Earlier this week, we reported that the Trump administration may consider reducing the cap on the home mortgage interest deductionThe mortgage interest deduction is an itemized deduction for interest paid on home mortgages. It reduces households’ taxable incomes and, consequently, their total taxes paid. The Tax Cuts and Jobs Act (TCJA) reduced the amount of principal and limited the types of loans that qualify for the deduction. from a maximum of $1 million acquisition debt to $500,000. We estimated that this proposal could raise as much as $95 billion to $300 billion over the next decade, depending on how the cap is structured. We also found that the tax increase would primarily fall on high-income taxpayers because they are more likely to own larger homes and have more mortgage debt. Middle- and lower-income taxpayers would be much less likely to face a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. increase.

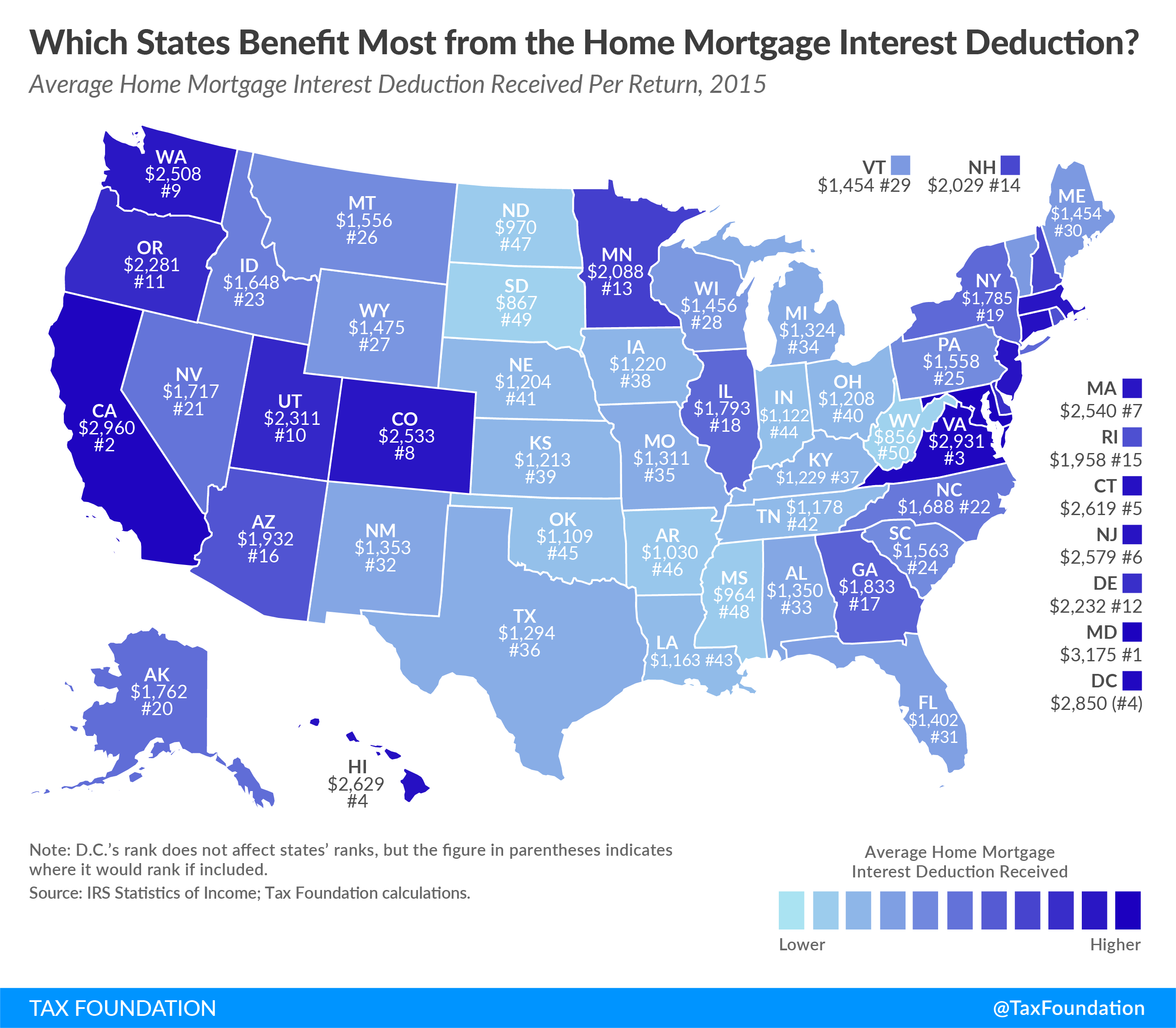

Changes to the home mortgage interest deduction would also impact certain parts of the country differently. There is a large degree of geographic disparity in who claims the mortgage interest deduction. Below is a map that shows the average deduction amount taken per tax return, or the total amount of home mortgage interest deducted in a state divided by the number of tax returns in a state.

The states that benefitted the most from the home mortgage interest deductions were Maryland ($3,175), California ($2,960), and Virginia ($2,931). The states that benefitted the least were Mississippi ($964), South Dakota ($867), and West Virginia ($856).

Two primary factors influence how much home mortgage interest is deducted in a state: state housing prices and state income levels.

Regional housing prices directly impact mortgage interest payments. In areas where land is scarce, such as Hawaii, the low levels of supply will push prices up and increase the amount of interest paid on mortgages. The opposite is also true. In states such as North and South Dakota where land is plentiful, low land prices will directly reduce the number of individuals claiming the home interest mortgage deduction and the amount of the deduction.

Income levels also impact the amount a state claims in mortgage interest. Higher-income taxpayers are more likely to purchase larger homes and have more mortgage debt. In addition, they are more likely to itemize to begin with because they pay more in state and local taxes and make more charitable contributions—the two other major itemized deductions available to taxpayers.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe