Trump Tariffs: The Economic Impact of the Trump Trade War

The tariffs amount to an average tax increase of nearly $1,300 per US household in 2025.

31 min read

The tariffs amount to an average tax increase of nearly $1,300 per US household in 2025.

31 min read

On April 10, the House adopted the Senate’s amended version of the budget resolution, which allows $5.3 trillion in deficit-financed tax cuts.

8 min read

Could tariffs, a form of government finance heavily relied upon in the 18th and 19th centuries, function as a major source of revenue for a modern, developed economy in the 21st century?

16 min read

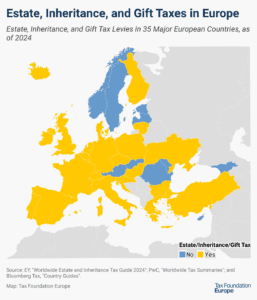

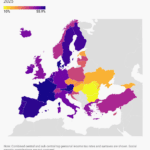

Twenty-four out of the 35 European countries covered in this map currently levy estate, inheritance, or gift taxes.

3 min read

Many states regulate and tax legal marijuana sales and consumption, despite the ongoing federal prohibition. Explore the data here.

8 min read

The empirical evidence thus far on sugar-sweetened beverage taxes fails to support claims that these taxes will create substantial health benefits. At the same time, their structural limitations make them ill-suited for generating stable, equitable revenue.

54 min read 2025 Tax Brackets

2025 Tax Brackets Facts & Figures 2024: How Does Your State Compare?

Facts & Figures 2024: How Does Your State Compare? Summary of the Latest Federal Income Tax Data, 2025 Update

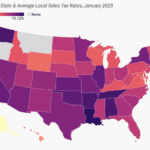

Summary of the Latest Federal Income Tax Data, 2025 Update State and Local Sales Tax Rates, 2025

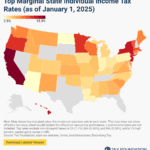

State and Local Sales Tax Rates, 2025 State Individual Income Tax Rates and Brackets, 2025

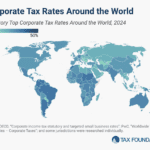

State Individual Income Tax Rates and Brackets, 2025 Corporate Tax Rates Around the World, 2024

Corporate Tax Rates Around the World, 2024 Top Personal Income Tax Rates in Europe, 2025

Top Personal Income Tax Rates in Europe, 2025

The Tax Foundation is the world’s leading nonpartisan tax policy 501(c)(3) nonprofit. For over 80 years, our mission has remained the same: to improve lives through tax policies that lead to greater economic growth and opportunity.

Our vision is a world where the tax code doesn’t stand in the way of success. Every day, our team of trusted experts strives towards that vision by remaining principled, insightful, and engaged and by advancing the principles of sound tax policy: simplicity, neutrality, transparency, and stability.

The State Tax Competitiveness Index enables policymakers, taxpayers, and business leaders to gauge how their states’ tax systems compare. While there are many ways to show how much state governments collect in taxes, the Index evaluates how well states structure their tax systems and provides a road map for improvement.

115 min read

Policymakers should have two priorities in the upcoming economic policy debates: a larger economy and fiscal responsibility. Principled, pro-growth tax policy can help accomplish both.

21 min read

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

92 min read

TaxEDU is designed to advance tax policy education, discussion, and understanding in classrooms, living rooms, and government chambers. It combines the best aspects of cutting-edge and traditional education to elevate the debate, enable deeper understanding, and achieve principled policy.

TaxEDU gives teachers the tools to make students better citizens, taxpayers a vocabulary to see through the rhetoric, lawmakers crash courses to write smarter laws, and videos and podcasts for anyone who wants to boost their tax knowledge on the go.

Understand the terms of the debate with our comprehensive glossary, including over 100 tax terms and concepts.

Our animated explainer videos are designed for the classroom, social media, and anyone looking to boost their tax knowledge on the go.

Our primers are classroom-ready resources for understanding key concepts in tax policy.

Learn about the principles of sound tax policy—simplicity, transparency, neutrality, and stability—which should serve as touchstones for policymakers and taxpayers everywhere.

Our Tax Foundation University and State Tax Policy Boot Camp lecture series are designed to educate tomorrow's leaders on the principles of sound tax policy.