All Related Articles

2020 State Business Tax Climate Index

Connecticut, California, New York, and New Jersey rank lowest in our 2020 State Business Tax Climate Index, which compares states on more than 120 tax policy variables to show how well they structure their tax systems and to provide a road map for improvement.

20 min read

Improving the Federal Tax System for Gig Economy Participants

Advances in technology have enabled workers to connect with customers via online platform applications for work ranging from ridesharing to home repair services. The rise of gig economy work has reduced barriers to self-employment, bringing tax challenges like tax complexity and taxpayer noncompliance.

32 min read

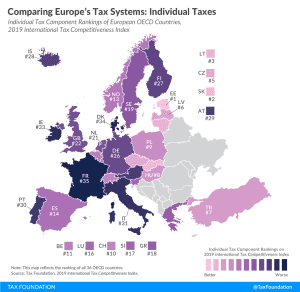

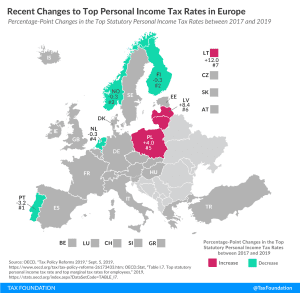

International Tax Competitiveness Index 2019

Our International Index compares OECD countries on over 40 variables that measure how well each country’s tax system promotes sustainable economic growth and investment.

11 min read

Booker’s Plan to Eliminate Step-up in Basis and Expand the Estate Tax

Removing step-up in basis would encourage taxpayers to realize capital gains and it would plug a hole in the current income tax, while increasing federal revenue. Combined, however, with the estate tax, this would result in a significant tax burden on certain saving by requiring both the appreciation in and total value of transferred property to be taxed at death

2 min read

Senator Sanders Proposes a Tax on “Extreme” Wealth

Bernie Sanders recently became the second major Democratic presidential candidate to propose a wealth tax.

2 min read

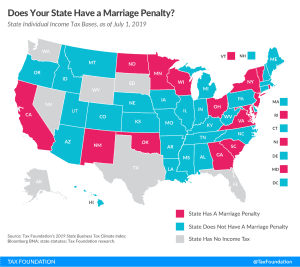

Does Your State Have a Marriage Penalty?

A marriage penalty is when married couples filing jointly face a higher effective tax rate than they would if they filed as two single individuals with the same amount of combined income.

2 min read

No Good Options as Chicago Seeks Revenue

Facing an $838 million budget shortfall, a looming pension crisis, and an aggressive spending wish list, some Chicago policymakers and activists are expressing interest in a laundry list of new and higher taxes that could, collectively, raise as much as an additional $4.5 billion a year.

6 min read