Facts and Figures 2020: How Does Your State Compare?

Our updated 2020 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

Our updated 2020 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

Full expensing, if made permanent, would be one of the most cost-effective ways to increase growth as it would produce about 4.5 times more GDP growth per dollar of revenue than making the law’s individual tax provisions permanent, according to our analysis.

3 min read

Though they are limited by both data and assumptions, the OECD will face similar limitations. As policymakers work to fine-tune the proposals under both Pillar 1 and 2 the impact assessment should be a critical part of that discussion.

6 min read

The CFC legislation in Spain is not as complicated as it is in some other countries, and it is aligned with the standards recommended by the OECD. The Spanish rules have evolved in a way that the rules are designed to comply with the EU principles not to interrupt the functioning of the Union and its single market.

4 min read

The OECD has been working to assess the impact of their program of work, and it will be critical for this assessment to take into account impacts not only on revenues, but also on growth and investment.

7 min read

What is a digital services tax (DST)? What countries have announced, proposed, or implemented a DST? What are some of the criticisms of a DST? What are alternatives to a DST? What is the OECD BEPS project and what is its main objective? What is the main objective of OECD Pillar 1? What is the main objective of OECD Pillar 2?

8 min read

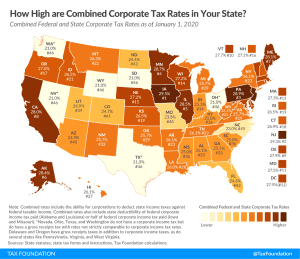

Forty-four states currently levy a corporate income tax. Rates range from 2.5 percent in North Carolina to 12 percent in Iowa. Over the past year, several states, including Florida, Georgia, Indiana, Mississippi, Missouri, and New Jersey, implemented notable corporate income tax changes.

7 min read

The past week has been nearly nonstop with news on various fronts of a dispute over taxation of digital businesses. The main characters have been the U.S., France, and the UK, although the EU and the OECD have also played roles. Though the dust is still settling, it is worth trying to tie the various events and arguments together.

7 min read

In France, Controlled Foreign Corporation (CFC) rules were first enacted in 1980. The French tax regime operates on a strict territorial basis, where only profits generated in the country are subject to tax in France.

5 min read