Update (6/6/17): Gov. Brownback has vetoed the bill. We also corrected the vote total in the House below; it was 69 to 52, not 69 to 32. We’ll update this post if a veto override attempt occurs.

Update (6/7/17): S.B. 30 is now law after the Kansas House voted 88 to 31 and the Kansas Senate voted 27 to 13 to override Governor Brownback’s veto.

Kansas Gov. Sam Brownback (R) this morning pledged to veto Senate Bill 30, which was passed yesterday by the House (69 to 52) and early this morning by the Senate (26 to 14). The bill would:

- Raise individual income taxes by creating a third bracket of the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. for income above $30,000 (single) and $60,000 (married filing jointly), with the rate set at 5.2 percent in 2017 and 5.7 percent in 2018 (compared to the current 4.6 percent). The bottom two income tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. of 2.7 percent and 4.6 percent would go to 2.9 percent and 4.9 percent respectively in 2017, and 3.1 percent and 5.25 percent respectively in 2018 and thereafter.

- Repeal the pass-through carveout (complete income tax exemptionA tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the Internal Revenue Service (IRS), preventing them from having to pay income tax. for Schedule C, E, and F income) retroactive to January 1, 2017. Kansas is the only state in the country with such a provision.

- Reenact the itemized deductions for mortgage interest, property taxes paid, and medical expenses, at 50 percent of the federal amount in 2018, 75 percent in 2019, and 100 percent in 2020 and thereafter.

- Reenact a child care tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. at 12.5 percent of the federal amount in 2018, 18.75 percent in 2019, and 25 percent in 2020.

- Reduce the low-income exclusion level from $5,000 to $2,500 (single) and $12,500 to $5,000 (married filing jointly).

The state Department of Revenue projects an $889 million gap between revenue and spending in the current and upcoming fiscal years. Additionally, in March the Kansas Supreme Court ordered legislators to increase school funding by June 30, concluding that $4 billion in state aid to local school districts is inadequate. State aid to schools reached a high of $4,433 per pupil in 2009, but fell to $3,780 per pupil in 2012. Brownback had earlier proposed $400 million in new revenue, from raising cigarette and alcohol taxes and a one-time securitization of future tobacco settlement revenue (in essence converting $58 million in annual revenue into one-time cash), and halting two-thirds of road projects until 2020, measures that legislators rejected.

S.B. 30 is estimated to increase taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. collections by approximately $600 million per year. The income tax rates would be higher than they are now, but lower than they were in 2012 (see table). Legislators also voted yesterday to boost school funding by $293 million over two years, bringing the per-pupil level to $4,006; the vote on that was 23 to 17 in the Senate and 67 to 55 in the House. Legislators had earlier rejected a combined tax and school funding bill. Governor Brownback has not said whether he’ll sign or veto the school funding bill.

| Note: Bracket amounts for married filing jointly are doubled. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Taxable Income | 1992 to 2012 | 2013 | 2014 | 2015 to 2017 (current law) | 2017 (under S.B. 30) | 2018 (under S.B. 30) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| >$0 | 3.5% | 3.0% | 2.7% | 2.7% | 2.9% | 3.1% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| >$15,000 | 6.25% | 4.9% | 4.8% | 4.6% | 4.9% | 5.25% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| >$30,000 | 6.45% | 5.2% | 5.7% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

