Key Findings

- The 2017 TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Cuts and Jobs Act (TCJA) made several significant changes to the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. , including reforms to itemized deductions and the alternative minimum tax, an expanded standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. Taxpayers who take the standard deduction cannot also itemize their deductions; it serves as an alternative. and child tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. , and lower marginal tax rates across brackets.

- These changes simplify the individual income tax for millions of households, as 28.5 million filers would be better off taking the newly expanded standard deduction, instead of itemizing various deductions, reducing compliance costs.

- The Internal Revenue Service estimates the average time to complete an individual tax return will decrease by 4 to 7 percent. Converting this to dollar terms, we estimate compliance savings could range from $3.1 billion to $5.4 billion.

- Under the new tax law, new limits apply to some itemized deductions, including deductions for state and local taxes paid and mortgage interest, which broadens the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. and reduces distortions in the tax code.

- The individual income tax changes are scheduled to expire after December 31, 2025. If permanent, the income tax provisions would reduce federal revenue by $165 billion per year on a conventional basis, but when incorporating economic growth and feedback, on a dynamic basis, they would reduce federal revenue by $115 billion a year.

Introduction

The Tax Cuts and Jobs Act (TCJA), passed in December 2017, made several significant changes to the individual income tax. These changes include a nearly doubled standard deduction, new limitations on itemized deductions, reduced income tax rates, and reforms to several other provisions. In all, these changes simplify the individual income tax by eliminating the need for millions of households to itemize their deductions.

After December 31, 2025, most of the changes to the individual income tax code revert to pre-TCJA status. If Congress allows these changes to go into effect, most households would experience tax increases beginning in 2026.[1] In the meantime, however, individual income taxes will be substantially lower for households across the income spectrum.

This paper provides a brief overview of the individual income tax and explains how the changes in the Tax Cuts and Jobs Act lead to a simpler tax code for many households.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeOverview of the Individual Income Tax

The individual income tax is the federal government’s largest source of revenue.[2] In tax year 2015, more than 150 million individual income tax returns were filed, and in each of these filings, a household added up its income and subtracted various deductions, exemptions, and credits to report its tax liability to the Internal Revenue Service (IRS).[3]

The base of the individual income tax is adjusted gross incomeFor individuals, gross income is the total of all income received from any source before taxes or deductions. It includes wages, salaries, tips, interest, dividends, capital gains, rental income, alimony, pensions, and other forms of income. For businesses, gross income (or gross profit) is the sum of total receipts or sales minus the cost of goods sold (COGS)—the direct costs of producing goods, including inventory and certain labor costs. (AGI). To calculate AGI, an individual first adds all sources of income to reach “total income.” Next, the individual determines his or her deductions, exclusions, and credits, which narrow the tax base. Prior to enactment of the TCJA, the federal tax code included three major provisions that reduced households’ income taxes in proportion to the number of household members: the standard deduction, the child tax credit, and the personal exemption.

Recall that a deduction allows taxpayers to reduce the amount of income that is subject to the tax. For example, the standard deduction means filers reduce their taxable income by a set amount. Alternatively, filers can itemize their deductions, which means they keep track of certain deductible expenses and then subtract them from their total income instead of taking the standard deduction. Exemptions likewise reduce the amount of income subject to tax. Credits, on the other hand, reduce the amount of taxes owed.

The federal income tax is levied at seven rates; it is a progressive taxA progressive tax is one where the average tax burden increases with income. High-income families pay a disproportionate share of the tax burden, while low- and middle-income taxpayers shoulder a relatively small tax burden. , in which the marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. on income increases for higher levels of income. Each tax bracket shows the tax rate an individual will pay on that particular portion of income; so, reaching higher tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. does not mean an individual pays that higher rate on all income, only the income within that particular tax bracket.

