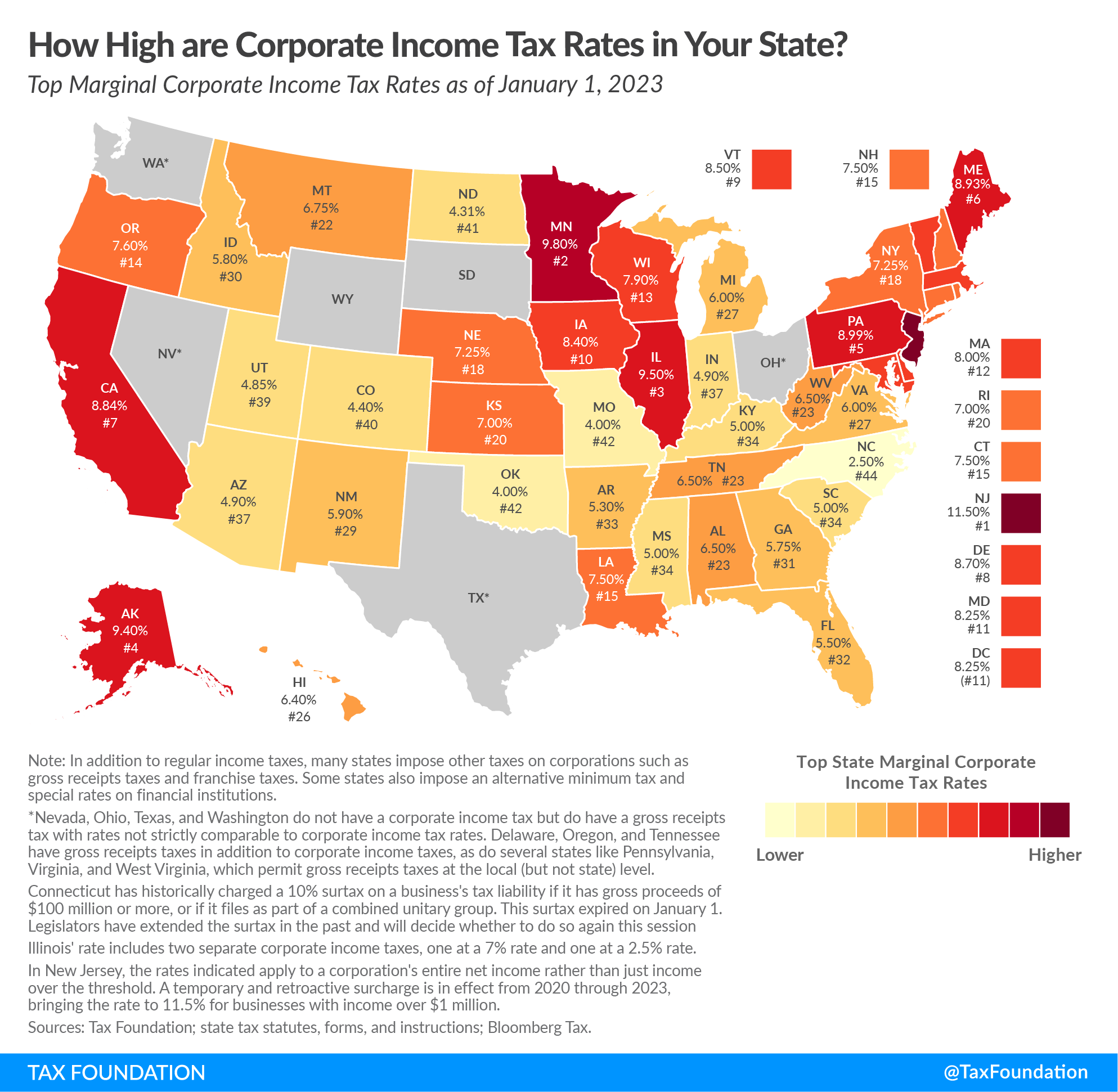

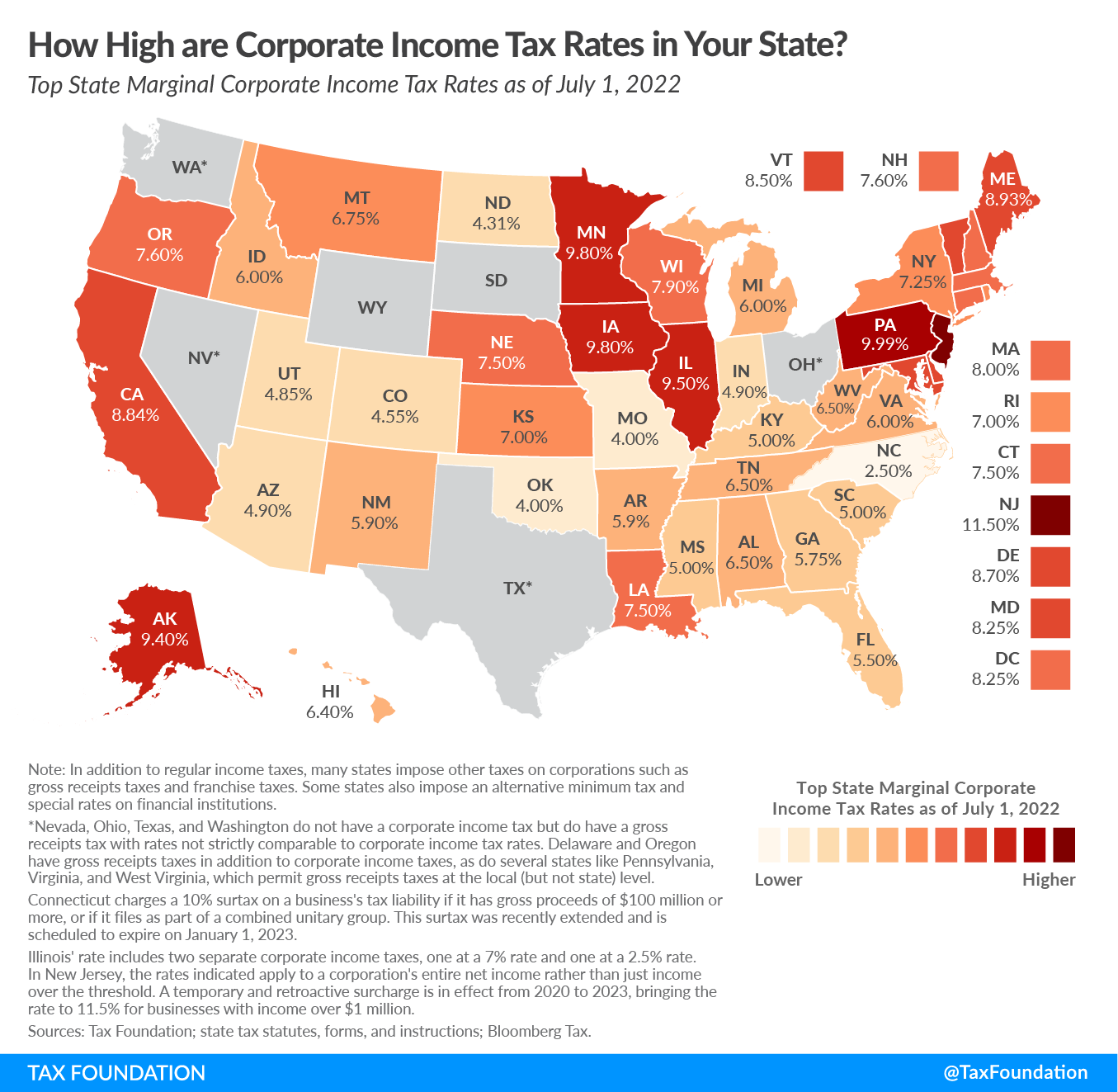

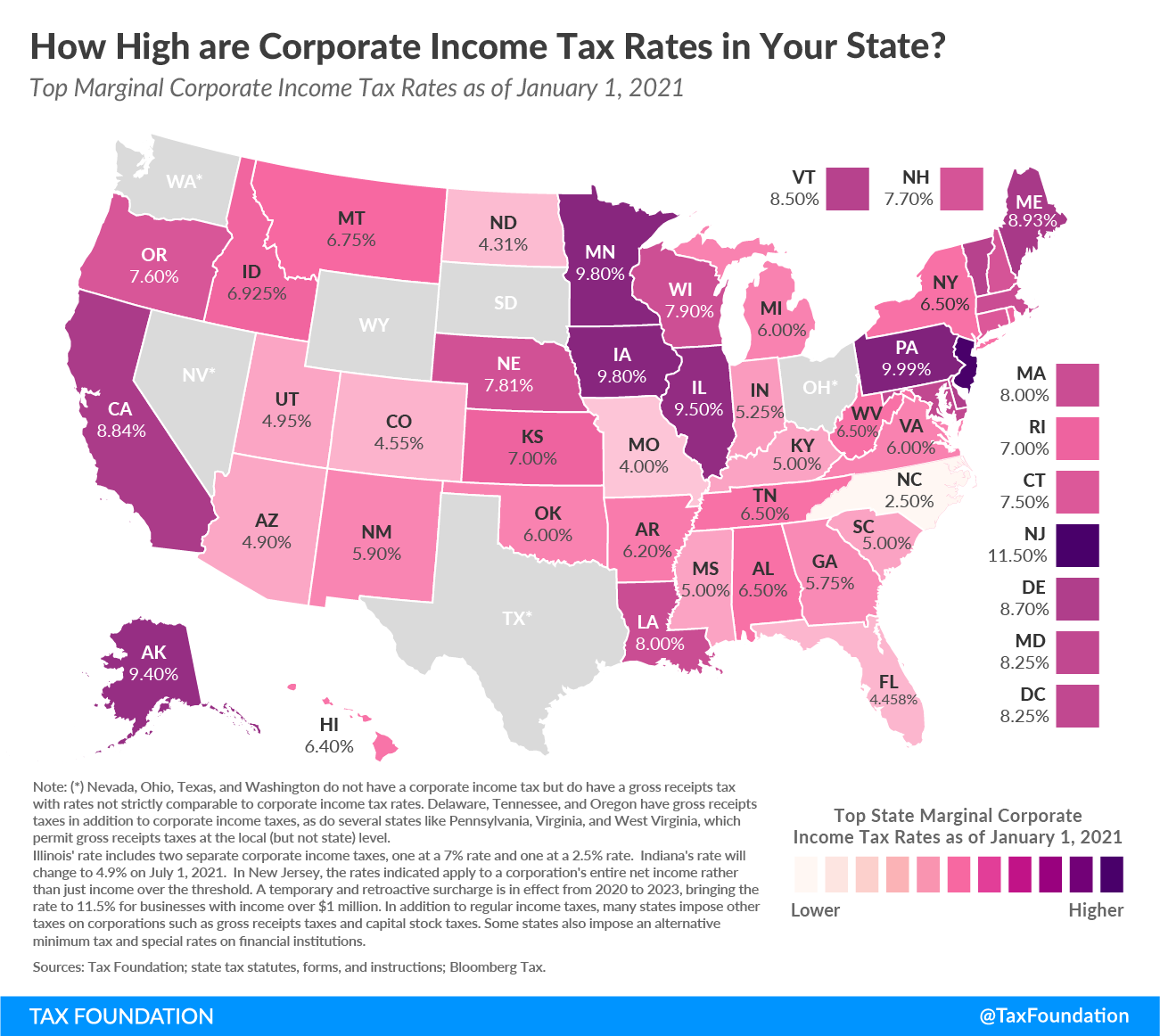

