One of the most significant provisions in the Tax Cuts and Jobs Act (TCJA) was the reduction of the U.S. corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate from 35 percent to 21 percent. Lowering the corporate rate was a pro-growth policy, and its importance is especially apparent from an international perspective.

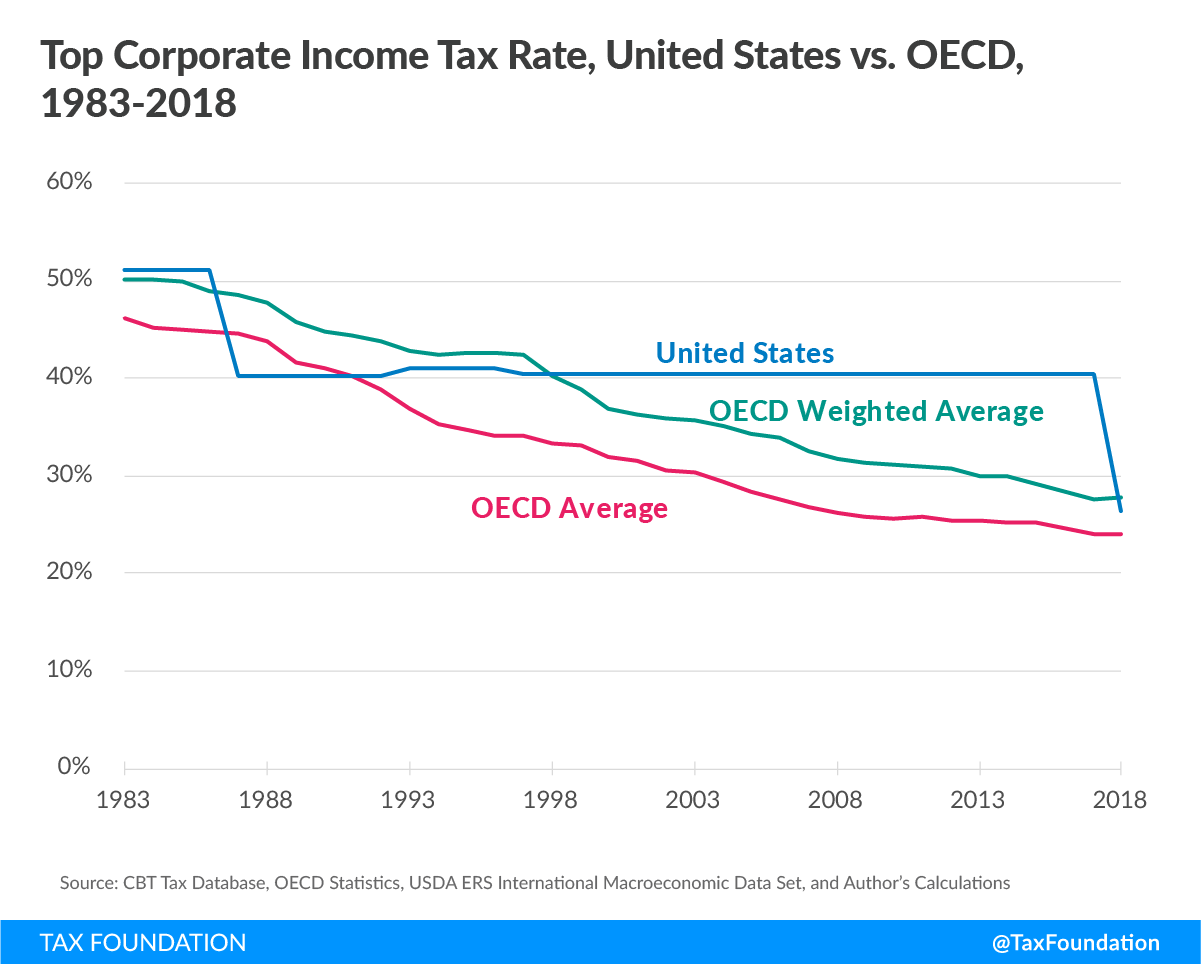

Previously, America’s combined statutory corporate income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rate, combining state and federal corporate income taxes, was 38.9 percent. This rate was the highest among all Organisation for Economic Co-operation and Development (OECD) countries and had long been well above the OECD average. As the following figure illustrates, while the top corporate income tax rate in the U.S. was virtually constant for decades, other OECD countries repeatedly cut their top corporate rates, making their economies more competitive and more attractive to investment. As a result of the TCJA, however, the U.S. now has a combined corporate income tax rate more in line with that of other OECD countries.

