All Related Articles

Unpacking the State and Local Tax Toolkit: Sources of State and Local Tax Collections (FY 2020)

The mix of tax sources states choose can have important implications for both revenue stability and economic growth, and the many variations across states are indicative of the different ways states weigh competing policy goals.

29 min read

Sales Tax Holidays: Bad Policy Any Year, But Especially in Response to High Inflation

However well-intended they may be, sales tax holidays remain the same as they always have been—ineffective and inefficient.

43 min read

Indiana Should Use Surplus to Expedite Rate Cuts, Index Exemptions for Inflation

Expediting income tax rate reductions and indexing major income tax provisions for inflation are two of the most important tax policy changes policymakers could make to provide meaningful tax relief to Hoosiers both now and in the years to come.

4 min read

New Jersey’s Proposed Menthol Ban Is All Pain and No Gain

New Jersey lawmakers should be weary of flavor bans after seeing the results in Massachusetts.

3 min read

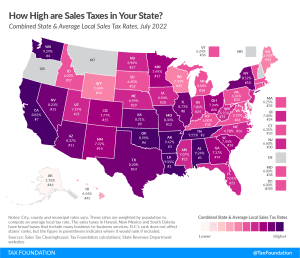

State and Local Sales Tax Rates, Midyear 2022

While many factors influence business location and investment decisions, sales taxes are something within policymakers’ control that can have immediate impacts.

12 min read

State Tax Reform and Relief Enacted in 2022

Among the 46 states that held legislative sessions this year, structural state tax reform and temporary tax relief measures were recurring themes.

13 min read

Tax Reform Options to Improve Wisconsin’s Competitiveness

Given the state’s strong budget surplus and projected continued revenue growth, Wisconsin is in a prime position to enact pro-growth reforms to improve the state’s competitive standing for decades to come.

54 min read

State Tax Changes Taking Effect July 1, 2022

Although the majority of state tax changes take effect at the start of the calendar year, some are implemented at the beginning of the fiscal year. Fourteen states have notable tax changes taking effect on July 1.

7 min read

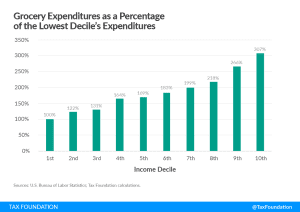

Clean Up on the Grocery Tax Aisle

Amidst soaring inflation, policymakers across the political spectrum proposed many ideas to soften the blow of higher prices–especially for low-income workers and families. One idea that caught on quickly: sales tax relief on groceries. The idea had its merits, but Tax Foundation research shows that it may have missed the mark.

Wisconsin Losing Ground to Tax-Friendly Peers

While Wisconsin has long been one of the highest-tax states in the nation, that distinction is increasingly detrimental as businesses and individuals enjoy increased economic and geographic mobility.

6 min read

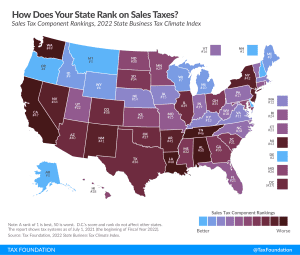

Ranking Sales Taxes on the 2022 State Business Tax Climate Index

An ideal sales tax applies to a broad base of final consumer goods and services, with few exemptions, and is levied at a low rate.

3 min read

Evaluating Wyoming’s Business Tax Competitiveness

Wyoming’s low taxes are highly attractive, but policymakers are still hard at work helping the state achieve broader economic development goals.

13 min read

State Sales Tax Breadth and Reliance, Fiscal Year 2021

The sales tax is too important a part of states’ revenue toolkits to be permitted further erosion, making sales tax modernization a vital project of the 2020s.

17 min read

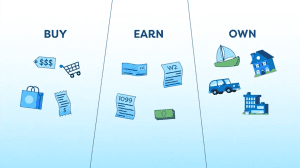

The Three Basic Tax Types

The better you understand taxes, the better equipped you are to make decisions about them. All taxes can be divided into three basic types: taxes on what you buy, taxes on what you earn, and taxes on what you own.

Kansas Policymakers Should Improve Food Credit, Not Exempt Groceries

This legislative session, the sales tax on food has garnered a great deal of attention in Kansas, with policymakers on both sides of the aisle proposing the removal of groceries from the sales tax base.

7 min read

The Surprising Regressivity of Grocery Tax Exemptions

Exempting groceries from the sales tax base reduces economic efficiency without achieving its objective of enhancing tax progressivity.

19 min read

Kentucky Legislature Sends Pro-Growth Tax Changes to Governor

Kentucky is making commendable progress toward a more modern and competitive tax code, but more work on comprehensive tax reform should be prioritized next session.

7 min read

State Legislatures Take Up Tax Reform and Relief in 2022

After a whirlwind of cuts and reforms in 2021, it looks like 2022 might be an even bigger year for state tax codes. Republican and Democratic governors alike used their annual State of the State addresses to call for tax reform, and there is already serious momentum from state lawmakers nationwide to get the job done.

3 min read