Key Findings

- President Joe Biden and congressional policymakers have proposed several changes to the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. , including raising the rate from 21 percent to 28 percent and imposing a 15 percent minimum taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. on the book incomeBook income is the amount of income corporations publicly report on their financial statements to shareholders. It provides a picture of a firm’s financial performance and follows Generally Accepted Accounting Practices (GAAP). While it is a useful measure for assessing financial performance, it is not useful for assessing tax liability. of large corporations. The proposals are being considered to raise revenue for new spending programs and would repeal changes to the corporate tax made by the Tax Cuts and Jobs Act (TCJA) in late 2017.

- An increase in the federal corporate tax rate to 28 percent would raise the U.S. federal-state combined tax rate to 32.34 percent, highest in the OECD and among Group of Seven (G7) countries, harming U.S. economic competitiveness and increasing the cost of investment in America. We estimate that this would reduce long-run economic output by 0.8 percent, eliminate 159,000 jobs, and reduce wages by 0.7 percent. Workers across the income scale would bear much of the tax increase. For example, the bottom 20 percent of earners would on average see a 1.45 percent drop in after-tax incomeAfter-tax income is the net amount of income available to invest, save, or consume after federal, state, and withholding taxes have been applied—your disposable income. Companies and, to a lesser extent, individuals, make economic decisions in light of how they can best maximize their earnings. in the long run.

- A minimum tax on the book income of large corporations would target gaps between financial and taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. Taxable income differs from—and is less than—gross income. that generally exist because the rules for taxation differ from standards for reporting income to shareholders. Such a minimum tax would likely introduce additional complexity and distortions into the tax code and generate relatively little tax revenue, in part because firms have a degree of flexibility in reporting book income. The tax would potentially undermine current-law investment incentives as well as those proposed by President Biden, such as the “Made in America” tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. .

Table of Contents

- Key Findings

- Introduction

- Review of the U.S. Corporate Income Tax

- — The Statutory Corporate Income Tax and American Competitiveness

- — Corporate Tax Changes and Marginal Effective Tax Rates

- — Economic, Revenue, and Distributional Impact of a Corporate Income Tax Increase

- — Impact of the Corporate Income Tax on Workers

- — Corporate Income Taxation, Supernormal Returns, and American Dynamism

- Corporate Minimum Book Taxation

- — Structure and Motivation for a Minimum Tax on Corporate Book Income

- — Consequences of a Minimum Book Tax on Financial Accounting and the Tax Code

- — Experience with the Now-Repealed Corporate Alternative Minimum Tax

- — Economic and Revenue Effects of a Minimum Tax on Corporate Book Income

- Conclusion

Related: Tax Proposals by the Biden Administration

Introduction

In December 2017, Congress passed the Tax Cuts and Jobs Act (TCJA), which greatly changed the way corporations, pass-through businesses, and individual taxpayers were treated in the tax code. The top federal corporate income tax rate fell from 35 percent to 21 percent beginning in 2018, investment in short-lived assets was provided bonus depreciationBonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings in the first year. Allowing businesses to write off more investments partially alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. (also known as full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. ), and the treatment of foreign income was completely overhauled, among other changes to the corporate income tax base.

Since passage of the TCJA, a variety of proposals have been introduced, ranging from relatively simple increases in the statutory corporate tax rate to complicated changes to the corporate income tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. or raising the effective tax rate on foreign income earned by U.S. corporations. The proposals made by President Joe Biden on the campaign trail would revert key portions of the TCJA, increase the tax burden on U.S. corporations by raising the corporate income tax rate to 28 percent, levy a new 15 percent minimum book tax on corporations with over $100 million in book income, and impose tax penalties for certain offshoring activity.[1]

As President Biden and Congress decide how to modify the tax code to raise additional revenue for new spending or deficit reduction, it is important to consider how the corporate income tax has evolved over time and the economic impacts of changes to the corporate tax in the context of the current economic recovery and in the years ahead.

Poorly considered changes to tax policy, including business tax increases, would hamper the economic recovery and limit prospects over the long term. Understanding the potential effects of proposed changes to the corporate income tax, including the potential impacts on American workers, consumers, and the broader American economy, can help avoid costly mistakes.

Review of the U.S. Corporate Income Tax

The federal corporate income tax is levied on C corporations, which contrasts with other business structures like pass-through firms that face tax only at the level of individual owners. For C corporations, the corporate income tax is levied at the entity level prior to shareholders receiving income in the form of dividends or capital gains on appreciated corporate equities.

In the United States, corporations face a federal statutory tax rate of 21 percent, and an additional average state statutory rate of about 6 percent, for a combined rate of 25.8 percent.[2]

In addition to lowering the federal corporate income tax rate, the TCJA made several changes to the corporate income tax base. The TCJA introduced full expensing for investment in short-lived assets through 2022, with this investment incentive phasing down completely by 2027, and repealed the corporate alternative minimum tax (AMT). The TCJA raised corporate taxes through a limitation on the deductibility of net interest expense (scheduled to increase at the end of this year from 30 percent of earnings before interest, taxes, depreciation, and amortization to 30 percent of earnings before interest and taxes) and by requiring amortization of R&D expense beginning next year.

Net operating losses (NOLs) were also reformed by providing a carryforward of up to 80 percent of taxable income annually to offset taxable income in future years, but carrybacks were eliminated.[3]

The economic literature shows that corporate income taxes are one of the most harmful tax types for economic growth,[4] as capital investment is sensitive to corporate taxation. The corporate income tax raises the pretax return firms require to pursue investment opportunities, reducing the pool of investments that firms find worthwhile to pursue. This lowers long-run economic output, reducing wages and living standards.

By reducing the corporate income tax rate in 2017, the TCJA made the American economy more competitive with other industrialized countries and boosted the incentive to invest in America. The resulting higher level of investment, in turn, helps workers earn higher wages in the long run as they become more productive due to a larger capital stock. Raising the corporate rate would undercut and potentially reverse these positive effects of the TCJA.

The Statutory Corporate Income Tax and American Competitiveness

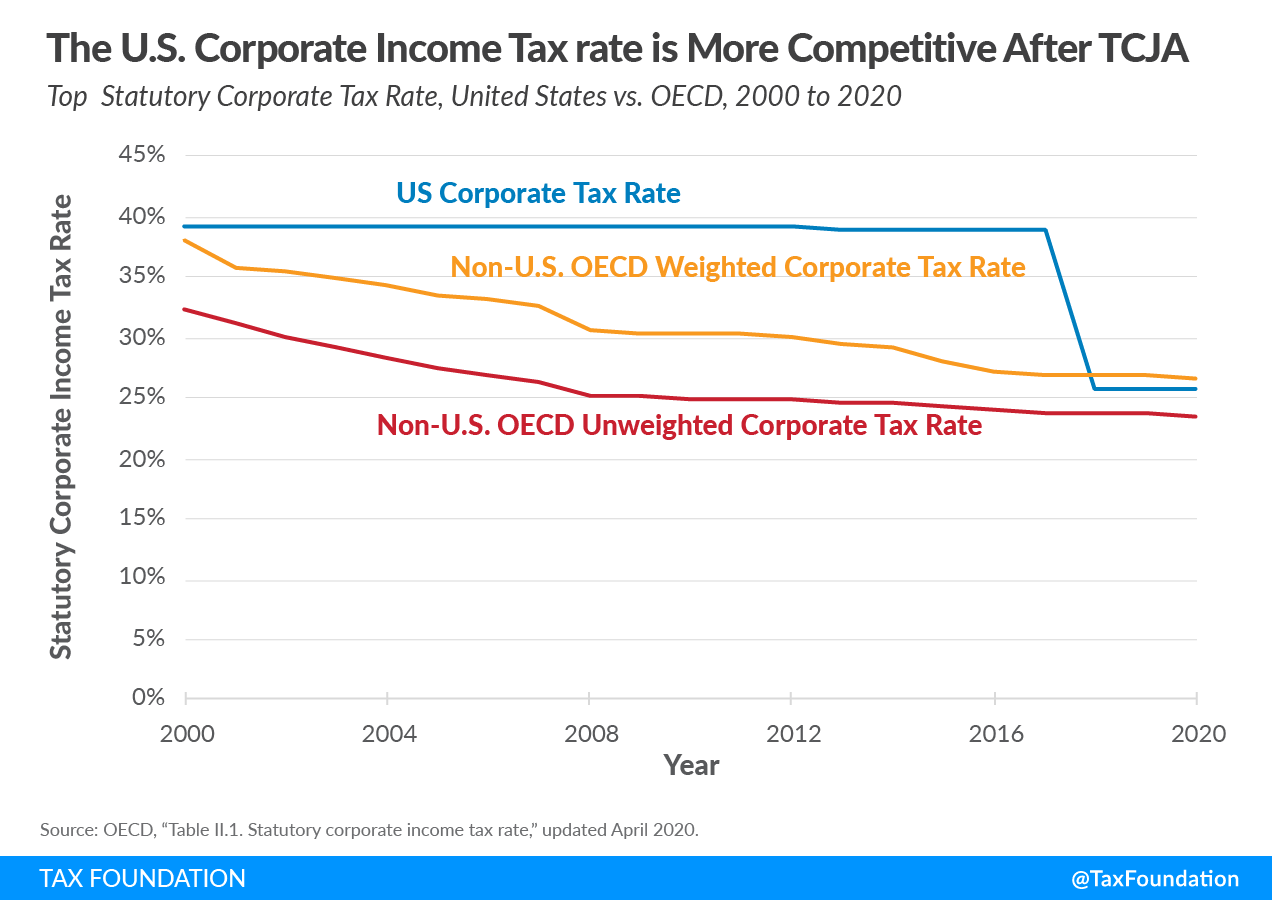

The TCJA brought the U.S. statutory corporate tax rate down from a federal-state combined rate of 38.9 percent in 2017—then the highest in the OECD—to 25.8 percent in 2020, slightly above the current OECD average (excluding the U.S.) of 23.4 percent.[5]

Prior to the TCJA, the high U.S. corporate tax rate reduced U.S. competitiveness and encouraged corporations to shift profits abroad and in some cases to “invert,” i.e., move headquarters to a foreign jurisdiction to avoid U.S. tax liability. Inversions were due to the high tax rate and the worldwide system of corporate taxation, which required corporations to pay U.S. tax on worldwide profits after receiving a credit for foreign taxes paid.[6] By lowering the corporate tax rate and moving closer to a territorial tax system, the TCJA reduced the incentive for U.S. corporations to invert and engage in other methods of profit shifting.

