Tax Trends in European Countries

8 min readBy:In recent years, European countries have undertaken a series of tax reforms designed to maintain taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. revenue levels while protecting households and businesses from high inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. .

These policies include reducing value-added taxes (VAT) and excise duties, indexing the income tax to inflation, and cutting tax rates for low-income families (while increasing them for higher-income individuals by raising net wealth taxes and recurrent taxes on immovable property). Some countries introduced temporary windfall profits taxes while others reduced environmental taxes.

Nevertheless, according to an Organisation for Economic Co-operation and Development (OECD) report (which covers tax revenue trends up till 2021), many countries experienced an increase in tax revenues after the pandemic while growth outpaced the rate of GDP expansion. If this trend is to continue through 2022 and 2023, it would suggest that governments used this inflationary scenario to raise more revenue, rather than protecting households and small businesses from inflation. The largest increases in tax-to-GDP ratio were observed in Norway (due to an increase in revenues from petroleum extraction), Lithuania, Spain, and Germany. The main drivers behind the revenue increases were corporate taxes and VATs. On the other hand, eight European countries registered a decline in their tax-to-GDP ratio with Hungary registering the largest fall at 2.2 percentage points.

Business Tax Reforms

Some countries increased their corporate tax incentives and encouraged investment through capital allowances combined with more support for research and development.

While Belgium approved measures that broadened the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. , Finland, Germany, Ireland, Italy, Latvia, and Poland implemented measures that narrowed the tax base. Portugal and the United Kingdom approved mixed measures that both broadened and narrowed the base.

Additionally, the Czech Republic, Denmark, Finland, Germany, and the United Kingdom increased or extended capital allowances, and Italy implemented a series of tax credits. While technically capital allowances narrow the tax base, permanent full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. supports capital formation and economic growth over the long term. On the contrary, temporary expansions, like the ones approved during the past years, have a much more limited impact because businesses may simply accelerate some already-planned investment decisions without increasing the overall level of investment.

Regarding the corporate tax rate, France began in 2022 a two-year tax reform to remove a sub-national production tax (Contribution sur la Valeur Ajoutée des Entreprises). However, as the government is now looking to reduce the budget deficit, the tax reform is planned to be completed by 2027.

The Netherlands increased its lowest corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate from 15 percent to 19 percent at the beginning of 2023, while broadening the tax base for its top tax rate by halving its threshold to EUR 200,000 (from EUR 395,000 in 2022).

Spain reduced their corporate income tax rate applicable to small and medium companies (net turnover of less than EUR 1 million) from 25 percent to 23 percent. The rate for start-up companies was also lowered from 25 percent to 15 percent.

After the EU Council approved the EU-wide windfall tax, twenty European countries implemented a windfall profits taxA windfall profits tax is a one-time surtax levied on a company or industry when economic conditions result in large and unexpected profits. Inheritance taxes and taxes levied on lottery winnings can also be considered windfall taxes on individual profits. (mostly on energy companies) while Luxembourg, the Netherlands, and Poland have published proposals to enact one. Latvia and Norway have either officially announced or shown intentions to implement a windfall tax. Additionally, the Czech Republic, Hungary, Slovakia, Spain, and the United Kingdom plan to extend the application of windfall taxes beyond 2023.

Some countries did not limit the scope of the windfall tax to energy producers or oil and gas companies. Hungary, the Czech Republic, Lithuania, and Spain extended the tax’s scope to cover the banking sector, while Latvia and Italy are considering doing the same. Currently, Italy’s windfall tax is expected to be approved by parliament along with an amendment to scrap the tax if the banks allocate 2.5 times this amount to increase capitalization. Estonia’s Social Democratic Party also proposed to tax banks’ windfall profits as the current government is looking to cut public spending. Portugal applied the windfall tax to food distribution companies, while Croatia extended it to all companies exceeding HRK 300 million (€40 million) revenue threshold.

Several countries have also announced plans to adopt domestic minimum taxes in anticipation of global anti-base-erosion (GLOBE) rules under Pillar Two. While there is no obligation for EU Member States or other European countries to implement a Qualified Domestic Minimum Top-up Tax (QDMTT), several countries have already announced their intention to do so (specifically Germany, Ireland, the Netherlands, and Lichtenstein by 2024). Additionally, Belgium adopted a temporary minimum tax that took effect in 2023, while Spain approved one for fiscal year 2022 and going forward. Romania is also planning to introduce a modified version of a minimum tax. Large companies, whose corporate income tax liability is under the minimum turnover tax liability, will have to pay the turnover tax.

Consumption Taxes Reforms

Many countries introduced temporary rate reductions to excise duties and value-added taxes on energy and food products as a price support measure to cushion the impact of a sharp rise in energy prices and inflation. This is despite the fact that the effectiveness of using reduced VAT rates to address equity, environmental, and other policy goals is questionable.

