Lawmakers have recently begun proposing different policy options that would change the U.S. taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. system—ranging from wealth taxes to higher marginal income tax rates to increasing the estate tax. When discussing changes like these, it’s important to understand the composition of taxes under the current system.

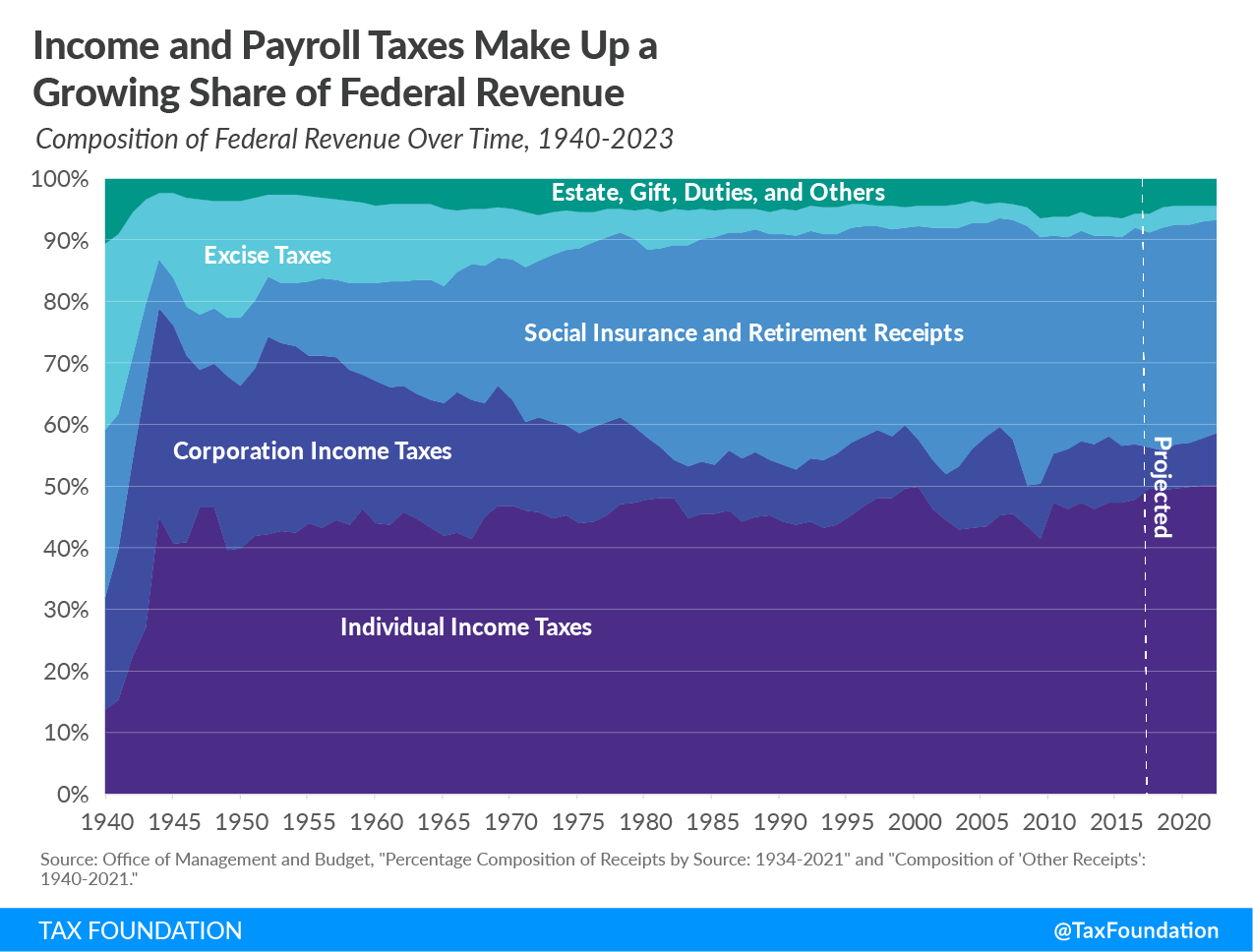

Using data from the Office of Management and Budget, we can look at how the composition of federal revenue has changed over time. Several trends stand out: the increasing significance of both individual income taxes and payroll taxes as well as the decreasing significance of corporate income taxes and excise taxes.

But before pointing to these trends as proof for the need to raise taxes on a certain group of taxpayers, it’s crucial to know some of the underlying information.

Before 1941, excise taxes, such as gas and tobacco taxes, were the largest source of revenue for the federal government, comprising nearly one-third of government revenue in 1940. Excise taxes were followed by payroll taxes and then corporate income taxes.

Today, payroll taxes remain the second largest source of revenue. However, other sources have shifted in relative importance. Specifically, individual income taxes have become a central pillar of the federal revenue system, now comprising nearly half of all revenue. Following an opposite trend, corporate income and excise taxes have decreased relative to other sources.

Several policy changes contributed to these trends. For example, the growth in payroll taxes as a source of revenue reflects the implementation and expansion of Social Security and Medicare. One factor explaining the changes in individual and corporate income taxes is that more business income is now taxed under the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. rather than the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. . The majority of companies in the United States are pass-through businesses and are not subject to the corporate income tax; they therefore pay individual income taxes instead.

Past decisions to change the tax code, such as creating payroll taxes or new forms of organizations, have led to changes in the composition of federal revenue. Awareness of these trends are important context for contemporary discussions of who pays taxes and how much.

Note: This is part of our “Putting a Face on America’s Tax Returns” blog series

- America Already Has a Progressive Tax System

- Income Taxes on the Top 0.1 Percent Weren’t Much Higher in the 1950s

- The Top 1 Percent’s Tax Rates Over Time

- Who Benefits from Itemized Deductions?

- How Do Transfers and Progressive Taxes Affect the Distribution of Income?

- A Growing Percentage of Americans Have Zero Income Tax Liability