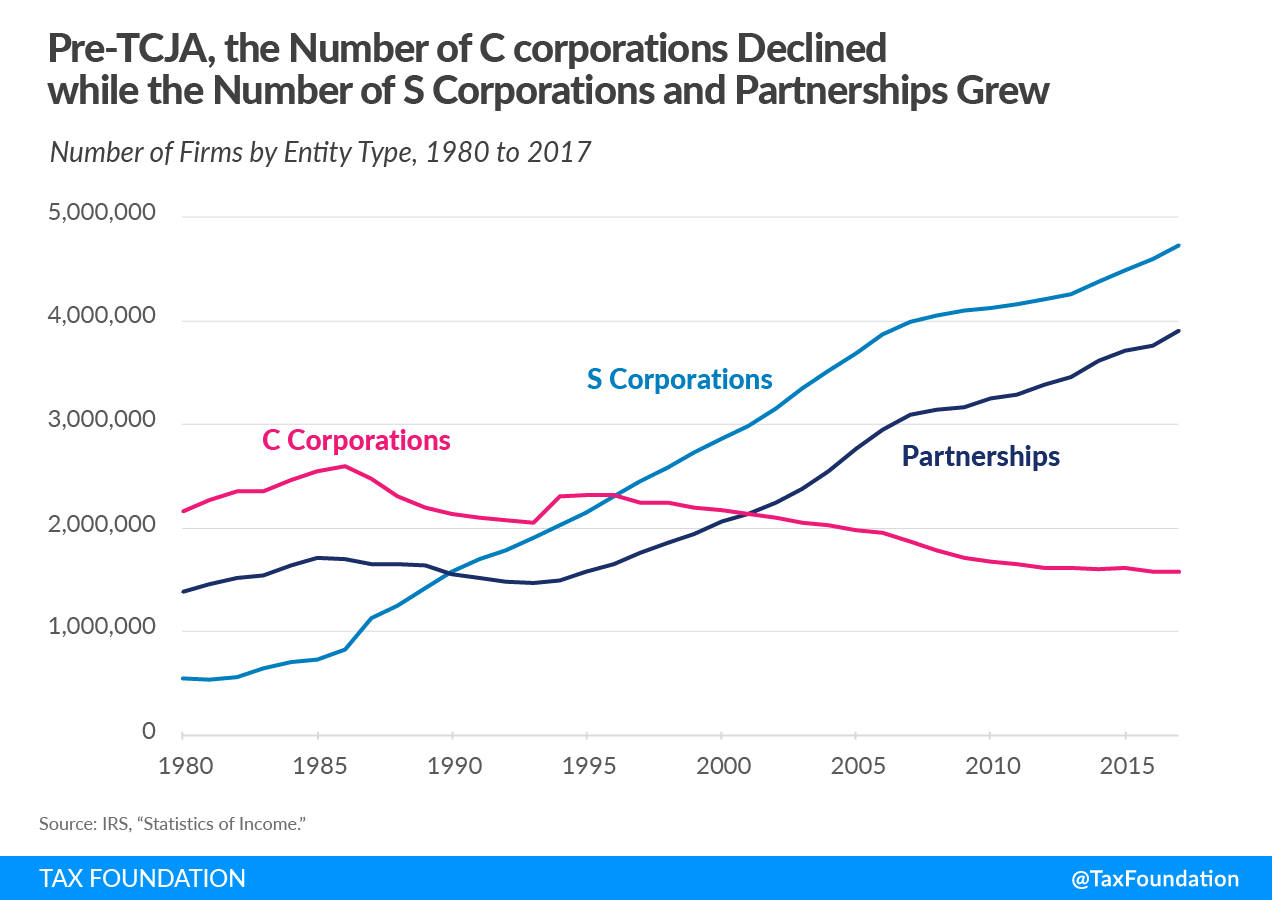

The high pre-TCJA corporate tax rate, combined with additional capital gains and dividends taxes on distributed corporate income, also encouraged C corporations to reorganize into pass-through entities, which are subject to only one layer of tax at the individual level. For example, the number of C corporations decreased from a high of 2.6 million in 1986 to 1.6 million in 2017, while the number of S corporations increased from about 800,000 to 4.7 million over the same period (see Figure 2).[7]

Prior to the TCJA, the U.S. was also suffering from a sustained slowdown in economic growth as it emerged from the Great RecessionA recession is a significant and sustained decline in the economy. Typically, a recession lasts longer than six months, but recovery from a recession can take a few years. , including historically low growth in productivity and wages.[8] New business formation was in retreat as firm entry rates declined.[9] An uncompetitive tax environment contributed to this stagnation in economic performance, with a large body of research indicating that the high corporate tax was slowing growth in the U.S.[10]

Lowering the corporate tax rate to 21 percent brought the U.S. closer to the OECD average, reduced the incentive for corporations to invert or shift profits, and increased investment incentives that lead to a higher growth rate.

Increasing the corporate income tax would undermine the progress policymakers made four years ago. An increase in the federal corporate tax rate to 28 percent would raise the U.S. federal-state combined tax rate to 32.34 percent, giving the U.S. the highest combined corporate income tax rate in the OECD, ahead of France at 32.02 percent.[11]

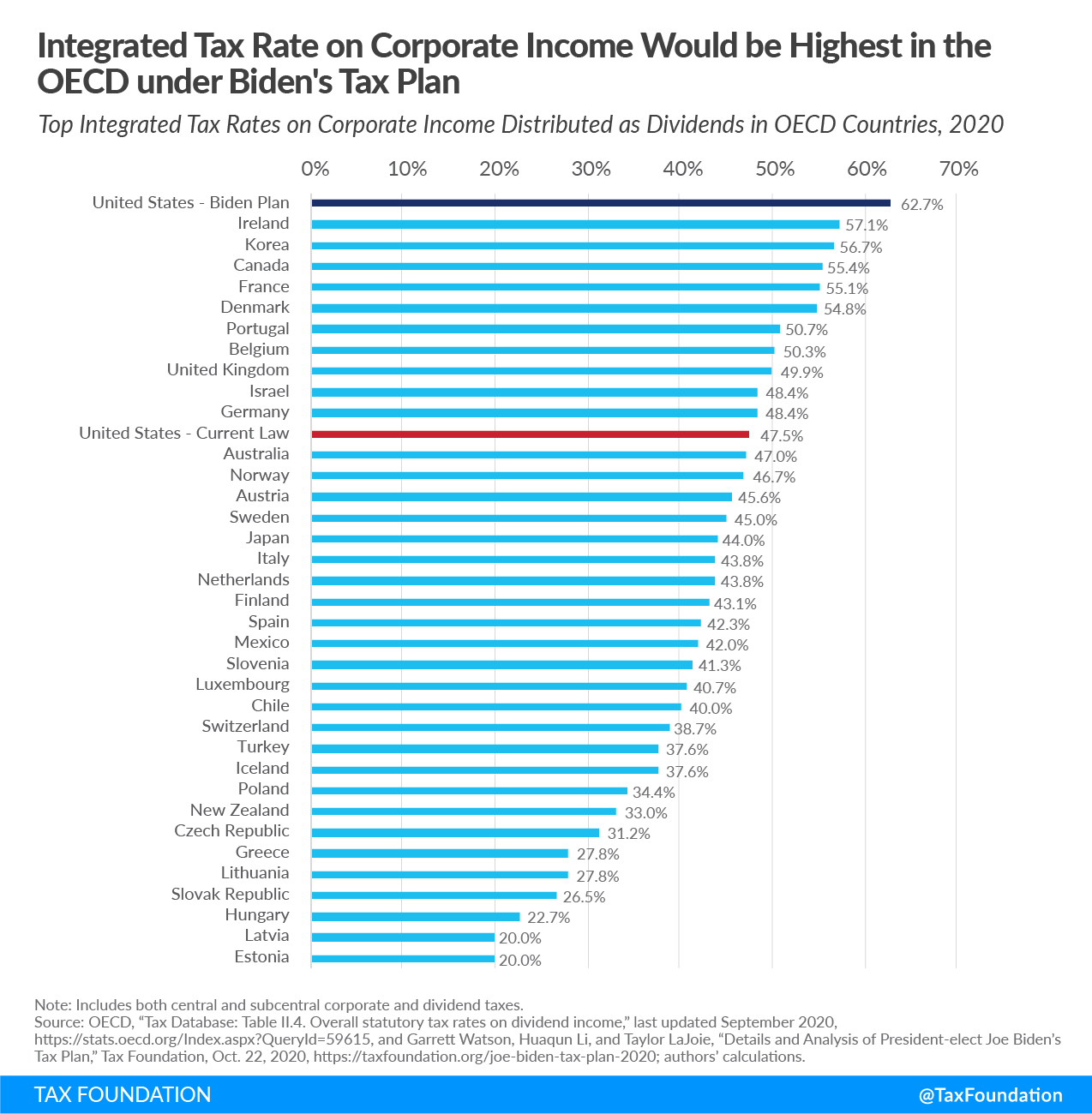

A higher U.S. corporate tax rate would also exacerbate the current double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income. of corporate income. Corporate income faces two layers of tax: once at the entity level through the corporate income tax and another at the individual level when that income is distributed as dividends or capital gains. When accounting for both levels of tax, under current law, corporate income faces a combined top tax rate of 47.47 percent, reduced from a pre-TCJA rate of 56.33 percent.[12]

