TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Foundation recently released the 2022 International Tax Competitiveness Index (ITCI) measuring the competitiveness and neutrality of countries’ tax systems. Since 2020, Spain has dropped from 26th to 34th (out of 38 countries) in the ITCI due to multiple tax hikes, new taxes, and weak performances in all five index components.

In Spain’s case, some of the 40 tax policy variables in the ITCI are set by regional governments. Therefore, the Spanish Regional Tax Competitiveness Index (RTCI) complements the ITCI by comparing the 19 Spanish regions on more than 60 variables in five major areas of taxation: individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. , wealth taxA wealth tax is imposed on an individual’s net wealth, or the market value of their total owned assets minus liabilities. A wealth tax can be narrowly or widely defined, and depending on the definition of wealth, the base for a wealth tax can vary. , inheritance taxAn inheritance tax is levied upon an individual’s estate at death or upon the assets transferred from the decedent’s estate to their heirs. Unlike estate taxes, inheritance tax exemptions apply to the size of the gift rather than the size of the estate. , transfer taxes and stamp duties, and other regional taxes, combining the results to generate a final ranking.

| Category | Score (out of 100) | Ranking (out of 38) |

|---|---|---|

| Overall | 56.9 | 34 |

| Corporate Income Tax | 51.8 | 31 |

| Individual Taxes | 63.3 | 25 |

| Consumption Taxes | 54.6 | 19 |

| Property Taxes | 36.4 | 37 |

| International Tax System | 79 | 18 |

|

Source: Tax Foundation, 2022 International Tax Competitiveness Index. |

||

Spain scores poorly on corporate tax policy, ranking 31st, due to a combination of factors. First, Spain has both a patent boxA patent box—also referred to as intellectual property (IP) regime—taxes business income earned from IP at a rate below the statutory corporate income tax rate, aiming to encourage local research and development. Many patent boxes around the world have undergone substantial reforms due to profit shifting concerns. and a credit for Research and Development. Second, it is one of the eight countries in the Organisation for Economic Co-operation and Development (OECD) that has implemented a digital service tax (DST). Third, it has a relatively high corporate tax rate of 25 percent, above the OECD average (23.6 percent). And some regions have rates above Spain’s general corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate, like Navarra at 28 percent.

Spain’s individual tax component is also weak, dropping from 16th in 2021 to 25th in this year’s ITCI due to an increase in the top income tax rate from 43.5 percent to 45.5 percent. This is the top income tax rate applied in 2021 in the Madrid region, the country’s most competitive region according to our RTCI. When the Spanish central government increased the top income tax rate by 2 percentage points, Madrid approved a general tax cut of 0.5 points for all workers, setting the overall (central and regional) current top marginal income tax rate at 45 percent.

Although tax competition helped keep tax hikes under control in some regions, 13 still have top marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. s higher than Germany’s (47 percent). Some regions in Spain, like the Valencia Community, have the fourth highest top-income tax rate in Europe (54 percent), after Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent). Valencia’s top statutory rate applies to income above €475,000 ($470,250) while Austria’s only applies to income above €1 million ($0.99 million). Denmark has a high tax rate because it does not rely on social security contributions as part of its tax mix, as Spain and other countries do.

Spain ranks 19th on its consumption taxA consumption tax is typically levied on the purchase of goods or services and is paid directly or indirectly by the consumer in the form of retail sales taxes, excise taxes, tariffs, value-added taxes (VAT), or an income tax where all savings is tax-deductible. component. However, less than 50 percent of consumption is covered by the value-added tax (VAT) due to exemptions that complicate the overall system and distort consumer choices. A broader VAT base could create fiscal space for lowering the overall VAT rate of 21 percent.

Spain scores worst on its property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. (ranking 37th), with multiple distortionary property taxes. Spain has a tax on real property, a property transfer tax, capital duties, and a financial transaction tax.

