Is the State and Local Tax Deduction in Place to Protect Against Double Taxation?

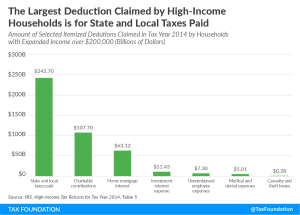

Repealing the state and local tax deduction will be an important part of pro-growth tax reform. Eliminating the deduction would free up $1.8 trillion to use for lowering rates across the board. Special interest groups will want you to think this deduction protects you against double taxation. Don’t fall for it.

2 min read