The top integrated tax rate faced by corporations today puts the United States near the middle of the pack compared to other OECD countries. However, a 28 percent federal corporate income tax rate combined with Biden’s proposal to tax long-term capital gains and qualified dividends at an ordinary income tax rate of 39.6 percent for income earned over $1 million would make the top integrated tax rate on corporate income in the U.S. the highest in the OECD at 62.7 percent (see Figure 3).[13]

If the Biden tax plan were fully implemented, the U.S. rank on the Tax Foundation’s International Tax Competitiveness Index would fall from 21st in 2020 to 30th, with the corporate rank falling from 19th to 33rd overall.[14]

Corporate Tax Changes and Marginal Effective Tax Rates

While the most attention has been paid to the statutory corporate income tax rate, the marginal effective tax rate (METR) is most relevant when evaluating the investment incentives corporations face in the United States. Built on the concept of the user cost of capital, the METR shows the tax burden on a break-even or marginal investment, accounting for statutory corporate tax rates and structural aspects such as depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. deductions and tax credits.[15]

In 2018, the Tax Foundation estimated that the TCJA reduced the METR for corporate investments from about 15.8 percent in 2017 to 9.9 percent in 2018.[16] Compared to other countries, the changes brought the U.S. from slightly above-average to a more competitive position.[17] Similarly, the Congressional Budget Office (CBO) evaluated METRs by asset type (equipment, structures, and intellectual property), finding the TCJA substantially reduced METRs across asset types (Table 1).

| Overall | Equipment | Structures | Intellectual Property (IP) | |

|---|---|---|---|---|

| Pre-TCJA METR | 28.4% | 22.9% | 28.7% | -0.2% |

| Post-TCJA METR | 19.9% | 6.9% | 21.2% | -6.9% |

| Difference | 8.5 percentage points | 16 percentage points | 7.5 percentage points | 6.7 percentage points |

|

Source: Congressional Budget Office, April 2018 Supplement to The Budget and Economic Outlook: 2018 to 2028, https://www.cbo.gov/sites/default/files/recurringdata/53724-2018-04-tax.xlsx. |

||||

Kyle Pomerleau, a Resident Fellow at the American Enterprise Institute, estimates that under Biden’s tax proposals, METRs on investment would rise by 12.2 percentage points for C corporations in 2021 (from 19.6 percent to 31.8 percent) and by 12.4 percentage points in 2030 (from 26.5 percent to 38.8 percent).[18]

President Biden’s corporate tax proposals would also distort the financing method of investment. The TCJA lowered the METR on equity-financed investment from 35.5 percent to 22.3 percent in 2021 (see Table 2), while raising the METR on debt-financed investment from -21.2 percent—a tax subsidy—to 9.2 percent. The TCJA’s limitation on net interest deductions raised the effective rate on debt financing, and the lower corporate tax rate reduced the value of debt financing.[19]

After the TCJA, the gap between the two methods of financing fell from 56.7 percentage points to 13.1 percentage points. Increasing the corporate tax rate would reverse this change, widening the gap between the two methods of investment again. Debt-financed investment would become more attractive compared to current law absent other offsetting tax changes.

| Equity-Financed Investment | Debt-Financed Investment | |

|---|---|---|

| Pre-TCJA METR | 35.5% | -21.2% |

| Post-TCJA METR | 22.3% | 9.2% |

| Difference | -13.2 percentage points | +30.4 percentage points |

|

Source: Congressional Budget Office, April 2018 Supplement to The Budget and Economic Outlook: 2018 to 2028, https://www.cbo.gov/sites/default/files/recurringdata/53724-2018-04-tax.xlsx. |

||

In addition, primarily by lowering the corporate tax rate, the TCJA brought C corporation METRs more into alignment with those for pass-through firms. Under prior law, pass-through firms would have faced a 25 percent METR compared to 28.4 percent for C corporations in 2021. The TCJA narrowed this 3.4 percentage-point gap to 0.4 percentage points, as pass throughs now face a 20.3 percent METR compared to 19.9 percent for C corporations.[20]

A higher corporate tax rate would make a pass-through firm structure comparatively more attractive, reversing the TCJA’s progress in closing the gap between the METRs of C corporations and pass-through firms.

There may be a temptation to raise tax rates on pass-through firms to maintain rate parity, which would magnify the economic harm of the original corporate income tax increase. On the other hand, the higher corporate rate in isolation will distort the tax code to favor certain business types, reducing neutrality in the tax code.

The Economic, Revenue, and Distributional Impact of an Increase in the Corporate Income Tax

Using the Tax Foundation General Equilibrium Model, we can estimate the economic, revenue, and distributional effects of raising the corporate income tax to 25 percent or 28 percent.

| Raise Corporate Income Tax Rate to 25 Percent | Raise Corporate Income Tax Rate to 28 Percent | |

|---|---|---|

| GDP | -0.4% | -0.8% |

| GNP | -0.4% | -0.8% |

| Capital Stock | -1.1% | -2.1% |

| Wage Rate | -0.4% | -0.7% |

| Full-Time Equivalent Jobs | -84,200 | -159,000 |

|

Source: Tax Foundation General Equilibrium Model, January 2021. |

||

An increase in the corporate income tax rate to 28 percent would reduce economic output by 0.8 percent in the long run, while reducing the capital stock by 2.1 percent. Under a 25 percent tax rate, economic output would be 0.4 percent lower and the capital stock would be 1.1 percent smaller.

The capital stock falls under both tax increases because the higher tax rate raises the service price of capital, meaning that fewer investments are viable and economic output is lower.

There would be 159,000 fewer full-time equivalent jobs under a 28 percent corporate rate. Wages also would fall by about 0.7 percent in the long run, as workers are less productive with a comparatively smaller capital stock.

A 25 percent corporate rate would reduce the number of full-time equivalent jobs by about 84,000. Wages would be 0.4 percent lower than under current law.

| 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | Total | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Conventional | $60.5 | $74.8 | $82.5 | $89.8 | $91.0 | $92.1 | $95.2 | $97.8 | $100.1 | $102.5 | $886.3 |

| Dynamic | $57.8 | $68.5 | $72.1 | $74.5 | $70.3 | $64.3 | $62.6 | $60.5 | $57.9 | $55.2 | $643.7 |

|

Source: Tax Foundation General Equilibrium Model, January 2021. |

|||||||||||

We estimate that a 28 percent corporate income tax rate would raise about $886.3 billion between 2022 and 2031 on a conventional basis (see Table 4). Revenue raised from a higher corporate rate is partially offset by increased profit shiftingProfit shifting is when multinational companies reduce their tax burden by moving the location of their profits from high-tax countries to low-tax jurisdictions and tax havens. behavior by corporations incentivized to avoid the higher tax rate.[21]

The higher corporate rate raises about $643.7 billion on a dynamic basis between 2022 and 2031 after factoring in reduced economic output, which reduces individual and payroll tax revenue.

| 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | Total | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Conventional | $35.7 | $44.0 | $48.6 | $52.9 | $53.6 | $54.2 | $56.1 | $57.6 | $59.0 | $60.4 | $522.1 |

| Dynamic | $35.1 | $40.7 | $43.2 | $44.7 | $42.3 | $39.2 | $38.4 | $37.4 | $35.9 | $34.7 | $391.6 |

|

Source: Tax Foundation General Equilibrium Model, January 2021. |

|||||||||||

Raising the corporate rate to 25 percent would raise about $522.1 billion between 2022 and 2031 on a conventional basis (see Table 5). Reduced economic output would mean that revenue only rises by $391.6 billion dynamically. A smaller economy lowers expected individual and payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. revenue.

Raising the corporate rate to 28 percent would reduce after-tax incomes across all income levels. In the first year of the tax change, after-tax incomes would fall by about 0.7 percent on average, with a larger impact on higher earners; the top quintile would experience a 0.9 percent decline in after-tax income while the top 1 percent would see a 1.5 percent reduction.