Additionally, Spain levies a net wealth tax as well as inheritance and gift taxes. However, not all regions in Spain levy a net wealth tax. In 2008, when the Spanish central government repealed the net wealth tax and then reintroduced it three years later, Madrid preserved 100 percent relief from the tax. Following the example of Madrid, Andalusia approved in September 2022 100 percent relief, while Galicia is looking to increase its tax relief from the current 25 percent to 50 percent. The rest of the Spanish regions levy a progressive wealth tax ranging from 0.16 percent up to 3.75 percent in Extremadura. Today, only two other European countries levy a net wealth tax—Norway and Switzerland—and at much lower rates than the Spanish regions. Norway levies a net wealth tax of 1.1 percent, barely more than one-fourth of the top wealth tax rate in Extremadura, while the top wealth tax rate in Zurich, Switzerland, is only 0.7 percent. Although most OECD countries have repealed their wealth taxes, Spain’s central government announced a new wealth tax with a top tax rate of 3.5 percent in response to the wealth tax relief in Madrid and Andalusia.

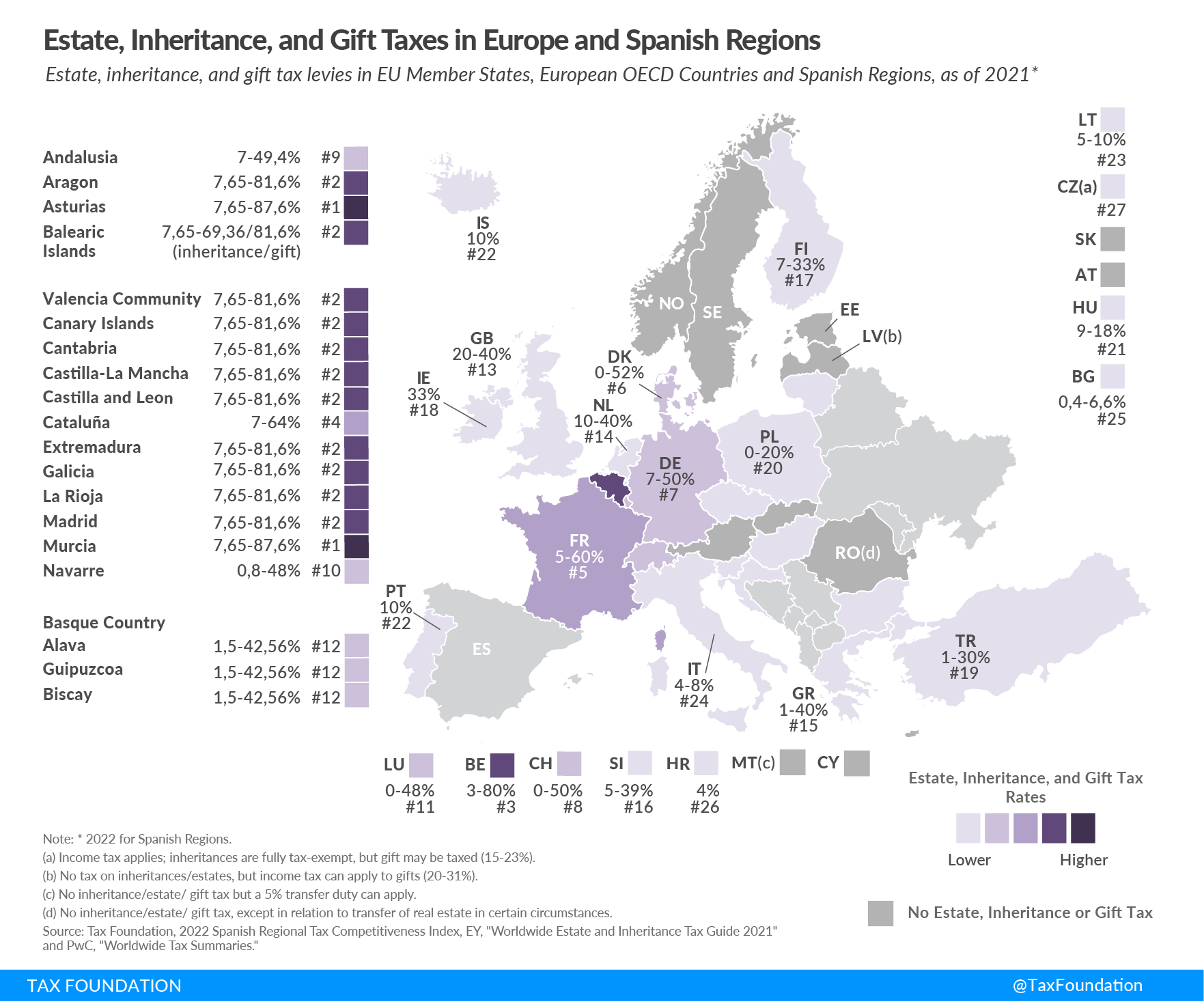

Asturias and 12 other Spanish Regions Lead Europe’s Estate, Inheritance, and Gift TaxA gift tax is a tax on the transfer of property by a living individual, without payment or a valuable exchange in return. The donor, not the recipient of the gift, is typically liable for the tax. Ranking

Similar to the net wealth tax, the inheritance and gift taxes in Spain are collected and administered by regional governments. Regional statutory inheritance tax rates in Spain can reach levels as high as 87.6 percent (in Asturias), depending not only on the level of the amount inherited but also on the inheritor’s level of pre-inheritance wealth and familial closeness to the inheritor. Unsurprisingly, Spanish regions have the highest inheritance tax rates in Europe; 13 Spanish regions levy a higher top statutory tax rate than the 80 percent rate applied by Belgium.

Tax competition has proved effective; some Spanish regions are already copying Madrid and other leading regions’ tax reforms. Castile and Leon, for example, improved seven places overall (from 13th to 6th in the RTCI) after reforming the inheritance tax. In 2022, Andalusia was the first region to cut the top statutory inheritance tax rate from 81.6 percent to 49.6 percent, just below Germany’s and Switzerland’s top tax rate of 50 percent.