The Compliance Cost of IRS Regulations

The growing complexity of the U.S. tax code had led to large compliance costs for households and businesses. The Tax Foundation used data from the Office of Information and Regulatory Affairs and the Bureau of Labor Statistics to estimate total cost of tax compliance on the U.S. economy in 2016.[4]

Complying with the tax code creates real costs for American households and businesses, starting with just the time it takes. It took individuals 2.6 billion hours to comply with IRS tax filing requirements in 2016.[5]

This time imposes a real cost on the economy. Individuals devote resources to complying with the tax code instead of doing other productive activities. Put in dollar terms, complying with the individual income tax costs $99 billion annually.[6] Tackling the cost of tax complexity was a significant motivation for the TCJA.[7]

The Tax Cuts and Jobs Act Simplified the Individual Income Tax

The TCJA simplified the tax code by making it more advantageous for many filers to take the standard deduction, instead of itemized deductions. The TCJA expanded the standard deduction from $6,500 to $12,000 for single filers and $13,000 to $24,000 for joint filers in 2018.[8] This near doubling of the standard deduction limited the value of itemized deductions, making it more attractive to use the standard deduction.

Additionally, under the TCJA, the three provisions that reduce household income taxes based on household size were consolidated into two: the personal exemption was eliminated, replaced by the aforementioned expanded standard deduction and an expanded child tax credit.

These changes, along with new limitations on certain itemized deductions, simplified the tax code for many Americans.[9]

The TCJA Nearly Doubled the Standard Deduction

As mentioned previously, the standard deduction was nearly doubled from the TCJA, growing from $6,500 to $12,000 for individual filers, and from $13,000 to $24,000 for joint filers.

By making the standard deduction larger, the value of itemized deductions is lessened. It is now more advantageous for many filers to take the standard deduction than to itemize their deductions.

To illustrate why this is a simplification, consider a married couple who under previous law would have taken $14,000 in various itemized deductions. Now, under the Tax Cuts and Jobs Act, it would be more advantageous for this couple to take the standard deduction of $24,000, as it allows them to deduct an extra $10,000 and eliminates the need to spend time and energy collecting receipts and completing Schedule A of the Form 1040.