While almost all European countries temporarily reduced the VAT rates for natural gas, heating, electricity, or other fuels, during 2022 and the beginning of 2023, these measures have already expired. Belgium is the only country that has permanently reduced the VAT rate applied to the supply of gas and electricity. Additionally, only Germany and Lithuania prolonged the duration of VAT reduced rates applied to restaurants and catering services, while Spain and Bulgaria are maintaining the reduced VAT tax rate for certain food products until the end of 2023. On the other hand, Lithuania made the initially temporary application of reduced VAT rate to artistic and cultural activities permanent.

Other countries implemented VAT exemptions and reduced rates for specific goods. Iceland expanded its temporary tax exemptionA tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the Internal Revenue Service (IRS), preventing them from having to pay income tax. for zero-emissions cars until the end of 2023, while Norway imposed VAT on electric vehicles whose purchase price exceeds NOK 500,000 (€40,000). Spain lowered the VAT rate applied to feminine hygiene products, while Italy also reduced it for children’s hygiene products.

To encourage consumption, Luxembourg cut by 1 percentage point both the standard and reduced VAT rates to 16 percent and 7 percent, respectively, until the end of 2023. Estonia is also planning to reduce the standard VAT rate starting in January 2024.

Individual Tax Reforms

A series of countries implemented measures to index tax bracketA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. thresholds, allowances, and credits for inflation within the personal income tax.

For the year 2023, Estonia, Germany, Slovenia, and Spain raised the basic allowance, while Ireland and the Netherlands raised the basic tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly. (lowering the tax burden for low-income earners). Austria and Germany indexed all income tax brackets to inflation (except for the top income bracket), while Ireland adjusted the first two tax bands.

Bulgaria, Croatia, France, Germany, Luxembourg, and Portugal increased the generosity of the personal income tax measures to support families with children. Portugal, Romania, and Slovenia introduced income tax provisions to support young workers.

For 2024, Sweden plans to cut income taxes to increase incentives to work and support households facing inflation and food price increases. Estonia is also planning to reduce the income tax rate in 2024 both for residents and non-residents. On the other hand, the Netherlands announced that it will phase out the income-dependent tax credit by 2025 to encourage labor participation for secondary earners. The tax deductions for self-employed will also be gradually reduced until 2027.

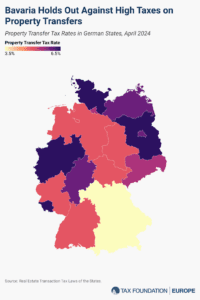

Property Taxes Reforms

Over the last year, new property taxes were introduced or proposed: a new wealth taxA wealth tax is imposed on an individual’s net wealth, or the market value of their total owned assets minus liabilities. A wealth tax can be narrowly or widely defined, and depending on the definition of wealth, the base for a wealth tax can vary. in Spain, an empty property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. in Ireland, and a crypto transaction tax in Portugal.

To finance government support measures related to high inflation, Spain introduced a national temporary solidarity tax on high net-worth individuals for the tax years 2022 and 2023, with tax rates between 1.7 percent and 3 percent. This is an additional wealth tax that complements the regional one and taxpayers can credit their regional wealth tax contributions against the national solidarity tax liability. Additionally, Norway continued to increase the progressivity of its wealth tax schedule in 2023, raising its higher rate from 0.95 percent to 1 percent.

Environmental Taxes Reforms

Several countries are also using tax incentives to support investment in green technologies and carbon emissions reductions. In 2022, to promote the use of electric cars the Czech Republic allowed faster depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. rules for charging stations. Portugal introduced reduced local tax rates for electric and hybrid cars.

While Italy pushed forward the implantation of a planned sugar and plastic tax, Sweden announced a budget proposal to repeal the tax on plastic bags, as Sweden’s plastic bag consumption is already under the EU’s target.

On the other hand, Spain is the only EU–country that introduced a tax on non-reusable plastic packaging. Although the tax has been criticized for its complexity, wide and unclear scope, and at the same time increased tax burden on food products, there is no plan to reform it. Given the revenue trend during the first six months of 2023, by the end of the year this tax would collect more than Spain’s solidarity (wealth) tax did. Ironically, the national solidarity wealth tax was implemented to offset the cost-of-living crisis that the government raised by the introduction of the non-reusable plastic packaging tax.

Tax Reforms for Economic Growth and Budgetary Stability

As governments are moving towards budgetary stability, policymakers should focus on consumption taxes by making them more neutral and efficient. This should be done by broadening the tax base, lowering the tax rate, and eliminating unnecessary tax exemptions. Countries could also put compensation measures in place for poorer households. Additionally, countries should move away from temporary measures and consider full expensing to increase private investment and move towards a permanent and neutral corporate tax. Finally, for capital investments, governments should provide adjustments for inflation and the time value of money.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe