Key Findings:

- Rep. Jim Renacci’s (R-OH) taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. plan would reform the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. code and replace the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. with a 7 percent value-added tax.

- The congressman’s plan would reduce federal revenues by $845 billion over the next decade. However, the plan will end up raising revenue when accounting for the increased economic output in the long run.

- According to the Tax Foundation’s Taxes and Growth Model, the plan would significantly reduce marginal tax rates and the cost of capital, which would lead to 5.6 percent higher GDP over the long term and 1.9 million additional jobs.

- On a static basis, the plan would lead to 2.1 percent higher after-tax incomeAfter-tax income is the net amount of income available to invest, save, or consume after federal, state, and withholding taxes have been applied—your disposable income. Companies and, to a lesser extent, individuals, make economic decisions in light of how they can best maximize their earnings. for all taxpayers and 6.6 percent higher after-tax income for the top 1 percent. When accounting for the increased GDP, after-tax incomes of all taxpayers would increase by an average of 4.4 percent.

Rep. Jim Renacci’s tax plan would reform the individual income tax by reducing marginal tax rates on individuals, simplify the tax code by eliminating most itemized deductions, and significantly expand the Earned Income Tax CreditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. (EITC). The plan would repeal the corporate income tax and replace the lost revenue with a 7 percent credit-invoice value-added tax (VAT). This VAT would apply to all private businesses and the federal government, but exempt nonprofit organizations and state and local governments. The plan would also eliminate the alternative minimum tax and enact a one-time tax on all deferred foreign earnings of multinational corporations.

Our analysis finds that the plan would reduce federal revenues by $600 billion over the next decade. The plan would also decrease marginal tax rates on both labor and capital. As a result, the plan would increase the size of gross domestic product (GDP) by 5.6 percent over the long term. This increase in GDP would translate into an 18 percent larger capital stock and 1.9 million more full-time equivalent jobs. After accounting for the economic effects of the tax changes, the plan would end up raising revenue.

Details of the Plan

Individual Income Tax Changes

- Consolidates the current seven tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. into three, with a top marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. of 35 percent (Table 1)

- Taxes capital gains and dividends as ordinary income

- Increases the standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. Taxpayers who take the standard deduction cannot also itemize their deductions; it serves as an alternative. from $6,300 to $15,000 for single filers and from $12,600 to $30,000 for married couples filing jointly

- Increases the personal exemption from $4,050 to $5,000

| Tax Rates | Taxable Income Brackets | ||

|---|---|---|---|

| Ordinary Income | Capital Gains and Dividends | Single Filers | Married Filing Jointly |

| 10.00% | 10.00% | $0-$50,000 | $0-$100,000 |

| 25.00% | 25.00% | $50,000-$750,000 | $100,000-$1,500,000 |

| 35.00% | 35.00% | $750,000 and above | $1,500,000 and above |

- Expands the Earned Income Tax Credit by increasing phase-in rates by 40 percent for taxpayers with children and by 100 percent for taxpayers without children. All other parameters would remain the same (details in the appendix)

- Eliminates the Alternative Minimum Tax

- Eliminates all itemized deductions except for the mortgage interest deductionThe mortgage interest deduction is an itemized deduction for interest paid on home mortgages. It reduces households’ taxable incomes and, consequently, their total taxes paid. The Tax Cuts and Jobs Act (TCJA) reduced the amount of principal and limited the types of loans that qualify for the deduction. and the charitable deduction. Caps the mortgage interest deduction at $500,000 of acquisition debt

Business Income Tax Changes

- Eliminates the corporate income tax

- Enacts a deemed repatriationRepatriation is the process by which multinational companies bring overseas earnings back to the home country. Prior to the 2017 Tax Cuts and Jobs Act (TCJA), the US tax code created major disincentives for US companies to repatriate their earnings. Changes from the TCJA eliminate these disincentives. of currently deferred foreign profits, at a tax rate of 8.75 percent for cash and cash-equivalent profits and 3.5 percent on other profits

