Retail Delivery Fees Are Not the Panacea for States’ Transport Budget Woes

Retail delivery fees are an inefficient and ineffective way to close budget gaps, and lawmakers should consider other, more sound, policy options.

5 min read

Retail delivery fees are an inefficient and ineffective way to close budget gaps, and lawmakers should consider other, more sound, policy options.

5 min read

Summer has arrived and states are beginning to implement policy changes that were enacted during the legislative session (or are being phased in over time).

13 min read

Neutral tax codes don’t play favorites or try to influence personal or business decisions but stick to what they’re best at – raising sufficient revenue through low rates and a broad base.

To stay competitive in an increasingly mobile post-pandemic world, states and localities must learn from the tax policy successes and failures of their neighbors and communities across the nation.

27 min read

Governments often justify higher tax burdens with more extensive public services. However, the cost of these services can be more than half of an average worker’s salary.

16 min read

With a robust surplus and plenty saved for a rainy day, Kansas can afford substantial tax relief, but not all tax relief is created equal.

7 min read

Two bills in Georgia will lower the flat individual income tax rate and align the corporate income tax rate with the individual income tax rate.

4 min read

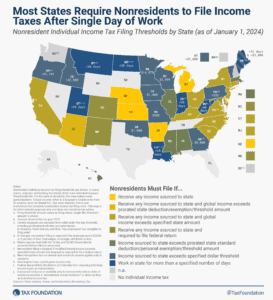

One relatively easy but meaningful step policymakers can take to make future tax seasons less burdensome is to modernize their state’s nonresident income tax filing, withholding, and reciprocity laws.

7 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

With state tax revenues receding from all-time highs, there’s been a great deal of handwringing about whether states can afford the tax cuts adopted over the past few years. Given that 27 states reduced the rate of a major tax between 2021 and 2023, is there reason for concern?

4 min read

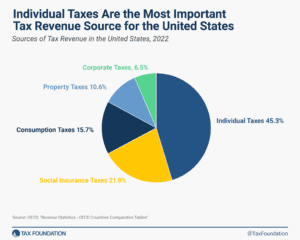

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

3 min read

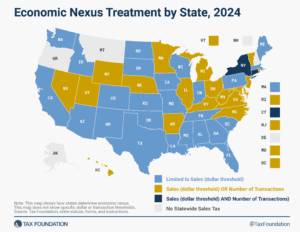

Reforming economic nexus thresholds would not only be better for businesses but for states as well. It is more cost-effective for states to focus on—and simplify—compliance for a reasonable number of sellers than to impose rules that have low compliance and are costly to administer.

4 min read

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

3 min read

In his FY 2025 budget, Illinois Gov. Pritzker outlined a number of proposed tax changes, including to individual and corporate income taxes, state sales taxes, and sports betting excise taxes.

7 min read

Expanding Virginia’s sales tax base to include B2B digital transactions could lead to tax pyramiding, hide the true cost of government, and make the sales tax system much less neutral and transparent.

5 min read

Sales taxes go beyond a few extra bucks at the register. It’s not just about what you pay, but who pays. What are the implications of state sales tax bases across the U.S.?

One particular provision of the Biden administration’s proposal to ban so-called “junk fees” would have unintended consequences.

5 min read

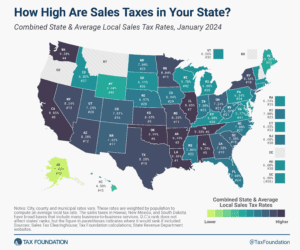

Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 32 percent of state tax collections and 13 percent of local tax collections (24 percent of combined collections).

9 min read

After years of strong revenue growth, Kansas has substantial cash reserves on hand, and policymakers on both sides of the aisle have expressed a desire to return some of the extra revenue to taxpayers.

5 min read

As policymakers continue efforts to improve Kentucky’s tax structure and competitiveness, they should keep in mind that not all offsets are created equal.

59 min read