All Related Articles

Idaho Tax Reform Bill Advances

3 min read

New York Taxpayers Must Pay for Ill-Advised Lawsuit Seeking Tax Cuts for Wealthiest Residents

New York, New Jersey, and Connecticut are pursuing a questionable legal strategy to overturn the cap on a federal tax deduction that benefits the wealthy.

5 min read

More States Considering Dubious SALT Charitable Contribution Workaround

California’s plan to circumvent the new state and local tax deduction cap is dubious, but now Illinois, Nebraska, Virginia, and Washington are considering similar plans.

3 min read

State Strategies to Preserve SALT Deductions for High-Income Taxpayers: Will They Work?

The scramble to restore the full state and local tax deduction for high-income taxpayers has resulted in inventive proposals that, for both legal and practical reasons, are unlikely to succeed.

22 min read

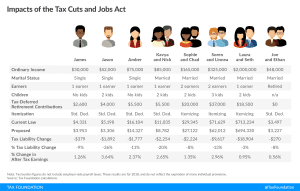

Who Gets a Tax Cut Under the Tax Cuts and Jobs Act?

How would the Tax Cuts and Jobs Act impact different households? Check out our sample taxpayers to see what would change if the bill is enacted.

5 min read

Prepaying SALT isn’t an Option

As the Tax Cuts and Jobs Act seeks to simplify the tax code, a last-minute provision closed a potential new tax-planning strategy germinating before the bill even passed.

2 min read

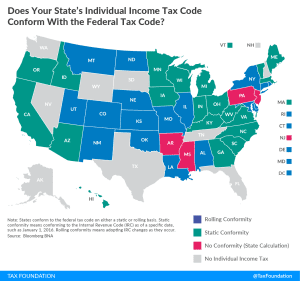

Does Your State’s Individual Income Tax Code Conform with the Federal Tax Code?

As the federal government continues to debate tax reform, states, and many taxpayers, are asking an important question: How is my state’s tax code impacted? The exact impacts won’t be known until the federal bill is finalized, but a good place to start is understanding the issue of conformity.

2 min read

High-Tax States are Inconsistent on the State and Local Tax Deduction

If the state and local tax deduction is necessary to prevent double taxation, why don’t states offer a deduction for federal and local taxes?

2 min read