Other Changes

- Creates a 7 percent credit-invoice method value-added tax. Applies to all private business and the federal government. Exempts nonprofit organizations and state and local governments

Economic Impact

According to the Tax Foundation’s Taxes and Growth Model, Rep. Renacci’s tax plan would increase the economy’s size by 5.6 percent in the long run. The plan would lead to 4.7 percent higher wages, an 18 percent larger capital stock, and 1.9 million more full-time equivalent jobs. The larger economy results from significantly lower marginal tax rates on capital and labor income.

| Source: Tax Foundation Taxes and Growth Model, March 2016. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GDP | 5.6% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Capital Investment | 17.8% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wage Rate | 4.7% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Full-time Equivalent Jobs (in thousands) | 1,877 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Revenue Impact

Overall, the plan would reduce federal revenue on a static basis by $845 billion over the next 10 years. Most of the revenue loss is due to much lower individual income tax collections, which we project to reduce revenues by approximately $5.9 trillion over the next decade. In addition, the elimination of the corporate tax would reduce revenues by approximately $3.6 trillion (net of the one-time tax on deferred foreign earnings). However, most of the revenue is replaced by the 7 percent VAT, which we project would raise $9.4 trillion over the next decade. The new VAT would result in a slightly smaller wage tax base and thus reduce payroll tax revenue by $733 billion.

If we account for the economic impact of the plan, it would end up raising $695 billion over the next decade. The larger economy would result in higher labor force participation and higher wages. This would broaden the income, payroll, and VAT bases and lessen the revenue loss of the plan.

| Tax | Static Revenue Impact (2016-2025) | Dynamic Revenue Impact (2016-2025) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Note: Individual items may not sum to the total due to rounding. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Source: Tax Foundation Taxes and Growth Model, March 2016. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Individual Income Taxes | -$5,917 | -$5,081 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Payroll Taxes | -$733 | -$361 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporate Income Taxes | -$3,613 | -$3,613 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Excise Taxes | $0 | $40 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Estate and Gift Taxes | $0 | $17 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Revenue (VAT) | $9,418 | $9,692 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | -$845 | $695 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The largest source of revenue loss in the plan is the consolidation of the tax brackets, which would reduce revenue by approximately $4.8 trillion over the next decade. The elimination of the corporate tax would also significantly reduce revenue: $3.7 trillion over the next decade (Table 4).

Enacting the VAT would raise $7.4 trillion on net. As stated above, the VAT itself would raise $9.4 trillion over the next decade. However, the VAT would reduce pretax wages paid by businesses, shrinking the individual income tax and payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. base, which would reduce revenue raised by those taxes.

| Provision | Change in Static Revenue from Provision | Change in GDP from Provision | Change in Dynamic Revenue from Provision | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Source: Tax Foundation Taxes and Growth Model, March 2016. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Eliminates the Alternative Minimum Tax | -$354 | -0.3% | -$428 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Eliminates all itemized deductions except for the mortgage interest and charitable contributions deductions | $2,331 | -0.4% | $2,218 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Caps the mortgage interest deduction at $500,000 of debt | $334 | 0.0% | $321 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Eliminates most non-business personal credits | $27 | 0.0% | $26 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Taxes capital gains and dividends as ordinary income | $1,691 | -3.8% | $512 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Increases the standard deduction to $15,000/$30,000 and the personal exemption to $5,000 | -$3,401 | 1.2% | -$2,955 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Consolidates individual income tax brackets into three of 10 percent, 25 percent, and 35 percent | -$4,833 | 4.0% | -$3,642 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Expands the Earned Income Tax Credit | -$449 | -0.2% | -$502 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Eliminates the corporate income tax | -$3,798 | 7.5% | -$1,984 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Creates a 7 percent value-added tax | $7,422 | -2.5% | $6,944 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Enacts a deemed repatriation of deferred foreign-source income | $185 | 0.0% | $185 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | -$845 | 5.6% | $695 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Source: Tax Foundation Taxes and Growth Model, March 2016.

