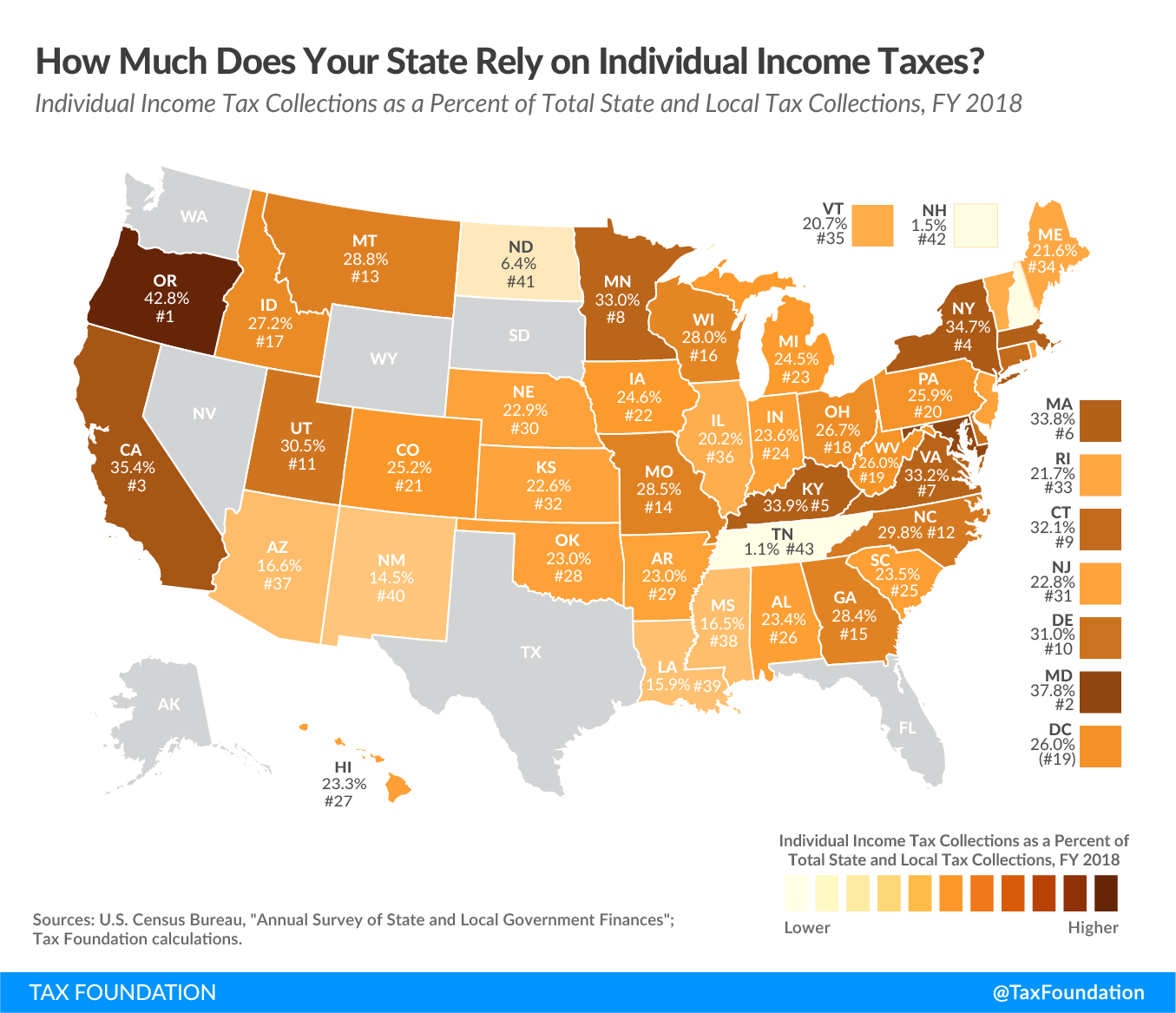

Sources of state revenue have come under closer scrutiny in light of the impact of the coronavirus pandemic, as different taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. types have differing volatility and economic impact—although even beyond these unique circumstances, it is important for policymakers to understand the trade-offs associated with different sources of tax revenue. This week’s map looks at what percentage of each state’s state and local tax collections is attributable to the individual income tax.

State and localities rely heavily on the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. , which accounted for 24.2 percent of total U.S. state and local tax collections in fiscal year 2018, the latest year for which data are available. The individual income tax ranks just above the general sales tax (23.3 percent) and behind property taxes (31.1 percent), taking its place as the second largest source of state and local revenue.

Of all the states, Oregon and Maryland rely most heavily on individual income taxes, which account for 42.8 percent and 37.9 percent of their total state and local tax collections respectively. Both are among the 17 states where localities also levy income taxes, though this does not factor into these rankings, which are of state reliance. Oregon has chosen not to collect sales taxes, a decision which contributes to that state’s heavy reliance on the individual income tax.

While the individual income tax tends to be a major revenue source for state and local governments, some states rely on it very little, and some not at all. Eight states (Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming) do not collect individual income taxes, while New Hampshire collects taxes on dividend and interest income but not wage income. Today’s map also shows a very small reliance on income tax collections in Tennessee, which had a similar tax on interest and dividends during the period captured here, though that tax on investment income (the Hall Income Tax) was fully repealed as of January 1, 2021.

Therefore, it comes as no surprise that Tennessee and New Hampshire raised the least amount of revenue from the individual income tax in 2018 among states with any such tax, at 1.1 and 1.5 percent of tax revenue respectively. In North Dakota and New Mexico, the next lowest states, the individual income tax generates 6.4 percent and 14.5 percent of their total tax collections respectively.

It is generally true that income taxes are more volatile than consumption taxes in an economic downturn, as income itself tends to fluctuate more than consumption. Even in a global pandemic, when social distancing restrictions and the nature of pandemics caused an initial drop in consumption, sales taxes have rebounded and returned to pre-pandemic levels, while income taxes—which have also rebounded—are still seeing some losses. Income taxes, however, have defied expectations from early in the pandemic, and have performed differently than they have in previous recessions.

Typically, states with heavy reliance on income taxes—particularly progressive, high-rate income taxes which lean substantially on the state’s highest income residents—fare poorly during an economic downturn. Not only do wages decline due to layoffs and pay cuts, but investments usually experience steep losses, depriving states of capital gains income—a substantial portion of income tax collections, particularly in wealthier states. During this crisis, however, stock markets saw substantial gains, meaning that states with heavy reliance on income taxes typically did well. The norm, however, is the opposite—capital gains realizations slid 71 percent at the trough of the Great RecessionA recession is a significant and sustained decline in the economy. Typically, a recession lasts longer than six months, but recovery from a recession can take a few years. —and states should not assume that this unique experience is predictive of future recessions.

Volatility is not the only factor to consider. As we’ve pointed out in the past, a state’s combination of tax sources has implications for its revenue stability and economic growth. Income taxes tend to be more harmful to economic growth than consumption taxes and property taxes. Income taxes fall on labor and savings, while consumption taxes, like the sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. , fall on what people spend instead of what they earn. As a result, income taxes tend to be less neutral than sales taxes.

Note: This is part of a map series in which we examine the primary sources of state and local tax collections