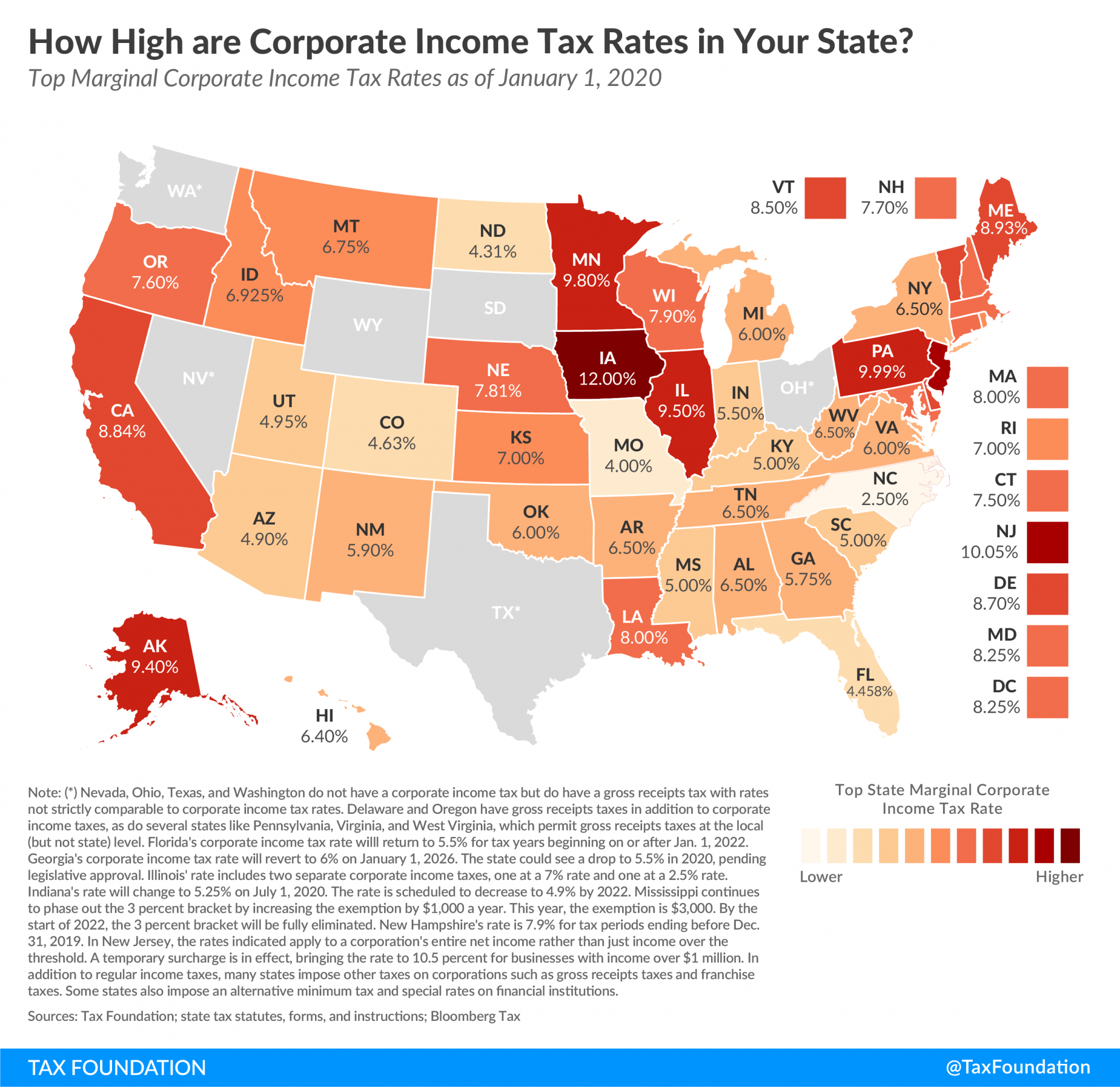

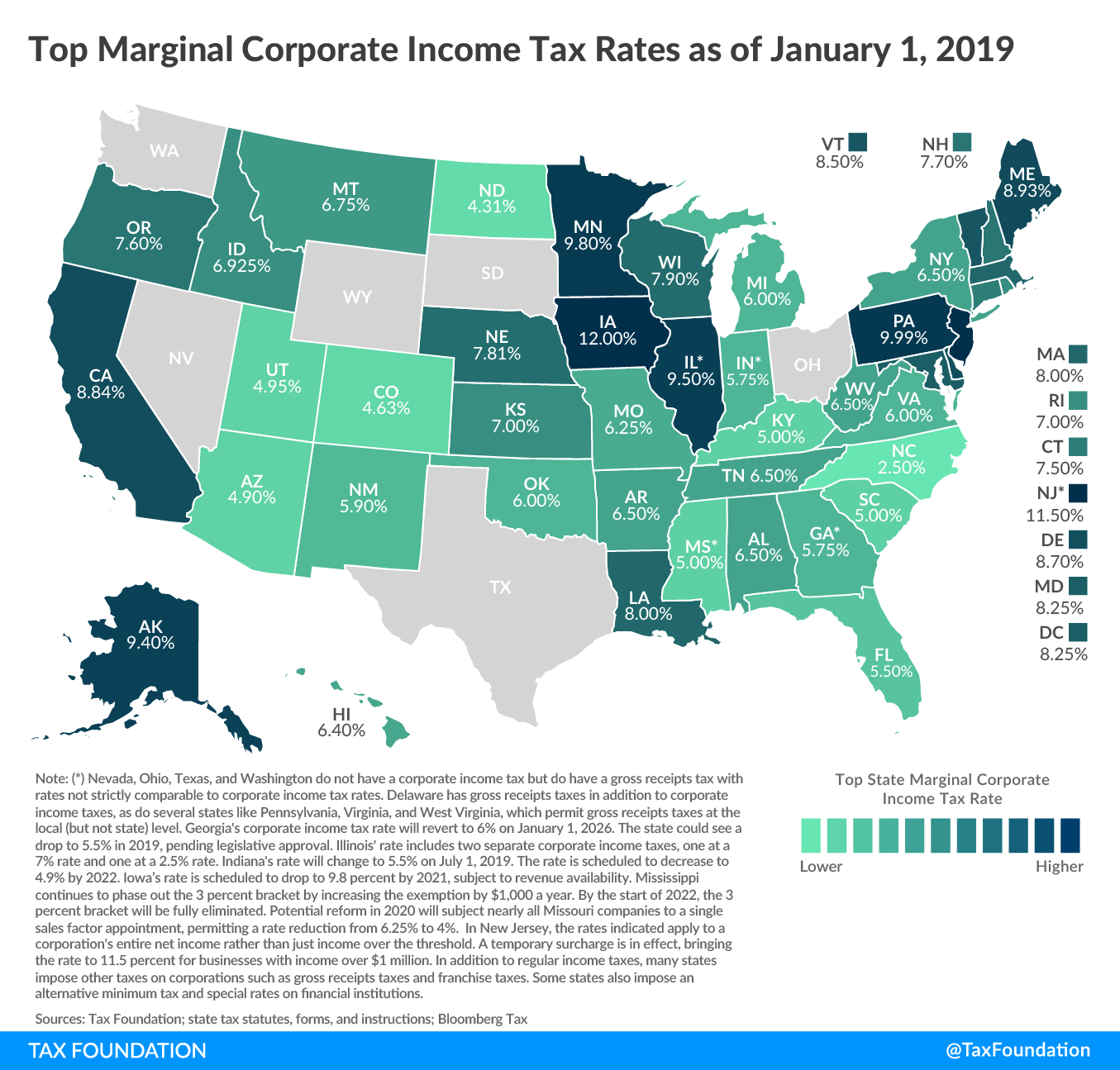

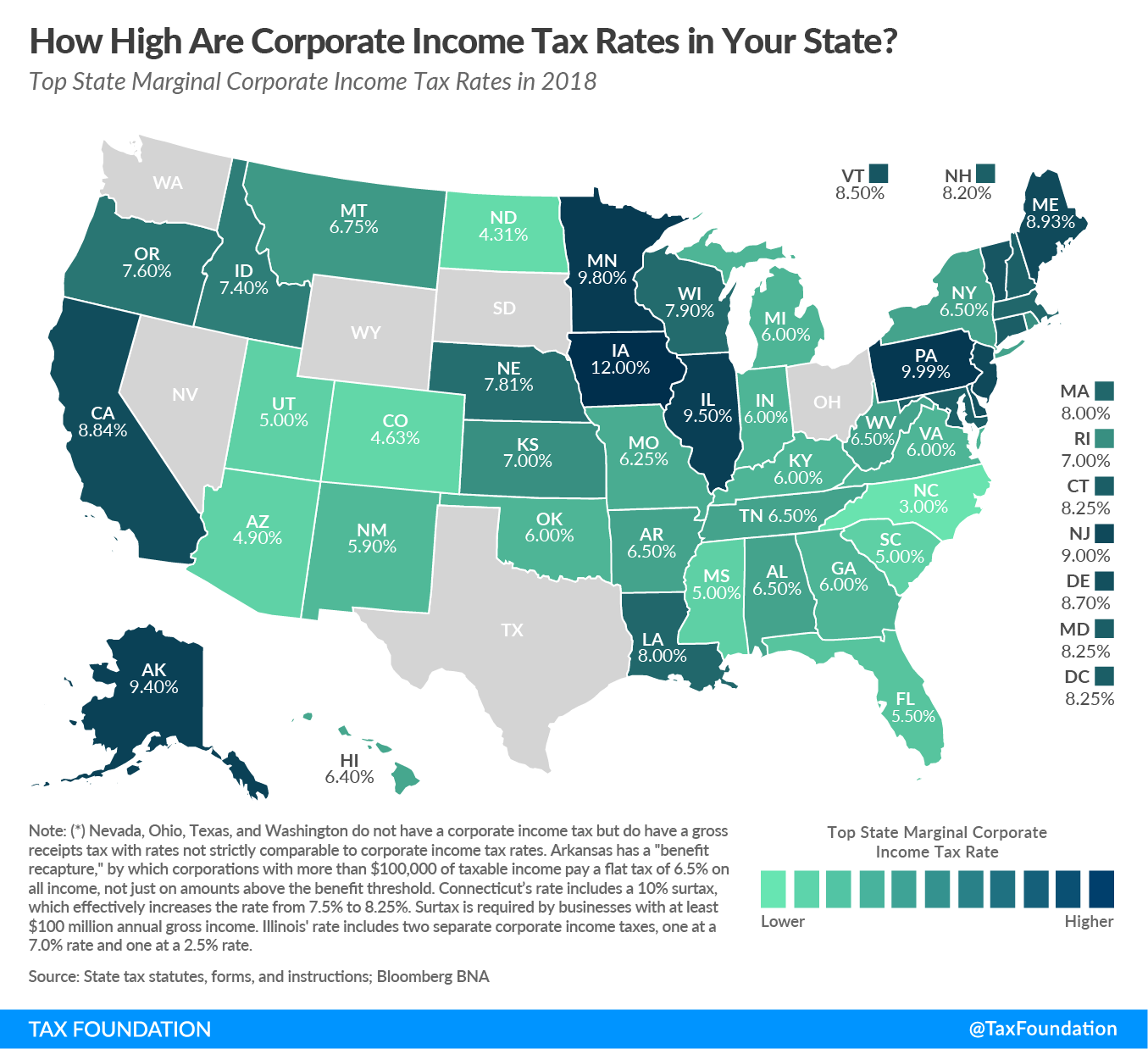

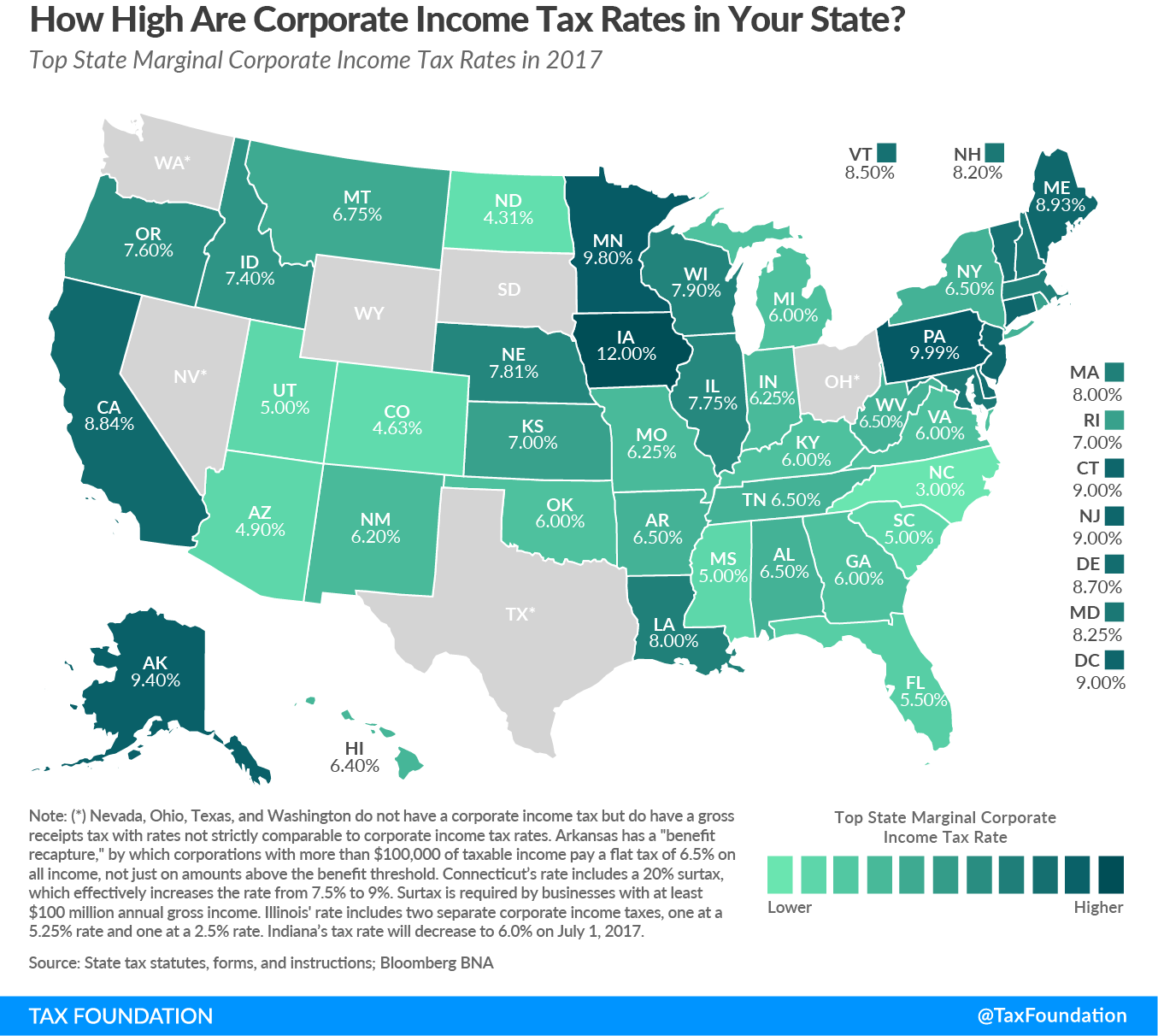

