2024 Tax Brackets

Explore the IRS inflation-adjusted 2024 tax brackets, for which taxpayers will file tax returns in early 2025.

4 min read

Explore the IRS inflation-adjusted 2024 tax brackets, for which taxpayers will file tax returns in early 2025.

4 min read

The 2023 version of the International Tax Competitiveness Index is the 10th edition of the report. Let’s take a look back and see how country ranks have changed over time.

5 min read

Lawmakers will have to weigh the economic, revenue, and distributional trade-offs of extending or making permanent the various provisions of the TCJA as they decide how to approach the upcoming expirations. A commitment to growth, opportunity, and fiscal responsibility should guide the approach.

18 min read

The latest tax gap report from the IRS has generated much media attention—and much misunderstanding.

6 min read

The variety of approaches to taxation among European countries creates a need to evaluate these systems relative to each other. For that purpose, we have developed the European Tax Policy Scorecard—a relative comparison of European countries’ tax systems.

52 min read

In recognition of the fact that there are better and worse ways to raise revenue, our Index focuses on how state tax revenue is raised, not how much. The rankings, therefore, reflect how well states structure their tax systems.

111 min read

Instead of adopting a highly distortive property tax assessment limit, policymakers should consider how similar goals could be met through other means.

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

88 min read

If tax increases are included in a package, international experience points toward raising consumption taxes, rationalizing tax expenditures, and broadening the tax base—not hiking income taxes.

6 min read

Outside of the pandemic years, this year’s federal deficit is the highest in U.S. history. While tax revenue has increased about 28 percent since the pre-pandemic year 2019, spending has increased about 46 percent. Annual deficits are headed towards $3 trillion over the next few years.

3 min read

Income taxes impose steeper economic costs, and often steeper administrative and compliance costs, than consumption taxes. Moving to a consumption tax would end the tax bias against saving and investment and provide an opportunity to greatly simplify anti-poverty programs embedded in the tax code.

45 min read

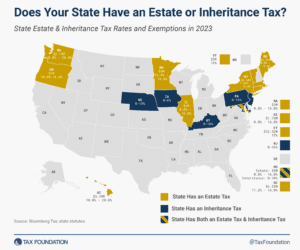

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax.

4 min read

Can an organization rightfully be called a “nonprofit” if it almost always makes money? And what if most of that organization’s income comes from “business income,” should it legitimately be considered a “charity”?

7 min read

The 2023 Spanish Regional Tax Competitiveness Index allows policymakers and taxpayers to evaluate and measure how their regions’ tax systems compare.

6 min read

In recent years, European countries have undertaken a series of tax reforms designed to maintain tax revenue levels while protecting households and businesses from high inflation.

8 min read

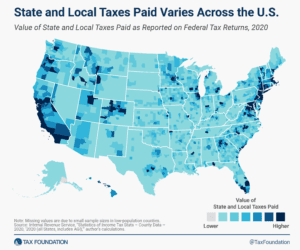

Any move to repeal the cap or enhance the deduction would disproportionately benefit higher earners, making the tax code more regressive.

5 min read

Now is the time for lawmakers to focus on long-term fiscal sustainability, as further delay will only make an eventual fiscal reckoning that much harder and more painful. Congressional leaders should follow through on convening a fiscal commission to deal with the long-term budgetary challenges facing the country.

35 min read

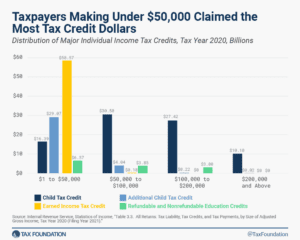

In tax year 2020, taxpayers claimed more than 159 million tax credits on their individual income tax returns worth a total of more than $277 billion. That was an increase of $35.3 billion from tax year 2019, largely due to an influx of pandemic relief administered through the tax code in 2020.

6 min read

As the TCJA expiration nears, lawmakers face difficult choices in reforming the CTC. While revenue, distributional and economic effects are important, lawmakers should also focus on simplifying the rules and reducing the administrative challenges.

9 min read

Starting on September 1st, federal student loan payments will resume after a three-and-a-half-year pause on payments and accrued interest following the onset of the COVID-19 pandemic.

6 min read