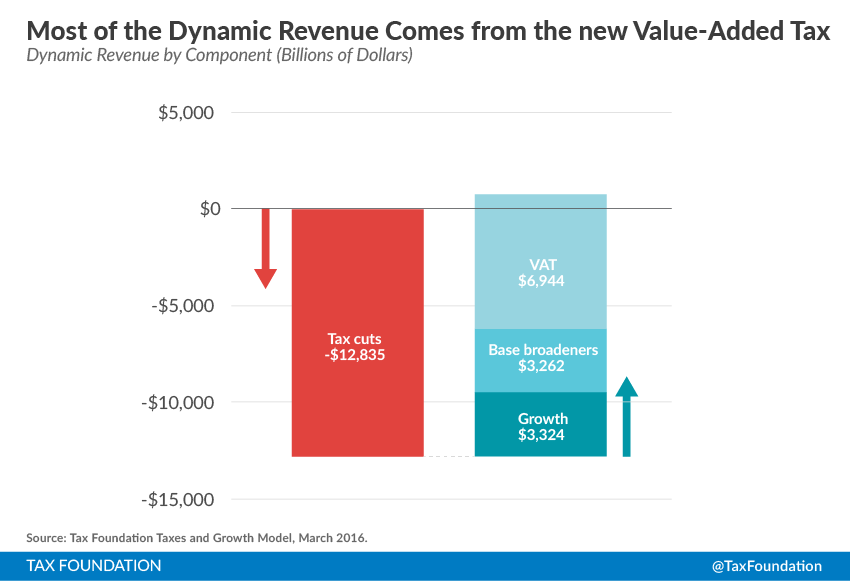

Components of the Dynamic Revenue Estimate

The Renacci tax plan’s dynamic revenue impact of $695 billion over the next decade can be broken down into four pieces: the marginal tax cuts, economic growth, base broadeners, and the value-added tax.

The plan would cut individual income tax rates, expand the standard deduction and personal exemption, and eliminate the corporate income tax. Combined, these cuts would reduce federal revenue by $12.8 trillion if enacted alone.

However, these cuts would reduce marginal tax rates on work, saving, and investment. As a result, the size of the economy would increase, boosting incomes, and growing the payroll and income tax bases. Overall, growth from the marginal rate cuts would reduce the 10-year cost of the plan by $3.3 trillion.

Then, the plan would make up even more revenue through broadening the individual income tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. . For example, it would eliminate most itemized deductions and personal credits, tax capital gains and dividends as ordinary income, and cap the mortgage interest deduction. Together, these base broadeners would reduce the cost of the plan by $3.3 trillion.

Finally, the plan would end up raising revenue on a dynamic basis, due to the new 7 percent value-added tax, which would raise $6.9 trillion.

Distributional Impact

On a static basis, the Renacci plan would end up increasing after-tax income of all taxpayers by at least 0.6 percent. Taxpayers in the bottom four quintiles would see modest increases in their after-tax income, with those in the bottom quintile seeing an increase of 1.7 percent. In contrast, taxpayers in the top quintile would see an increase in after-tax income of 3.1 percent. The top 1 percent of all taxpayers would experience a 6.6 percent increase in their after-tax income.

After accounting for economic effects, taxpayers would see their after-tax incomes increase by an average of 4.4 percent. The larger economy in the long run would mean higher wages and capital income.

| Effect of Tax Reform on After-Tax Income Compared to Current Law | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Returns with positive AGI by Quintile | Static | Dynamic | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0% to 20% | 1.7% | 5.3% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 20% to 40% | 1.2% | 5.3% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 40% to 60% | 1.1% | 5.4% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 60% to 80% | 0.6% | 4.7% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 80% to 100% | 3.1% | 4.0% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 90% to 100% | 3.6% | 3.3% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 99% to 100% | 6.6% | 2.2% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL | 2.1% | 4.4% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Conclusion

Rep. Jim Renacci’s tax plan would reform the individual income tax and replace the corporate income tax with a credit-invoice value-added tax. If enacted, his plan would reduce federal revenues by $845 billion over the next decade. The Renacci plan would significantly reduce marginal tax rates on capital and labor income, which would result in a substantial increase of the size of the U.S. economy in the long run. This would increase the revenue that the tax plan would ultimately collect, making the plan slightly revenye positive. Rep. Renacci’s plan would increase after-tax incomes for taxpayers at all income levels.