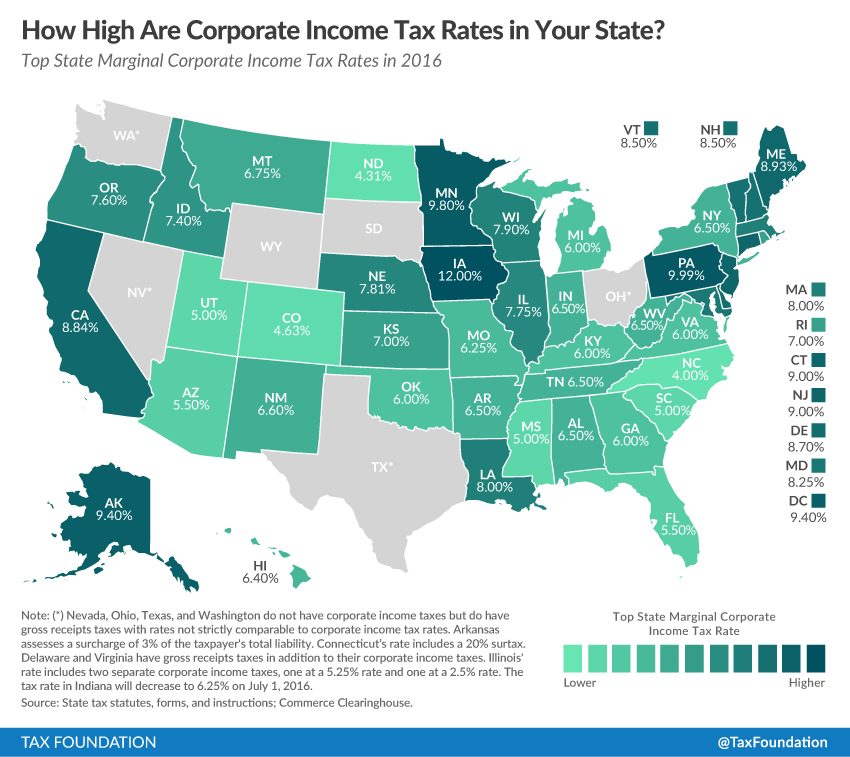

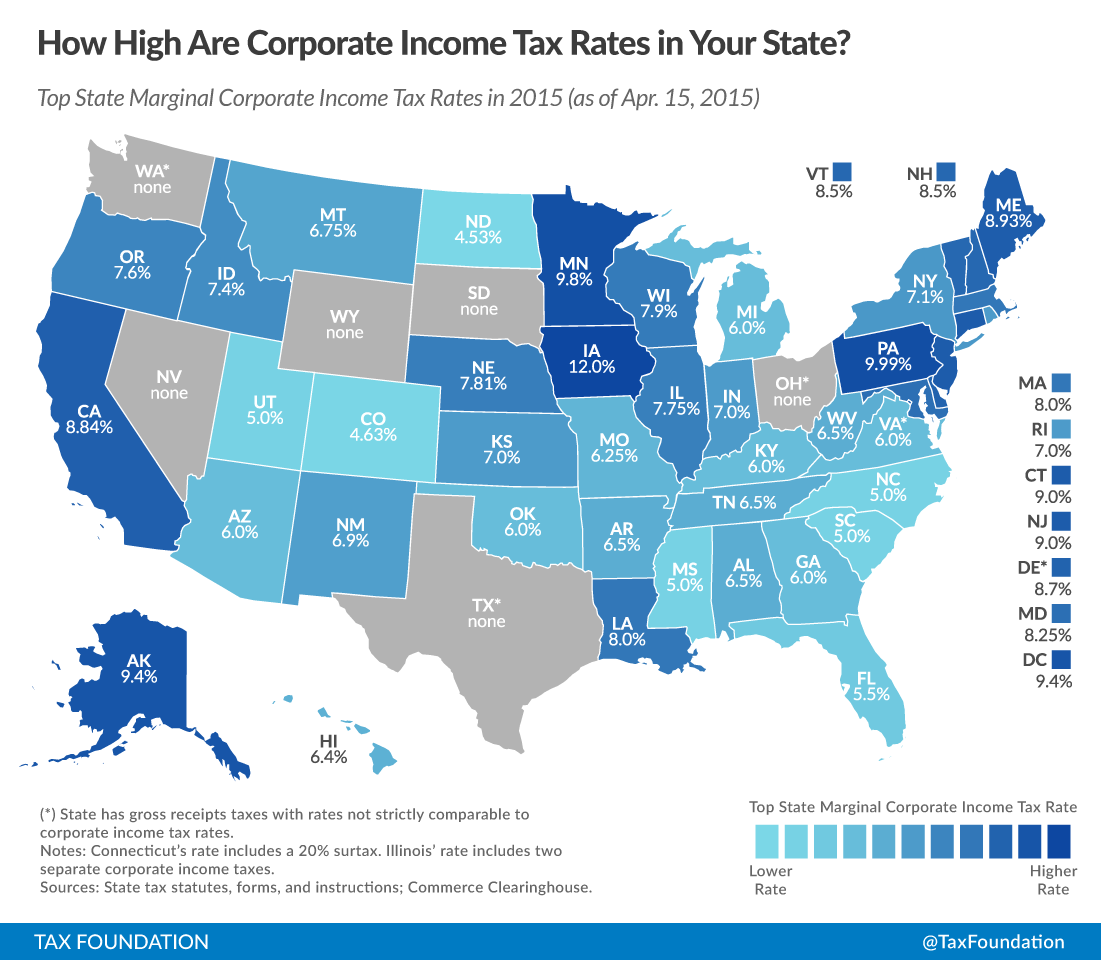

Forty-four states levy a corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. . Top rates range from a 2.25 percent flat rate in North Carolina to a 11.5 percent top marginal rate in New Jersey. Four states—Louisiana, Nebraska, North Carolina, and Pennsylvania—reduced corporate income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates on January 1, 2025, while two states—New Mexico and New Jersey—increased tax burdens for corporations.

