Firm Variation by Employment and Taxes

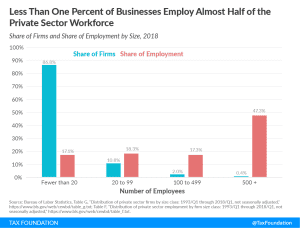

Less than one percent of businesses employ almost half of the private sector workforce. Large companies pay 89% of corporate income taxes in the United States.

2 min read

Less than one percent of businesses employ almost half of the private sector workforce. Large companies pay 89% of corporate income taxes in the United States.

2 min read

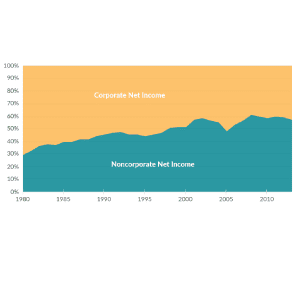

More business income is reported on individual tax returns than corporate returns. The U.S. now has fewer corporations and more individually owned businesses. Corporations make up less than 5 percent of businesses but earn 60 percent of revenues.

3 min read

Sen. Elizabeth Warren introduced a 7 percent surtax on corporate profits called the “Real Corporate Profits Tax.” We estimate that this tax would reduce the incentive to invest in the United States, and result in a 1.9 percent smaller economy, a 3.3 percent smaller capital stock, and 1.5 percent lower wages. The surtax would raise $872 billion between 2020 and 2029 on a conventional basis and $476 billion on a dynamic basis. The tax would make the tax code more progressive, but it would fall on taxpayers in every income group.

9 min read

Although Congress intended the AMT to be a tax on wealthy taxpayers, for much of its history it has subjected middle-income taxpayers in high-tax states to heavy compliance burdens. TCJA reforms that have increased the AMT’s exemption and exemption phaseout threshold will shield some taxpayers from the AMT through 2025, but the number of taxpayers impacted will increase in 2026 when the TCJA’s individual income tax reforms expire.

14 min read

A key element of America’s dynamism problem is a drop in entrepreneurship. Removing tax barriers for entrepreneurs would improve America’s dynamism while making America’s tax code more neutral, efficient, and simple for all taxpayers.

25 min read

Who really bears the burden of federal taxes? How progressive is our current tax system and what role do taxes play in the debate over income inequality?

5 min read

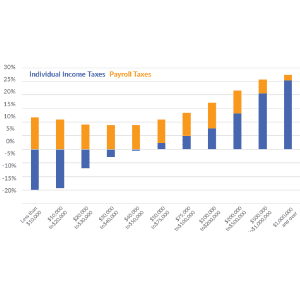

The tax burden for most Americans in 2019 –67.8 percent—will come primarily from payroll taxes, not income taxes. While the income tax is progressive, with average rates rising with income, the payroll tax is regressive, with the highest average rate falling on Americans with the lowest incomes.

4 min read

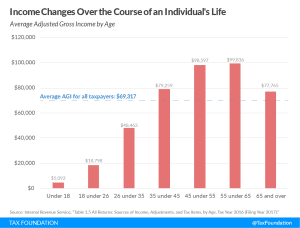

Average income tends to rise dramatically as someone ages and gains education and experience. Viewing just one year of income tax data without digging any deeper misses some crucial context.

2 min read