All Related Articles

Don’t Judge Your Taxes by Your Refund

3 min read

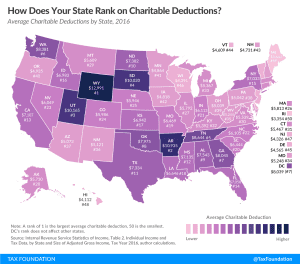

Charitable Deductions by State

2 min read

Tax Trends Heading Into 2019

In 2019, key trends in state tax policy include reductions in corporate tax rates, updating sales tax systems to include remote online sales, taxes on marijuana and sports betting, gross receipts taxes, and more. Explore our new 2019 guide!

32 min read

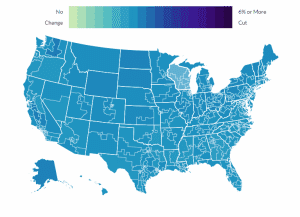

The Tax Cuts and Jobs Act After A Year

5 min read

South Carolina: A Road Map For Tax Reform

South Carolina is by no means a high tax state, though it can feel that way for certain taxpayers. The problems with South Carolina’s tax code come down to poor tax structure. Explore our new comprehensive guide to see how South Carolina can achieve meaningful tax reform.

16 min read

2019 Tax Brackets

The IRS recently released its 2019 individual income tax brackets and rates. Check out the new standard deduction, child tax credit, earned income tax credit, rates and brackets, and more.

5 min read

Family Provisions in the New Tax Code

22 min read

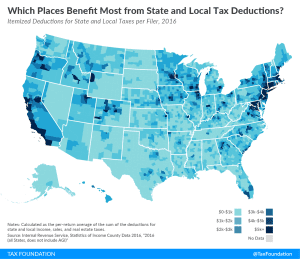

The Benefits of the State and Local Tax Deduction by County

Do taxpayers in your area rely heavily on state and local tax deductions? See how the Tax Cuts and Jobs Act tax plan may impact taxpayers in your county.

2 min read