Tax Calculator: How the TCJA’s Expiration Will Affect You

Unless Congress acts, Americans are in for a tax hike in 2026.

3 min read

Unless Congress acts, Americans are in for a tax hike in 2026.

3 min read

The 2017 Tax Cuts and Jobs Act (TCJA) was the largest corporate tax reform in a generation, lowering the corporate tax rate from 35 percent to 21 percent, temporarily allowing full expensing for short-lived assets (referred to as bonus depreciation), and overhauling the international tax code.

6 min read

Lawmakers will have to weigh the economic, revenue, and distributional trade-offs of extending or making permanent the various provisions of the TCJA as they decide how to approach the upcoming expirations. A commitment to growth, opportunity, and fiscal responsibility should guide the approach.

18 min read

Policymakers on Capitol Hill should prioritize permanent pro-growth policy in the coming years as the economy struggles with inflation and the recovery from the pandemic.

4 min read

While the approaches differ, they share a reliance on similar linkages: new capital investment drives productivity growth, which grows the economy and raises wages for workers.

37 min read

The Tax Cuts and Jobs Act of 2017 (TCJA) reformed the U.S. system for taxing international corporate income. Understanding the impact of TCJA’s international provisions thus far can help lawmakers consider how to approach international tax policy in the coming years.

30 min read

The TCJA improved the U.S. tax code, but the meandering voyage of its passing and the compromises made to get it into law show the challenges of the legislative process.

6 min read

BEAT is intended to address a legitimate problem, and there are virtues to BEAT’s overall strategic approach; however, its execution leaves room for improvement.

7 min read

The global landscape of international corporate taxation is undergoing significant transformations as jurisdictions grapple with the difficulty of defining and apportioning corporate income for the purposes of tax.

22 min read

Over the next 10 years, the IRA’s energy tax credits are projected to cost north of $1 trillion, adding to the federal government’s budgetary challenges and burgeoning debt.

6 min read

When the tax code is stable and predictable, individuals, families, and businesses can set goals for the future and make plans to achieve them.

Lawmakers should aim for policies that support investment and hiring in the United States and refining anti-avoidance measures to improve administrability and lower compliance costs.

9 min read

With proposals to adopt the nation’s highest corporate income tax, second-highest individual income tax, and most aggressive treatment of foreign earnings, as well as to implement an unusually high tax on property transfers, Vermont lawmakers have no shortage of options for raising taxes dramatically.

7 min read

With state tax revenues receding from all-time highs, there’s been a great deal of handwringing about whether states can afford the tax cuts adopted over the past few years. Given that 27 states reduced the rate of a major tax between 2021 and 2023, is there reason for concern?

4 min read

Given that U.S. debt is roughly the size of our annual economic output, policymakers will face many tough fiscal choices in the coming years. The good news is there are policies that both support a larger economy and avoid adding to the debt.

6 min read

In the context of the 2024 election year, what does President Biden’s 2025 budget proposal signify regarding his strategies and priorities as he seeks reelection? And how could these proposals shape the overall landscape of this election cycle?

President Biden is proposing extraordinarily large tax hikes on businesses and the top 1 percent of earners that would put the U.S. in a distinctly uncompetitive international position and threaten the health of the U.S. economy.

19 min read

The 2021 tax year was the fourth since the Tax Cuts and Jobs Act (TCJA) made many significant, but temporary, changes to the individual income tax code to lower tax rates, widen brackets, increase the standard deduction and child tax credit, and more.

9 min read

We’re examining the differences between the broad incentives provided by the Tax Cuts and Jobs Act and the targeted approach of the Inflation Reduction Act and the CHIPS and Science Act.

Unless Congress acts, Americans are in for a tax hike in 2026.

3 min read

While the approaches differ, they share a reliance on similar linkages: new capital investment drives productivity growth, which grows the economy and raises wages for workers.

37 min read

Though providing permanent R&D expensing alone would not be a China-competition magic bullet, it is a no-brainer place to start. In this technological race, we should first make sure we have not tied our own shoes together.

4 min read

What does it mean to be an American company?

4 min read

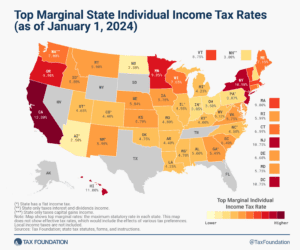

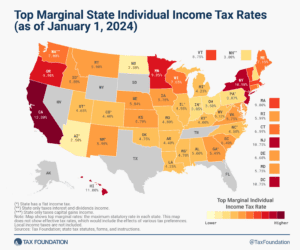

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

8 min read

The CBO projects deficits will be higher than historical levels, largely due to growth in mandatory spending programs While some recent legislation has reduced the deficit, the Inflation Reduction Act is proving to be more expensive than originally promised.

5 min read

Limiting interest deductibility continues to be a worthwhile policy goal, but given the current climate, policymakers should opt to pair any further limitations with other pro-growth policies such as full expensing to ensure firms’ incentives to invest are preserved.

3 min read