Americans Abroad Need Compliance Cost Relief

Trump’s proposal would bring the US more in line with most other developed economies, which tax only those who live and work within their borders.

4 min read

Trump’s proposal would bring the US more in line with most other developed economies, which tax only those who live and work within their borders.

4 min read

We estimate Trump’s proposed tariffs and partial retaliation from all trading partners would together offset more than two-thirds of the long-run economic benefit of his proposed tax cuts.

12 min read

Spain’s central government is considering making its windfall taxes on energy companies and the banking sector permanent.

6 min read

While federal tax collections—especially corporate taxes—have reached historically high levels, these gains have not kept pace with escalating spending, particularly on debt interest, leading to a substantial and concerning budget deficit in FY24.

6 min read

As the geopolitical scene continues to change, policymakers in Europe should focus on lowering effective marginal tax rates to drive much-needed investment and long-term economic growth.

6 min read

Neither presidential candidate has a perfect tax plan. But what changes could Trump and Harris make to their respective tax plans to better serve American workers and the economy? In this episode, we dissect their plans and provide practical solutions for improvement.

Restoring expensing for R&D, machinery, and equipment; extending better cost recovery to structures investment; and avoiding raising the corporate tax rate would create a stronger, pro-investment policy environment for the US economy.

44 min read

The Brazilian government is poised to make the biggest change to its alcohol tax policy in recent history.

6 min read

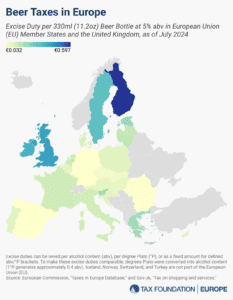

As Oktoberfest celebrations wrap up across the continent, now is a great time to examine beer taxes in the European Union. Hefty beer taxes add to the price of every drink consumed.

5 min read

Due to the peculiar design of the proposed tax increase, it’s true: the largest tax increase Oregon has ever seen would create a substantial budget shortfall.

8 min read

Especially for a state that relies so heavily on the sales tax as a source of revenue—and where most people want to keep it that way—a broad base and a low rate is crucial.

5 min read

By 2035, Social Security as we know it will largely be insolvent. If we want to fix the issue, it’s time for our parties’ leaders to reform the program so it can be around for the long run for all Americans.

Focusing on competitiveness, neutrality, and efficient policies to raise revenue would go a long way in increasing economic growth and stabilizing public finances over the long term.

7 min read

Georgia should focus on policies that restrict the overall growth of property taxes, not policies that functionally freeze property taxes for current owners by shifting costs onto new owners and into the sales tax.

6 min read

Louisiana’s tax code currently features a number of inefficient and uncompetitive policies that are leaving the state further and further behind.

Sports stadium subsidies are salient political gimmicks designed to appear as if politicians are providing tangible benefits to taxpayers. The empirical evidence shows repeatedly that stadium subsidies fail to generate new tax revenue and new jobs or attract new businesses.

6 min read

If voters are being asked to charge state legislators with raising the equivalent of a doubling of the current income and sales tax, shouldn’t they get to know what the plan is first?

The 2024 Spanish Regional Tax Competitiveness Index allows policymakers and taxpayers to evaluate and measure how their regions’ tax systems compare.

7 min read

Using tariff policy to reallocate investment and jobs is a costly mistake—that’s a history lesson we should not forget.

6 min read

The Department of Justice (DOJ) recently announced that it would move to reschedule marijuana. This move doesn’t do as much for legal cannabis sales as proposed federal legislation like the States 2.0 Act, but rescheduling cannabis has major ramifications for cannabis businesses.

4 min read