While inheritance and gift taxes collect little revenue, a recent study revealed that inheritances can reduce wealth inequality as transfers are proportionately larger (relative to their pre-inheritance wealth) for households lower in the wealth distribution. And this is especially true for Spain where inherited wealth as a portion of net wealth reaches 95.6 percent. Therefore, given their limited capacity to collect revenue and negative impact on entrepreneurial activity, savings, and work, policymakers should consider repealing inheritance and gift taxes. Currently, 12 OECD countries have no estate, inheritance, or gift taxes: Australia, Austria, Canada, Colombia, Costa Rica, Estonia, Israel, Latvia, New Zealand, Norway, Slovak Republic, and Sweden.

New Tax Reforms Threaten to Reduce Spain’s Tax Competitiveness Even Further

Spain’s tax reforms are not stopping here. The central government plans to introduce a new wealth or solidarity tax and again raise the top capital gains and dividend tax by 2 percentage points to 28 percent. The offsetting of tax losses for entities belonging to a consolidated tax group will be limited to 50 percent of that amount (currently 70 percent) for the following two years. In exchange, the corporate income tax for small businesses would be reduced to 23 percent.

While the central government is not planning to adjust the income tax brackets for inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. , it has proposed a slight reduction in the effective tax rate for households earning less than €21,000 per year. However, while the withholding tax will be reduced and the amount of income tax paid during 2023 by low-income households will be cut, it is not clear that these households’ final income tax bills will be reduced.

If these policies are implemented, they will reduce the country’s overall ranking in the 2023 ITCI from 34th to 35th. The corporate income tax rank will fall from 31st to 32nd while the individual tax score will be slightly reduced and the property tax rank will drop from 37th to 38th.

These new tax hikes have the potential to negatively impact capital formation, growth, and economic recovery. As public spending, debt, and taxes are increased, Spain’s current economic challenges could turn into a long-term recessionA recession is a significant and sustained decline in the economy. Typically, a recession lasts longer than six months, but recovery from a recession can take a few years. . Policymakers should avoid unnecessary tax hikes and consider repealing wealth and inheritance taxes, the financial transaction tax, and the digital services tax. To increase private investment and accelerate economic growth, Spain should consider full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. for capital investment and shift the tax mix towards less harmful consumption taxes by broadening the VAT tax base.

Spain should implement tax reforms that have the potential to stimulate economic activity by supporting private investment and employment and attracting highly qualified workers while increasing its internal and international tax competitiveness.

Share