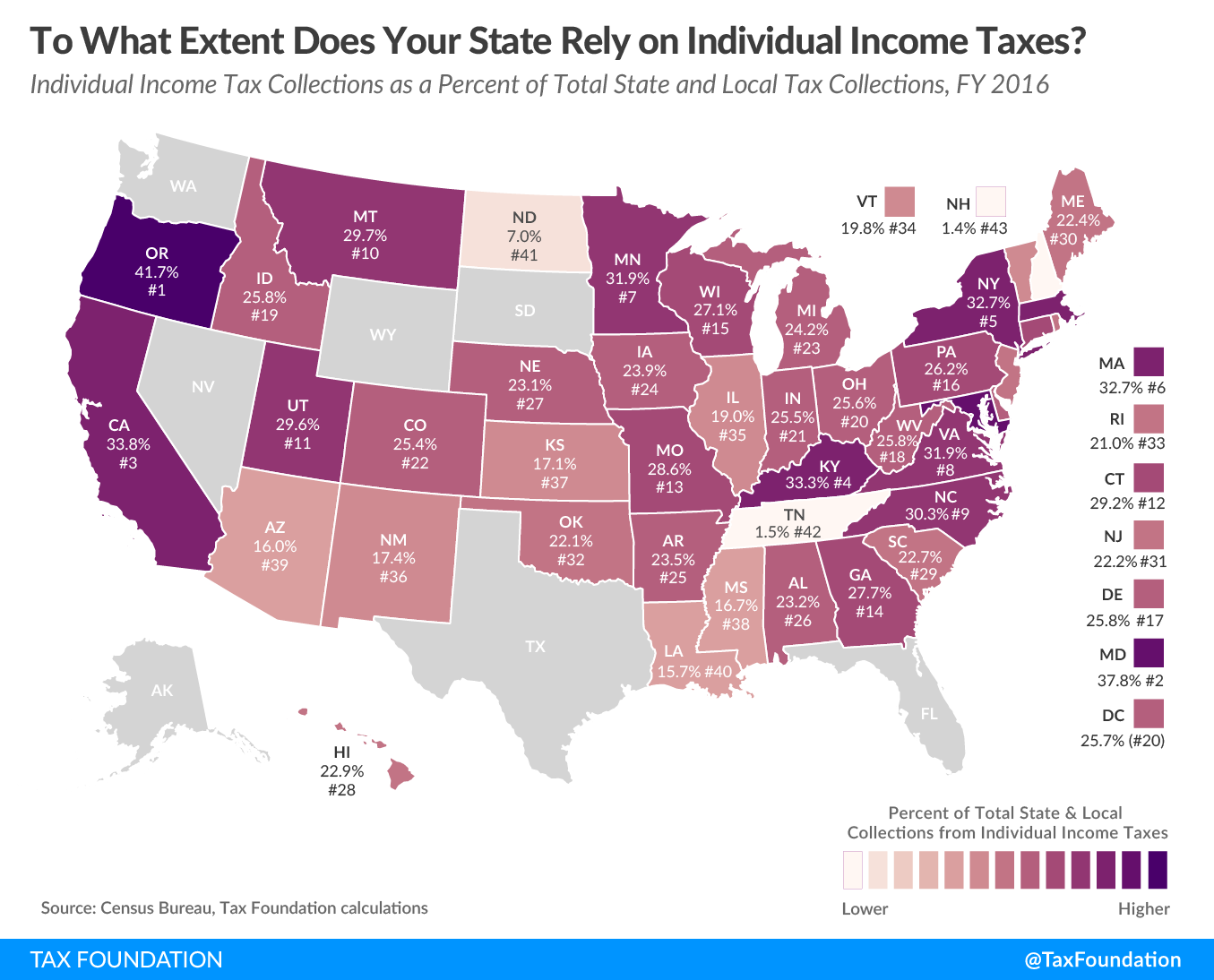

State and localities rely heavily on the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. , which comprised 23.5 percent of total U.S. state and local taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. collections in fiscal year 2016, the latest year of data available. The individual income tax lands just below the general sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. (23.6 percent), both behind property taxes (31.5%) as the largest category of state and local revenue sources (See Facts & Figures Table 8).

Today’s map shows the percentage of each state’s state and local tax collections attributable to the individual income tax.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeOf all the states, Oregon and Maryland rely most heavily on individual income taxes, which account for 41.7 percent and 37.8 percent of their total state and local tax collections, respectively. Both are among the 17 states where localities also levy income taxes. Oregon has chosen not to collect sales taxes, a decision which contributes to that state’s heavy reliance on the individual income tax.

While the individual income tax tends to be a major revenue source for state and local governments, some states rely on it very little, and some not at all. Seven states (Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming) do not collect individual income taxes, while two states (New Hampshire and Tennessee) collect taxes on dividend and interest income but not wage income. Tennessee’s tax on investment income–known as the “Hall tax”–is in the process of being phased out and will be fully repealed by 2021, which will leave the state with no individual income tax.

It comes as no surprise that Tennessee and New Hampshire, which levy no taxes on wage income, raise the least amount of revenue from the individual income tax, respectively 1.5 and 1.4 percent, from the individual income tax. In North Dakota and Louisiana, the next lowest states, the individual income tax generates 7.0 percent and 15.7 percent of their total tax collections, respectively.

As we’ve previously pointed out, a state’s combination of tax sources has implications for its revenue stability and economic growth. Income taxes tend to be more harmful to economic growth than consumption taxes and property taxes. Income taxes fall on labor and savings, while consumption taxes, such as sales taxes, tax what people spend instead of what they earn. As a result, income taxes tend to be less neutral than sales taxes.

Furthermore, income taxes tend to be a less stable source of tax revenue than sales taxes. Households tend to see more volatility with their income than with consumption through the business cycle. In particular, the investment component of income contributes to the volatility of the income tax as a whole. As a result, the income tax tends to generate a less stable source of revenue than other forms of taxation.

Note: This is part of a map series in which we examine the primary sources of state and local tax collections.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe