The fate of alternative minimum taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. (AMT) received much speculation as House and Senate negotiators worked together to reach a conference agreement. Lawmakers agreed to repeal the corporate AMT—following the House version—but retained the individual AMT with temporary increases in both the exemption amount and the phaseout threshold—resembling the Senate amendment. These changes will temporarily reduce AMT liability relative to current law, but still retain the complexity involved with twice calculating household tax liability.

Running parallel to the regular tax code, the AMT is a separate set of rules under which some households must calculate their tax liability a second time. It has a larger exemption amount, but at the same time it has fewer tax preferences; this design allows it to capture more income tax from households that would otherwise claim large deductions and have less tax liability. For example, under the AMT, the state and local tax deductionA tax deduction is a provision that reduces taxable income. A standard deduction is a single deduction at a fixed amount. Itemized deductions are popular among higher-income taxpayers who often have significant deductible expenses, such as state and local taxes paid, mortgage interest, and charitable contributions. is disallowed, miscellaneous itemized deductions are disallowed, and there is no standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers not to itemize deductions when filing their federal income taxes. . Several other possible tax deductions may also be added back to a household’s income—Form 6251, Alternative Minimum Tax-Individuals, has more than 60 lines—often making income that is subject to the alternative minimum tax higher than regular adjusted income.

After calculating income for AMT purposes, households are then subject to an alternative schedule that has only two rates: 26 percent and 28 percent. For tax year 2017, income above the AMT exemption (see below) and less than $187,800 is subject to the 26 percent rate and income above $187,800 is subject to the 28 percent rate.

Currently, more than 4.4 million households are subject to the AMT per year, though even more are affected by it. In tax year 2015, more than 10.3 million households had to calculate their AMT liability.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