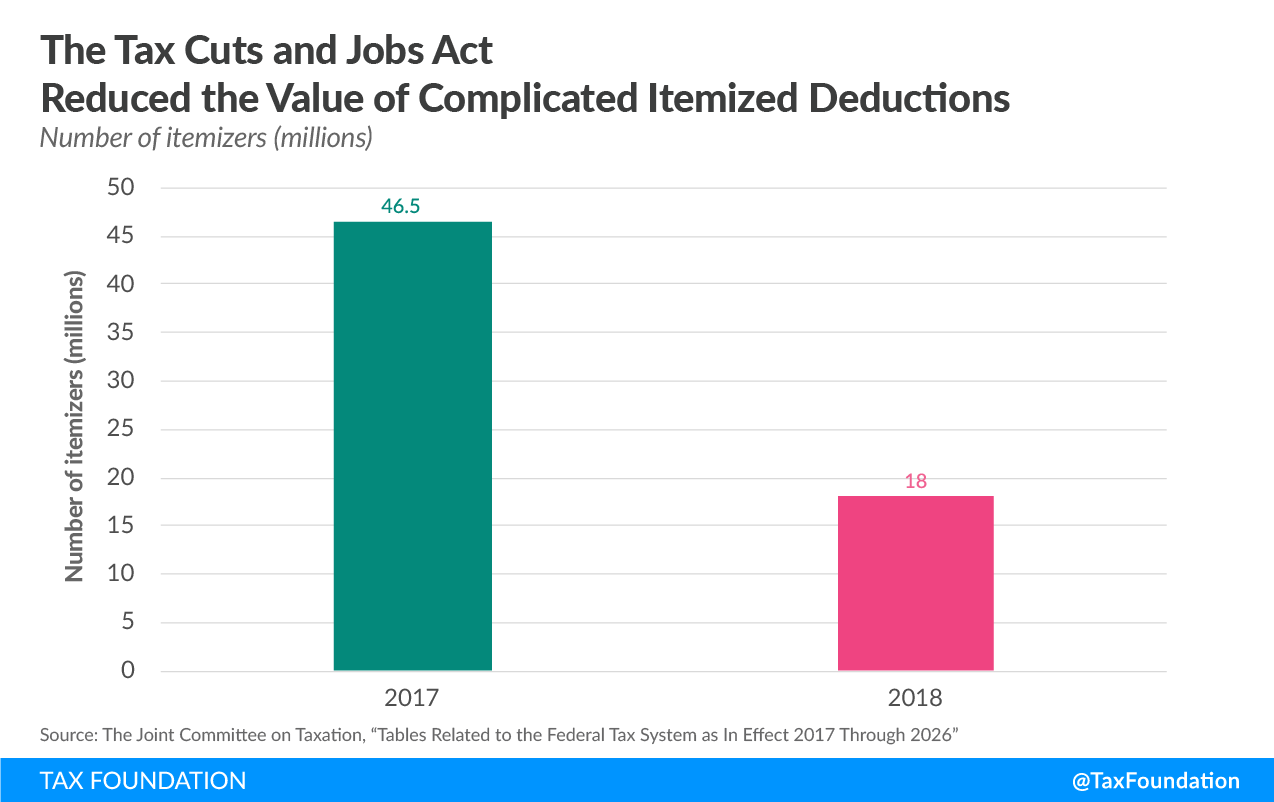

In all, the Joint Committee on Taxation (JCT) estimates that the number of itemized filers will decline from 46.5 million in 2017 to just over 18 million in 2018, implying that nearly 30 million households will now find it more advantageous to take the standard deduction.[10] In total, now 88 percent of filers will use the standard deduction to complete their taxes.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeIn addition, these changes are concentrated among low- and middle-income groups. The number of returns itemizing deductions will fall by 75 percent for those with income between $20,000 and $30,000 and 74 percent for those with income between $30,000 and $40,000. The table calculates the percent change among returns using itemized deductions between 2017 and 2018.

| Number of Returns (Thousands) | |||

|---|---|---|---|

| Income Category | 2017 | 2018 | Percent Change |

|

Source: The Joint Committee on Taxation, “Tables Related to the Federal Tax System as In Effect 2017 Through 2026”; authors’ calculations |

|||

|

Less than $10,000 |

178 | 65 | -63.5% |

|

$10,000 to $20,000 |

517 | 154 | -70.2% |

|

$20,000 to $30,000 |

933 | 237 | -74.6% |

|

$30,000 to $40,000 |

1,595 | 410 | -74.3% |

|

$40,000 to $50,000 |

2,222 | 635 | -71.4% |

|

$50,000 to $75,000 |

6,683 | 2,136 | -68.0% |

|

$75,000 to $100,000 |

6,622 | 2,442 | -63.1% |

|

$100,000 to $200,000 |

17,959 | 6,513 | -63.7% |

|

$200,000 to $500,000 |

8,207 | 4,185 | -49.0% |

|

$500,000 to $1,000,000 |

1,089 | 791 | -27.4% |

|

$1,000,000 and over |

509 | 444 | -12.8% |

Changes to Other Family Provisions

The individual income tax code, as mentioned above, has several major provisions that reduce household income. Many of these provisions are based on family status and can be difficult to navigate, as they may have different definitions of what qualifies as a “child” as well as other complexities.[11] The TCJA helped alleviate some of this complexity by eliminating the personal exemption, which would have been $4,150 in 2018,[12] and expanding the child tax credit.

Recall that an exemption reduces taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. Taxable income differs from—and is less than—gross income. , so its value depends on the taxpayer’s marginal tax rate. For example, if a household were in the 12 percent tax bracket, a $4,150 exemption would result in about a $500 reduction in tax liability. On the other hand, a credit directly reduces tax liability, and doesn’t directly depend on the marginal tax rate.

Beginning in 2018, the child tax credit doubles from $1,000 to $2,000 per qualified child under the age of 17, with up to $1,400 refundable. The TCJA also raised the income level at which the phaseout of the credit begins, up from $110,000 to $400,000 for married filed jointly households These two provisions expand both the value of the credit as well as the number of individuals able to claim the credit.

Changes to Itemized Deductions

In conjunction with expanding the standard deduction, the Tax Cuts and Jobs Act limited two key itemized deductions, the mortgage interest and state and local taxes paid (SALT), and eliminated several smaller itemized deductions. The new law also makes other changes, such as those that expand the charitable contributions and medical expenses deductions.[13]

Under previous law, individuals could deduct the entire amount paid of either state individual income tax or state sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. , but not both, along with state and local property taxes paid.[14] This deduction disproportionally benefited high-income taxpayers.[15] Now, itemizers are limited to deducting a total of $10,000 among state and local property, sales, and income taxes paid. The Joint Committee on Taxation estimates that this change, in concert with the new expanded standard deduction, will result in a dramatic reduction in the usage of the deduction.[16] In 2018, an estimated 16.6 million filers will claim the capped SALT deduction, compared to 42.3 million under prior law.[17] The cost of the SALT deduction is estimated to fall from $100.9 billion in 2017 to $36.6 billion in 2018.[18]