Among states that impose a corporate income tax, the average top rate is 6.5 percent with a median rate of 6.5 percent.

Four states—Alaska, Illinois, Minnesota, and New Jersey—levy top marginal corporate income tax rates of 9 percent or higher. Maine and California are not far behind.

Twelve states—Arizona, Arkansas, Colorado, Indiana, Kentucky, Mississippi, Missouri, North Carolina, North Dakota, Oklahoma, South Carolina, and Utah—have top rates at or below 5 percent.

Nevada, Ohio, Texas, and Washington impose gross receipts taxes instead of corporate income taxes. Delaware, Oregon, and Tennessee impose gross receipts taxes in addition to their corporate income taxes. Some localities in Pennsylvania, Virginia, and West Virginia likewise impose gross receipts taxes, which are generally understood to be more economically harmful than corporate income taxes.

South Dakota and Wyoming are the only states that levy neither a corporate income nor gross receipts taxGross receipts taxes are applied to a company’s gross sales, without deductions for a firm’s business expenses, like compensation, costs of goods sold, and overhead costs. Unlike a sales tax, a gross receipts tax is assessed on businesses and applies to transactions at every stage of the production process, leading to tax pyramiding. .

2025 State Corporate Income Tax Rates & Brackets

| State | Rates | Brackets | |

|---|---|---|---|

| Alabama | 6.50% | > | $0 |

| Alaska | 0.00% | > | $0 |

| Alaska | 2.00% | > | $25,000 |

| Alaska | 3.00% | > | $49,000 |

| Alaska | 4.00% | > | $74,000 |

| Alaska | 5.00% | > | $99,000 |

| Alaska | 6.00% | > | $124,000 |

| Alaska | 7.00% | > | $148,000 |

| Alaska | 8.00% | > | $173,000 |

| Alaska | 9.00% | > | $198,000 |

| Alaska | 9.40% | > | $222,000 |

| Arizona | 4.90% | > | $0 |

| Arkansas | 1.00% | > | $0 |

| Arkansas | 2.00% | > | $3,000 |

| Arkansas | 3.00% | > | $5,000 |

| Arkansas | 4.30% | > | $11,000 |

| California | 8.84% | > | $0 |

| Colorado (a) | 4.40% | > | $0 |

| Connecticut (b) | 7.50% | > | $0 |

| Connecticut (b) | 8.25% | > | $100,000,000 |

| Delaware (c) | 8.70% | > | $0 |

| Florida | 5.50% | > | $50,000 |

| Georgia (d) | 5.39% | > | $0 |

| Hawaii | 4.40% | > | $0 |

| Hawaii | 5.40% | > | $25,000 |

| Hawaii | 6.40% | > | $100,000 |

| Idaho | 5.695% | > | $0 |

| Illinois (e) | 9.50% | > | $0 |

| Indiana | 4.90% | > | $0 |

| Iowa | 5.50% | > | $0 |

| Iowa | 7.10% | > | $100,000 |

| Kansas | 3.50% | > | $0 |

| Kansas | 6.50% | > | $50,000 |

| Kentucky | 5.00% | > | $0 |

| Louisiana | 5.50% | > | $0 |

| Maine | 3.50% | > | $0 |

| Maine | 7.93% | > | $350,000 |

| Maine | 8.33% | > | $1,050,000 |

| Maine | 8.93% | > | $3,500,000 |

| Maryland | 8.25% | > | $0 |

| Massachusetts | 8.00% | > | $0 |

| Michigan | 6.00% | > | $0 |

| Minnesota | 9.80% | > | $0 |

| Mississippi | 4.00% | > | $5,000 |

| Mississippi | 5.00% | > | $10,000 |

| Missouri | 4.00% | > | $0 |

| Montana | 6.75% | > | $0 |

| Nebraska | 5.20% | > | $0 |

| Nevada | (c) | ||

| New Hampshire | 7.50% | > | $0 |

| New Jersey (f) | 6.50% | > | $0 |

| New Jersey (f) | 7.50% | > | $50,000 |

| New Jersey (f) | 9.00% | > | $100,000 |

| New Jersey (f) | 11.5% | > | $10,000,000 |

| New Mexico | 5.90% | > | $0 |

| New York | 6.50% | > | $0 |

| New York | 7.25% | > | $5,000,000 |

| North Carolina | 2.25% | > | $0 |

| North Dakota | 1.41% | > | $0 |

| North Dakota | 3.55% | > | $25,000 |

| North Dakota | 4.31% | > | $50,000 |

| Ohio | (c) | ||

| Oklahoma | 4.00% | > | $0 |

| Oregon (c) | 6.60% | > | $0 |

| Oregon (c) | 7.60% | > | $1,000,000 |

| Pennsylvania | 7.99% | > | $0 |

| Rhode Island | 7.00% | > | $0 |

| South Carolina | 5.00% | > | $0 |

| South Dakota | None | ||

| Tennessee (c) | 6.50% | > | $0 |

| Texas | (c) | ||

| Utah | 4.55% | > | $0 |

| Vermont | 6.00% | > | $0 |

| Vermont | 7.00% | > | $10,000 |

| Vermont | 8.50% | > | $25,000 |

| Virginia | 6.00% | > | $0 |

| Washington | (c) | ||

| West Virginia | 6.50% | > | $0 |

| Wisconsin | 7.90% | > | $0 |

| Wyoming | None | ||

| Washington, D.C. | 8.25% | > | $0 |

(a) Colorado's 4.4% rate may be reduced midyear subject to revenue availability.

