Reviewing the Economic and Revenue Implications of Cost Recovery Options

Permanent full expensing for all types of investment is an effective policy change lawmakers can use to encourage additional investment and economic growth.

9 min read

Permanent full expensing for all types of investment is an effective policy change lawmakers can use to encourage additional investment and economic growth.

9 min read

One of the most cost-effective policy changes would be to make full expensing of machinery and equipment permanent and extend this important tax treatment to structures as well as for firms in a net operating loss position.

7 min read

Virginia enacted a biennial budget, which includes a new excise tax on “skill games.” Meanwhile, Arizona and Connecticut announced plans to convene in special sessions later this year while Oklahoma gets the green light to use rainy day fund money to close budget gaps.

4 min read

What could the next phase of relief look like and what role does tax policy play in ensuring the U.S. and countries around the world make a strong economic recovery?

1 min read

The U.S. Department of the Treasury recently issued new guidance on allowable expenses using the $150 billion in state aid provided under the CARES Act, a point on which there has been considerable confusion.

3 min read

The sooner federal policymakers or regulators clarify tax questions about the Paycheck Protection Program (PPP), the more certainty firms will have when they accept the economic relief to keep their businesses afloat.

3 min read

When businesses and taxpayers look to the government for relief, it is paramount that lawmakers do their best to craft transparent and coherent legislation that is the least confusing for all.

4 min read

While it’s unclear how soon state economies may be able to fully open again, it’s not too early for states to consider how they can remove barriers to businesses & consumers resuming activity.

3 min read

Governments at all levels must work to remove the tax policy barriers that stand in the way of economic recovery and long-term prosperity following the COVID-19 crisis. Our new guide outlines several comprehensive options that policymakers can take at the federal and state levels.

26 min read

Learn about how taxes can influence human behavior through the power of incentives. See how different tax policies have impacted everything around us, including the buildings we live in, the cars we drive, and even what we eat and wear. Gain a deeper appreciation for the importance of designing tax policies that encourage positive economic behaviors.

Have you ever wondered where the money comes from to build roads, maintain a national defense, or pay for programs like Social Security? Taxes.

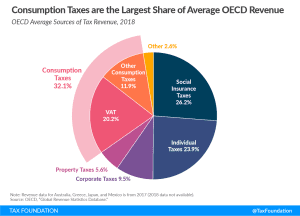

Discover the three basic tax types—taxes on what you earn, taxes on what you buy, and taxes on what you own. Learn about 12 specific taxes, four within each main category. Develop a basic understanding of how these taxes fit together, how they impact government revenues and the economy, and where you may encounter them in your daily life.

Discover why there are better and worse ways for governments to raise a dollar of revenue. Compare the economic impact of the three basic tax types—taxes on what you earn, buy, and own—including three specific taxes within each category. Learn about the basics of “dynamic scoring,” one tool economists can use to compare the economic and revenue impact of different tax policies.

Identify some of the most common tax myths and tax policy misconceptions and learn how to separate fact from fiction. Discover why tax refunds shouldn’t be celebrated, why you should pay your income tax bill, and why certain deductions are wrongly labeled “loopholes,” among other useful facts. Improve your ability to counter misleading arguments about the tax code.

In addition to providing economic relief to individuals and loans to businesses struggling during the coronavirus crisis, the CARES Act changed several tax provisions to increase liquidity to ensure firms survive a large decline in cash flow.

7 min read

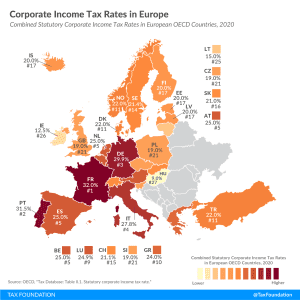

Compared to other tax revenue sources, consumption tax revenue as a share of GDP tends to be relatively stable over time, even during economic downturns.

2 min read

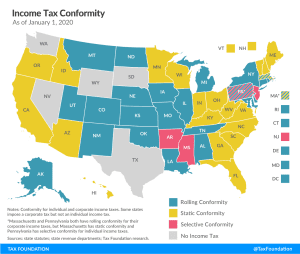

If states fail to update their income tax conformity, they will wind up taxing the federal lifeline to small businesses in the CARES Act: the Paycheck Protection Program (PPP) loans.

3 min read

Seemingly unconcerned about how the digital project could impact the economy at this crisis moment, officials at the OECD recently released a statement boasting that they are continuing to work “full steam” on their global digital tax project.

5 min read

California extends tax filing and payment deadline to July 31 for a broad spectrum of business taxes as Virginia keeps May 1st tax filing deadline.

5 min read