The TCJA also reduced the amount of home mortgage debt that itemizers can deduct interest on from $1 million to $750,000, and “suspended the deductibility of interest on home equity loans and lines of credit unless they are used to buy, build, or substantially improve the taxpayer’s home that secures the loan.”[19] The Joint Committee on Taxation estimates that this change, in concert with the new expanded standard deduction, will result in a dramatic reduction in the usage of the deduction.[20] In 2018, the JCT estimates 13.7 million taxpayers will claim the capped mortgage interest deductionThe mortgage interest deduction is an itemized deduction for interest paid on home mortgages. It reduces households’ taxable incomes and, consequently, their total taxes paid. The Tax Cuts and Jobs Act (TCJA) reduced the amount of principal and limited the types of loans that qualify for the deduction. , compared to 32.3 million in 2017.[21] The cost of this tax expenditureTax expenditures are departures from a “normal” tax code that lower the tax burden of individuals or businesses through an exemption, deduction, credit, or preferential rate. However, defining which tax expenditures grant special benefits to certain groups of people or types of economic activity is not always straightforward. is estimated to fall from $66.4 billion in 2017 to $40.7 billion in 2018.[22]

| Deduction | Change | Number of Returns (2017) | Number of Returns (2018) | |

|---|---|---|---|---|

|

Source: The Joint Committee for Taxation, “Tables Related to the Federal Tax System as in Effect 2017 Through 2026” |

||||

|

State and Local Taxes |

Capped at $10,000 |

42.3 million |

16.6 million |

|

|

Mortgage Interest |

Lowered the cap for interest paid from $1 million to $750,000 of mortgage debt and limited the deductibility of home equity debt |

32.3 million |

13.7 million |

|

The percentage limit for charitable cash donations made by an individual was increased from 50 percent to 60 percent, meaning for individuals who donate large shares of their income to charitable organizations, they will be able to take a larger deduction. The medical and dental expenses deduction threshold decreased from 10 percent of AGI to 7.5 percent of AGI (for tax years 2017 and 2018), meaning taxpayers have a lower threshold to exceed to deduct their medical expenses if they itemize.

Outside of these major changes, the TCJA also eliminated a handful of lesser utilized, Schedule A itemized deductions. These include deductions for casualty and theft losses (except for those attributed to federal disasters as declared by the President) as well as job expenses and miscellaneous deductions subject to a 2 percent floor.[23] This too will simplify the process for filing individual income taxes, as more taxpayers can benefit from selecting the expanded standard deduction rather than itemizing various deductions.

Fewer Households Will Incur Alternative Minimum Tax Liability

The TCJA also made reforms to the Alternative Minimum Tax (AMT), which means far fewer filers will need to spend time working on Form 6251. The Internal Revenue Service estimates AMT filings will decrease from 10 million to 1 million, [24] with ever fewer owing AMT liability.[25] Running parallel to the regular tax code, the AMT is a separate set of rules under which some households must calculate their tax liability a second time. It has a larger exemption than the regular tax code, but at the same time it has fewer tax preferences; this design allows it to capture more income tax from households that would otherwise claim large deductions and have less tax liability. The TCJA increased the AMT exemption from $84,500 to $109,400 for joint filers and increased the phaseout of the exemption from $160,900 to $1 million for joint filers. This combination will result in far fewer households incurring AMT liability and for those still owing, the liability will likely be smaller.[26]

Compliance Savings

The simplification of the tax code will lead to economic savings thanks to less time spent filing. Using estimates of how many hours it takes taxpayers to comply with certain forms, we can estimate the value of time saved by certain reforms made by the TCJA. Specifically, the reduction in filers owing AMT liability and the simplified process of filing individual income taxes could greatly reduce compliance costs for certain households.