After accounting for reduced economic output in the long run, after-tax incomes would fall by about 1.8 percent on average, ranging from a 1.3 percent reduction for households in the 20th to 40th income percentiles to a 3.2 percent reduction for households in the top 1 percent.

| Income Quintile | Conventional, 2022 | Conventional, 2031 | Dynamic, Long-Run |

|---|---|---|---|

| 0% to 20% | -0.5% | -0.6% | -1.5% |

| 20% to 40% | -0.4% | -0.5% | -1.3% |

| 40% to 60% | -0.4% | -0.5% | -1.4% |

| 60% to 80% | -0.5% | -0.5% | -1.4% |

| 80% to 100% | -0.9% | -1.0% | -2.1% |

| 80% to 90% | -0.5% | -0.6% | -1.4% |

| 90% to 95% | -0.6% | -0.7% | -1.6% |

| 95% to 99% | -0.8% | -0.9% | -1.9% |

| 99% to 100% | -1.5% | -1.8% | -3.2% |

| TOTAL | -0.7% | -0.8% | -1.8% |

|

Source: Tax Foundation General Equilibrium Model, January 2021. |

|||

Raising the corporate rate to 25 percent would reduce after-tax incomes by 0.4 percent on a conventional basis in 2022. When accounting for lower economic output, after-tax incomes would be about 1 percent lower in the long run. Filers in the bottom quintile would have 0.9 percent less after-tax income on a dynamic basis, and filers across the income spectrum would have lower after-tax incomes when the corporate rate is raised.

| Income Quintile | Conventional, 2022 | Conventional, 2031 | Dynamic, Long-Run |

|---|---|---|---|

| 0% to 20% | -0.3% | -0.4% | -0.9% |

| 20% to 40% | -0.2% | -0.3% | -0.8% |

| 40% to 60% | -0.3% | -0.3% | -0.8% |

| 60% to 80% | -0.3% | -0.3% | -0.8% |

| 80% to 100% | -0.5% | -0.6% | -1.2% |

| 80% to 90% | -0.3% | -0.3% | -0.8% |

| 90% to 95% | -0.3% | -0.4% | -0.9% |

| 95% to 99% | -0.4% | -0.5% | -1.1% |

| 99% to 100% | -0.9% | -1.0% | -1.8% |

| TOTAL | -0.4% | -0.5% | -1.0% |

|

Source: Tax Foundation General Equilibrium Model, January 2021. |

|||

Impact of the Corporate Income Tax on Workers

President Biden’s campaign pledge not to increase taxes on those earning less than $400,000 brought into focus the economic effect and incidence of proposed corporate tax rate increases.[22]

Studies examining corporate income taxes across countries, those looking at differences in corporate taxation within countries, and models of wage bargaining in the corporate sector support the idea that workers bear a large portion of the corporate income tax through lower wages.[23] The estimates vary, but most studies indicate labor bears 50 to 100 percent of the corporate income tax. This is because labor is less mobile than capital in response to a corporate tax change, so when the corporate tax rate increases and investment flows elsewhere, workers are left holding the bag.

For example, a recent study of corporate tax rates in German municipalities over a 20-year period finds that workers bear about half of the corporate tax burden, with low-skilled, young, and female employees bearing a larger share of the burden.[24] Our model reflects current thinking on corporate tax incidenceTax incidence is a measure of who bears the legal or economic burden of a tax. Legal incidence identifies who is responsible for paying a tax while economic incidence identifies who bears the cost of tax—in the form of higher prices for consumers, lower wages for workers, or lower returns for shareholders. , indicating about half of the corporate tax burden is ultimately borne by workers, due to reduced investment, productivity, and wages.[25]

Furthermore, to the extent workers own corporate stock, whether directly or indirectly through pensions and other retirement accounts, their savings are harmed by a higher corporate tax. This is because a higher corporate tax lowers the present value of future after-tax cash flows from corporations, reducing equity values.[26]

Data from the Federal Reserve indicates that workers across different income levels have direct and indirect holdings of stock.[27] About 52 percent of all families have direct or indirect investments in stocks, at a median holding of about $40,000.[28] While ownership levels vary depending on household income, holdings are owned across each income level. For example, among families earning $35,000 to $52,999, about 44 percent own stock.[29]

Corporate equities are commonly owned within tax-exempt and retirement accounts that are a major source of retirement security for households at all income levels. As of 2015, about 37 percent of U.S. stock was held in retirement accounts and plan holdings, and 24 percent in taxable accounts. In 2017, Public Employee Funds held about 41 percent of the top 1,000 retirement fund assets or about $4.25 trillion. Public defined benefit plans held about $955 billion in domestic equity in 2017.[30] Beneficiaries of these plans are often middle-income workers, who will experience lower returns as a result of a higher corporate income tax rate.

Corporate Income Taxation, Supernormal Returns, and American Dynamism

One common argument provided to justify a higher corporate income tax rate is that it mostly targets profits that exceed the normal return on investment. Put another way, tax provisions like accelerated depreciation help ensure that the marginal effective tax rate on investment is close to zero. The corporate tax, according to this argument, better targets supernormal returns that are a more efficient source of revenue. Supernormal returns are less sensitive to taxation and so taxing those returns would be less likely to distort investment decisions.

For example, Treasury economist Kimberly Clausing argues:

“The corporate tax, when it does fall on profitable companies, mostly falls on the excess profits they earn from market power or other factors (due to the dominance of large companies in markets with little competition, luck or risk-taking), not the normal return on capital investment. Treasury economists calculated that such excess profits made up more than 75% of the corporate tax base by 2013. A higher corporate tax rate can rein in market power and promote a fairer economy.”[31]

This argument has a few issues. While the TCJA’s bonus depreciation provisions for short-lived assets helped to lower marginal effective tax rates on investment, it excluded certain types of assets like structures, and it will begin to phase out at the end of 2022. The corporate tax base under current law is not optimally structured to fully exclude normal returns from tax.

The Treasury Department estimates of supernormal profits in the corporate tax base may overestimate the share of excess returns.[32] Using a revised measure of supernormal returns yields a roughly 50-50 split between capital and labor for the incidence of the corporate income tax.[33]

Supernormal returns resulting from market power or other rents may be less sensitive to taxation, as they are windfalls accrued to the recipients of those returns. While it is true that firms with market power or accruing rents from land, for example, may be less sensitive to taxation, it does not follow that all supernormal returns arising from other causes must also be as insensitive. Notably, risk-taking is sensitive to taxation and a higher tax burden can reduce future risk-taking on the extensive and intensive margins.[34]

What portion of supernormal returns can be attributed to a risk premium or rents outside of risk-taking is still the subject of debate. An analysis of the rising spread between the returns of safe and risky assets by the Federal Reserve Bank of Chicago argues that “both the risk premium and rents stories play significant and roughly equal roles in accounting for the increase in the spread during the past 30 years.”[35] Changing risk preferences may also play a role, as investors may have become less willing to bear risk. Demographic factors may also be partly driving this effect.[36]

At minimum, a corporate rate hike is likely to affect both returns to risk-taking and rents from market power. A higher corporate tax rate could create a headwind against risk-taking and American dynamism.

A higher corporate income tax rate could also undercut attempts to reduce income inequality, a counterintuitive unintended consequence. Economist James R. Hines Jr. finds that a higher corporate tax burden would encourage a shift into the pass-through sector, leading to a wider income distribution due to a wider variance in risk-taking.[37]

A higher corporate income tax and a greater movement toward pass-through tax treatment could undercut the progressivity of the tax code elsewhere: as Hines argues, “the greater income dispersion accompanying higher corporate tax rates may significantly dampen or even reverse the net effect of higher rates on the concentration of income in the top one percent.”[38]

Setting aside a corporate tax rate increase, we could improve the tax by exempting the normal return to capital investment. This could be accomplished by moving closer to a cash-flow tax base, by making bonus depreciation permanent, extending full cost recoveryCost recovery refers to how the tax system permits businesses to recover the cost of investments through depreciation or amortization. Depreciation and amortization deductions affect taxable income, effective tax rates, and investment decisions. treatment to all assets, and making other changes to the corporate income tax base.[39] By doing so, this would ensure the corporate income tax does not impact marginal investments.

Corporate Minimum Book Taxation

During the 2020 presidential primaries, two candidates proposed taxes on the financial “book” income of corporations in addition to the standard corporate income tax.

Sen. Elizabeth Warren (D-MA) proposed a “Real Corporate Profits Tax” to be levied at 7 percent of a corporation’s profits as reported on financial statements after the first $100 million in profits.[40] It would be assessed in addition to the standard corporate income tax.

President Biden proposed a minimum tax of 15 percent on the financial income of corporations reporting more than $100 million in book income. Unlike Warren’s proposal, Biden’s proposal would operate as a minimum tax that would be applied to large corporations if their effective tax rate falls below 15 percent on income as reported on financial statements.[41]

A minimum tax on book income would introduce significant complexity into the corporate tax code while outsourcing key aspects of the corporate income tax to unelected decision-makers at the Financial Accounting Standards Board (FASB), who establish the standards for corporate book income. It may also undercut other proposed changes to the tax code, such as Biden’s proposed tax credit for onshoring of American supply chains.

Structure and Motivation for a Minimum Tax on Corporate Book Income

A minimum tax on corporate income is not a new proposal. In fact, corporations paid tax under an Alternative Minimum Tax (AMT) prior to 2018. The TCJA repealed the corporate AMT to simplify the corporate tax base.

A minimum tax on corporate book income faces several questions and challenges, including issues related to the design and administration of the tax and the impact of the tax on federal revenue and economic output.

Proponents of a minimum tax on corporations’ financial “book” income point to the fact that some corporations in certain tax years will post profits on financial statements while paying little or no tax liability to tax authorities. This phenomenon is driven by the difference in the structure of financial income reported to shareholders, investors, and regulatory bodies, and taxable income which is calculated and reported to the Internal Revenue Service (IRS).

The calculations for financial income and taxable income are different because they are used for different purposes and by different audiences. Financial income is used by investors and other stakeholders to evaluate the financial performance of corporations and is determined using Generally Accepted Accounting Principles (GAAP) as defined by the FASB. This method includes a standardized recognition of expenses and gross incomeFor individuals, gross income is the total of all income received from any source before taxes or deductions. It includes wages, salaries, tips, interest, dividends, capital gains, rental income, alimony, pensions, and other forms of income. For businesses, gross income (or gross profit) is the sum of total receipts or sales minus the cost of goods sold (COGS)—the direct costs of producing goods, including inventory and certain labor costs. to produce a consistent concept of net income over time and across firms.[42]

While there are rules and guidelines set by FASB, firms have flexibility when calculating financial income in some cases.

