A Net Operating Loss (NOL) Carryback allows businesses suffering losses in one year to deduct them from previous years’ profits. Businesses thus are taxed on their average profitability, making the tax code more neutral. In the U.S., a Net Operating Loss cannot be carried back (only carried forward).

Why Are NOL Carrybacks Important?

Net operating loss deductions are important because business profitability can vary over time. New businesses and those operating in cyclical industries especially may suffer from losses.

Imagine a business has $100 in profits in one year and then $50 in losses in the subsequent year. Without a carryback provision, the business would be taxed on the full $100 in profits in the first year but would not be taxed in the second year.

A carryback provision would allow the business to “carry back” its $50 loss in year two to reduce its taxable profits in year one, averaging the taxable profits over the two years.

| Year One | Year Two | |

|---|---|---|

| Without a NOL Carryback Provision | ||

| Taxable Profit (Loss) | $100 | -$50 |

| Tax Liability (Tax Rate of 21%) | $21 | $0 |

| With a NOL Carryback Provision | ||

| Taxable Profit (Loss) | $100 | -$50 |

| Taxable Profit (Loss) with Carryback | $50 | -$50 |

| Tax Liability (Tax Rate of 21%) | $10.50 | $0 |

| Source: Tax Foundation calculation. | ||

U.S. Federal NOL Carryback Provisions

At the federal level, businesses cannot carry back their net operating losses. Prior to the Tax Cuts and Jobs Act (TCJA) of 2017, businesses could carry back losses for two years.

U.S. State-Level NOL Carryback Provisions

Most U.S. states do not allow businesses to carry back their net operating losses. Only five states—California, Idaho, Mississippi, Montana, and New York—have carryback provisions. An overview of state-level carryback provisions can be found here.

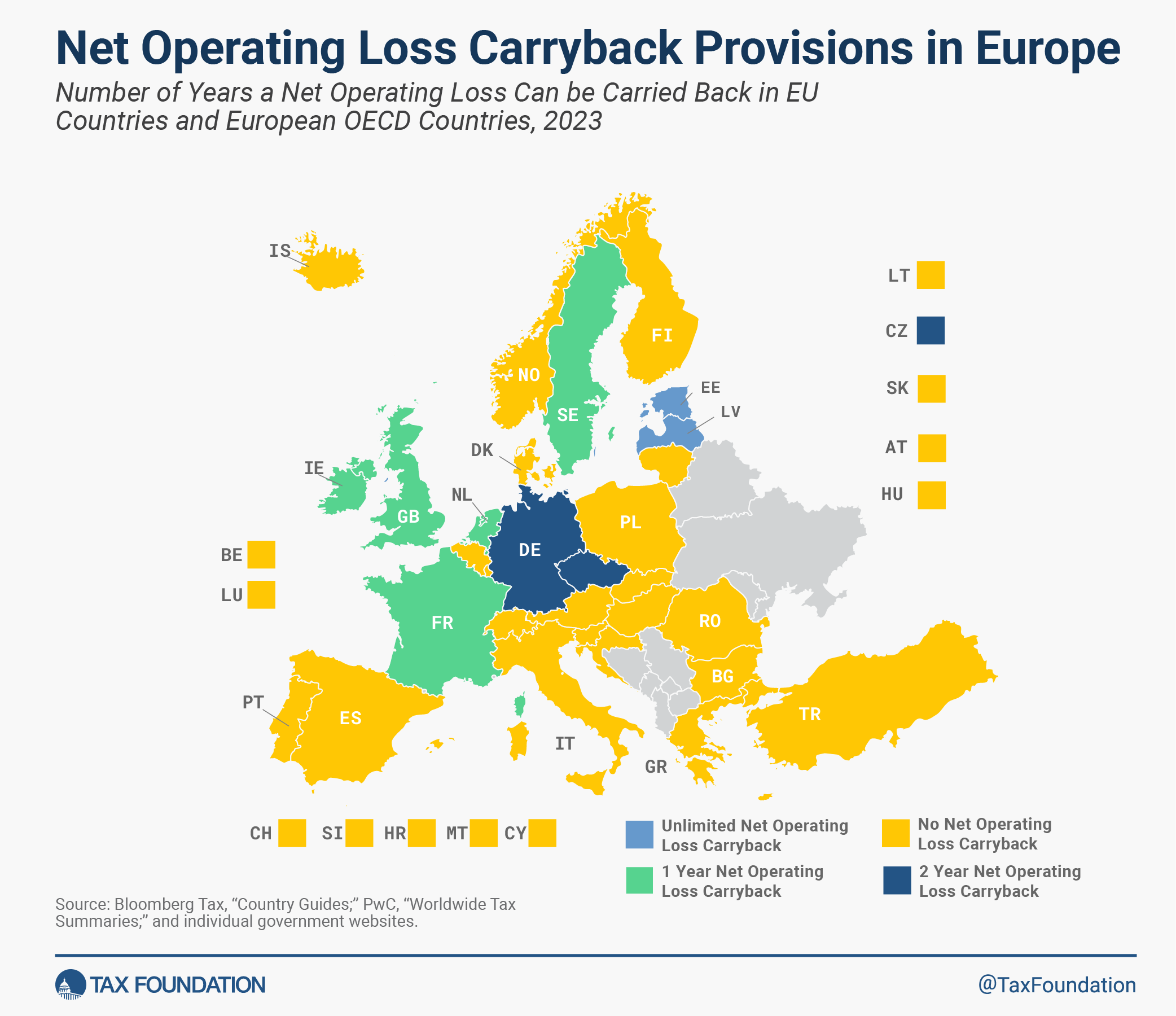

NOL Carryback Provisions in Europe

Only seven European OECD countries allow businesses to carry back their net operating losses, with Estonia and Latvia the only two countries allowing for indefinite carrybacks.

What are NOL Carryforwards?

NOL carryforwards allow businesses to deduct current year losses against future profits. A more detailed definition can be found here.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe