Public Funding for Sports Stadiums Just Doesn’t Pay off for Taxpayers

The long-term value of these projects to the broader public remains highly debatable.

The long-term value of these projects to the broader public remains highly debatable.

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

92 min read

Especially for a state that relies so heavily on the sales tax as a source of revenue—and where most people want to keep it that way—a broad base and a low rate is crucial.

5 min read

Georgia should focus on policies that restrict the overall growth of property taxes, not policies that functionally freeze property taxes for current owners by shifting costs onto new owners and into the sales tax.

6 min read

Louisiana’s tax code currently features a number of inefficient and uncompetitive policies that are leaving the state further and further behind.

Sports stadium subsidies are salient political gimmicks designed to appear as if politicians are providing tangible benefits to taxpayers. The empirical evidence shows repeatedly that stadium subsidies fail to generate new tax revenue and new jobs or attract new businesses.

6 min read

Under the tax created by Measure 118, Oregon businesses would be significantly disadvantaged against their larger and out-of-state rivals.

6 min read

Oregon’s Measure 118, though presented as a tax on big business, would function as an aggressive sales tax on consumers.

7 min read

Taxes are on the ballot this November—not just in the sense that candidates at all levels are offering their visions for tax policy, but also in the literal sense that voters in some states will get to decide important questions about how their states raise revenue.

9 min read

Utah is the only state to earmark the entirety of one of its major taxes, but a measure on the ballot this November might change that.

4 min read

The sales tax is the second-largest source of state tax revenue and an important source of local tax revenue, but decades of base erosion threaten the tax’s share of overall revenue and have prompted years of countervailing rate increases.

72 min read

World War II shaped many aspects of the modern world, including the US tax code. But the dramatic changes to our system that military mobilization required didn’t subside when the fighting finished; they’ve persisted to today.

4 min read

States would do better to broaden the sales tax base to include currently exempt classes of final consumption than to impose disproportionate taxes on prepared foods.

6 min read

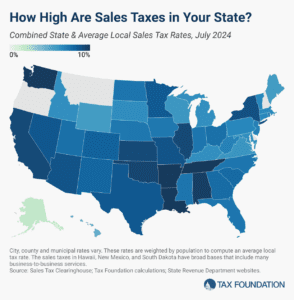

While many factors influence business location and investment decisions, sales taxes are something within policymakers’ control that can have immediate impacts—especially as a large number of major cities have combined rates of 9 percent or more.

6 min read

The government provides various services at the federal, state, and local levels. How are they paid for? Taxes.

Next year, West Virginians will see an income tax cut thanks to revenue triggers in a 2023 law. The Mountain State joins 14 other states that have cut income taxes this year.

4 min read

Gov. Pillen is searching for tax burden relief. But his plan, which reportedly involves a two-tiered sales tax and the state’s assumption of most school funding responsibility, would have profound implications that even those most convinced of the urgency of property tax relief may find unworkable and unpalatable.

12 min read

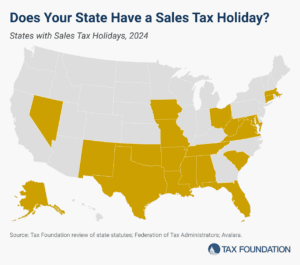

However well-intended they may be, sales tax holidays remain the same as they always have been—ineffective and inefficient.

11 min read

An ideal sales tax is imposed on all final consumption, both goods and services, but excludes intermediate transactions to avoid tax pyramiding.

15 min read

Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 32 percent of state tax collections and 13 percent of local tax collections (24 percent of combined collections).

8 min read