All Related Articles

Increasing Individual Income Tax Rates Would Impact a Majority of US Businesses

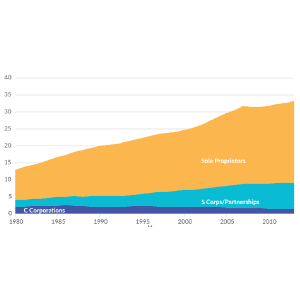

Since most U.S. businesses are pass-through businesses, such as partnerships, S corporations, LLCs, and sole proprietorships, changes to the individual income tax, especially to top marginal rates, can affect a business’s incentives to invest, hire, and produce.

4 min read

A Growing Percentage of Americans Have Zero Income Tax Liability

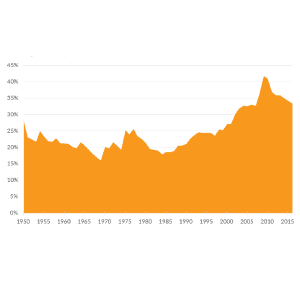

From 1986 to 2016, the top 1 percent’s share of income taxes rose from 25.8 percent to 37.3 percent, while the bottom 90 percent’s share fell from 45.3 percent to 30.5 percent.

4 min read

How Do Transfers and Progressive Taxes Affect the Distribution of Income?

Federal tax rates vary by income group and tax source. The federal tax system redistributes income from high- and low-income taxpayers.

3 min read

Analysis of the “SALT Act”

Lawmakers recently introduced a bill to repeal the $10,000 cap on the state and local deduction (SALT) and raise the top tax rate on ordinary income from 37 percent to 39.6 percent.

4 min read

New Mexico Tax Increase Package Advances

7 min read

Arkansas Chips Away at Tax Reform

3 min read

Analysis of the Cost-of-Living Refund Act of 2019

We estimate that a new proposal to expand the EITC would reduce federal revenue by $1.8 trillion and decrease long-run GDP by 0.29 percent, while boosting labor force participation for low-income tax filers by 822,788 full-time equivalent jobs.

10 min read

The Top 1 Percent’s Tax Rates Over Time

In the 1950s, when the top marginal income tax rate reached 92 percent, the top 1 percent of taxpayers paid an effective rate of only 16.9 percent. As top marginal rates have fallen, the tax burden on the rich has risen.

5 min read

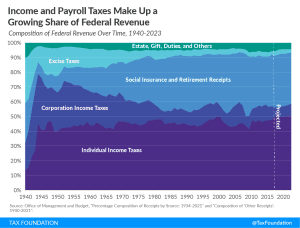

The Composition of Federal Revenue Has Changed Over Time

The federal income tax and federal payroll tax make up a growing share of federal revenue. Individual income taxes have become a central pillar of the federal revenue system, now comprising nearly half of all revenue.

2 min read

The Case for Universal Savings Accounts

21 min read