State and Local Tax Ballot Measures to Watch on Election Day 2020

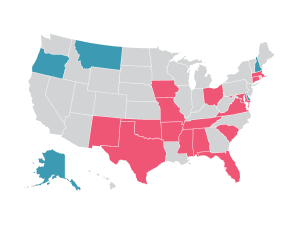

Here are the state tax ballot measures to watch on Election Day 2020. Explore the most notable 2020 state tax ballot measures in 15 states.

4 min read

Here are the state tax ballot measures to watch on Election Day 2020. Explore the most notable 2020 state tax ballot measures in 15 states.

4 min read

Legalizing recreational marijuana is a hot topic in many states where the state budgets are in disarray because of the coronavirus pandemic and new revenue sources are being sought.

7 min read

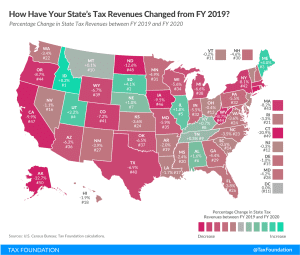

State tax revenue collections were down 5.5 percent in FY 2020, driven by a dismal final quarter (April through June) as states began to feel the impact of the COVID-19 pandemic. While these early losses are certainly not desirable, they are manageable and far better than many feared.

16 min read

First, the introduction of the wealth tax would significantly impact international capital flows and cause large economic dislocations in the short term. Second, provinces that are looking at raising their corporate tax rates might hinder capital attraction, growth, and economic recovery.

4 min read

Today marked the release of second-quarter GDP data and provides a new glimpse into early changes in state and local revenues and spending. All told, second-quarter state and local tax receipts came in about 3.8 percent lower than they did in the same quarter a year ago. Income and sales taxes fell considerably while property and excise tax collections remained stable.

3 min read

In the midst of the coronavirus crisis, some states are hoping that a sales tax holiday might help restart struggling industries by stimulating the economy. However, sales tax holidays can mislead consumers about savings and distract from genuine, permanent tax relief.

41 min read

Revised state revenue forecasts show a significant decline in projected revenues for both the recently concluded FY 2020 and current FY 2021, though the picture they paint is considerably less dire than many feared a few months ago.

13 min read

Nineteen states had notable tax changes take effect on July 1, 2020. Pandemic-shortened sessions contributed to less—and different—activity on the tax front than is seen in most years, and will likely yield an unusually active summer and autumn, with many legislatures considering new measures during special sessions.

12 min read

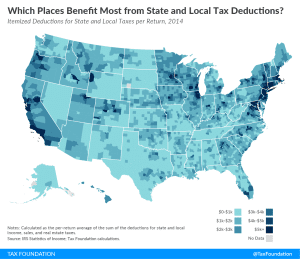

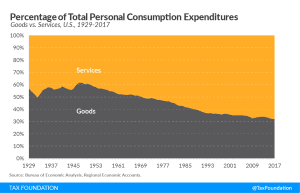

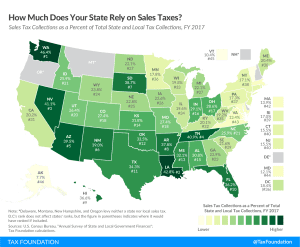

Sales tax rates differ by state, but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy.

12 min read

As New Jersey lawmakers grapple with reduced revenues due to the coronavirus pandemic, they have turned to an unusual solution: the issuance of bonds that would be repaid, if necessary, through temporarily higher sales and property taxes.

2 min read

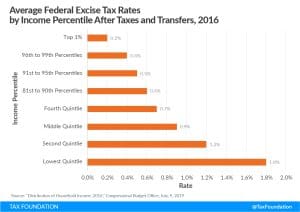

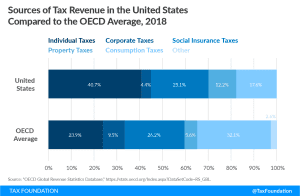

Consumption taxes, like sales taxes, are more economically neutral than taxes on capital and income because they target only current consumption.

3 min read