Facts and Figures 2019: How Does Your State Compare?

Our updated 2019 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

Our updated 2019 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

Taxing the extraction of water does not make sense as an excise tax and does not make sense as a mechanism to finance rural broadband and public education.

4 min read

Arkansas’s Senate Bill 576 would overhaul the state’s corporate income tax code and dramatically increase its competitiveness from 46th to 44th nationally.

3 min read

The Tax Cuts and Jobs Act made significant changes to the way U.S. multinationals’ foreign profits are taxed. GILTI, or “Global Intangible Low Tax Income,” was introduced as an outbound anti-base erosion provision.

5 min read

Federal tax rates vary by income group and tax source. The federal tax system redistributes income from high- and low-income taxpayers.

3 min read

Secretary Mnuchin, Finance Minister Le Maire, and other tax policy leaders should encourage the OECD and their own research staff to perform serious economic analysis on the alternatives for changing international tax rules before moving forward. It would be quite unfortunate for the world to learn the wrong lessons from U.S. tax reform.

3 min read

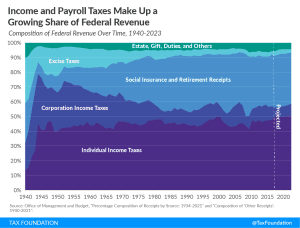

The federal income tax and federal payroll tax make up a growing share of federal revenue. Individual income taxes have become a central pillar of the federal revenue system, now comprising nearly half of all revenue.

2 min read