Modeling Notes

The Taxes and Growth Model does not take into account the fiscal or economic effects of interest on debt. It also does not require budgets to balance over the long term, nor does it account for the potential macroeconomic or distributional effects of any changes to government spending that may accompany the tax plan.

In modeling the value-added tax, we assumed 5 percent noncompliance and no small business exemption. Higher levels of noncompliance and the introduction of an exemption would reduce the amount of revenue the value-added tax would ultimately collect. We also assumed that businesses would be allowed to deduct unused depreciation against the new value-added tax.

We did not model how the plan would affect the frequency of capital gains realizations. To the extent that the plan causes households to realize capital gains less frequently, it will raise less revenue than estimated above. Additionally, our model results do not account for the possibility that pass-through businesses may reorganize as C corporations as a result of the plan.

The Expanded Earned Income Tax Credit

Under current law, the Earned Income Tax Credit (EITC) provides a refundable credit to low-income taxpayers with earned income. The credit phases in as taxpayers earn more income until the credit hits a maximum. Once a taxpayer hits a certain income limit, the credit begins phasing out. The phase-in rate and credit sizes vary by the number of children in a household, with the largest credit available to taxpayers with three or more children.

The Renacci tax plan would increase the current law phase-in rates for taxpayers with children by 40 percent and by 100 percent for taxpayers without children. For example, the phase-in rate for a taxpayer with no children is 7.65 percent under current law. Under this proposal, the phase-in rate would be 15.3 percent. Since the credit phases in faster, the ultimate credit size is larger. These taxpayers would receive a maximum credit of $1,012. In addition, the income level at which the credit ultimately phases out to zero will be higher. Taxpayers with no children could receive some amount of EITC up to $21,481, while under current law, the max income would be $14,880.

| Current Law | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Filing Status | No Children | One Child | Two Children | Three or More Children | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Single or Head of Household | Income at Max Credit | $6,610 | $9,920 | $13,930 | $13,930 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Maximum Credit | $506 | $3,373 | $5,572 | $6,268 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Phaseout Begins | $8,270 | $18,190 | $18,190 | $18,190 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Phaseout Ends (Credit Equals Zero) | $14,880 | $39,296 | $44,648 | $47,955 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Married Filing Jointly | Income at Max Credit | $6,610 | $9,920 | $13,930 | $13,930 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Maximum Credit | $506 | $3,373 | $5,572 | $6,268 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Phaseout Begins | $13,810 | $23,730 | $23,730 | $23,730 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Phaseout Ends (Credit Equals Zero) | $20,420 | $44,836 | $50,188 | $53,495 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Proposal Parameters | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Filing Status | No Children | One Child | Two Children | Three or More Children | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Single or Head of Household | Income at Max Credit | $6,610 | $9,920 | $13,930 | $13,930 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Maximum Credit | $1,012 | $4,722 | $7,801 | $8,777 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Phaseout Begins | $8,270 | $18,190 | $18,190 | $18,190 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Phaseout Ends (Credit Equals Zero) | $21,481 | $47,738 | $55,231 | $59,861 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Married Filing Jointly | Income at Max Credit | $6,610 | $9,920 | $13,930 | $13,930 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Maximum Credit | $1,012 | $4,722 | $7,801 | $8,777 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Phaseout Begins | $13,810 | $23,730 | $23,730 | $23,730 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Phaseout Ends (Credit Equals Zero) | $27,040 | $53,288 | $60,781 | $65,411 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||