In tax year 2015, 10.3 million forms were filed for the AMT, though only 4.5 million ended up owing any AMT liability. It is estimated that only about 200,000 will owe the AMT under new thresholds;[27] however, approximately 1 million individuals may still need to file the forms to determine whether they owe.[28] According to the Internal Revenue Service Taxpayers Advocate Service, filers who face the AMT spend almost twice as long complying with the tax code than filers who do not face the AMT.[29] In 2017, the average total time spent filing a Form 1040 was 15 hours.[30] Using this information, the decline in AMT filers translates to approximately 135 million hours saved, or in dollar terms, $4.6 billion.[31]

Additionally, the doubling of the standard deduction and subsequent move away from the itemized deductionItemized deductions allow individuals to subtract designated expenses from their taxable income and can be claimed in lieu of the standard deduction. Itemized deductions include those for state and local taxes, charitable contributions, and mortgage interest. An estimated 13.7 percent of filers itemized in 2019, most being high-income taxpayers. will also result in tax compliance savings. The IRS has estimated that the average time to complete an individual tax return will decrease by 4 to 7 percent.[32] This would reduce the time of 15 hours spent filing Form 1040 to an average between 13.95 and 14.4 hours per Form 1040.[33] If we expect 150 million individual income tax filers, this translates into a total time savings anywhere from 90 million to 157.5 million hours. Converting this to dollar terms, savings could range from $3.1 billion to $5.4 billion.[34]

Conclusion

The Tax Cuts and Jobs Act made several significant changes to the individual income tax, which will simplify the tax filing process for millions of households. These changes include reforms to family tax provisions, such as the near doubling of the standard deduction and child tax credit combined with the elimination of the personal exemption; they also include reforms to the alternative minimum tax and lower marginal tax rates across brackets.

These changes will simplify tax filing for tens of millions of taxpayers who will no longer have to itemize deductions, and instead find it more advantageous to take the expanded standard deduction. So too, millions fewer will incur alternative minimum tax liability. A simpler tax filing process translates to millions fewer hours wasted by households complying with the individual income tax, which will translate into real cost savings.

The Tax Cuts and Jobs Act: Explained

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeNotes

[1] For a discussion on the costs and benefits of making the individual income tax changes permanent, see Nicole Kaeding, Kyle Pomerleau, and Alex Muresianu, “Making the Tax Cuts and Jobs Act Individual Income Tax Provisions Permanent,” Tax Foundation, July 10, 2018, https://taxfoundation.org/making-the-tax-cuts-and-jobs-act-individual-income-tax-provisions-permanent/. If extended, these provisions would increase long-run GDP by 2.2 percent, long-run wages by 0.9 percent, and add 1.5 million full-time equivalent jobs. In the long run these provisions would reduce federal revenue by $165 billion annually on a conventional basis and $112 billion dynamically.

[2] Erica York, “Sources of Personal Income 2015 Update,” Tax Foundation, Feb 27, 2018, https://taxfoundation.org/sources-of-personal-income-2015/#_ftn1.

[3] Ibid.

[4] Scott A. Hodge, “The Compliance Costs of IRS Regulations,” Tax Foundation, June 15, 2016, https://taxfoundation.org/compliance-costs-irs-regulations/.

[5] Ibid.

[6] Ibid.

[7] Speaker Ryan Press Office, “The Tax Cuts and Jobs Act,” Nov. 7, 2017, https://www.speaker.gov/press-release/tax-cuts-and-jobs-act.

[8] The value of the standard deduction is inflation-adjusted, so these values increase annually.

[9] The Tax Cuts and Jobs Act also lowered marginal income tax rates across brackets, leading to increases in after-tax incomes for all taxpayers, on average. For a discussion of the distributional impact of the TCJA, see Huaqun Li and Kyle Pomerleau, “The Distributional Impact of the Tax Cuts and Jobs Act over the Next Decade,” Tax Foundation, June 28, 2018, https://taxfoundation.org/the-distributional-impact-of-the-tax-cuts-and-jobs-act-over-the-next-decade/.

[10] The Joint Committee on Taxation Staff, “Tables Related to the Federal Tax System as in Effect 2017 Through 2026,” April 24, 2018, 6, https://www.jct.gov/publications.html?func=startdown&id=5093.

[11] Scott Greenberg, “Five Ideas for Simplifying the Individual Tax Code,” Tax Foundation, July 24, 2017, https://taxfoundation.org/five-ways-federal-tax-code-simpler/.

[12] Internal Revenue Service, “In 2018, Some Tax Benefits Increase Slightly Due to InflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. Adjustments, Others Unchanged,” Oct. 19, 2017, https://www.irs.gov/newsroom/in-2018-some-tax-benefits-increase-slightly-due-to-inflation-adjustments-others-unchanged.