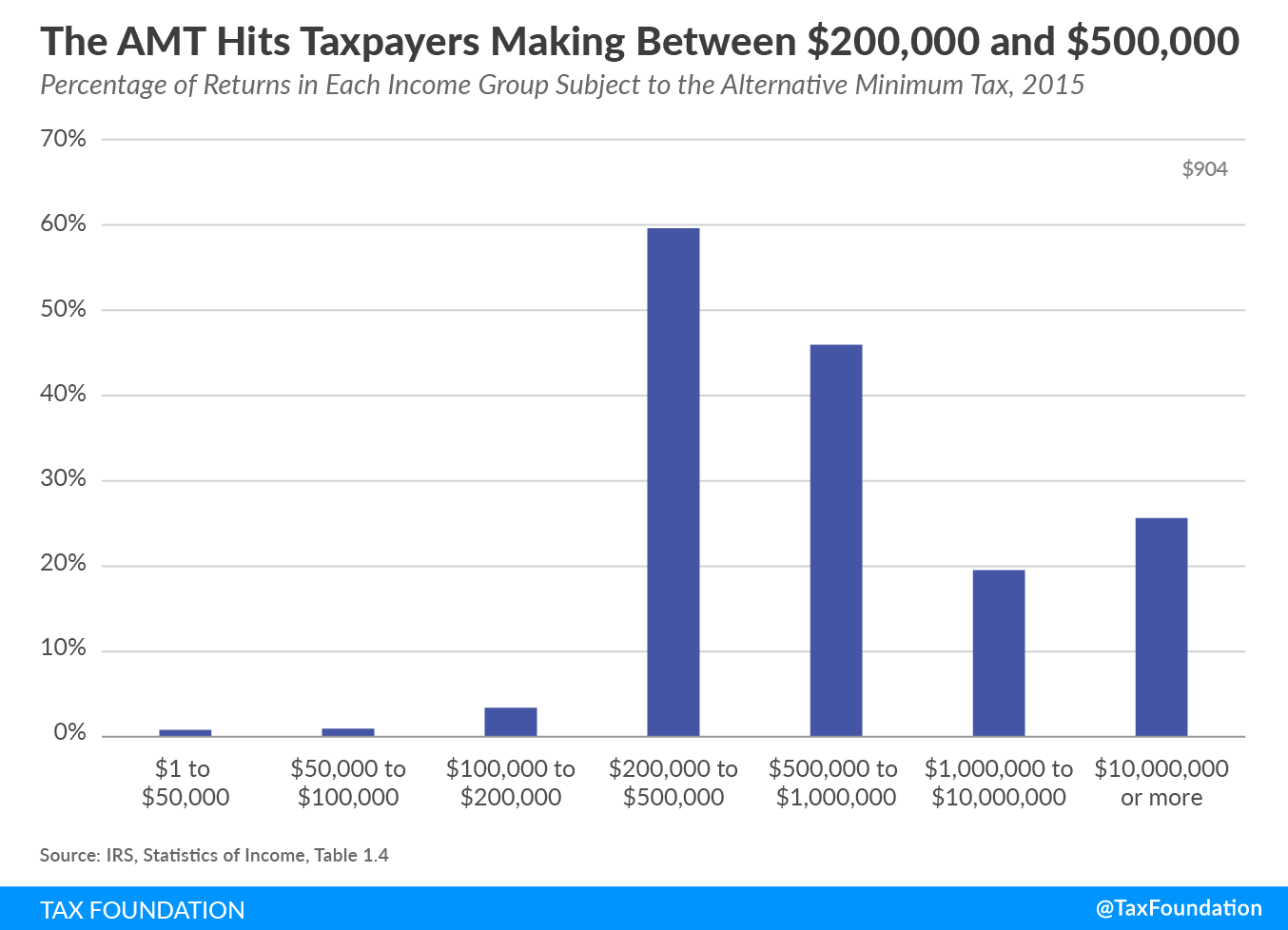

SubscribeNearly 60 percent of households making between $200,000 and $500,000 were subject to the AMT in 2015, the largest share of any income group. Those making less than $200,000 were very unlikely to owe under this parallel tax system.

Exemption amounts under the conference agreement are increased from their current level of $84,500 for joint filers and $54,300 for other filers to $109,400 and $70,300, respectively. This is unchanged from the final Senate amendment, and would decrease the number of households subject to the AMT.

The threshold at which the exemption amount phases out would also be increased. Currently, the phaseout for joint filers begins at $160,900, while for other filers this begins at $120,700; these amounts would be increased to $1 million and $500,000, respectively. For every dollar in income that exceeds the threshold, a household loses $0.25 of their exemption. The conference agreement levels are significantly higher than what the Senate amendment outlined, indicating a compromise with the House version that would have fully eliminated the individual AMT.

The conference agreement also specifies that both the exemptions and phaseouts would be increased by cost-of-living adjustments beginning after 2018, using 2017 as the base year.

These changes will dramatically limit the number of individuals impacted by the AMT over the next decade. All told, the Joint Committee on Taxation estimated that these changes would reduce federal revenues by $637.1 billion over the next decade, compared to current law.

Another aspect to consider is how the AMT will interact with other changing provisions, such as the increased standard deduction, new rate schedules, and limitations on itemized deductionItemized deductions allow individuals to subtract designated expenses from their taxable income and can be claimed in lieu of the standard deduction. Itemized deductions include those for state and local taxes, charitable contributions, and mortgage interest. An estimated 13.7 percent of filers itemized in 2019, most being high-income taxpayers. s including mortgage interest and state and local property or income and sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. . A larger standard deduction combined with limited itemized deductions makes it likely that more households will benefit from simply taking the standard deduction, which in turn makes them less likely to have AMT liability.

Currently, high-income households in high-tax states and localities are much more likely to pay the AMT. By simultaneously limiting the value of the state and local tax deduction and the mortgage interest deductionThe mortgage interest deduction is an itemized deduction for interest paid on home mortgages. It reduces households’ taxable incomes and, consequently, their total taxes paid. The Tax Cuts and Jobs Act (TCJA) reduced the amount of principal and limited the types of loans that qualify for the deduction. and raising the AMT exemption level, fewer households making between $200,000 and $500,000 will owe the AMT. As the exemption does not begin to phase out until alternative minimum taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. exceeds $1 million, under the proposed changes households making in excess of this level will be left to pay a larger share of the AMT.

Ultimately, the combination of a higher exemption and a higher phaseout threshold will result in fewer households incurring AMT liability and for those still owing, the liability will likely be smaller. However, unless extended by a future Congress, these changes will expire on December 31, 2025. The goal of the alternative minimum tax, ensuring that households do not benefit too much from itemized deductions, would be better accomplished by simplifying the regular tax code, thus making an alternative tax code unnecessary. However, the AMT was retained presumably in a trade-off to keep the bill under the $1.5 trillion revenue loss limit guiding negotiations, meaning the conference agreement preserved the individual AMT to raise revenue to pay for cuts elsewhere.

Share