The rules defining taxable income were not designed to reflect corporate financial performance, but instead to raise revenue for government activities and encourage or penalize certain behaviors. Taxable income is defined by the Internal Revenue Code (IRC) and the IRS, codified in statutes passed by Congress, implemented via agency administrative action, and interpreted in precedents set in tax law. In general, there is much less leeway granted to corporations when calculating taxable income.[43]

Differences in book and taxable income can occur in several ways. Some of the most common reasons for a difference include timing differences under the tax law and financial accounting.

For example, consider net operating losses (NOLs).[44] Net operating loss provisions are in place to ensure that firms are taxed based on profitability over time and are not penalized in the tax code for earning profits or losses that do not align with a calendar year.[45]

A net operating loss carryforward is used when a firm earns a loss in one year and carries forward that loss to offset taxable income in a future year. This can create a book-tax gap when a firm employs NOL carryforwards during a year with positive book income.

Similarly, an NOL carryback permits firms to offset taxable income from prior years with current losses. NOL provisions smooth out effective tax rates over time and are a useful source of liquidity for firms during downturns, such as the current pandemic and economic fallout.[46]

On the other hand, limitations to NOL carrybacks and carryforwards can prevent firms from smoothing out the effect of losses incurred during a downturn. As tax scholars Michael P. Devereux and Clemens Fuest argue, “the absence of full relief for losses has led to a substantial reduction in the automatic stabilizing properties of the corporation tax.”[47] One study indicates that only about half of all NOLs are ultimately claimed by firms, an effect which tends to disproportionately harm younger firms.[48]

Biden’s minimum tax may permit firms to use NOL carryovers, which would be critical for ensuring firms are properly taxed on net income. However, it would reduce some of the effectiveness of the minimum tax, because NOLs are a major source of gaps in book and taxable income.

Differences in depreciation rules also create book-tax income gaps. Financial accounting typically requires firms to allocate a portion of an investment’s cost over the life of the asset, while the tax code sometimes provides accelerated cost recovery for the same investment expense. In the short run, for a given investment expense, book income may exceed taxable income as the large tax deduction is taken up front, but in the long run, taxable income rises compared to book income as the tax deductionA tax deduction allows taxpayers to subtract certain deductible expenses and other items to reduce how much of their income is taxed, which reduces how much tax they owe. For individuals, some deductions are available to all taxpayers, while others are reserved only for taxpayers who itemize. For businesses, most business expenses are fully and immediately deductible in the year they occur, but others, particularly for capital investment and research and development (R&D), must be deducted over time. shrinks but the book deduction rises.

For example, consider a firm that has $100 million in revenue, $65 million in operating expenses, and makes a capital investment of $30 million in equipment for a factory (Table 8). Assume the capital investment can be fully expensed in the first year under tax law but must be deducted over its useful life—say, five years—for calculating book income. In the first year, the firm has more book income than taxable income because the firm immediately deducted the capital investment for tax purposes but only deducted a portion of the cost on its financial statement.

In year two, taxable income exceeds book income, because the deduction was fully taken for tax purposes in year one. If the firm experiences a drop in revenue in year 3, it may accrue a net operating loss, which it can carry forward to the next year it has taxable income (assuming carrybacks are not permitted). In year four, this means taxable income is again below book income as the firms uses the NOL to reduce its tax liability. By year five, taxable income has recovered and exceeds book income by the amount of the depreciation deduction.

| Year | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|

| A Gross Revenue | $100 million | $100 million | $55 million | $95 million | $110 million |

| B Operating Expenses | $65 million | $65 million | $65 million | $65 million | $65 million |

| C Capital Investment | $30 million | $0 | $0 | $0 | $0 |

| D Capital Investment Deduction for Taxable Income | $30 million | $0 | $0 | $0 | $0 |

| E Taxable Income (A – B – D = E) | $5 million | $35 million | -$10 million | $20 million | $45 million |

| F Capital Investment Deduction for Book Income ($30 million divided by 5 years) | $6 million | $6 million | $6 million | $6 million | $6 million |

| G Book Income (A – B – F = G) | $29 million | $29 million | -$16 million | $24 million | $39 million |

|

Note: Assumes carrybacks are not permitted, but unlimited NOL carryforwards apply. Capital investment is fully expensed for tax purposes, while the expense must be deducted over five years for calculating book income. Source: Tax Foundation calculations. |

|||||

This example shows that the difference in how financial income and taxable income is calculated does not mean one is “wrong” and the other is “right.” The purpose of the tax code’s accelerated depreciation deductions is so that firms have full cost recovery reflecting the time value of money and inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. and there is neutral taxation with respect to investment. In contrast, rules for financial income aim to match expenses to economic depreciation to derive net income over time.[49] The presence of a gap between these measures of income is not necessarily nefarious, and in many cases is necessary to ensure the tax code is neutral with respect to investment.

Other common sources of book-tax income differences include tax credits for certain activities that lawmakers want to encourage (such as the tax credit for research & development costs).

The tax treatment of employee stock compensation can differ too. Stock-based compensation may be deducted from taxable income while not producing an equivalent deduction for calculating financial income, because the compensation is deducted for book purposes when issued but is deducted for tax purposes only after it vests. In the time between when this compensation is deducted from financial income and when it vests for the employee, the stock value may have changed. Book income is greater than taxable income if the stock value has increased when vested, and vice versa if the stock value declined.

Financial income is sometimes perceived to be a broader definition of income than taxable income, though that’s not always true. For example, expenses related to entertainment were limited for tax purposes in the TCJA despite being fully deductible when calculating financial income. Similarly, business meals only received a partial deduction until 2021 under the income tax, while it was and remains fully deductible for financial income.[50]

Foreign profits also create a wedge between taxable income and book income, as the corporate income tax only taxes a portion of foreign income under the base erosion and profit shifting guardrails established in the TCJA, such as the tax on global intangible low taxed income (GILTI).

Evidence suggests that the gap between financial and taxable income has widened, beginning in the 1990s.[51] This may be due to several causes, including globalization and the growing importance of foreign income, more aggressive earnings management as firms try to project a larger financial income to shareholders, and tax sheltering.[52] The latter could be addressed more directly by improving the structure of the corporate tax base, some of which was done in the reforms enacted through the TCJA.[53]

One area of ambiguity in minimum book tax proposals is whether the minimum tax would permit firms to carry forward differences in book and taxable income that are temporary in nature. This can have important consequences for corporate tax burdens.

Consider, for example, a gap in taxable and book income driven by a large depreciation deduction that was accelerated under the TCJA’s bonus depreciation provision. A firm that was not allowed to carry forward this benefit against future income would be disallowed the cost recovery not just for that year, but indefinitely.[54]

Analyses of the President’s proposal tend to assume there would be such a credit for temporary differences between the two types of income, though this has not been confirmed publicly. These critical details would need to be specified before the proposal is pursued legislatively.

Consequences of a Minimum Book Tax on Financial Accounting and the Tax Code

Imposing a minimum tax based on corporate financial income would, to some extent, effectively hand over the determination of this part of the tax base to FASB, the nonprofit body that is certified by the Securities and Exchange Commission (SEC) to make decisions and adjustments to GAAP rules.

Such a possibility is concerning, because it deprives elected representatives in Congress a degree of control over the tax base. It would insert FASB into tax disputes normally resolved by the democratic process and elected representatives, IRS guidance, and tax courts. It would also introduce additional concerns and responsibilities for FASB, which is currently not well equipped to resolve complex business tax issues.

Policymakers could choose to deviate from FASB’s decisions for book income, but it would quickly increase the risk of creating an entirely new definition of income that conforms with neither tax nor book income. Having a third definition of income would increase compliance costs for firms while reducing the effectiveness of the book tax at closing book-tax income gaps.

Another risk of mixing these two definitions of income, especially in the extreme case of supplanting taxable income with book income for calculating tax liability, is a loss of information provided to corporate shareholders and investors.[55] Each definition of income serves a separate purpose. Mixing them either through a minimum tax or replacing one with the other would dilute the value of each, including the information financial statements provide shareholders and prospective investors regarding valuation of firms based on net income and other book income measures.

Tentative evidence suggests that the reporting of financial income would be sensitive to tax, especially in the case of a direct taxA direct tax is levied on individuals and organizations and is not expected to be passed on to another payer (unlike indirect taxes such as sales and excise taxes), though economic incidence can still fall upon others. Often with a direct tax, such as the individual income tax, tax rates increase as the taxpayer’s ability to pay, or financial resources, increases, resulting in what is called a progressive tax. Article 1, Section 9, of the US Constitution requires direct taxes to be apportioned by state population, though the 16th Amendment establishes that income taxes are not subject to this requirement. on book income and to a lesser degree in the case of a minimum book tax.[56] One measurement of how financial incomes responds to taxation suggests a large responsiveness of financial statement income.[57]

A minimum book tax would also have implications for tax credits provided in the tax code to encourage preferred behavior by policymakers. For example, tax credits provided to encourage greater investment in research & development could be clawed back by a minimum tax, because the credits would reduce taxable income while not reducing financial income. President Biden’s tax proposals, including the “Made in America” tax credit for onshoring certain activity back to the U.S., could be affected by these interactions.

Consider, for example, a corporation earning $100 million in book income within the United States (Table 9). Suppose for simplicity that all income is earned domestically and none of the income is Foreign Derived Intangible Income (FDII). The corporation has $70 million in taxable income when accounting for $30 million in accelerated depreciation deductions above book depreciation. The firm also takes advantage of tax credits for research & development and Biden’s “Made in America” tax credit.