(b) Connecticut charges a 10% surtax on a business's tax liability if it has gross proceeds of $100 million or more, or if it files as part of a combined unitary group. This surtax was recently extended and is scheduled to expire on January 1, 2026.

(c) Nevada, Ohio, Texas, and Washington do not have a corporate income tax but do have a gross receipts tax with rates not strictly comparable to corporate income tax rates. Delaware, Oregon, and Tennessee have gross receipts taxes in addition to corporate income taxes, as do several states like Pennsylvania, Virginia, and West Virginia, which permit gross receipts taxes at the local (but not state) level.

(d) Georgia's corporate income tax rate is scheduled to revert to 6% on January 1, 2026.

(e) Illinois' rate includes two separate corporate income taxes, one at a 7% rate and one at a 2.5% rate.

(f) In New Jersey, the rates indicated apply to a corporation's entire net income rather than just income over the threshold.

In addition to regular income taxes, many states impose other taxes on corporations such as gross receipts taxes and capital stock taxes. Some states also impose an alternative minimum tax and special rates on financial institutions.

Sources: Tax Foundation; state tax statutes, forms, and instructions; Bloomberg Tax.

Data compiled by Abir Mandal

Notable State Corporate Income Tax Changes for 2025

Louisiana

Louisiana’s corporate income tax rate was cut to 5.5 percent as of January 1, 2025, via House Bill 2, adopted in special session in late 2024. The bill also eliminated several distortionary exemptions. Previously, the state had a three-bracket system with rates ranging from 3.5 percent to 7.5 percent.

At the same time, via HB3, the state has now eliminated the economically harmful corporation franchise tax, a capital stock tax, putting the state on the path to a more efficient tax system.

Nebraska

Nebraska has lowered its corporate income tax to a flat rate of 5.2 percent. This is part of its comprehensive pro-growth tax reform passed via LB754 in May 2023. That flat rate is scheduled to be reduced to 4.55 percent for 2026 and then down to 3.99 percent for tax years beginning on or after January 1, 2027, subject to revenue availability. Previously, for 2024, Nebraska had two tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. , with income below $100,000 taxed at 5.58 percent all subsequent corporate income taxed at the top rate of 5.84 percent.

New Jersey

After a brief hiatus, New Jersey reimposed a 2.5 percent additional surtaxA surtax is an additional tax levied on top of an already existing business or individual tax and can have a flat or progressive rate structure. Surtaxes are typically enacted to fund a specific program or initiative, whereas revenue from broader-based taxes, like the individual income tax, typically cover a multitude of programs and services. on corporations with taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. Taxable income differs from—and is less than—gross income. in excess of $10 million. This is in addition to its top marginal rate of 9 percent, which kicks in at $100,000. Now dubbed the Corporate Transit Fee, the surtax applies to all net taxable income for such firms, not only the excess above $10 million. The surtax is not imposed on S corporations or public utilities. This replaces a 2018 surtax imposed on corporations with incomes above $1 million dollars, which expired at the end of 2023.

New Mexico

New Mexico has now moved to a flat rate corporate income tax system, imposing a rate of 5.9 percent on all corporate income from January 1, 2025. Previously, the state had a graduated-rate corporate income tax structure, with rates of 4.8 percent on the first $500,000 of income and 5.9 percent on income exceeding $500,000. This is a rare instance of an increase in the effective average corporate income tax rate in recent years. The associated bill, HB252, signed into law in March 2024, also expands the state’s corporate income tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. to include Subpart F income, and allows credit for gross receipts tax paid by some industries.

North Carolina

North Carolina has reduced its flat corporate income tax rate to 2.25 percent starting from January 1, 2025, from the previous 2.5 percent. This is part of the budget passed in November 2021, which calls for the progressive elimination of the tax by 2030.

North Carolina, however, is one of the handful of states that still impose a capital stock tax (the franchise tax), an economically harmful tax that is payable even if the corporation does not turn a profit and reduces the incentive for new investments. North Carolina’s franchise tax is larger, and a more significant source of revenue, than most other remaining capital stock taxes.

Pennsylvania

In 2021, when Pennsylvania had what was then the second-highest corporate income tax rate in the nation after Iowa’s (subsequently reduced) 12 percent, lawmakers enacted HB 1342, a multi-year phasedown of the corporate net income tax rate. Starting in tax year 2023, the bill reduced Pennsylvania’s corporate net income tax rate from 9.99 percent to 8.99 percent, with further 0.5 percentage point reductions each year until 2031, when the rate will be 4.99 percent. Consequently, for 2025, corporations will face a flat 7.99 percent income tax in Pennsylvania, down from 8.49 percent in 2024.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe