All Related Articles

New Research Finds Limited Effects on Taxpayer Behavior from Pass-through Deduction

While proponents of the Section 199A pass-through deduction claimed it would boost investment and critics claimed it would encourage tax avoidance and income shifting, new research casts doubt on both claims.

3 min read

Common Tax Questions, Answered

Get answers to some of the tax policy questions we hear most often from taxpayers, businesses, and journalists. Learn everything from the basics of who pays taxes and the difference between credits and deductions, to how taxes impact the economy and what constitutes sound tax policy. Discover additional resources to explore each question and topic in more depth.

What to Expect During the 2021 Tax Season

The IRS recently announced the extension of tax filing and payment deadlines from April 15th to May 17th to help taxpayers navigating the many tax changes amid the pandemic and give the IRS opportunity to clear its backlog of tax returns and correspondence.

7 min read

Making the Expanded Child Tax Credit Permanent Would Cost Nearly $1.6 Trillion

As the Biden administration and Congress consider making the expanded child tax credit permanent, a nearly $1.6 trillion expansion of tax code-administered benefits, they should consider financing it in a way that doesn’t create significant headwinds to economic recovery.

3 min read

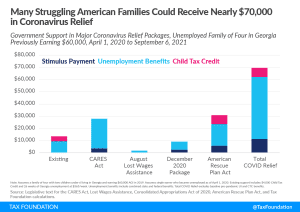

U.S. COVID-19 Relief Provided More Than $60,000 in Benefits to Many Unemployed Families

During the pandemic, an unemployment family of four previously earning $60,000 will have received $50,840 in federal and state unemployment benefits from April 1, 2020 to September 6, 2021, plus $11,400 in stimulus payments, plus $7,200 in Child Tax Credit, totaling $69,440 in combined COVID-19 relief benefits.

4 min read

The American Rescue Plan Act Greatly Expands Benefits through the Tax Code in 2021

The major tax-related benefits in the $1.9 trillion economic relief plan are a third round of direct payments, extended unemployment insurance (UI) benefits and a $10,200 unemployment insurance income exemption for 2020, and an expansion of the Child Tax Credit.

6 min read

Facts and Figures 2021: How Does Your State Compare?

Our updated 2021 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

Alabama Passes Tax Reform Aimed at Throwback, GILTI, and More

Learn more about the recent Alabama tax reform measures (House Bill 170), which combines pandemic-era tax policy responses with broader tax policy reforms.

4 min read

Marginal Tax Rates on Labor Income Under the Democratic House Ways and Means Child Tax Credit Proposal

The coronavirus relief legislation passed out of the House Ways and Means Committee would significantly expand the child tax credit for 2021, from its current $2,000 maximum to a fully refundable $3,600 for children 6 and under and $3,000 for children over 6.

4 min read

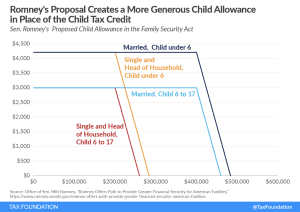

Marginal Tax Rates on Labor Income Under Sen. Mitt Romney’s Family Security Act

Sen. Mitt Romney’s Family Security Act would replace the Child Tax Credit with a monthly child allowance administered by the Social Security Administration, making the benefit more generous and accessible to low-income households without earned income.

4 min read

House Ways and Means Committee Takes First Steps Toward Additional Coronavirus Relief Legislation

The House Ways and Means Committee measures would further extend the relief measures created by the CARES Act and the Consolidated Appropriations Act of 2021, and would go further by significantly expanding existing tax credits and making changes to the international tax system.

7 min read

Congressional Democrats Propose Expanding Child Tax Credit as Monthly Payment for Pandemic Relief

House Ways and Means Democrats recently released a proposal to expand the child tax credit for one year as part of President Biden’s larger $1.9 trillion economic relief package.

5 min read

Sen. Romney’s Child Tax Reform Proposal Aims to Expand the Social Safety Net and Simplify Tax Credits

Sen. Mitt Romney (R-UT) recently proposed the Family Security Act, which features a new, more generous child allowance for families with children while reforming other sources of aid for low-income individuals.

5 min read

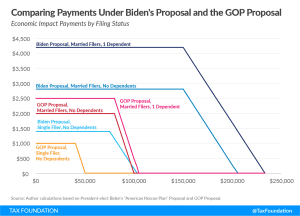

Modeling Different Proposals for Round Three Direct Payments

President Biden is calling for a third round of economic impact payments to households as part of his $1.9 trillion American Rescue Plan. Under the plan, the payments would be $1,400 per person, topping off the recent round of $600 payments for a combined $2,000 per person. Senate Republicans have proposed payment amounts of $1,000 per individual and $500 per dependent, lower income thresholds, and faster phaseout rates.

5 min read

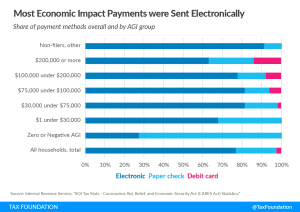

IRS Data Shows Who Benefited from the First Round of Economic Impact Payments

Newly published data from the Internal Revenue Service (IRS) shows that the first round of economic impact payments primarily benefited households earning less than $100,000.

3 min read

Who Benefits from the State and Local Tax Deduction?

Some lawmakers have expressed interest in repealing the SALT cap, which was originally imposed as part of the Tax Cuts and Jobs Act (TCJA) in late 2017. It is important to understand who benefits from the SALT deduction as it currently exists, and who would benefit from the deduction if the cap were repealed.

6 min read

President Biden Outlines Plan for Additional Coronavirus-Related Relief and Stimulus

President Biden’s plan builds on previous relief packages and would include larger payments to individuals, expanded relief for households and small businesses, funding for vaccine distribution, and aid to state and local governments.

7 min read

COVID-19 Relief Package FAQ

The latest $900 billion coronavirus relief bill extends and modifies several provisions first enacted in the CARES Act, Congress’s $2.2 trillion pandemic relief law that was passed in March. With this package, lawmakers will have responded to the coronavirus and related economic hardship with a record-setting $3 trillion of fiscal support.

14 min read