The individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. is the third largest source of taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. revenue for state and local governments, accounting for 22.9 percent of collections in fiscal year 2014. Property taxes and sales taxes comprise larger shares of state and local tax collection at 31.3 percent and 23.3 percent respectively.

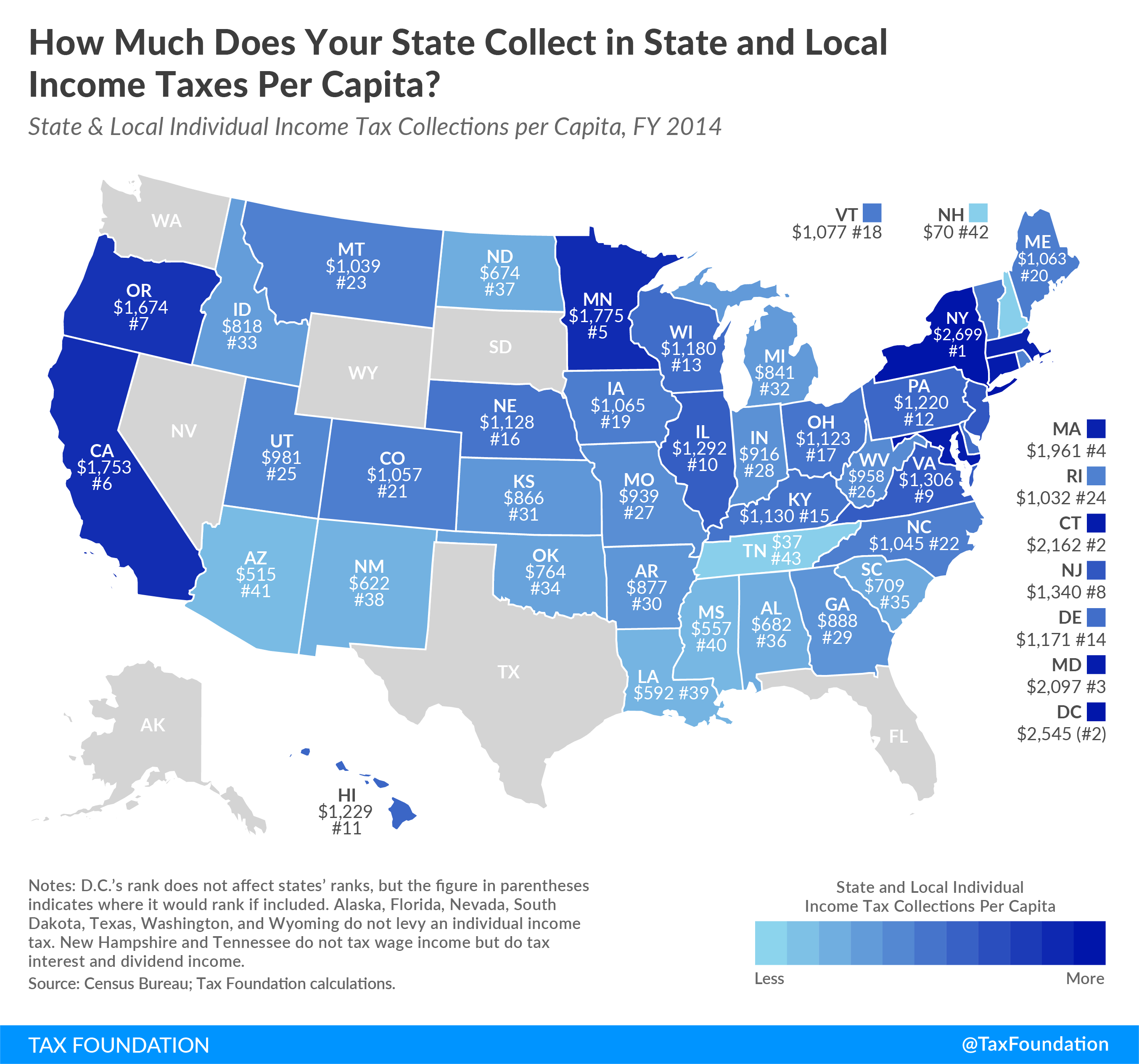

This week’s map shows the combined state and local individual income tax collections per person in fiscal year 2014. Here, individual income taxes include both broad-based taxes on wage income and taxes on specific types of income, such as dividend and interest income. Forty-one states have broad-based individual income taxes. New Hampshire and Tennessee only tax interest and dividend income (though Tennessee is in the process of phasing its out), while seven states have no individual income taxes (Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming).

State and local governments collected an average of $1,070 per person from individual income taxes, but the collection amount varies widely from state to state. New York collected $2,699 per person, the most of any state. Connecticut comes in second at $2,162, with Maryland rounding out the top three at $2,097 collected per person.

Arizona collected $515 per person, the least among states with broad-based taxes on wage income. Other states with relatively low collections include Mississippi ($557), Louisiana ($592), and New Mexico ($622). New Hampshire and Tennessee, which tax only interest and dividend income, collected $70 and $37 per person respectively. The seven states that don’t collect individual income taxes predictably reported $0 in per person collections.

Share this article