Over time, the reduction of the corporate income tax rate will incentivize new investment and lead to additional economic growth. A lower corporate rate will make the U.S. more attractive for companies by increasing after-tax returns on investments and will discourage companies from shifting profits to low-tax jurisdictions. The Tax Foundation’s Taxes and Growth model estimates that lowering the corporate rate will increase long-run GDP by 2.6 percent, increase worker pay, and grow the U.S. capital stock as more investments become profitable.

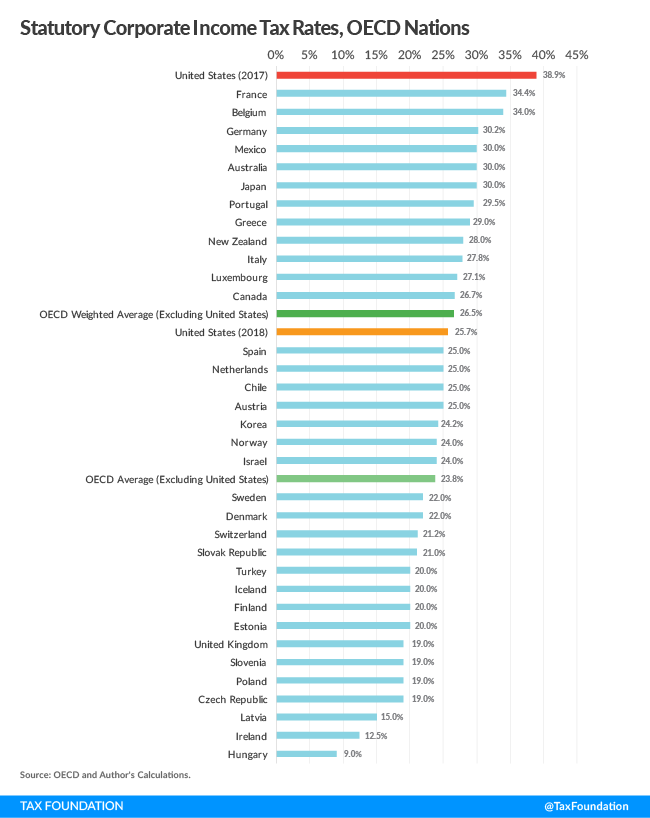

However, while the U.S. corporate income tax rate is far below what it used to be, many countries’ rates are lower still. As the following figure shows, 22 OECD countries still have statutory corporate income tax rates below that of the U.S. The new combined U.S. corporate rate of 25.7 remains above the OECD average of 23.8 percent and is just below the GDP-weighted average of 26.5 percent.

In other words, while the U.S. corporate income tax rate is no longer the highest among other OECD countries, it is still only in the middle of the pack. If the trend of recent decades continues, other countries will continue to reduce their corporate rates in the future. But for now, the TCJA has put the U.S.’s corporate tax rate in line with the average among OECD nations.

Note: This is part of our “Business in America” blog series

- Corporate and Pass-through Business Income and Returns Since 1980

- Firm Variation by Employment and Taxes

- 2017 GDP and Employment by Industry

- Pass-Through Businesses Q&A

- State Corporate Income Taxes Increase Tax Burden on Corporate Profits

- Marginal Tax Rates for Pass-through Businesses Vary by State

- Taxes on Capital Income Are More Than Just the Corporate Income Tax

- Depreciation Requires Businesses to Pay Tax on Income That Doesn’t Exist

- Not All Tax Expenditures Are Equal