[13] For discussion of a new deduction for pass-through entities created by the TCJA, see Scott Greenberg and Nicole Kaeding, “Reforming the Pass-Through Deduction,” Tax Foundation, June 21, 2018, https://taxfoundation.org/reforming-pass-through-deduction-199a/.

[14] Jared Walczak, “The State and Local Tax DeductionA tax deduction allows taxpayers to subtract certain deductible expenses and other items to reduce how much of their income is taxed, which reduces how much tax they owe. For individuals, some deductions are available to all taxpayers, while others are reserved only for taxpayers who itemize. For businesses, most business expenses are fully and immediately deductible in the year they occur, but others, particularly for capital investment and research and development (R&D), must be deducted over time. : A Primer,” Tax Foundation, March 15, 2017, https://taxfoundation.org/state-and-local-tax-deduction-primer/.

[15] Ibid.

[16] The Joint Committee on Taxation, “Tables Related to the Federal Tax System as in Effect 2017 through 2026,”, 8.

[17] Ibid.

[18] The Joint Committee on Taxation, “Estimates Of Federal Tax Expenditures For Fiscal Years 2017 – 2021,” May 25, 2018, 44, https://www.jct.gov/publications.html?func=startdown&id=5095.

[19] Internal Revenue Service, “Interest on Home Equity Loans Often Still Deductible Under New Law,” Feb. 21,2018, https://www.irs.gov/newsroom/interest-on-home-equity-loans-often-still-deductible-under-new-law.

[20] The Joint Committee on Taxation, “Tables Related to the Federal Tax System as in Effect 2017 through 2026,” 7.

[21] Ibid.

[22] The Joint Committee on Taxation, “Estimates Of Federal Tax Expenditures For Fiscal Years 2017 – 2021,” 37.

[23] Kelly Phillips Erb, “What Your Itemized Deductions On Schedule A Will Look Like After Tax Reform,” Forbes, Dec. 20, 2017, https://www.forbes.com/sites/kellyphillipserb/2017/12/20/what-your-itemized-deductions-on-schedule-a-will-look-like-after-tax-reform/#6f5739dc6334.

[24] Internal Revenue Service, “Proposed Collection; Comment Request for Regulation Project 83 FR 34698,” July 20, 2018, https://www.federalregister.gov/documents/2018/07/20/2018-15627/proposed-collection-comment-request-for-regulation-project.

[25] Laura Saunders, “Who Will and Won’t Pay the AMT, America’s Rich-Person Tax?” The Wall Street Journal, May 18, 2018, https://www.wsj.com/articles/who-will-and-wont-pay-americas-rich-person-tax-1526635802.

[26] Erica York, “Under Conference Agreement, Fewer Households Would Face the Alternative Minimum Tax,” Tax Foundation, Dec. 16, 2017, https://taxfoundation.org/conference-report-alternative-minimum-tax/.

[27] Laura Sanders, “Who Will and Won’t Pay the AMT, America’s Rich-Person Tax?”

[28] Internal Revenue Service, “Proposed Collection; Comment Request for Regulation Project 83 FR 34698.”

[29] Taxpayers Advocate Service, “Repeal the Alternative Minimum Tax, 2013 Annual Report to Congress,” 298, http://www.taxpayeradvocate.irs.gov/2013-Annual-Report/downloads/Repeal-the-Alternative-Minimum-Tax.pdf.

[30] Internal Revenue Service, “1040 Instructions 2017,” 100, https://www.irs.gov/pub/irs-pdf/i1040gi.pdf.

[31] These hourly aggregates were translated into compliance costs by multiplying them by average total employer compensation costs for private industry workers of $34.17. See Bureau of Labor Statistics, “Employer Costs for Employee Compensation – March 2018,” June 8, 2018, https://www.bls.gov/news.release/pdf/ecec.pdf.

[32] Internal Revenue Service, “Proposed Collection; Comment Request for Regulation Project 83 FR 34698.”

[33] “Internal Revenue Service, “1040 Instructions 2017,” 100.

[34] These hourly aggregates were translated into compliance costs by multiplying them by average total employer compensation costs for private industry workers of $34.17. See Bureau of Labor Statistics, “Employer Costs for Employee Compensation – March 2018.”

Share this article