Facts & Figures 2025: How Does Your State Compare?

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

Lawmakers should finish the work they have begun over the past few decades, tackling tax rates and structures to give the state a leg up in an era of enhanced competition.

84 min read

Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 24 percent of combined state and local tax collections.

15 min read

Georgia should focus on policies that restrict the overall growth of property taxes, not policies that functionally freeze property taxes for current owners by shifting costs onto new owners and into the sales tax.

6 min read

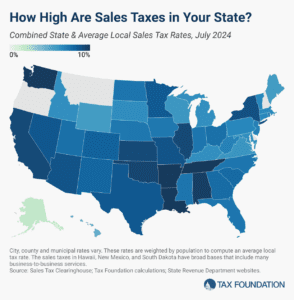

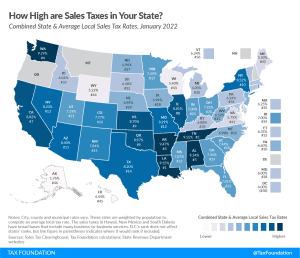

While many factors influence business location and investment decisions, sales taxes are something within policymakers’ control that can have immediate impacts—especially as a large number of major cities have combined rates of 9 percent or more.

6 min read

Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 32 percent of state tax collections and 13 percent of local tax collections (24 percent of combined collections).

8 min read

To stay competitive in an increasingly mobile post-pandemic world, states and localities must learn from the tax policy successes and failures of their neighbors and communities across the nation.

27 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 32 percent of state tax collections and 13 percent of local tax collections (24 percent of combined collections).

9 min read

Contrary to initial expectations, the pandemic years were good for state and local tax collections, and while the surges of 2021 and 2022 have not continued into calendar year 2023, revenues remain robust in most states and well above pre-pandemic levels even after accounting for inflation.

5 min read

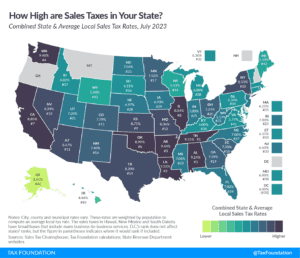

Compare the latest 2023 sales tax rates as of July 1st. Sales tax rate differentials can induce consumers to shop across borders or buy products online.

8 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

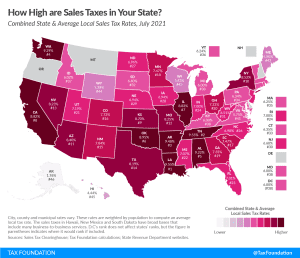

While many factors influence business location and investment decisions, sales taxes are something within policymakers’ control that can have immediate impacts.

11 min read

The logic that has prevailed for local sales taxes should apply equally to other taxes that localities impose on multijurisdictional businesses, including local tourism taxes. The evidence is clear that central administration of local taxes reduces compliance costs without sacrificing local revenue.

15 min read

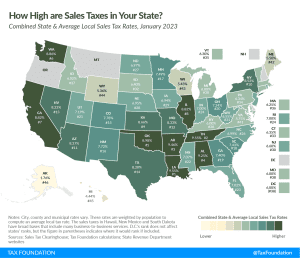

While many factors influence business location and investment decisions, sales taxes are something within policymakers’ control that can have immediate impacts.

12 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

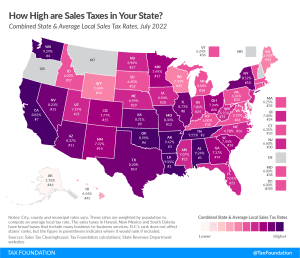

While many factors influence business location and investment decisions, sales taxes are something within policymakers’ control that can have immediate impacts.

12 min read

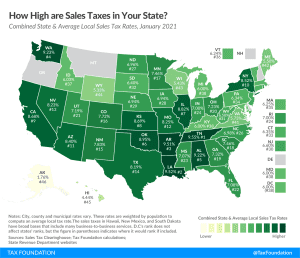

The highest average combined state and local sales tax rates are in Louisiana (9.55 percent), Tennessee (9.547 percent), Arkansas (9.48 percent), Washington (9.29 percent), and Alabama (9.22 percent).

12 min read

Our updated 2021 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

While many factors influence business location and investment decisions, sales taxes are something within lawmakers’ control that can have immediate impacts.

12 min read