forecasts show a significant decline in projected revenues for both the recently concluded FY 2020 and current FY 2021, though the picture they paint is considerably less dire than many feared a few months ago.

13 min read

What Can Connecticut Learn from its Neighbors About Property Tax Limitations?

Property tax burdens in Connecticut continue to increase even as property values decline, whereas other states—including neighboring Massachusetts and New York—have managed to keep the growth of property tax burdens in check.

42 min read

Non-Profit Files Lawsuit over Withholding Requirements in Ohio

As work increasingly takes place in home offices, states will have to grapple with the revenue implications, and may find it necessary to adopt policies to better compete with outlying areas. Taxing people in places in which they no longer work, however, will not be the solution.

3 min read

Improved Cost Recovery Is A Wide-Ranging Policy Solution

Rather than limit improvements to certain sectors, lawmakers could pursue a broader policy of full expensing for all capital investment and neutral cost recovery for structures and clear the tax policy hurdles that currently stand in the way of private investment.

3 min read

Peruvian “Solidarity Tax” Unlikely to Offset Deficit Spending

While it is important that Peru find ways to offset its deficit spending, a temporary wealth tax may introduce more problems than it solves.

5 min read