Property taxes are an important revenue source for state and local governments. In fiscal year 2014 (the most recent data available), property taxes were the largest source of state and local taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. collections, comprising 31.3 percent.

As a colleague explained last year, states tax real property in a variety of ways. Some states impose a rate or millage on the full fair market value of the property, while others impose it on a given percentage of the market value or even based on income potential.

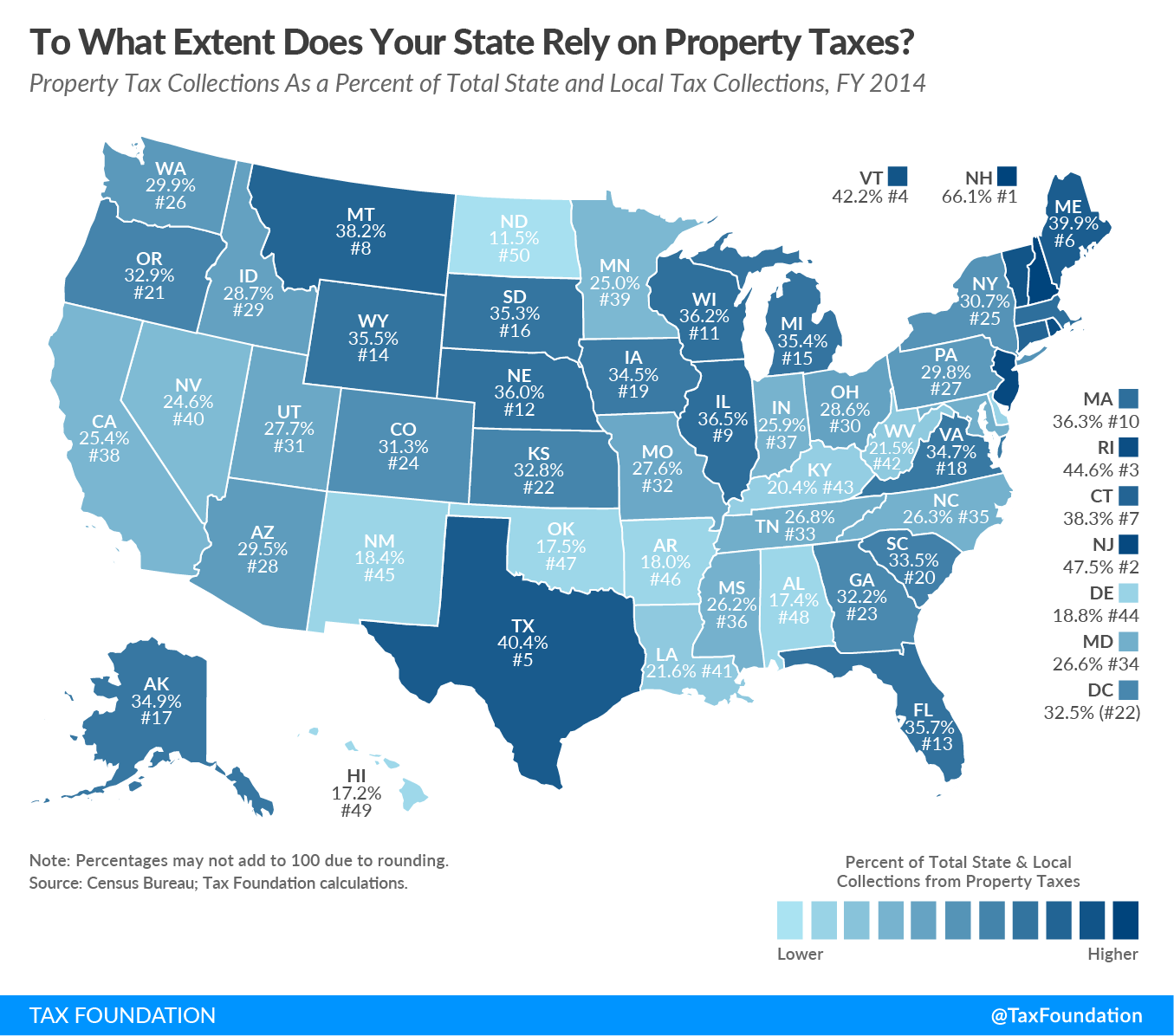

Reliance on property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. es also varies across states. North Dakota (which derives much of its revenue from severance taxes) relies the least on property taxes, at only 11.5 percent of its state and local tax collections. New Hampshire, by contrast, relies most heavily on property taxes, at 66.1 percent of total state and local tax collections.

However, a heavy reliance on any given tax does not equate to a high tax burden overall. New Hampshire, for example, has the highest reliance on property taxes but the 44th lowest tax burden in the country, as the state does not levy a sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. or a tax on wage income. Texas, the state with the fifth highest reliance on property taxes, has the 46th lowest tax burden in the country. Texas does not levy a corporate or individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. (though it does have a harmful business tax in the form of the Margin Tax).

Note: This is the first in a four-part map series in which we will examine the primary sources of state and local tax collections. Other maps in this series are linked below.