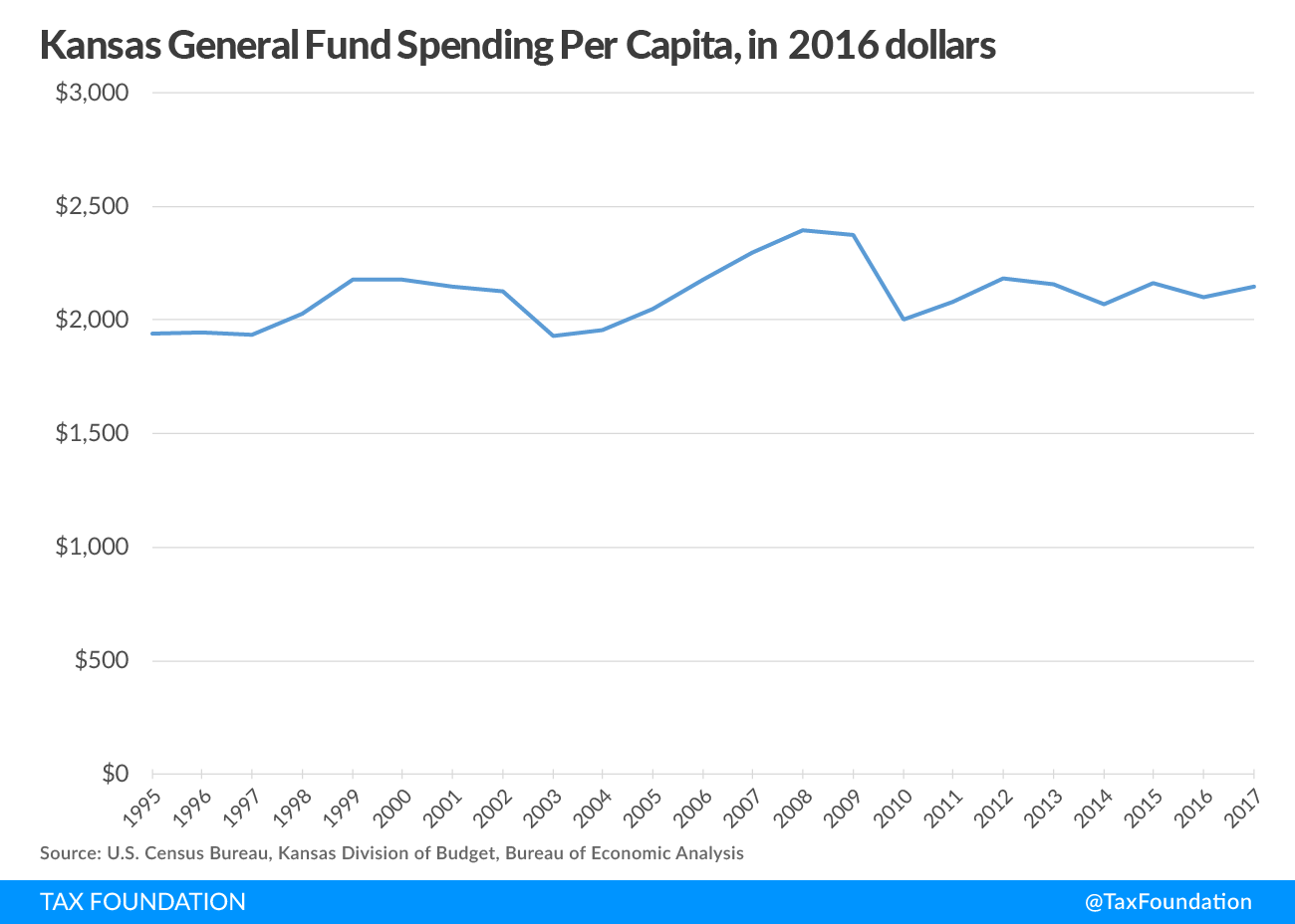

Kansas’s economy remains steady but its budget situation has been unsteady for several years. The state is one of four with essentially zero in budget reserves (the others being North Dakota, Oklahoma, and Pennsylvania), with those funds having been drawn down to cover budget gaps since 2013. The state raised sales taxes and cigarette taxes and reduced itemized deductions in 2015. On several occasions the state has swept funds from government accounts and forced loans from the pension fund, the road fund, and local government funds. Revenue dropped sharply after the tax cuts and has remained anemic since; state spending (adjusted for population and inflation) has grown very slowly at about 0.3 percent per year:

We have been a voice for retaining some or all of the broad-based income tax reductions Kansas has enacted, while we have been very critical of the pass-through exclusion for creating a distortionary tax carveout. Contrary to Kansas, the tax reform approach taken by other states such as North Carolina and Indiana have focused on eliminating special carveouts rather than adding new ones, and building tax reductions into budget baselines.

Coming up with a solution is not easy and may set a record: yesterday marked 108 days into Kansas’s traditionally 90-day session; the all-time record was 114 days in 2015.

Share this article