All Related Articles

Pro-Growth Tax Reform for Oklahoma

Our new study identifies a number of deficiencies in Oklahoma’s tax code and outlines possible solutions for reform that would create a more neutral tax code and encourage long-term growth in the state.

6 min read

Tracking 2021 Election Results: State Tax Ballot Measures

Through 10 ballot measures across four states—Colorado, Louisiana, Texas, and Washington—voters will decide significant questions of state tax policy.

7 min read

Louisiana Voters Have Chance to Simplify Taxes and Lower Burdens

Passage of Louisiana Amendments 1 and 2, which are aimed at the sales tax and individual and corporate income taxes, respectively, would substantially simplify the Pelican State’s tax code and provide tax relief in both the short and long term.

8 min read

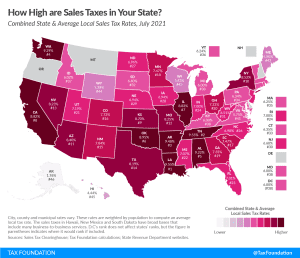

Sales Tax Rates in Major Cities, Midyear 2021

Neither Anchorage, Alaska, nor Portland, Oregon, impose any state or local sales taxes. Honolulu, Hawaii, has a low rate of 4.5 percent and several other major cities, including Milwaukee and Madison, Wisconsin, keep overall rates modest.

13 min read

Here’s How Louisiana’s Tax Plan Would Simplify the Tax Code and Benefit Residents

Louisiana legislators passed a tax reform plan that has received overwhelming support in both the House and Senate, but voters will get the ultimate say on whether that plan succeeds. In light of this, it may be valuable to walk through what is included in these reforms and what effect the changes will have on taxpayers.

5 min read

Sales Tax Holidays by State, 2021

Although state budgets may be in unusual places this year, sales tax holidays remain the same as they always have been—ineffective and inefficient.

4 min read

Even Within States, Tax Treatment Differs by Industry

States can enhance tax neutrality across industries by reforming tax structures that penalize certain business activity, leaning less on generous incentives, and focusing more on creating a tax code that provides for low and competitive burdens for all comers.

5 min read

State and Local Sales Tax Rates, Midyear 2021

The highest average combined state and local sales tax rates are in Louisiana (9.55 percent), Tennessee (9.547 percent), Arkansas (9.48 percent), Washington (9.29 percent), and Alabama (9.22 percent).

12 min read

Property and Sales Taxes Are a Major Driver of Corporations’ State and Local Tax Burdens

As policymakers consider ways to improve their tax structure to encourage business investment and promote economic growth, corporate income tax rate reductions are a crucial part of that conversation, but they shouldn’t be the only consideration.

6 min read

Illuminating Independence Day Taxes

4 min read

State Tax Changes Taking Effect July 1, 2021

Thirteen states have notable tax changes taking effect on July 1, 2021, which is the first day of fiscal year (FY) 2022 for every state except Alabama, Michigan, New York, and Texas. Individual and corporate income tax changes usually take effect at the beginning of the calendar year for the sake of maintaining policy consistency throughout the tax year, but sales and excise tax changes often correspond with the beginning of a fiscal year.

11 min read

Louisiana Fiscal Session Finishes Strong with Tax Reform

It took until the last day of the session, but Louisiana lawmakers succeeded in passing a tax reform package Thursday that would simplify a complicated tax code and make the state more economically competitive.

4 min read

A Comparison of the Tax Burden on Labor in the OECD, 2021

Governments often justify higher tax burdens with more extensive public services. However, the cost of these services can be more than half of an average worker’s salary.

21 min read

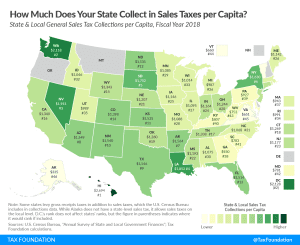

How Much Does Your State Collect in Sales Taxes Per Capita?

Rightsizing a state’s sales tax base can not only make the tax more equitable and better align it with the modern economy but also generate revenue that can be used to pay down the rates of more harmful taxes. That is why sales tax base broadening, which is favored by public finance scholars across the political spectrum, features in many tax reform plans.

3 min read

What Location Matters Can Tell Us About State Tax Competitiveness

Location Matters is an account of tax complexity and the ways that tax structure affect competitiveness. For policymakers, it represents an opportunity to explore the seemingly more arcane tax provisions that can have a significant impact on business tax burdens, and to discover how their tax code—often completely by accident—picks winners and losers.

4 min read

Location Matters 2021: The State Tax Costs of Doing Business

A landmark comparison of corporate tax costs in all 50 states, Location Matters provides a comprehensive calculation of real-world tax burdens, going beyond headline rates to demonstrate how tax codes impact businesses and offering policymakers a road map to improvement.

8 min read

Outlier No More: Kansas Adopts Tax Reform with Wayfair Safe Harbor, GILTI Exclusion

After three years of deliberations, more than two-thirds of members in both the Senate and the House enacted tax reform and relief legislation Monday over the veto of Gov. Laura Kelly (D).

4 min read

These States Will Pay You to Move. Does That Strategy Make Sense?

State and local tax policy have always mattered, but the rise of remote work is bringing tax burdens and economic competitiveness to the forefront. It is a development that states cannot afford to ignore.

5 min read