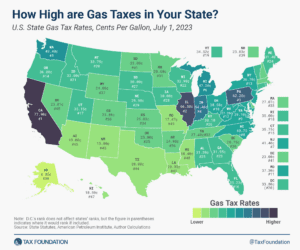

Michigan Tobacco Bills Could Reduce Revenue and Increase Smuggling

Two pieces of tobacco legislation in Michigan have the potential to decrease state tax collections by $320 million per year, deter smokers from switching to less harmful products, and increase illicit trade and crime.

4 min read