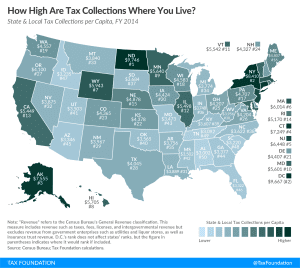

Unpacking the State and Local Tax Toolkit: Sources of State and Local Tax Collections (FY 2020)

The mix of tax sources states choose can have important implications for both revenue stability and economic growth, and the many variations across states are indicative of the different ways states weigh competing policy goals.

29 min read