However, the “Made in America” tax credit is clawed back due to the 15 percent minimum book tax, as the firm’s effective tax rate on book income is below the minimum rate. The firm’s worldwide book income is taxed to obtain a 15 percent effective rate on financial income, more than offsetting the “Made in America” credit and partially offsetting the R&D credit.

The example shows that the minimum tax offsets the “Made in America” tax credit, and part of the R&D credit, in cases where large corporations face an effective tax rate on book income lower than 15 percent, undercutting the President’s broader goal of encouraging onshoring and domestic capital investment (including R&D). Instead of providing a tax credit with one hand and taking it away through a minimum tax with the other, it would be more coherent and transparent to change the corporate income tax base directly to address tax expenditures or other provisions that are generating book-tax gaps.

| Current Law | Biden Proposal | |

|---|---|---|

| A U.S. book income | $100 million | $100 million |

| B Excess of tax depreciation over book depreciation | $30 million | $30 million |

| C U.S. taxable income | $70 million (A- B = C) | $70 million (A -B = C) |

| D Corporate Tax Rate | 21% | 28% |

| E U.S. tax on U.S. income before credits | $14.7 million (C * D = E) | $19.6 million (C * D = E) |

| F R&D tax credit | $5 million | $5 million |

| G Made in America Tax Credit | $0 | $0.48 million (see note) |

| H U.S. tax on U.S. income after credits | $9.7 million (E – F – G = H) | $14.12 million (E – F – G = H) |

| I 15 Percent Minimum Book Tax | $0 | $0.88 million [(A * 15%) – H = I)] |

| J Total tax liability | $9.7 million (H +I = J) | $15 million (H +I = J) |

|

Note: Details have not been provided on the exact design of the “Made in America” credit, but it would likely act like an incremental wage and investment tax credit. This example assumes that domestic wages and investment are equal to 133 percent of domestic net income, or about $133 million. At a 5 percent incremental increase, this yields an additional $6.65 million in new domestic investment and wages that qualifies for the 10 percent credit, or about $480,000 after the 28 percent corporate income tax. See Martin A. Sullivan, “Biden’s Incoherent Corporate Tax Policy,” Tax Notes, Jan. 4, 2021, https://www.taxnotes.com/tax-notes-today-federal/tax-policy/bidens-incoherent-corporate-tax-policy/2021/01/04/2dc59. Source: Author calculations, adapted from Martin A. Sullivan, “Biden’s Incoherent Corporate Tax Policy,” Tax Notes, Jan. 4, 2021, https://www.taxnotes.com/tax-notes-today-federal/tax-policy/bidens-incoherent-corporate-tax-policy/2021/01/04/2dc59. |

||

Experience with the Now-Repealed Corporate Alternative Minimum Tax

The now-repealed corporate alternative minimum tax (AMT) is an instructive case study for understanding the trade-offs and challenges of using a minimum tax to raise effective tax rates faced by corporations.

The corporate AMT was originally created in 1969 by Congress as an “add-on” tax that was paid in addition to regular corporate income tax based on certain tax preferences. In 1986, Congress redesigned the corporate AMT to be a minimum tax aimed at raising effective tax rates.[58] This parallel tax system required two calculations, one under the regular tax code and one under the AMT’s tax rules, and firms had to pay the greater of the two liabilities.

Part of the motivation for establishing an alternative minimum tax on corporate income was to maintain a connection between income tax liability and a firm’s ability to pay, along with concerns about fairness in the tax code.[59] The corporate AMT was also viewed as a “second-best” method of broadening the corporate tax base short of directly repealing tax deductions or credits directly.[60]

The calculation for alternative minimum taxable income (AMTI) used a broader base than the regular income tax.[61] The AMT tended to use a less generous system for depreciation deduction than the regular corporate income tax base. Another important difference was the corporate AMT was levied at 20 percent, lower than the 35 percent levied under the regular corporate income tax (prior to the AMT’s repeal and the lower corporate tax rate under the TCJA).

The corporate AMT altered the relative tax burdens for corporations in distortionary ways, and evidence indicates that the provision did not raise effective tax rates for firms with low effective tax rates prior to 1986, nor did the AMT result in higher tax burdens for more profitable firms.[62]

Not only was the corporate AMT distortionary, but the number of corporations impacted by the AMT and the number of AMT payments dwindled in the 1990s and early 2000s. The decline was partly driven by accelerated depreciation provisions affecting both the regular and AMT tax base.[63] This made the corporate AMT less effective at raising revenue while adding complexity to the tax code.[64] Firms falling into the corporate AMT had compliance costs 18 to 26 percent higher than firms not subject to the corporate AMT, according to a survey by economists Joel Slemrod and Marsha Blumenthal.[65]

The common arguments in favor of the corporate AMT were that it was necessary to discourage investment in tax-preferred assets and to reduce the reliance on tax shelters. Reducing tax preferences directly is a more efficient way to deal with the former problem. Regarding tax sheltering, the corporate AMT introduced complex interactions into the tax code, encouraging firms to devote more resources to finding creative ways to shelter income from both regular tax and the AMT.

The corporate AMT was not effective at targeting firms that were engaging in aggressive tax avoidance. Instead, the AMT generally ended up curtailing investment incentives such as accelerated depreciation.[66]

As the Tax Foundation argued in a 2002 report:

“The corporate AMT does not increase efficiency or improve fairness in any meaningful way. It nets little money for the government, imposes compliance costs that in some years are actually larger than collections, and encourages firms to cut back or shift their investments. The Congress’s bipartisan Joint Committee on Taxation was undoubtedly correct in recommending that it be repealed.”[67]

Economic and Revenue Effects of a Minimum Tax on Corporate Book Income

Using the Tax Foundation General Equilibrium Model, and based on the Biden campaign’s descriptions, we estimated that Biden’s proposed 15 percent minimum book tax would raise about $202.7 billion in additional revenue from 2021 to 2030, when combined with Biden’s other tax proposals.[68] This compares to the Biden campaign’s estimate that the minimum book tax would raise about $400 billion over 10 years.

The interaction between a higher corporate income tax rate and Biden’s proposed changes to the tax treatment of foreign income may undercut the minimum tax’s ability to raise revenue particularly on the foreign income of U.S. multinationals.[69] To the extent Biden’s proposal does not provide offsets for domestic investment incentives, such as accelerated depreciation and the R&D credit, the minimum tax would likely fall most heavily on the U.S. domestic manufacturing and information technology sectors.[70]

We estimate that Biden’s minimum tax would reduce long-run economic output by about 0.21 percent in combination with Biden’s other tax proposals.[71] The impact of the minimum tax on output depends on its structure and treatment of investment incentives specifically. For example, if the minimum tax does not provide a credit for tax provisions like accelerated depreciation, the tax would be more harmful to investment and economic output.[72]

Turning to other estimates of Biden’s corporate minimum tax, based on firm responses to the book income adjustment established in 1987 for the old corporate AMT, one estimate finds that firms would not make significant production or investment changes and the tax would raise about $270 billion over 10 years.[73]

The American Enterprise Institute (AEI) and Tax Policy Center (TPC) estimate that Biden’s proposed minimum tax would raise $93.5 billion and $108.5 billion from 2021 to 2030, respectively.[74] The Penn Wharton Budget Model (PWBM) found that the minimum tax would raise about $227 billion between 2021 and 2030.[75]

While the tax policy community will continue refining estimates for the revenue potential of a minimum tax on book income, it is becoming clear that such a minimum tax would not be a significant source of revenue when compared to other tax proposals, and instead the main effect would be to introduce additional complexity and distortions into the tax code.

The economic effect of a tax on book income depends on whether the tax is assessed as a minimum tax, like the Biden proposal, or if it is a tax applied to book income on top of the existing corporate income tax.

In the case of a minimum tax, firms would tend to enter in-and-out of the minimum tax regime over time, producing investment incentives that could be higher or lower than the existing corporate income tax.[76] The variation in METRs on investment across asset types would rise under a minimum tax on book income, producing added distortions to the tax code.[77]

Conclusion

As President Biden and congressional policymakers consider changes to the corporate income tax this year to raise revenue and raise tax burdens on U.S. corporations, it is important to remember why the United States updated the tax treatment of corporate income under the TCJA in 2017 and lowered the corporate tax burden: years of slipping American competitiveness particularly regarding corporate tax, corporate inversions to other lower-tax countries including some of our major trading partners, migration to the pass-through sector, and other forms of corporate tax avoidance, plus reduced investment, productivity, and wage growth.

Raising the U.S. corporate income tax rate would erode America’s international tax competitiveness, giving us the highest combined corporate tax rate in the OECD. Such a relatively high corporate tax rate would encourage profit shifting abroad and otherwise out of the U.S. corporate sector.

President Biden’s proposed tax hike would reduce American economic output during a time when we need to maximize economic growth to reach our country’s pre-pandemic growth trend and return to full employment. We estimate an increase in the corporate tax rate to 28 percent, for example, would reduce long-run economic output by 0.8 percent, eliminate 159,000 jobs, and reduce wages by 0.7 percent. A 25 percent tax rate would reduce output by 0.4 percent and result in about 84,000 fewer full-time equivalent jobs.

A minimum tax on corporate book income would bring with it a shallow understanding of the reasons why corporations face gaps in financial and taxable income, and it would introduce new complexity and distortions into the tax code. Moreover, it would give undue control over the corporate tax base to FASB, an unelected body.

For those concerned about book-tax differences, a more direct path would involve identifying the tax provisions driving book-tax differences, e.g., accelerated depreciation, and weighing the pros and cons of those provisions. Additionally, a more thorough measurement to determine the extent to which earnings management or tax avoidance is driving the gaps would be a valuable contribution to the broader debate over minimum taxation of book income. Policymakers should consider alternative tools to address tax avoidance, such as by improving international tax rules.[78]

As the U.S. bounces back from intertwined public health and economic crises in 2021, avoiding harmful tax increases and pursuing reform opportunities in corporate taxation should be the areas of focus.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe[1] For full details on President Biden’s tax plan, see Garrett Watson, Huaqun Li, and Taylor LaJoie, “Details and Analysis of President Joe Biden’s Tax Plan,” Tax Foundation, Oct. 22, 2020, https://www.taxfoundation.org/joe-biden-tax-plan-2020/. For an analysis of President Biden’s international corporate tax proposals, see Daniel Bunn, “U.S. Cross-border Tax Reform and the Cautionary Tale of GILTI,” Tax Foundation, Feb. 17, 2021, https://www.taxfoundation.org/gilti-us-cross-border-tax-reform/.

[2] Taylor LaJoie, “Reviewing Effective Tax Rates Faced by Corporate Income,” Tax Foundation, Nov. 19, 2020, https://www.taxfoundation.org/effective-tax-rates-faced-by-corporate-income-biden-corporations/.

[3] NOL carrybacks were reinstituted temporarily as part of the pandemic-related economic relief provided in March 2020’s Coronavirus Aid, Relief, and Economic Security (CARES) Act. NOLs accrued in the 2018, 2019, and 2020 tax years could be carried back up to five years to provide additional liquidity to corporations during the pandemic. For more information, see Karl Smith and Garrett Watson, “Net Operating Loss Carrybacks Are a Vital Source of Tax Relief for Struggling Firms in the Coronavirus Crisis,” Tax Foundation, May 26, 2020, https://www.taxfoundation.org/nol-carrybacks-vital-source-tax-relief-for-struggling-businesses/.

[4] See Asa Johansson, Christopher Heady, Jens Arnold, Bert Brys, and Laura Vartia, “Tax and Economic Growth,” Organisation for Economic Co-operation and Development, July 11, 2008, https://www.oecd.org/tax/tax-policy/41000592.pdf.

[5] Robert Bellafiore, “The Lowered Corporate Income Tax Rate Makes the U.S. More Competitive Abroad,” Tax Foundation, May 2, 2019, https://www.taxfoundation.org/lower-us-corporate-income-tax-rate-competitive/.

[6] Kyle Pomerleau, “Inversions under the New Tax Law,” Tax Foundation, Mar. 13, 2018, https://www.taxfoundation.org/inversions-new-tax-law/.

[7] William McBride, “America’s Shrinking Corporate Sector.,” Tax Foundation, Jan. 6, 2015, https://www.taxfoundation.org/america-s-shrinking-corporate-sector/. See also Scott A. Hodge, “The Real Lesson of 70 Percent Tax Rates on Entrepreneurial Income,” Tax Foundation, Jan. 29, 2019, https://www.taxfoundation.org/70-tax-rate-entrepreneurial-income/.

[8] U.S. Bureau of Labor Statistics, “Below Trend: The U.S. Productivity Slowdown Since the Great Recession,” January 2017, https://www.bls.gov/opub/btn/volume-6/below-trend-the-us-productivity-slowdown-since-the-great-recession.htm.

[9] Ian Hathaway and Robert E. Litan, “Declining Business Dynamism in the United States: A Look at States and Metros,” Brookings Institution, May 5, 2014, https://www.brookings.edu/research/declining-business-dynamism-in-the-united-states-a-look-at-states-and-metros/.

[10] Jens Arnold, “Do Tax Structures Affect Aggregate Economic Growth? Empirical Evidence from a Panel of OECD Countries,” Organisation for Economic Co-operation and Development Economics Department Working Paper No. 643, Oct. 14, 2008, http://www.oecd.org/officialdocuments/displaydocumentpdf/?cote=eco/wkp(2008)51&doclanguage=en.

[11] Elke Asen, “Corporate Tax Rates around the World, 2020,” Tax Foundation, Dec. 9, 2020, https://www.taxfoundation.org/publications/corporate-tax-rates-around-the-world.

[12] Taylor LaJoie and Elke Asen, “Double Taxation of Corporate Income in the United States and the OECD,” Tax Foundation, Jan. 13, 2021, https://www.taxfoundation.org/double-taxation-of-corporate-income/.

[13] Ibid, 5.

[14] Daniel Bunn, “How Would Biden’s Tax Plan Change the Competitiveness of the U.S. Tax Code?” Tax Foundation, Oct. 19, 2020, https://www.taxfoundation.org/biden-tax-plan-us-competitiveness/.

[15] Huaqun Li and Kyle Pomerleau, “Measuring Marginal Effective Tax Rates on Capital Income Under Current Law,” Tax Foundation, January 2020, https://www.files.taxfoundation.org/20200115104709/Measuring-Marginal-Effective-Tax-Rates-on-Capital-Income-Under-Current-Law.pdf.

[16] Kyle Pomerleau, “New York Fed Blog Post Understates Effective Corporate Tax Rates,” Tax Foundation, Oct. 26, 2018, https://www.taxfoundation.org/new-york-fed-blog-post-understates-effective-corporate-tax-rates/.

[17] Ibid.

[18] Kyle Pomerleau, “The Tax Burden on Business Investment Under Joe Biden’s Tax Proposals,” American Enterprise Institute, Sept. 8, 2020, https://www.aei.org/research-products/report/the-tax-burden-on-business-investment-under-joe-bidens-tax-proposals/.

[19] A higher corporate income tax rate increases the value of deducted interest for debt-financed investment, lowering the marginal effective tax rate. See also Ibid, 7.

[20] Data supplement to Congressional Budget Office, The Budget and Economic Outlook: 2018 to 2028, Apr. 9, 2018, https://www.cbo.gov/publication/53651.

[21] We used a semi-elasticity of 0.8 to estimate the relationship between an increase in the statutory corporate income tax rate and a decrease in the amount of taxable income reported by the affiliates of multinational corporations. For more information, see Gavin Ekins, “Corporate Income Tax Rates and Base BroadeningBase broadening is the expansion of the amount of economic activity subject to tax, usually by eliminating exemptions, exclusions, deductions, credits, and other preferences. Narrow tax bases are non-neutral, favoring one product or industry over another, and can undermine revenue stability. from Income Shifting,” Tax Foundation, Oct. 26, 2015, https://www.taxfoundation.org/corporate-income-tax-rates-and-base-broadening-income-shifting/.

[22] For context, see Glenn Kessler, “Joe Biden’s claim that he won’t raise taxes on people making less than $400,000,” The Washington Post, Aug. 31, 2020, https://www.washingtonpost.com/politics/2020/08/31/joe-bidens-claim-that-he-wont-raise-taxes-people-making-less-than-400000/.

[23] Stephen J. Entin, “Labor Bears Much of the Cost of the Corporate Tax,” Tax Foundation, Oct. 24, 2017, https://www.taxfoundation.org/labor-bears-corporate-tax/, 8-10.

[24] Clemens Fuest, Andreas Peichl, and Sebastian Siegloch, “Do High Corporate Taxes Reduce Wages? Micro Evidence from Germany,” American Economic Review 108:2 (February 2018), https://www.aeaweb.org/articles?id=10.1257/aer.20130570.

[25] Erica York, “The Benefits of Cutting the Corporate Income Tax Rate,” Tax Foundation, Aug. 14, 2018, https://www.taxfoundation.org/benefits-of-a-corporate-tax-cut/.

[26] See, for example, Christian Imboden, “Do Stock Prices Respond to Changes in Corporate Income Tax Rates?” National Tax Association Session Paper, Nov. 1, 2018, https://www.ntanet.org/wp-content/uploads/2019/03/Session1237_Paper1665_FullPaper_1.pdf.

[27] Board of Governors of the Federal Reserve System, “Changes in the U.S. Family Finances from 2016 to 2019: Evidence from the Survey of Consumer Finances,” Federal Reserve Bulletin, September 2020, https://www.federalreserve.gov/publications/files/scf20.pdf, 18-19.

[28] Kim Parker and Richard Fry, “More than half of U.S. households have some investment in the stock market,” Pew Research Center, Mar. 25, 2020, https://www.pewresearch.org/fact-tank/2020/03/25/more-than-half-of-u-s-households-have-some-investment-in-the-stock-market/.

[29] Ibid.

[30] Erica York, “The Economics of Stock Buybacks,” Tax Foundation, Sept. 19, 2018, https://www.taxfoundation.org/economics-stock-buybacks/.

[31] Kimberly Clausing, “The Tax Cuts and Jobs Act was Wrongheaded from Day 1. It Should be Rethought,” Los Angeles Times, Oct. 22, 2020, https://www.latimes.com/opinion/story/2020-10-22/op-ed-clausing-economics-headline.

[32] See Stephen J. Entin, “Labor Bears Much of the Cost of the Corporate Tax,” 19-22.

[33] Ibid, 21-22.

[34] Garrett Watson and Nicole Kaeding, “Tax Policy and Entrepreneurship: A Framework for Analysis,” Apr. 3, 2019, https://www.taxfoundation.org/tax-policy-entrepreneurship/. See also Stephen J. Entin, “Labor Bears Much of the Cost of the Corporate Tax,” 15-16.

[35] Emmanuel Farhi and François Gourio, “What is Driving the Return Spread Between ‘Safe’ and ‘Risky’ Assets?” Federal Reserve Bank of Chicago, Chicago Fed Letter No. 416, 2019, https://www.chicagofed.org/publications/chicago-fed-letter/2019/416.

[36] Ibid.

[37] James R. Hines Jr., “Corporate Taxation and the Distribution of Income,” National Bureau of Economic Research, October 2020, https://www.nber.org/papers/w27939. See also Erica York and Garrett Watson, “The Unintended Consequences of Higher Corporate Taxes on Income Inequality,” Tax Foundation, Oct. 29, 2020, https://www.taxfoundation.org/do-corporate-tax-cuts-increase-income-inequality/.

[38] Ibid, 25.

[39] Douglas Holtz-Eakin, “Taxing Capital Income: Effective Rates and Approaches to Reform,” Congressional Budget Office, October 2005, https://www.cbo.gov/sites/default/files/109th-congress-2005-2006/reports/10-18-tax.pdf.

[40] For a detailed analysis, see Kyle Pomerleau, “An Analysis of Senator Warren’s ‘Real Corporate Profits Tax’,” Apr. 18, 2019, https://www.taxfoundation.org/elizabeth-warren-corporate-tax-plan/.

[41] Jennifer Epstein, “Biden to Target Tax-Avoiding Companies Like Amazon With Minimum Federal Levy,” Bloomberg, Dec. 4, 2019, https://www.bloomberg.com/news/articles/2019-12-04/biden-to-target-tax-avoiding-companies-with-minimum-federal-levy.

[42] Simple examples include the rules surrounding accrual accounting and the matching principle for expense recognition. See L. Todd Johnson, “Understanding the Conceptual Framework,” Financial Accounting Standards Board, Dec. 28, 2004, https://www.fasb.org/jsp/FASB/Document_C/DocumentPage&cid=1218220177794.

[43] Kyle Pomerleau, “Joe Biden’s Alternative Minimum Book Tax,” Tax Notes, Oct. 5, 2020, https://www.taxnotes.com/tax-notes-federal/corporate-taxation/joe-bidens-alternative-minimum-book-tax/2020/10/05/2d056.

[44] Garrett Watson, “Biden’s Minimum Book Income Tax Proposal Would Create Needless Complexity,” Tax Foundation, Dec. 13, 2019, https://www.taxfoundation.org/joe-biden-minimum-tax-proposal/.

[45] Nicole Kaeding, “Taxable Income vs. Book Income: Why Some Corporations Pay No Income Tax,” Tax Foundation, May 2, 2019, https://www.taxfoundation.org/why-corporations-pay-no-income-tax/.

[46] See Karl Smith and Garrett Watson, “Net Operating Loss Carrybacks Are a Vital Source of Tax Relief for Struggling Firms in the Coronavirus Crisis.”

[47] Michael P. Devereux and Clemens Fuest, “Is the Corporation Tax an Effective Automatic Stabilizer?” National Tax Journal 62:3 (2009), http://www.ntanet.org/NTJ/62/3/ntj-v62n03p429-37-corporation-tax-effective-automatic.html.

[48] Michael G. Cooper and Matthew J. Knittel, “The Implications of Tax Asymmetry for U.S. Corporations,” National Tax Journal 63:1 (March 2010), https://www.ntanet.org/NTJ/63/1/ntj-v63n01p33-61-implications-tax-asymmetry-for.pdf?v=%CE%B1&r=03589733876287937.

[49] For more on why the tax system should not be tied to economic depreciation, see Everett Stamm and Erica York, “Inefficiencies Created by the Tax System’s Dependence on Economic Depreciation,” Tax Foundation, June 12, 2020, https://www.taxfoundation.org/us-tax-inefficiencies-created-by-dependence-on-economic-depreciation/.

[50] For 2021 and 2022, business meals are fully deductible. See Garrett Watson and Erica York, “Congress Passes $900 Billion Coronavirus Relief Package,” Dec. 21, 2020, https://www.taxfoundation.org/coronavirus-relief-bill-stimulus-check/.

[51] Michelle Hanlon and Terry Shevlin, “Book-Tax Conformity for Corporate Income: An Introduction to the Issues,” Tax Policy and the Economy 19 (2005), https://www.journals.uchicago.edu/doi/abs/10.1086/tpe.19.20061897,107.

[52] Ibid, 111-112.

[53] Notably, the tax treatment of foreign income reduced profit shifting incentives. See Kyle Pomerleau, “A Hybrid Approach: The Treatment of Foreign Profits under the Tax Cuts and Jobs Act,” Tax Foundation, May 3, 2018, https://www.taxfoundation.org/treatment-foreign-profits-tax-cuts-jobs-act/.

[54]Kyle Pomerleau, “Joe Biden’s Alternative Minimum Book Tax,” 110.

[55] Michelle Hanlon and Terry Shevlin, “Book-Tax Conformity for Corporate Income: An Introduction to the Issues.”

[56] Dhammika Dharmapala, “The Tax Elasticity of Financial Statement Income: Implications for Current Reform Proposals,” National Tax Journal 73:4 (December 2020), https://www.ntanet.org/NTJ/73/4/ntj-v73n04p1047-1064-Tax-Elasticity-of-Financial-Statement-Income.html.

[57] Ibid, 20. Dharmapala finds that the elasticity of taxable income ranges from 1.4 to 2.1.

[58] Terrence Chorvat and Michael S. Knoll, “The Economic and Political Implications of Repealing the Corporate Alternative Minimum Tax,” Tax Foundation, Feb. 1, 2002, https://www.taxfoundation.org/economic-and-political-implications-repealing-corporate-alternative-minimum-tax/.

[59] Daniel Shaviro, “What Are Minimum Taxes, and Why Might One Favor or Disfavor Them?” New York University Law and Economics Research Paper No. 20-38, July 27, 2020, https://www.papers.ssrn.com/sol3/papers.cfm?abstract_id=3604328.

[60] Ibid, 27.

[61] Among the many steps involved included computing regular taxable income, adding back in NOL deduction carryforwards, adding or subtracting adjusted current earnings (ACE) and other preference items, and deducting the AMT NOL deduction. See Ibid, 5.

[62] Thomas C. Omer and David A. Ziebart, “The Effect of the Alternative Minimum Tax on Corporate Tax Burdens,” The Quarterly Review of Economics and Finance 3:2 (Summer 1993), https://www.sciencedirect.com/science/article/abs/pii/106297699390018F.

[63] Curtis P. Carlson, “The Corporate Alternative Minimum Tax: Aggregate Historical Trends,” U.S. Department of the Treasury, June 2005, https://www.treasury.gov/resource-center/tax-policy/tax-analysis/Documents/WP-93.pdf.

[64] Repealing the corporate AMT reduced federal revenue by about $40.3 billion from 2018 to 2027, according to the Joint Committee on Taxation (JCT). This is about 1 percent of corporate income tax revenue projected over that period by the Congressional Budget Office (CBO). See Joint Committee on Taxation, “Estimated Budget Effects Of The Conference Agreement For H.R.1, The Tax Cuts And Jobs Act,” Dec. 18, 2017, https://www.jct.gov/publications/2017/jcx-67-17/, and Congressional Budget Office, The Budget and Economic Outlook: 2017 to 2027, Jan. 24, 2017, https://www.cbo.gov/publication/52370.

[65] Joel B. Slemrod and Marsha Blumenthal, “The Income Tax Compliance Cost of Big Business,” Public Finance Review 24:4 (Oct. 1, 1996, https://www.journals.sagepub.com/doi/10.1177/109114219602400401.

[66] Daniel Shaviro, “What Are Minimum Taxes, and Why Might One Favor or Disfavor Them?” 33-34.

[67] Terrence Chorvat and Michael S. Knoll, The Economic and Political Implications of Repealing the Corporate Alternative Minimum Tax.”

[68] Garrett Watson, Huaqun Li, and Taylor LaJoie, “Details and Analysis of President Joe Biden’s Tax Plan.”

[69] The interaction with a higher corporate income tax rate reduced Tax Foundation’s revenue estimate compared to the Biden campaign.

[70] The most recent data available from the IRS “Statistics of Income” (tax year 2017) indicates that manufacturers claim 52 percent of the R&D credit and another 21 percent is claimed by information technology companies.

[71] Garrett Watson, Huaqun Li, and Taylor LaJoie, “Details and Analysis of President Joe Biden’s Tax Plan.”

[72] Tax Foundation’s preliminary estimate treats the proposed minimum book tax as an effective increase in the corporate tax burden compared to current law.

[73] Jordan Richmond, “Firm Responses to Book Income Alternative Minimum Taxes,” Feb. 12, 2021, https://www.jordan-richmond.github.io/research/book_inc_AMT.pdf.

[74] Kyle Pomerleau, “An analysis of Joe Biden’s tax proposals, October 2020 update,” American Enterprise Institute, Oct. 13, 2020, https://www.aei.org/research-products/report/an-analysis-of-joe-bidens-tax-proposals-october-2020-update/, and Gordon B. Mermin et al., “An Updated Analysis of Former Vice President Biden’s Tax Proposals,” Tax Policy Center, Nov. 6, 2020, https://www.taxpolicycenter.org/publications/updated-analysis-former-vice-president-bidens-tax-proposals.

[75] Penn-Wharton Budget Model, “The Updated Biden Tax Plan: Budgetary, Distributional, and Economic Effects,” Mar. 10, 2020, https://www.budgetmodel.wharton.upenn.edu/issues/2020/3/10/the-biden-tax-plan-updated.

[76] See Kyle Pomerleau, “Joe Biden’s Alternative Minimum Book Tax,” 110.

[77] Ibid.

[78] Daniel Bunn, “U.S. Cross-border Tax Reform and the Cautionary Tale of GILTI.”

Share this article